Stock Market Today: Stocks slip with CPI inflation, new tariffs in focus

Inflation data, Powell testimony, a 10-year auction and potentially new tariffs will keep Wall Street on alert Wednesday.

Check back for updates throughout the trading day

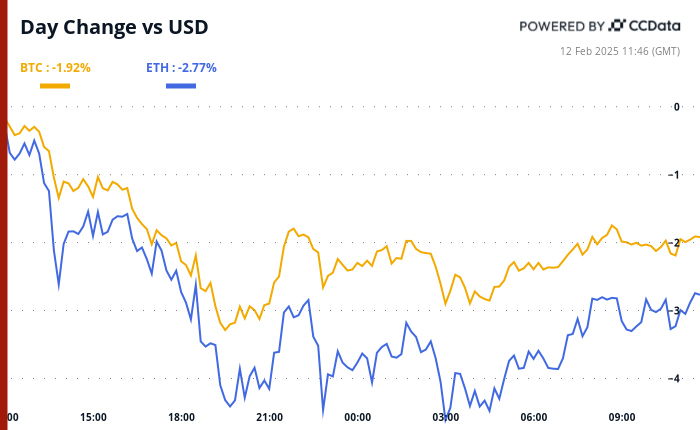

U.S. equity futures edged lower Wednesday, while Treasury bond yields and the dollar held steady, as investors looked to a key January inflation report while bracing for another round of tariff announcements from President Donald Trump.

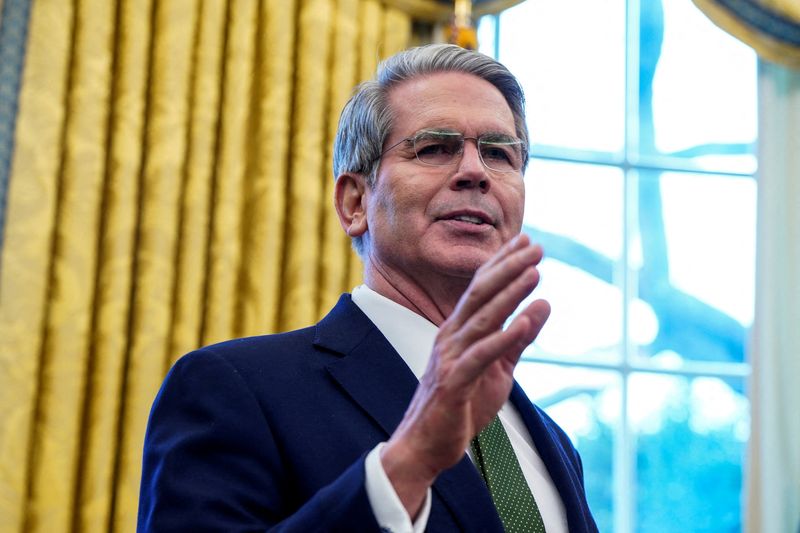

Stocks ended mixed on Tuesday, with a notable slump for Tesla (TSLA) pulling the Nasdaq into the red by the close of trading while the Dow and the S&P 500 notched modest gains following an uneventful appearance from Fed Chairman Jerome Powell in front of the Senate Banking Committee.

