Anatomy of a Crisis: Tariffs, Markets and the Economy!

A New Economic Order?

I was boarding a plane for a trip to Latin America late in the evening last Wednesday (April 2), and as is my practice, I was checking the score on the Yankee game, when I read the tariff news announcement. Coming after a few days where the market seemed to have found its bearings (at least partially), it was clear from the initial reactions across the world that the breadth and the magnitude of the tariffs had caught most by surprise, and that a market markdown was coming. Not surprisingly, the markets opened down on Thursday and spent the next two days in that mode, with US equity indices declining almost 10% by close of trading on Friday. Luckily for me, I was too busy on both Thursday and Friday with speaking events, since as the speaker, I did not have the luxury (or the pain) of checking markets all day long. In my second venue, which was Buenos Aires, I quipped that while Argentina was trying its best to make its way back from chaos towards stability, the rest of the world was looking a lot more like Argentina, in terms of uncertainty. On Saturday, on a long flight back to New York, I wrestled with the confusion, denial and panic that come with a market meltdown, and tried to make sense of what had happened, and more importantly of what is coming. That thinking is still a work-in-progress but as in prior crises, I find that putting even unfinished thoughts down on paper (or in a post) is healthy, and perhaps a critical component to finding your way back to serenity.

The Tariffs and Markets

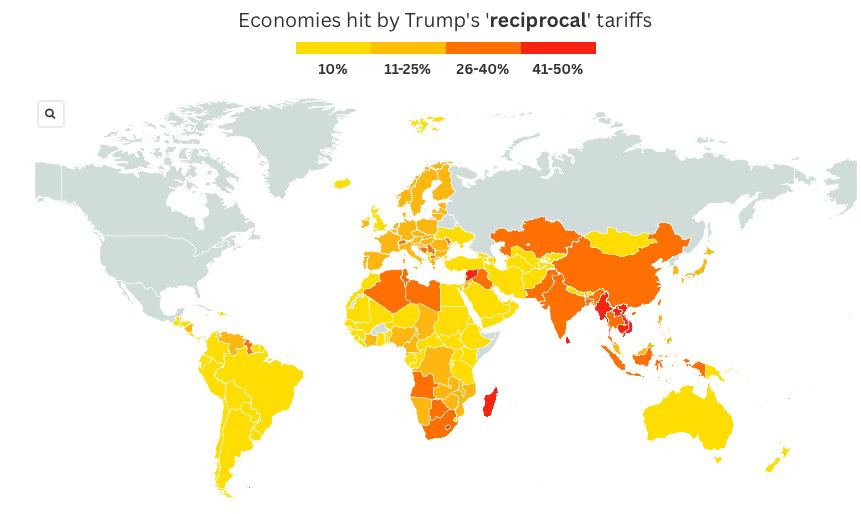

Since talk of tariffs has filled the airwaves for most of this year, you may wonder why markets reacted so strongly to the announcement on Wednesday. One reason might have been that investors and businesses were not expecting the tariff hit to be as wide and as deep as they turned out to be.

Note that while Canada and Mexico were not on the Wednesday list of tariff targets that was released on Wednesday, they have been targeted separately, and that the remaining countries that do not show up on this map (Russia and North Korea, for instance) are under sanctions that prevent them from trading in the first place.

Another reason for the market reaction was that the basis for the tariff estimates, which have now been widely shared, are not easily fixable, since they are not based on tariffs imposed by other countries, but on the magnitude of the trade deficit of the United States with these countries. Thus, any country with which the US runs a significant trade deficit faces a large tariff, and smaller countries are more exposed than larger ones since the trade deficit is computed on a percentage basis, from exports and imports related to that country. Thus, the easy out, where other countries offer to reduce or even remove their tariffs may have no or little effect on the tariffs, to the extent that the trade deficit may have little to do with tariffs.

Equities

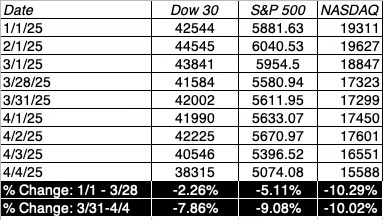

The extent of the market hit can be seen by looking at the major US equity indices, the Dow, the S&P 500 and the NASDAQ, all of which shed significant portions of their value on Thursday and Friday:

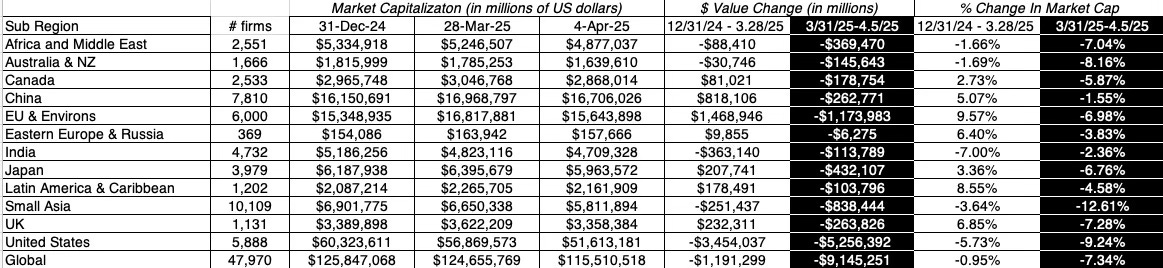

Looking beyond these indices and across the globe, the negative reaction has been global, as can be seen in the returns to equity across sub-regions, with all returns denominated in US dollars:

