Optimism Among Gamblers & Investors?

You might have been bored by the not-so-Superbowl last night (at least the better team won this year). Several non-football fans went to see the Becoming Led Zeppelin documentary (they raved). But neither the game nor Zep’s origin story was the biggest story last night. Rather, the most intriguing aspect of last night was… Read More The post Optimism Among Gamblers & Investors? appeared first on The Big Picture.

You might have been bored by the not-so-Superbowl last night (at least the better team won this year). Several non-football fans went to see the Becoming Led Zeppelin documentary (they raved).

But neither the game nor Zep’s origin story was the biggest story last night. Rather, the most intriguing aspect of last night was the gambling. Sports betting on Super Bowl LIX (2025) was estimated at more than $1.5 billion — a 15% increase compared to 2024. This football season saw projections for betting by Americans at $35 billion with legal sportsbooks. Overall, sports gambling is now worth about $150 billion per year.

Why do sports fan and gambling junkies keep coming back to throw good money at games? A fascinating new study suggests the answer. The Wall Street Journal discussed this;1 BusinessWeek went into the social aspects of gambling.

But the key academic takeaway is this:

Sports bettors typically expect to break even on future wagers even when they have consistently lost money in the past. The average gambler predicts they will break even, but in fact lose 7.5 cents for every dollar wagered.

Despite evidence from their recent track records, gamblers retain a misplaced sense of optimism. They ignore many of the mathematical truths about wagering and maintain numerous false expectations. Generally, the participating gamblers:

-Believe they have an edge, despite their P&L showing they do not;

-Deny (at least to themselves) the profound advantage held by the house;

-Claim to be doing this for entertainment purposes.

This is more than mere over-optimism; it also reflects an industry that has grown incredibly adept at taking advantage of the psychological makeups of human beings.

Investors share many of the same foibles: over-confidence in their own abilities despite obvious evidence to the contrary, ignoring the advantages of simply being the house (indexing) instead of trying to beat the house (alpha). Having fun with their “real” money, rather than just their “play” money.

It is an old but true story. We assume we are investing when what we are so often actually doing is speculating…

~~~

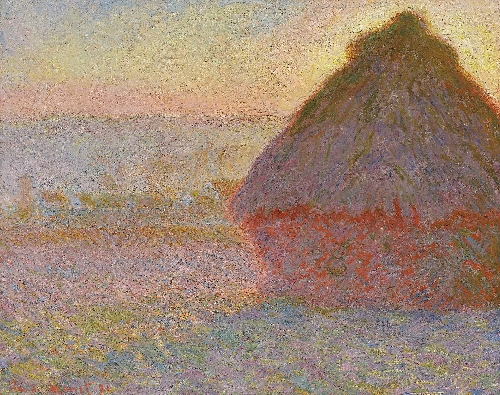

A few years ago (2015ish?), I was on a panel at the SALT conference in Las Vegas. It was held at the Bellagio Hotel & Casino. I will never forget my experience upon checking in. They had famously purchased numerous priceless works of art, held in a gallery on grounds. But that’s not flashy enough for Vegas, so they made a big deal about displaying two of Monet’s works on the wall in the lobby. They set up velvet ropes and encouraged a line to form to view the works, recently priced at about $40 million each.

After checking in, I wandered over to the work to see it. I’ll never forget the exchange between a married couple in front of me; these tourists were intrigued by the works. “C’mon, honey,” the husband said to the wife, “Let’s go win us a Monet.” At the time, I thought he was making a pun about the similarity between the artist’s name and the common word for cash.

In hindsight, I was incorrect — I now realize that he was dead serious…

~~~

“What odds do we misunderstand entirely, to our own great detriment?”

It’s worthwhile to ask ourselves about the various probabilities surrounding money—risk capital, gambling stakes, speculation, etc…

Sources:

Do Sports Bettors Need Consumer Protection? Evidence from a Field Experiment

by Matthew Brown* Nick Grasley Mariana Guido

Stanford University† January 23, 2025

Sports Bettors Are a Lot More Confident Than They Should Be

By Nick Fortuna

Wall Street Journal, Feb. 9, 2025

Betting $10,000 Every Sunday

By Charley Locke

Businessweek, February 6, 2025

__________

1. Abstract:

“Corrective policy in sports betting markets is motivated by concerns that demand may be distorted by behavioral bias. We conduct a field experiment with frequent sports bettors to measure the impact of two biases, overoptimism about financial returns and self-control problems, on the demand for sports betting. We find widespread overoptimism about financial returns. The average participant predicts that they will break even, but in fact loses 7.5 cents for every dollar wagered. We also find evidence of significant self-control problems, though these are smaller than overoptimism. We estimate a model of biased betting and use it to evaluate several corrective policies. Our estimates imply that the surplus-maximizing corrective excise tax on sports betting is twice as large as prevailing tax rates. We estimate substantial heterogeneity in bias across bettors, which implies that targeted interventions that directly eliminate bias could improve on a tax. However, eliminating bias is challenging: we show that two bias-correction interventions favored by the gambling industry are not effective.”

The post Optimism Among Gamblers & Investors? appeared first on The Big Picture.