Can I withdraw $50,000-$70,000 annually in retirement at age 55 with $1,100,000?

Retirement is exciting for many people due to the freedom and flexibility that it provides. However, if you retire too early, you risk having to rejoin the workforce at a much older age. Your career prospects may not be as good if you have to return after a 10-year hiatus. Retiring at 55 years old […] The post Can I withdraw $50,000-$70,000 annually in retirement at age 55 with $1,100,000? appeared first on 24/7 Wall St..

Retirement is exciting for many people due to the freedom and flexibility that it provides. However, if you retire too early, you risk having to rejoin the workforce at a much older age. Your career prospects may not be as good if you have to return after a 10-year hiatus.

Retiring at 55 years old with a $1.1 million portfolio already sounds risky. While a $1.1 million portfolio is impressive, that amount doesn’t carry as much weight as it used to. Rising costs can deplete your nest egg before you reach your 70s, especially if the stock market enters a correction.

These are some of the reasons it’s risky to withdraw $50,000 to $70,000 per year with a $1.1 million portfolio. You’ll also discover some things that you can do instead.

Key Points

-

Can you retire at 55 with a $1.1 million nest egg? There are some risks with this approach.

-

Working for a few more years and investing in index funds can put you in a better position by the time you are 65.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

It’s Hard To Produce A Consistent 7% Annualized Return

Withdrawing $70,000 from your portfolio each year requires that your portfolio produce a 6.4% return each year. For the sake of simplicity and giving yourself some extra breathing room, we will round that number to an annualized 7% return.

The withdrawal won’t even include taxes, so you will need more than a 7% return each year if your money isn’t stored away in a Roth retirement account. Any stock market correction will require that you withdraw a higher percentage of your money. Right now, a $50,000 to $70,000 withdrawal ranges from 5%-7% of your portfolio. That’s much higher than the preferred 4% withdrawal rule.

Some financial advisors can attempt to produce high annualized returns, but they may take riskier strategies in the pursuit of high returns. While it’s good to always keep some of your money in the stock market, investors usually put their cash into less risky assets like CDs and high-yield savings accounts as they get older.

Working a little longer will give the 55-year-old more time to build their nest egg. Furthermore, if someone works until they turn 65, they don’t have to stretch the nest egg for as many years.

Don’t Rely On Social Security

No winning financial strategy puts Social Security on the pedestal. Retiring at 55 and taking out $50,000 to $70,000 per year may sound good on paper since you can tap into Social Security when you turn 62. However, if you take Social Security at 62, you will receive the lowest amount. You will qualify for higher Social Security payouts if you wait until you turn 70 to start making withdrawals.