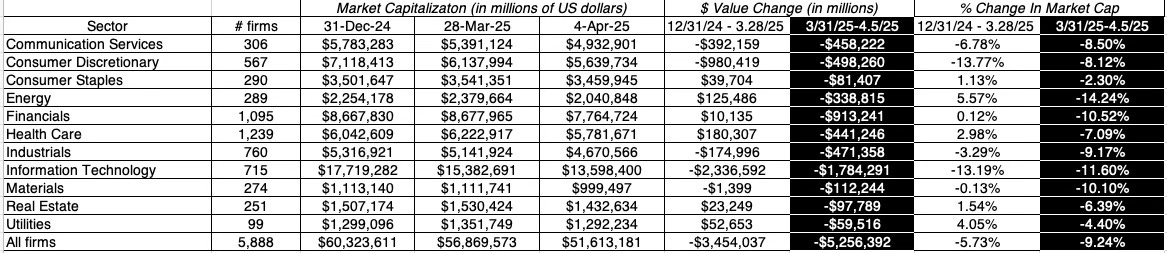

The worst hit regions of the world is Small Asia, which is Asia not counting India, China and Japan, which saw equity values in the aggregate decline by 12.61% in the last week. US equities had the biggest decline in dollar value terms, losing $5.3 trillion in value last week, a 9.24% decline in value from the Friday close on March 28, 2025. China and India have held up the best in the last week, perhaps because both countries have large enough domestic markets to sustain them through a trade war. It is also a factory that with time differences, these markets both closed before the Friday beatdown on Wall Street unfolded, and the open on Monday may give a better indication of the true reaction. Breaking down just US equities, by sector, we can see the damage across sectors:

The technology sector lost the most in value last week, both in dollar terms, shedding almost $1.8 trillion (and 11.6%) in equity value, and consumer staples and utilities held up the best, dropping 2.30% and 4.40% respectively. In percentage terms, energy stocks have lost the most in value, with market capitalizations dropping by 14.2%, dragged down by declining oil prices.

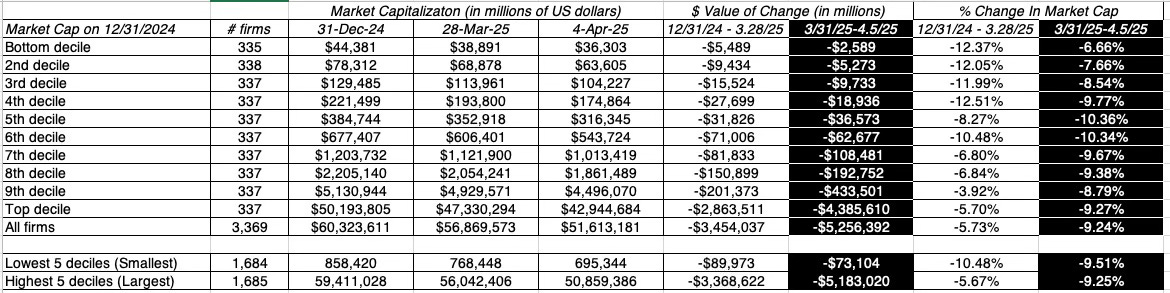

Staying with US equities, and breaking down companies, based upon their market capitalizations coming into 2025, we can again see write downs in equity value across the spectrum from last week's sell off:

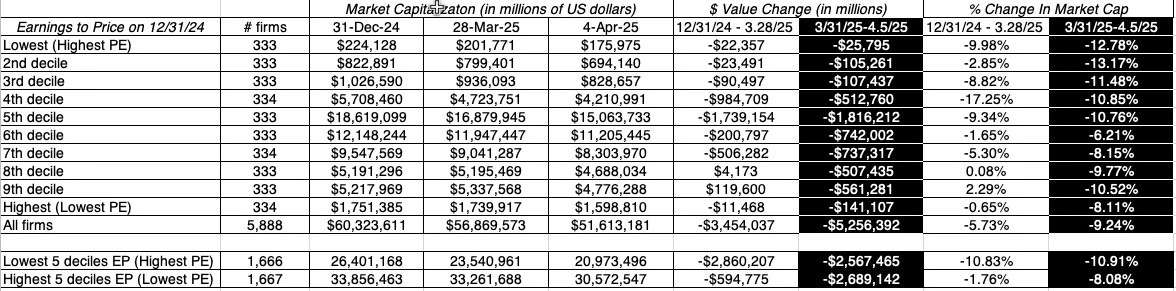

As you can see, it looks like there is little to distinguish across the market cap spectrum, as the pain was widely distributed across the market cap classes, with small and large companies losing roughly the same percent of value. To the extent that market crisis usually cause a flight to safety, I looked at US stocks, broken down by decile into earnings yield (Earnings to price ratios), over the last week:

