Research links: fighting for a better deal

Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s edition including a look at...

Rebalancing

- The costs of rebalancing are real. (papers.ssrn.com)

- How to use threshold-based rebalancing for target-date funds. (corporate.vanguard.com)

- Tracking a total market index comes with its own costs. (papers.ssrn.com)

Behavior

- Just how over-optimistic are sports bettors? (wsj.com)

- In surveys, how you ask people about their well-being matters. (papers.ssrn.com)

- How misogyny helps explain the gender wage gap. (papers.ssrn.com)

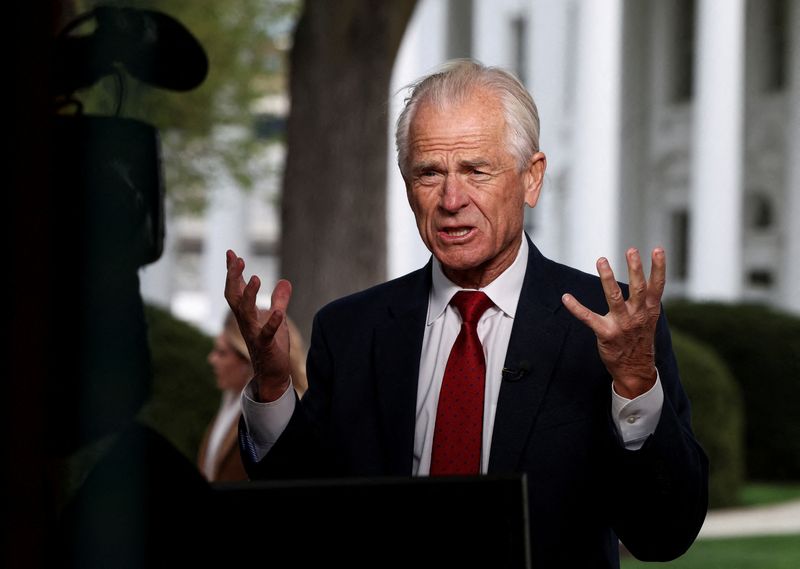

Politics

- Political stability matters for investors. (klementoninvesting.substack.com)

- The U.S. is segregating itself on partisan lines. (papers.ssrn.com)

Research

- Is there a bubble in private credit? Not yet. (alphaarchitect.com)

- Tactical asset allocation funds are a persistent disappointment. (morningstar.com)

- Do rising pair-wise correlations show the downside of indexing? (klementoninvesting.substack.com)

- The three factors driving U.S. vs. international equity market performance. (alphaarchitect.com)

- Did real assets hedge post-Covid inflation shocks? Not really. (blogs.cfainstitute.org)

- The sponsors of structured products want you to benchmark to the wrong number. (moontower.substack.com)

- Options listings provide companies with valuable information. (papers.ssrn.com)

- On the fading of the turn-of-the-month effect. (quantseeker.com)

- Risk attitudes are not constant across countries. (mrzepczynski.blogspot.com)

- 18 lessons from the Great Recession. (scottsumner.substack.com)