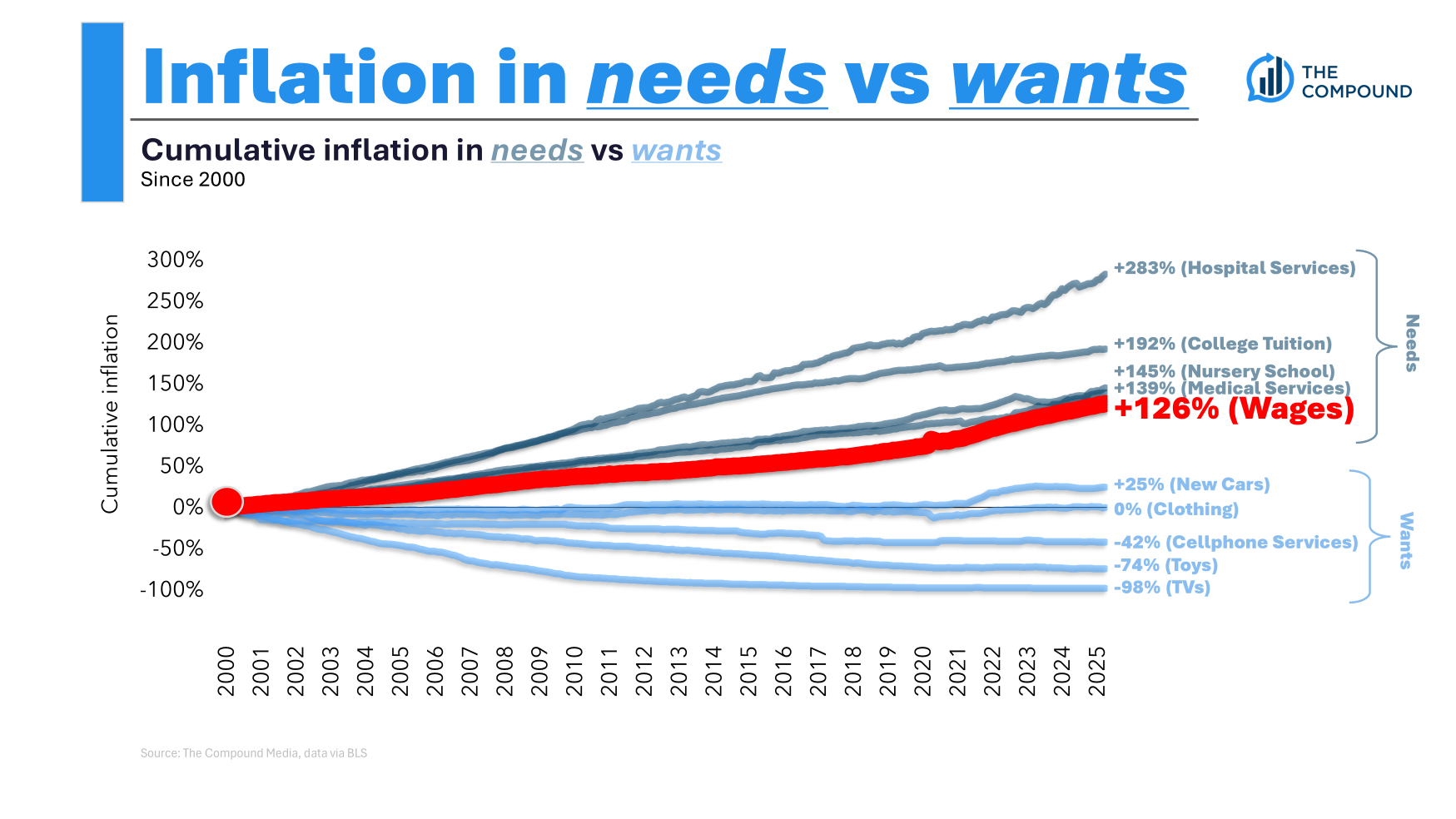

Furthermore, your living expenses will likely increase due to inflation. While Social Security claims to keep up with inflation, various products and services will experience higher price hikes than Social Security’s annual cost-of-living adjustments.

It’s better to plan your finances as if you will not receive Social Security. This approach isn’t an indictment of Social Security’s future, but it gives you more control over your finances instead of relying on the government.

Focus On Index Funds, Not Individual Stocks

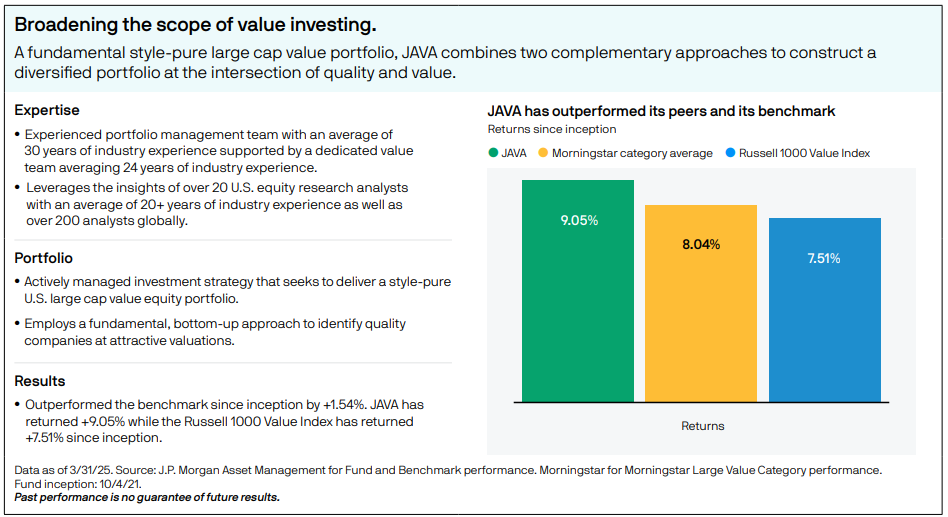

While individual stocks have their place, they aren’t for everyone. Index funds and ETFs that track benchmarks like the S&P 500 and Nasdaq Composite can generate respectable returns without much effort. You don’t have to know much about the stock market or follow the news if you invest in mutual funds and ETFs that track reliable indices.

As people get older, they gradually move out of stocks into less risky assets. If you continue to work, it may make sense to delay that transition. Since you’re still earning money and don’t have to touch your nest egg right away, you have more time to recover from corrections and accumulate gains during strong market cycles.

The post Can I withdraw $50,000-$70,000 annually in retirement at age 55 with $1,100,000? appeared first on 24/7 Wall St..