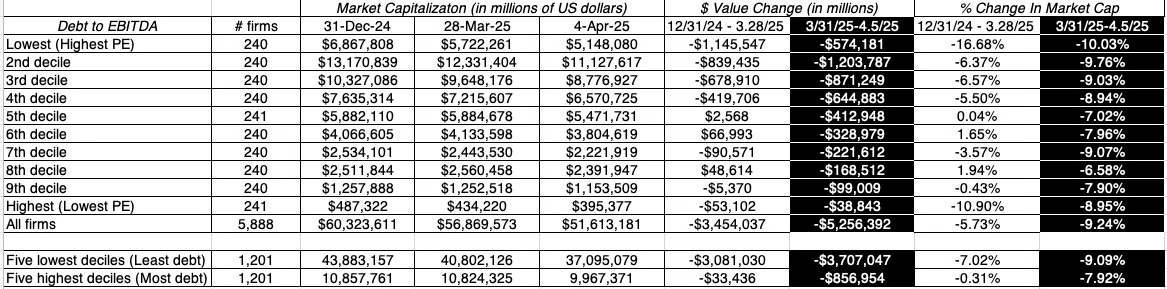

The lowest earnings to price ratio (highest PE) stocks, in the aggregate, lost 10.91% of their market capitalization last week, compared to the 8.08% decline in market cap at the highest earnings to price (lowest PE ratio) companies, providing some basis for the flight to safety hypothesis. Staying with the safety theme, I looked at US companies, broken down by debt burden (measured as debt to EBITDA):

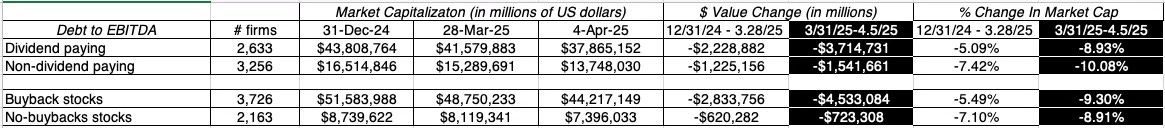

On this dimension, the numbers actually push against the flight to safety hypothesis, since the companies with the least debt performed worse than those with the most debt. Finally, I looked at whether dividend paying and cash returning companies were better protected in the sell off, by looking at dividend paying (buying back stock) companies versus non-dividend paying (not buying back stock) companies:

While dividend paying stocks did drop by less than non-dividend paying stocks, companies buying back stock underperformed those that did not buy back stock in 2024.

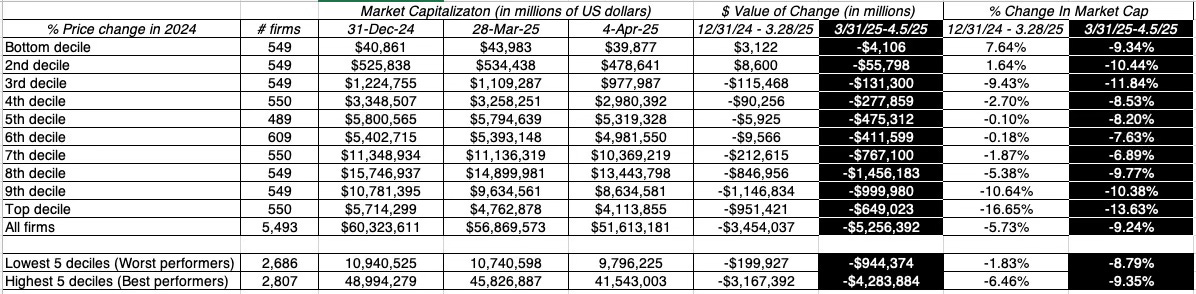

If you came into last week, believing that stocks were over priced, you would expect the correction to be worse at companies that have been bid up the most, and to test this, I classified US stocks based upon percentage stock price performance in 2024:

While the worst performers from last year came into the week down only 1.83% through March 28, whereas the best performers from 2024 were down 6.46% over the same period, there was little to distinguish between the two groups last week.

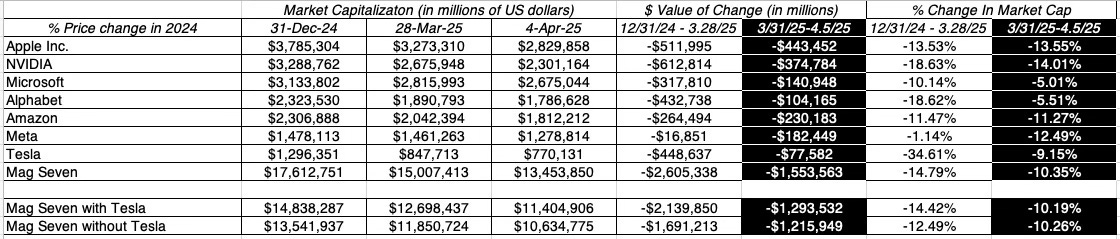

Finally, I looked at the Mag Seven stocks, since they have, in large part, carried US equities for much of the last two years;

Collectively, the Mag Seven came into last last week, already down 14.79% for the year (2025), but their losses last week, which massive in dollar value terms ($1.55 trillion) were close in percentage terms to the losses in the rest of the market.

Other Markets

As equity markets reacted to the tariff announcement, other markets followed. US treasury rates, which had entered the week down from the start of the year, continued to decline during the course of the week:

While the 3-month treasury bill rate remained fairly close to what it was at the start of the week, the rates at the longer end, from 2-year to 30-year all saw drops during the week, perhaps reflecting a search for safety on the part of investors. The drops, at least so far, have been modest and much smaller than what you would expect from a market sell off, where US equities dropped by $5.3 trillion.

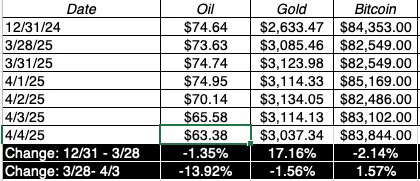

Looking past financial markets, I focused on three diverse markets - the oil market as a stand-in for commodity markets overall, the gold market, representing the time-tested collectible, and Bitcoin, which is perhaps the millennial version of gold:

Oil prices dropped last week, especially as financial asset markets melted down on Thursday and Friday, while both gold and bitcoin held their own last week. For bitcoin advocates, that is good news, since in other market crises since its creation, it has behaved more like risky stock than a collectible. Of course, it I still early in this crisis, and the true tests will come in the next few weeks.