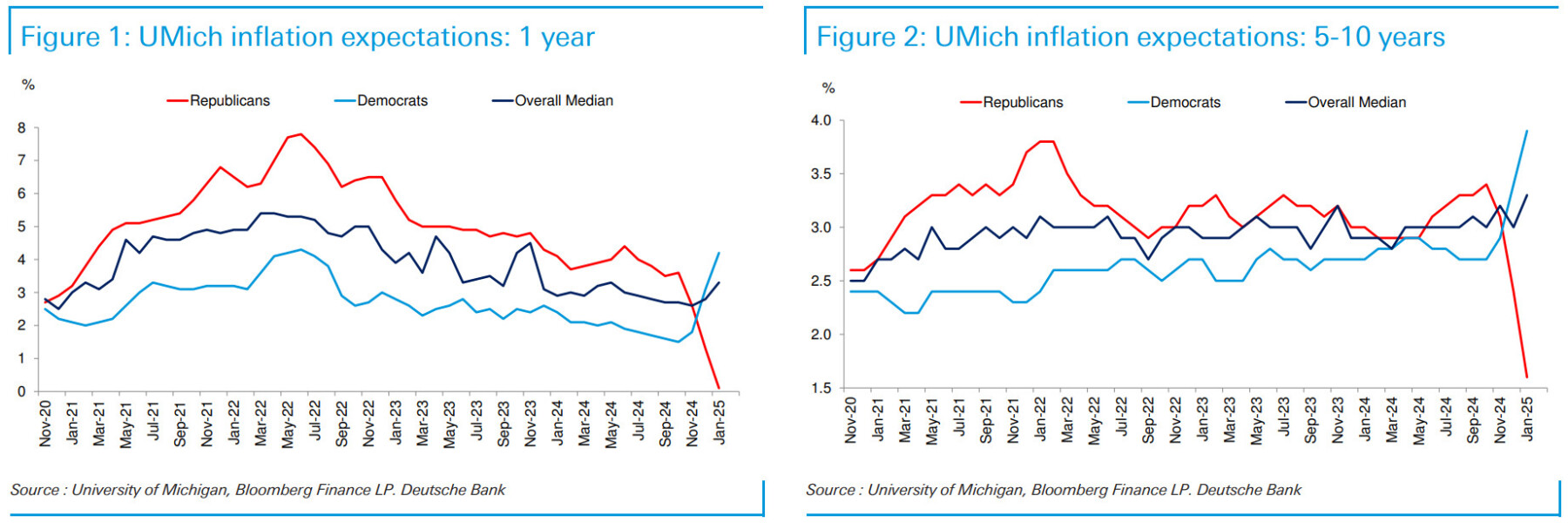

Powell, who faces another round of questions from the House Financial Services Committee later this morning, echoed the Fed's recent messaging on growth, inflation and the labor market and repeated his view that the central bank is in "no hurry" to lower its benchmark borrowing rate.

“The economy is strong, growing 2.5% last year. The labor market is also very solid. Unemployment at 4% is quite a low level. Inflation last year was 2.6% for the year,” Powell told lawmakers.

“So we’re in a pretty good place with this economy. We want to make more progress on inflation, and we think our policy rate is in a good place. We don’t see any reason to be in a hurry to reduce it further,” he added.

Questions in today's session, however, could be more pointed as Powell will appear following a key January inflation reading at 8:30 am Eastern time, which is expected to show modest easing in core price pressures and little change in the headline reading. Olivier Douliery/Bloomberg via Getty Images

"While Wednesday's CPI is an important input into the Federal Reserve's thinking on rates, we may be 6-8 months away from the next rate cut, so it's premature to put much weighting on what this data point means for the Fed," said Michael Rosner, managing director at Raymond James in Birmingham, MI.

"Barring any major changes to the near-term economic data, we don't think the Fed is going to pivot from its 'wait and see' approach on rates," he added.

Related: Analyst resets Tesla stock forecast as Musk targets OpenAI

Benchmark 10-year Treasury bond yields were holding steady at 4.543% in overnight trading ahead of today's CPI inflation report and the auction of $42 billion in new notes later in the session.

The U.S. dollar index, meanwhile, was marked 0.02% higher against a basket of six global currency peers and changing hands at 107.988, as investors awaited details of a fresh round of reciprocal tariffs from President Trump.

Trump, who unveiled new steel and aluminum levies earlier this week, has said he will increase duties on goods from countries that tariff U.S. exports, stoking further concerns for the potential of an tit-for-tat trade war.

On Wall Street, stocks are set for a modestly weaker open, with futures contracts tied to the S&P 500 priced for a 7 point dip and those linked to the Dow Jones Industrial Average indicated 70 points lower.

The tech-focused Nasdaq, meanwhile, is called 5points lower, with Tesla, Super Micro Computer (SMCI) , Intel (INTC) and Nvidia (NVDA) active in early trading.

More Wall Street Analysis:

- Goldman Sachs analysts warn on Trump tariff impact for stocks

- Analyst predicts stocks likely to join the S&P 500 in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

In overseas markets, Europe's Stoxx 600 was marked 0.18% higher in mid-day Frankfurt trading, with Britain's FTSE 100 edging 0.02% higher in London.

Overnight in Asia, Japan's Nikkei 225 returned from its mid-February holiday to rise 0.42% by the close of trading, while the regional MSCI ex-Japan benchmark rose 0.77%.

Related: Veteran fund manager issues dire S&P 500 warning for 2025