Disney’s Stock (DIS) Has a Churn Problem, but It’s Not Even the Biggest Problem

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. 24/7 Wall St. : Disney+ saw subscriber churn despite price hikes, reinforcing concerns that Walt Disney Co. (NYSE: DIS) remains a second-tier player in the streaming market. The company’s core revenue drivers—theme parks, […] The post Disney’s Stock (DIS) Has a Churn Problem, but It’s Not Even the Biggest Problem appeared first on 24/7 Wall St..

compensation for actions taken through them.

24/7 Wall St. Key Points:

- Disney+ saw subscriber churn despite price hikes, reinforcing concerns that Walt Disney Co. (NYSE: DIS) remains a second-tier player in the streaming market.

- The company’s core revenue drivers—theme parks, cruise lines, and studio content—are far more important to its financial health than streaming.

- Rising costs and economic uncertainty could pressure Disney’s theme park business, making it a bigger risk factor than streaming losses.

- Also: Are you ahead, or behind on retirement? Click here to take a quick quiz and see for yourself. (sponsored)

Watch the Video

Transcript:

[00:00:04] Doug McIntyre: So, uh, our friends over at Disney, Bob Iger and company, uh, announced earnings and they were very proud of them. They were very proud of them. I would not describe what happened after that as a massive rally. It’s not like, Oh my God, it got back to the five year high.

[00:00:23] Doug McIntyre: Look, I understand the streaming business is now making a little money. Okay. And I think that’s amazing because they lost billions of dollars. What they did is they raised prices, but the number of subscribers came down, which means there’s churn. You know, which is not to me, I understand you’re getting more money per subscriber, but now you’ve got churn.

[00:00:46] Doug McIntyre: Right. And I still think that a savvy investor understands that Disney is in fourth or fifth place and people are not gonna subscribe to four or five of these things. No. Everybody has Netflix (NASDAQ: NFLX), almost everybody has Amazon (NASDAQ: AMZN) Prime video.

[00:01:06] Lee Jackson: Right.

[00:01:07] Doug McIntyre: And I still get the shopping and the bonus. Right, exactly. To me, if you’re not in the top couple of them, there’s still a huge amount of risk as to whether you can grow or not.

[00:01:17] Doug McIntyre: And if Disney’s starting to have more churn, it’s just not a good business. I, I’m happy for Iger. that he’s had this tiny turn around before. He, he says he’s gonna retire next year. I bet you Iger doesn’t retire for, he’s like, he’s like Jamie Dimon. He’ll retire 10 years from now. Listen, the other businesses they have, theme parks, I mean, listen, it’s all fine.

[00:01:42] Lee Jackson: Yeah, if you don’t have the issue in this Ernie’s report was the decline and it wasn’t in Hulu. It was in Disney Plus, and that’s their big package that to try to lure you in, you get you get you get Hulu, you get Disney Plus, and you get ESPN Plus. you would think that the biggest draw, of course, is Disney plus, because people that are switching from cable to streaming, what, okay, we can get Disney for our kids and there’s kids movies and a lot of that stuff and a lot of Disney programming, but if they’re starting to lose subscribers, uh-oh,

[00:02:19] Doug McIntyre: Here’s the problem with Disney.

[00:02:22] Doug McIntyre: Whenever they announce earnings, everybody looks at the streaming numbers. The streaming numbers are insignificant. Okay. they have studios, they have theme parks, they have those big boats people ride around on. If you want to know what’s happening with Disney, look at that stuff, because if it’s doing well, I don’t want to say streaming surrounding error,

[00:02:45] Doug McIntyre: but it’s not, it’s not really a, doesn’t drive the growth. if it goes back to breake where it is, it’s, that’s Disney, but the press seems to think that many subscribers Disney plus has is a big deal.

[00:03:00] Lee Jackson: You’re exactly right.

[00:03:02] Doug McIntyre: If you want to understand Disney, you want to look at the stock, you have to say to yourself, where do they make money? It’s where they’ve made money for decades. Okay.

[00:03:12] Doug McIntyre: It hasn’t changed. So I’m begging everybody forget out the number of streaming subscribers. They have, it’s not that important.