Summing up

In sum, the data seems to point more to a mark down in equity values than to panic selling, at least based upon the small sample of two days from last week. There was undoubtedly some panic selling on Friday, but the flight to safety, whether it be in moving into treasuries or high dividend paying stocks, was muted.

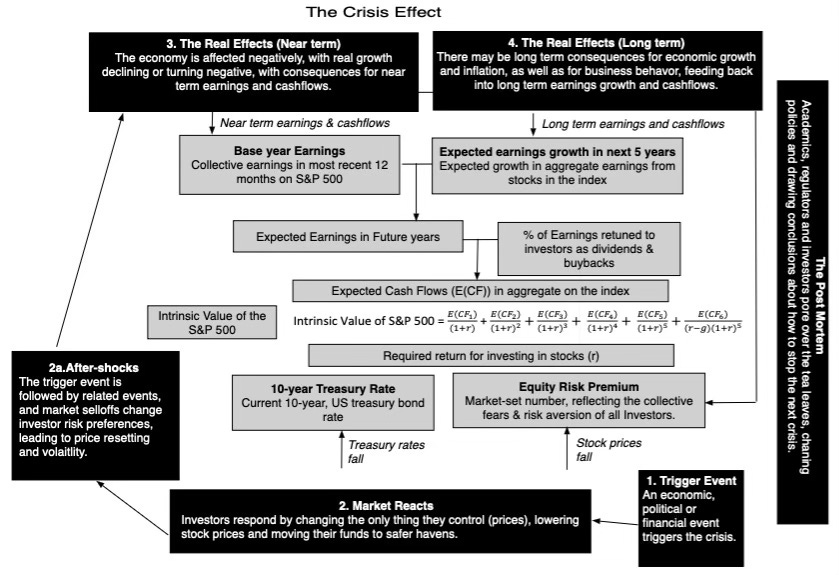

The Crisis Cycle

Each crisis is unique both in its origins and in how it plays out, but there is still value in looking across crises, to see how they unfold, what causes them to crest, and how and why they recede. In this section, I will present a crisis cycle, which almost every crisis works its way through, with big differences in how quickly, and with how much damage. The crisis cycle starts with a trigger event, which can be economic, political or financial, though there are often smaller events ahead of is occurrence that point to its coming. The immediate effect is in markets, where investors respond with the only instrument the they control, which is the prices they pay for assets, which they mark down to reflect at least their initial response to the crisis. In the language of risk, they are demanding higher prices for risk, translating into higher risk premiums. In conjunction, they often move their money to safer assets, with treasuries and collectibles historically benefiting from the fund flows. In the days and weeks that follow, there are aftershocks from the trigger event, both on the news and the market fronts, and while these aftershocks can sometimes be positive for markets, the net effect is usually negative. The effects find their way into the real economy, as consumers and businesses pull back, causing an economic slowdown or a recession, with negative effects on earnings and cash flows, at least in the near term. In the long term, the trigger event can change the economic dynamics, causing a resetting of real growth and inflation expectations, which then feed back into markets:

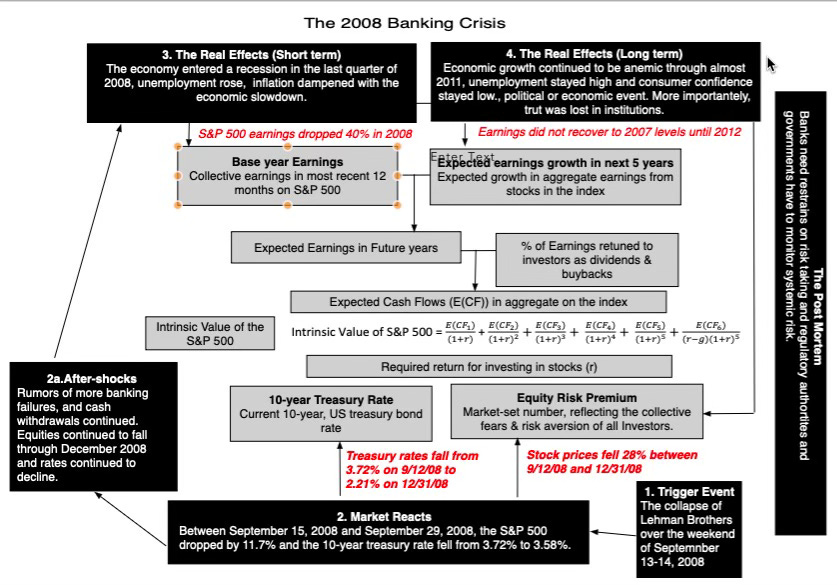

To illustrate, consider the 2008 banking crisis, where the Lehman collapse over the weekend before September 15 triggered a sell off in the stock market that caused equities to drop by 28% between September 12 and December 31, 2008, and triggered a steep recession, causing unemployment to hit double digits in 2009. The earnings for S&P 500 companies took a 40% hit in 2008, and long term, neither the economy nor earnings recovered back to pre-crisis levels until 2012.

