Can a person retire comfortably at 65 with 3 million saved?

A $3 million nest egg gives you a financial advantage and makes it easier to retire. However, living expenses have been on the rise, and some things get more expensive as you get older. For instance, healthcare costs may ramp up in your 70s or 80s, and you don’t want to deplete your nest egg […] The post Can a person retire comfortably at 65 with 3 million saved? appeared first on 24/7 Wall St..

A $3 million nest egg gives you a financial advantage and makes it easier to retire. However, living expenses have been on the rise, and some things get more expensive as you get older. For instance, healthcare costs may ramp up in your 70s or 80s, and you don’t want to deplete your nest egg too early.

If you’re prudent with your portfolio withdrawals and Social Security cash distributions, you can make a $3 million nest egg work, especially if you have paid off your mortgage. This guide will explore some of the things to consider before stepping out of your career as a 65-year-old with a $3 million nest egg.

Key Points

-

65-year-olds with $3 million nest eggs are in a great position, but it may not be enough to retire.

-

Assessing your expenses, considering taxes, and predicting your future healthcare costs can help you gauge if you are ready to leave the workforce.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

How Much Should You Withdraw Each Year?

The 4% rule is a common benchmark that assesses how much you should withdraw each year. The theory is that your portfolio will go up by more than 4% each year, allowing you to replace the money that you withdrew. This strategy only works if the market continues to trend upward.

A stock market crash can put this strategy in serious jeopardy. That’s why it is popular to de-risk your portfolio as you get older. With that said, it’s still good to have some of your money in the stock market, so you are prepared for bullish economic cycles.

A 65-year-old who sticks with the 4% withdrawal rule can withdraw $120,000 per year from a $3 million portfolio. You should assess your finances to determine if you can live on $10,000 per month.

Add Taxes to Your Calculations

If your nest egg is in a traditional 401(k) or IRA, you will have to pay taxes on your withdrawals. It’s easier to calculatetaxes on a Roth 401(k) or IRA, since you don’t pay any taxes on your withdrawals. Any traditional 401(k) and IRA withdrawals are taxed as ordinary income. If you need $5,000 per month to cover your expenses, you will have to withdraw more than $5,000 per month from a traditional retirement account due to taxes.

You can also receive Social Security in your 60s, but waiting until you turn 70 will result in the maximum Social Security benefits. Unfortunately, your Social Security benefits will be taxed, and traditional retirement account withdrawals will result in a higher tax rate.

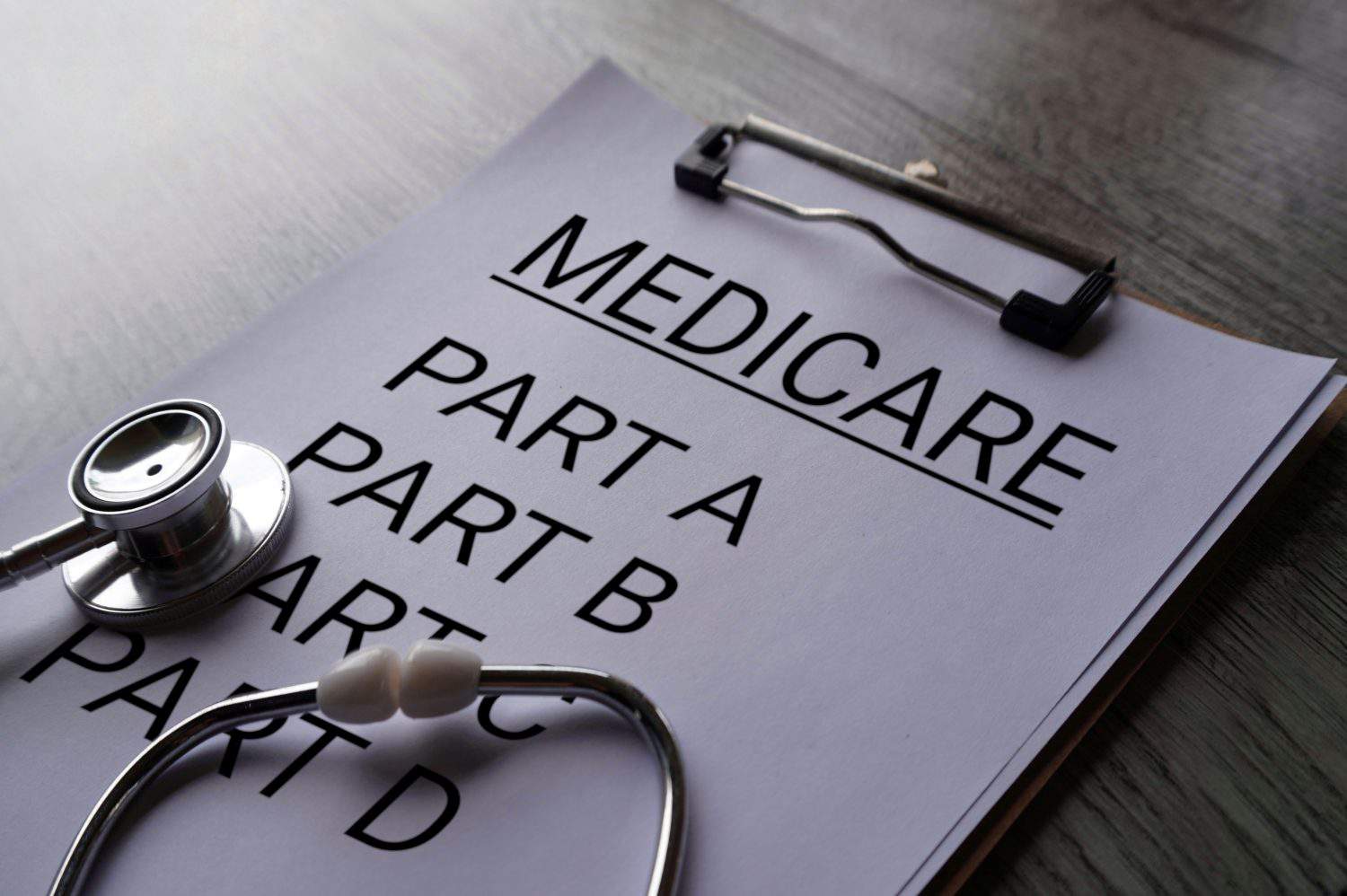

Consider Future Costs Like Healthcare

Healthcare is one of the biggest expenses you may face as you get older. You can take proactive measures to minimize these costs, such as staying healthy and exercising often. However, it’s good to anticipate how this expense can add up.

You might want to work a part-time job or a side hustle instead of tapping out of the workforce. That way, you can still save money and put yourself in a better position if you have to contend with expensive healthcare bills.

However, some costs may go away. For instance, a couple with two cars may only need one car when they retire. As people get older, they may not be able to drive their vehicles and have to opt for ride-hailing services instead.

Your housing expenses may also look different if you decide to downsize. Empty nesters, in particular, have a lot of space in their old houses and may need a smaller place instead. There’s also a lot of value in moving to a 1-floor house when you get older to eliminate the risk of falling down the stairs.

You’re ahead of the game if you have $3 million saved up. It’s good to keep working if you can, as it provides a sense of purpose. However, this nest egg gives you the flexibility to work part-time if you prefer. Your monthly expenses and how you adjust your lifestyle will determine if $3 million is enough.

The post Can a person retire comfortably at 65 with 3 million saved? appeared first on 24/7 Wall St..