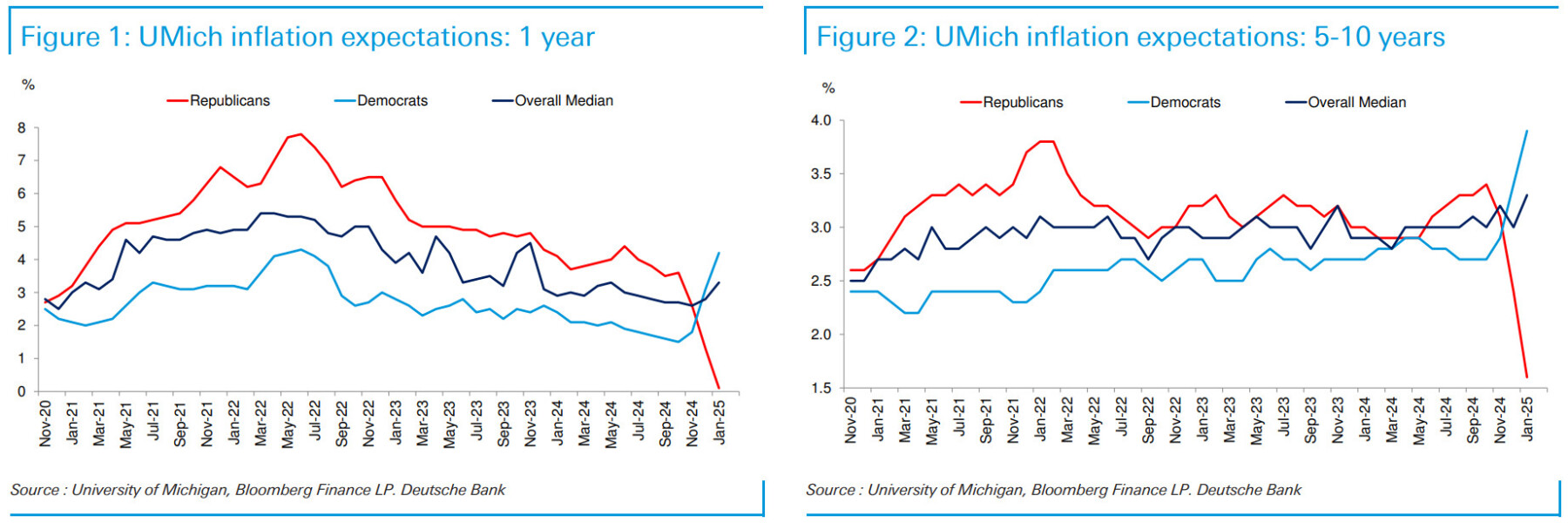

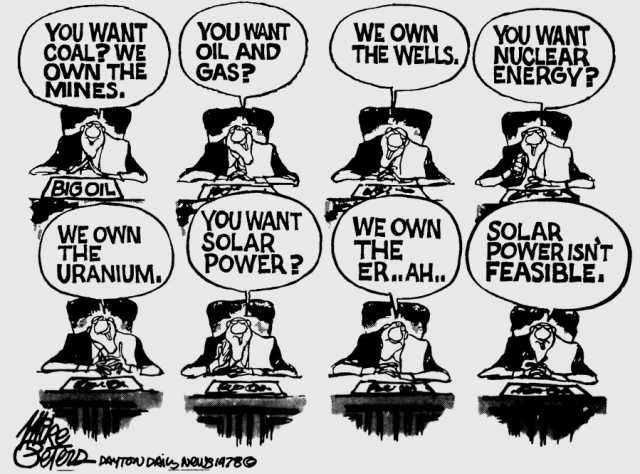

[00:03:22] Lee Jackson: And they’re going to have to be careful because the theme parks are gigantic, but they’re expensive. They’re very expensive and in an inflationary environment where things are still holding at 3%, you know, the social security cola wasn’t even equal to where the rate of inflation is and for families that your kids that are, you know, tugging on their legs going, I want to go to Disney World.

[00:03:45] Lee Jackson: I want to go to Disney World. It’s an expensive proposition. It is a very expensive proposition, especially if you don’t live near Disney.

[00:03:53] Doug McIntyre: No, if you’ve got to fly from Minneapolis to Orlando. Yeah. It’s, it’s a couple and their three kids. And then those Disney hotels are, you know what I’m saying though? I don’t know how many thousands of dollars it is for a family of five, but.

[00:04:08] Lee Jackson: Oh, it’s gotta be five grand. It’s gotta be five grand all in, if not more. And so they’re going to have to be careful with that because if the economy turns down at all and things get put on the side burner, going to Disneyland and spending five to 10 grand is going to be one of them.

[00:04:26] Doug McIntyre: I agree right now the risk in Disney is the theme parks. It’s not streaming. No.

The post Disney’s Stock (DIS) Has a Churn Problem, but It’s Not Even the Biggest Problem appeared first on 24/7 Wall St..