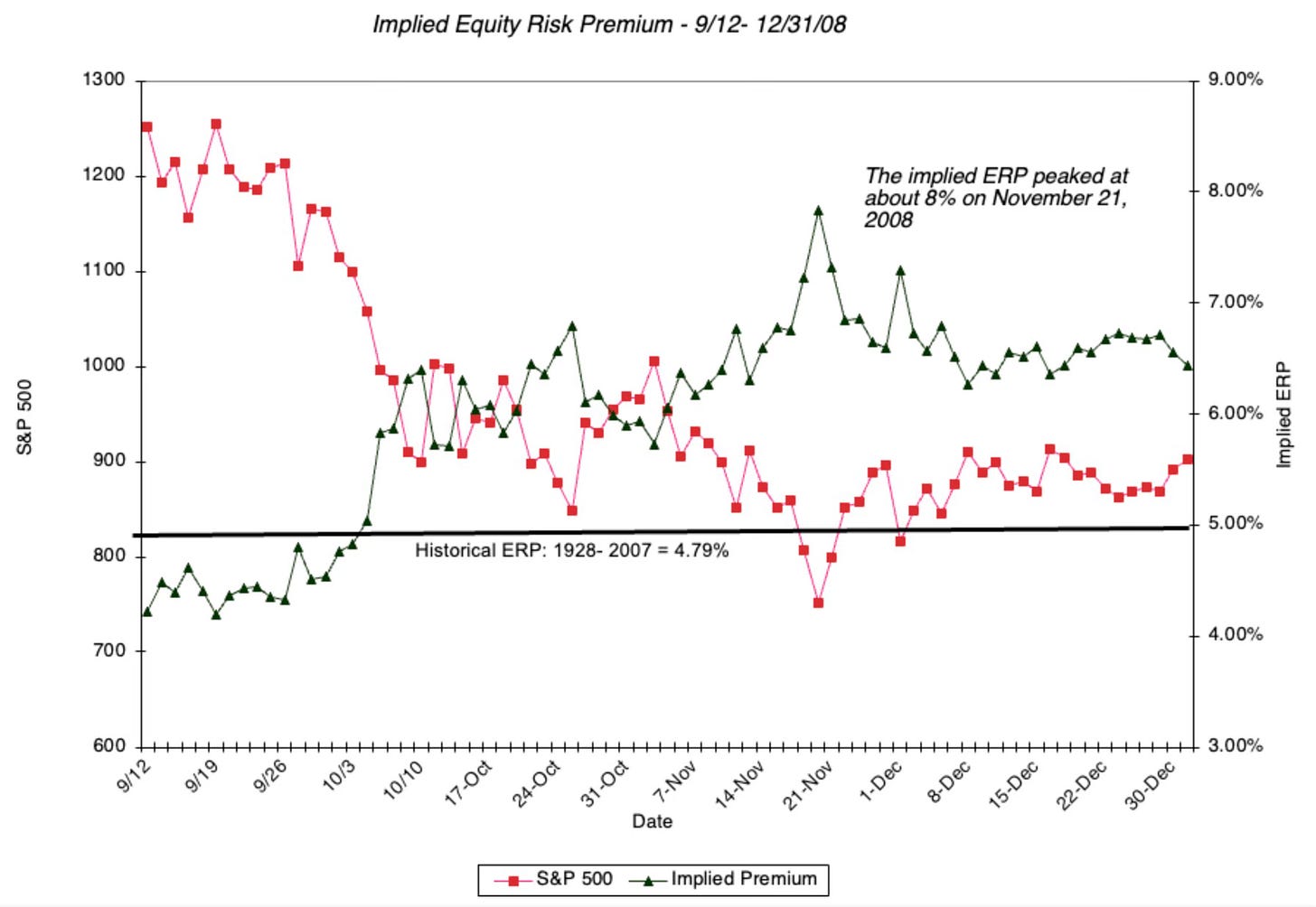

During that crisis, I started a practice of estimating equity risk premiums by day, reflecting my belief that it is day-to-day movements in the price of risk that cause equity markets to move as much as they do in a crisis:

Equity risk premiums which started the crisis at around 4% peaked at almost 8% on November 21, 2008, before ending the year at 6.43%, well above the levels at the start of 2008. Those equity risk premiums did not get back to pre-2008 levels until almost 15 years later.

