I’m 37, married, no kids, house, cars, etc. Bringing in decent income. Looking for someone (company/private) to guide on what to do with the savings, as I think it’s just collecting dust.

The financial world gets easier to understand as you dive deeper into it, but it can feel very complex for someone who is just getting started. That’s how a Redditor feels, and they posted about it in the CFP subreddit. The original poster is a married 37-year-old with no kids. The individual brings in a […] The post I’m 37, married, no kids, house, cars, etc. Bringing in decent income. Looking for someone (company/private) to guide on what to do with the savings, as I think it’s just collecting dust. appeared first on 24/7 Wall St..

The financial world gets easier to understand as you dive deeper into it, but it can feel very complex for someone who is just getting started. That’s how a Redditor feels, and they posted about it in the CFP subreddit.

The original poster is a married 37-year-old with no kids. The individual brings in a decent income and is looking for some guidance. The Redditor is specifically looking for a financial advisor and hoped that the subreddit could provide some suggestions. Fellow Redditors jumped into the comments and shared resources that can help the original poster find a good CFP.

Key Points

-

A 37-year-old wants to work with a financial advisor.

-

Redditors jumped in the comments to share where to find a financial advisor.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Look In Your Local Area

The top comment came from a Redditor who suggested finding CFPs in your area and interviewing them. Narrowing the search to your area gives you the flexibility to meet your CFP in person if necessary.

While you can’t speak with every financial advisor in your area, the commenter suggested interviewing 2-3 of them to see who you get along with the most. If you’re not sure where to find CFPs in your area, the commenter suggested Lets Make A Plan. This website only lists CFPs.

When you work with any financial advisor, make sure you are working with a fiduciary. These advisors are required to serve in your best interests. The issue with advisors who aren’t fiduciaries is that they may focus on promoting financial products that maximize their commissions instead of products that maximize your returns or minimize risk.

Exhaust Free Resources First

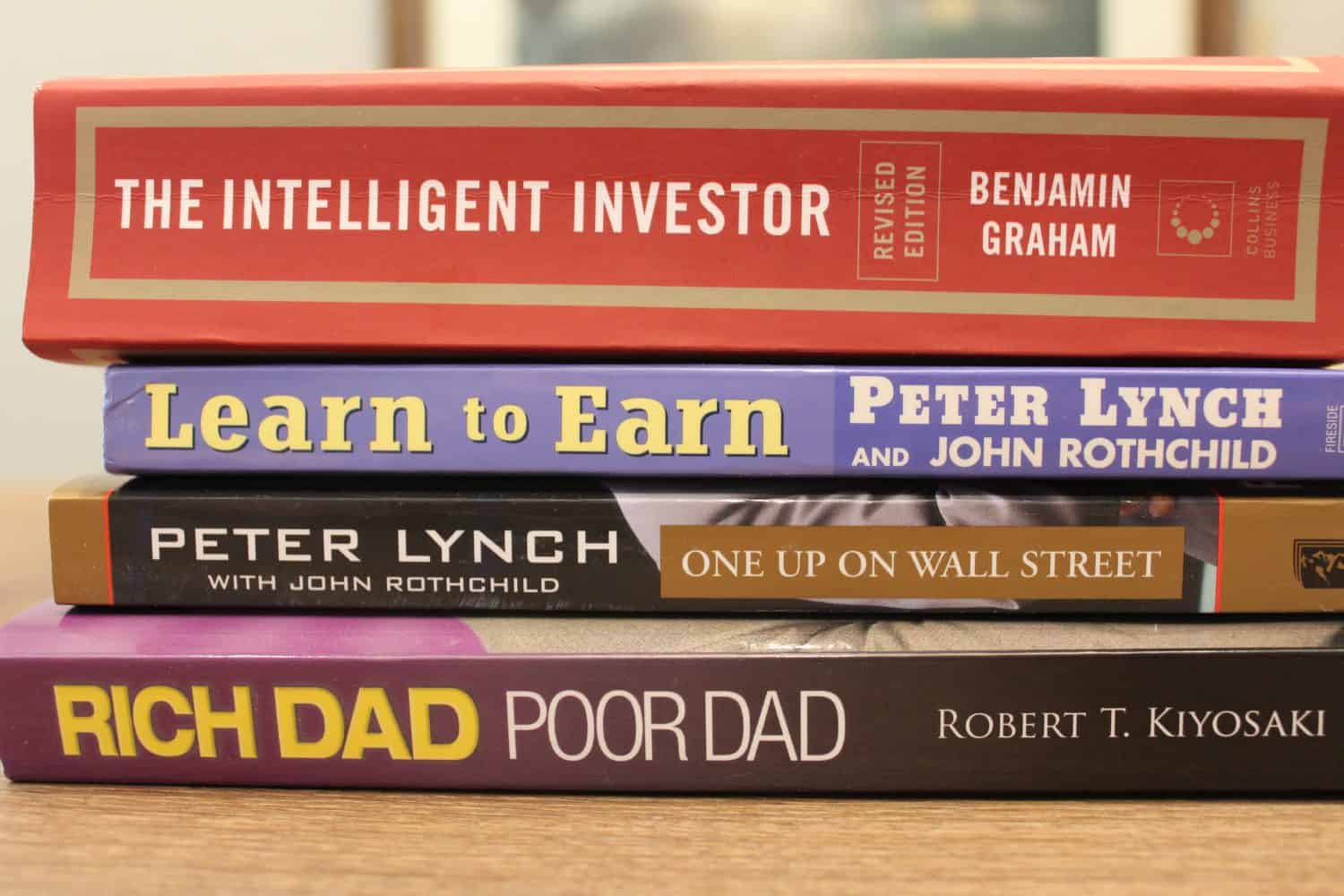

One commenter suggested that the original poster exhausts their free resources first. For instance, the Redditor can read financial books and browse educational content on Fidelity, Vanguard, and Schwab. The Redditor can focus on the basics, such as maxing out their 401(k) plan.

Some financial plans are complex and require assistance from a professional. However, other people can buy shares in an index fund and stay on top of their budgets. Doing those two things can go a long way in creating a good financial strategy. Then, you can continue to learn more about personal finance by capitalizing on free resources.

Establish Your Financial Goals

Most financial advisors will sit you down and ask about your financial goals. Instead of waiting for that meeting, you should write a list of your goals. These are some of the questions to consider when mapping out your goals:

- When do I want to retire?

- How much do I need in my portfolio to cover living expenses when I retire?

- How many kids do I want to have?

- Will I pay for their college education?

- What lifestyle do I want to have?

These types of questions help you envision what you want life to look like in the future. You can then use these goals to map out the actions you have to take today. For instance, you can use your retirement goal to calculate how much you have to invest in your portfolio each month. Reaching your preferred number may require working a side hustle and cutting down on unnecessary expenses.

Knowing your goals is similar to knowing the end destination of a vacation trip. There’s no point in driving if you don’t know where you’re supposed to wind up. Then you can get lost and end up well off course by the time you figure out where you want to go.

Figuring out your long-term financial goals makes it easier to determine what actions to take and which skills you have to learn.

The post I’m 37, married, no kids, house, cars, etc. Bringing in decent income. Looking for someone (company/private) to guide on what to do with the savings, as I think it’s just collecting dust. appeared first on 24/7 Wall St..