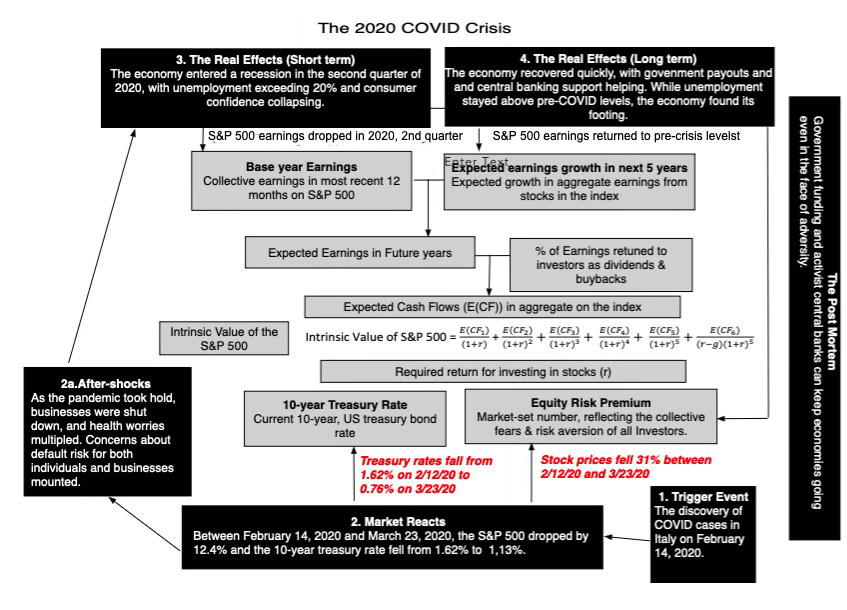

Moving to 2020 and looking at the COVID crisis, the trigger event was a news story out of Italy about COVID cases in the country that could not be traced to either China or cruise ships, shattering the delusion that the pandemic would be contained to those settings. In the weeks after, the S&P 500 shed 33% of its value before bottoming out on March 23, 2020, and treasury rates plunged to historic lows, hitting 0.76% on that day. The key difference from 2008 was that the damage to the economy and earnings was mostly short term, and by the end of the year, both (economy and earnings) were on the mend, helped undoubtedly by multi-trillion dollar government support and central banking activism:

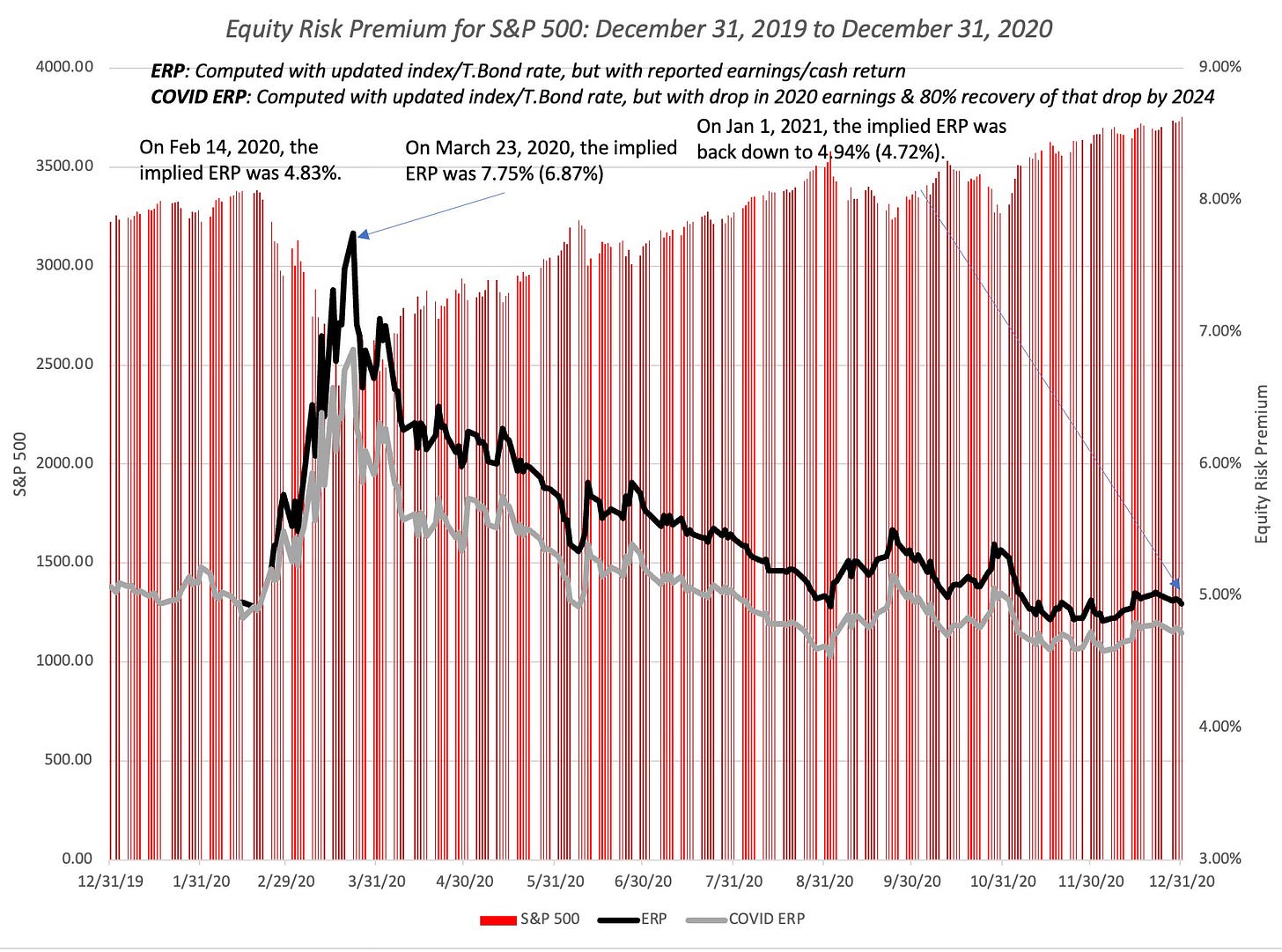

As in 2008, I computed equity risk premiums by day all through 2020, and the graph below tells the story:

As you can see, the equity risk premium which started at 4.4% on February 14, 2020, peaked a few weeks later at 7.75% on March 23, 2020, and as with the economy and earnings, it was back down to pre-crisis levels by September 2020.

The Perils of Post Mortems

Each crisis gives rise to postmortems, where investors, regulators and researchers pore over the data, often emerging with conclusions that extrapolate too much from what happened.

For investors: The lesson that many investors get out of looking at past crises is that markets come back from even the worst meltdowns, and that contrarian investing with a long time horizon always works. While that may be comforting, this lesson ignores the reality that the fact that a catastrophe did not occur in the crisis in question does not imply that the probability of it occurring was always zero. Markets assess risks in real time.

For regulators: To the extent that crises expose the weakest seams in markets and businesses, regulators often come in with fixes for those seams, mostly by dealing with the symptoms, rather than the causes. After the 2008 crisis, the conclusions were that the problems was banks behaving badly and ratings agencies that were not doing their job, both merited judgments, but the question of risk incentives that had led them on their risk taking misadventures were largely left untouched.

For researchers: With the benefit of hindsight, regulators weave stories about crises that are built around their own priors, by selectively picking up data items that support them. Thus, behavioral economists find every crisis to be an example of bubbles bursting and corrections for irrational investing, and efficient market theorists use the same crisis as an illustration of the magic of markets working.

It is worth remembering that each crisis is a sample size of one, and since each crises is different, aggregating or averaging across them can be difficult to do. Thus, the danger is that we try to learn too much from past crises rather than too little.

The Tariff Crisis?

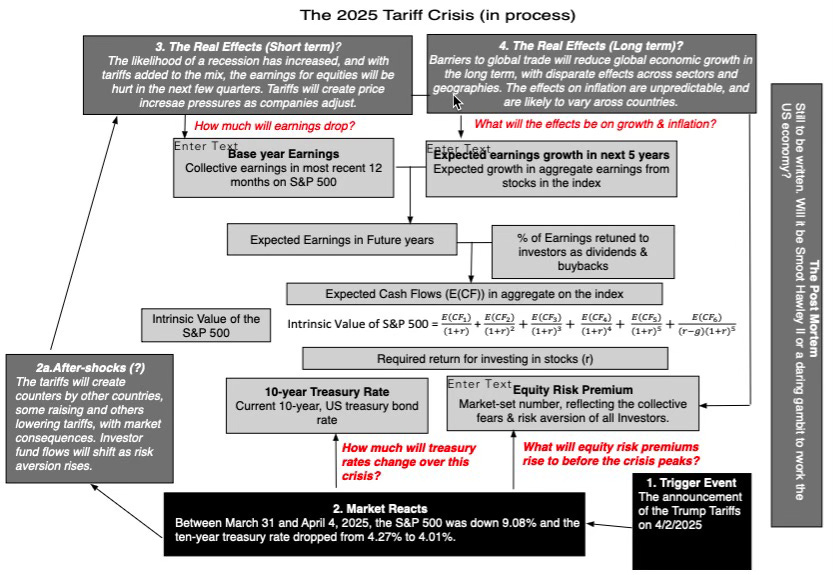

I don't believe that it is premature to put the tariff news and reaction into the crisis category. It has the potential to change the global economic order, and a market reaction is merited. It is, however, early in the process, since we are just past the trigger event (tariff announcement) and the initial market reaction, with lots of unknowns facing us down the road:

There are clearly stages of this crisis that have played out, but based on what we know now, here is how I see them:

After shocks: The tariff story will have after shocks, with both negatives (other countries imposing their own tariffs, and the US responding) and positives (a pause in tariffs, countries dropping tariffs). Those after shocks will create more market volatility, and if history is any guide, there is more downside than upside in the near term. In addition, the market volatility can feed itself, as levered investors are forced to close out positions and fund flows to markets reflect investor concerns and uncertainty. If you add on top of that the possibility that global investors may decide to reduce their US equity holdings, that reallocation will have price effects.

Real economy (near term): In the near term, the real economy will slow down, with the plus being that while tariff-related price increases are coming, a cooling down in the economy will dampen inflation. The likelihood of a recession has spiked in the days since the tariff announcement, and while we will have to wait for the numbers on real growth and unemployment to come in, it does look likely that real growth will be impacted negatively. The steep declines in commodity prices suggests that investors see an economic slowdown on the horizon. As

Real economy (long term): Global economic growth will slow, and the US, as the world’s largest economy, will slow with it.. There are other dynamics at play including a restructuring of old economic and political alliances (Is there a point to having a G7 meeting?) and a new more challenging environment for global companies that have spent the last few decades building supply chains that stretch across the globe, and selling to consumers all over.

It is worth noting that if we measure winning by not the size of the pie (the size of the entire economy) but who gets what slice of that economy, it is possible that tariffs could reapportion the pie, with capital (equity markets) getting a smaller slice, and workers getting a larger slice,. In fact, much of this administration's defense of the tariff has been on this front, and time will tell whether that works out to be the case.

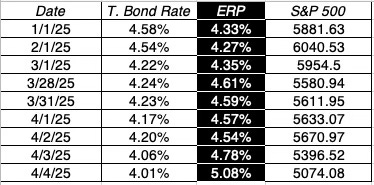

In the two days after the announcement, stock prices have dropped and the price of risk has risen, as investors reassess the economy and markets:

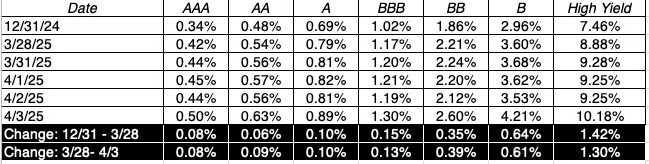

The implied equity risk premium has risen from 4.57% on April 2 to 5.08% by the close of trading on Friday. The road ahead of us is long, but I plan to continue to compute these implied equity risk premiums every day for as long as I believe we are in crisis-mode, and I will keep these updated numbers on my webpage. As stocks have been revalued with higher prices of risk, that same uncertainty is playing out in the corporate bond market, where corporate default spreads widened on Thursday (April 3) and Friday (April 4):

As with the equity risk premiums, the price of risk in the bond market had already risen between the start of 2025 and March 28, 2025, but they surged last week, with the lowest ratings showing the biggest surges. With treasury rates, equity risk premiums and default spreads all on the move it may be time for companies and investors to be reassessing their costs of equity and capital.

What now?

If you have stayed with me so far on this long and rambling discourse, you are probably looking for my views on how this crisis will unfold, and how investors should respond now. I am afraid that dishing out investment advice is not my cup of tea, but I will try to explain how I plan to deal with what's coming, with the caveat that what I do may not work for you

A (Personal) Postscript

In the midst of every market meltdown, you will see three groups of experts emerge. The first will be the "I told you so" group, eager to tell you that this is the big one, the threat that they have spent a decade or more warning you about. They will of course not let on that if you had followed their advice from inception, you would have been invested in cash for the last decade, and even with a market crash, you would not be made hold again. The second will include "knee jerk contrarians", arguing that stock markets always come back, and that every market dip is a buying opportunity, an extraordinarily lazy philosophy that gets the rewards (none) that its deserves. The third will be the "indecisives", who will present every side of the argument, conclude that there is too much uncertainty right now to either buy or sell, but to wait until the uncertainty passes. There are elements of truth in all three arguments, but they all have blind spots.

In the midst of a crisis, the market becomes a pricing game, where perception gets the better of reality, momentum overwhelms fundamentals and day-to-day movements cannot be rationalized. Anyone who tells you that their crystal balls, data or charts can predict what's coming is lying or delusional, and there is no one right response to this (or any other) crisis. It will depend on:

Cash needs and time horizon: If you are or will soon be in need of cash, to pay for health care, buy a home or pay tuition, and you are invested in equities, you should take the cash out now. Waiting for a better time to do so, when the clock is ticking is the equivalent of paying Russian Roulette and just as dangerous. Conversely, if you do not need the cash and are patient, you have the flexibility of waiting, though having a longer time horizon does not necessarily mean that you should wait to act.

Macro views: The effects on markets and the real economy will depend on how you see the tariffs playing out, with the outcomes ranging from a no-holds-barred trade war (with tariffs and counter tariffs) to a partial trade war (with some countries capitulating and others fighting) to a complete clearing of the air (where the tariff threat is scaled down or put on the back burner). While you may be inclined to turn this over to macro economists, this is less about economics and more about game theory, where an expert poker player will be better positioned to forecast what will happen than an economic think tank.

Investment philosophy: I have long argued (and teach a class to that effect) that every investor needs an investment philosophy, attuned to his or her personal make up. That philosophy starts with a set of beliefs about how markets make mistakes and corrects them, and manifests in strategies designed to take advantage of those mistakes.

My investment philosophy starts with the belief that markets, for the most part, do a remarkable job in aggregating and reflecting crowd consensus, but that they sometimes make big mistakes that take long periods to correct, especially in periods and portions of the market where there is uncertainty. I am terrible at gauging market mood and momentum, but feel that I have an edge (albeit a small one) in assessing individual companies, though that may be my delusion. My response to this crisis (or any other) will follow this script:

Daily ERP: As in prior crises, I will continue to monitor the equity risk premiums, treasury rates and the expected return on stocks every day until I feel comfortable enough to let go. Note that this process lasted for months after the 2008 and 2020 crises, but as earnings updates for the S&P 500 reflect tariffs, my confidence in my assessments will increase. (As mentioned earlier, you will find these daily updates at this link)

Revalue companies in my portfolio: While I was comfortable with the companies in my portfolio on March 28, viewing them as under valued or at least not over valued enough to merit a sell, the tariffs may have an significant effect on their values, and I plan to revalue them in batches, starting with my big tech holdings (the Mag Five, since I did sell Tesla and most of my Nvidia holdings) and working through the rest.

Buy value: I have drawn a contrast between great companies and great investments, with the former characterized by large moats, great management and strong earnings power, and the latter by being priced too low. There are companies that I believe are great companies, but are priced so highly by the market that they are sub-standard investments and I choose not to invest in them. During a crisis, where investors often sell without discrimination, there companies can become buys, and I have to be ready to buy at the right price. Since buying in the face of a market meltdown can require fortitude that I may not have, I have been scouring my list of great companies, revaluing them with the tariff effects built in, and putting buys at limit prices below those values. In the last week, both BYD, a company that I said that I liked, a few weeks ago in my post on globalization and disruption, and Mercado Libre, a Latin American powerhouse, that has the disruptive potential of an Amazon combined with a fintech enterprise, have moved from being significantly overvalued to within shouting distance of the limit prices I have on them.

Go back to living: I certainly don't see much gain watching the market hour-to-hour and day-to-day, since its doings are out of my control and anything that I do in response is more likely to do harm than good. Instead, I plan on living my life, enjoying life's small pleasures, like a Yankee win or taking my dog for a walk, to big ones, like celebrating my granddaughter's birthday in a couple of days.

I hope that you find your own path back to serenity in the face of this market volatility, and that whatever you end up doing with your portfolio allows you to pass the sleep test, where you don't lie awake at night thinking about your portfolio (up or down).

YouTube Video

Data Links