Stock Market Today: Stocks fade; Shell reportedly in talks to buy BP

A giant oil merger might be in the works. Powell testimony continues. Tesla lower as European sales slump. FedEx shares slide on tariff woes.

Updated 11:50 a.m. EDT

WSJ: Shell in early talks to buy BP

Shell (SHEL) is in early talks to buy BP (BP) , The Wall Street Journal reported. BP's current market value is around $80 billion.

Such a tieup, the paper reported, "would be a landmark combination of two so-called supermajor oil companies, a group of multinational behemoths that dominate the production of the world’s most important energy sources."

Updated: 11:40 a.m. EDT

Tech stocks lead market higher; Tesla off

Technology stocks were driving the market averages higher in early trading Wednesday.

The Nasdaq 100 Index hit a 52-week high of 22,329 but faded to 22,235, up 44 points. The Nasdaq Composite had risen 61 points to 19,973.

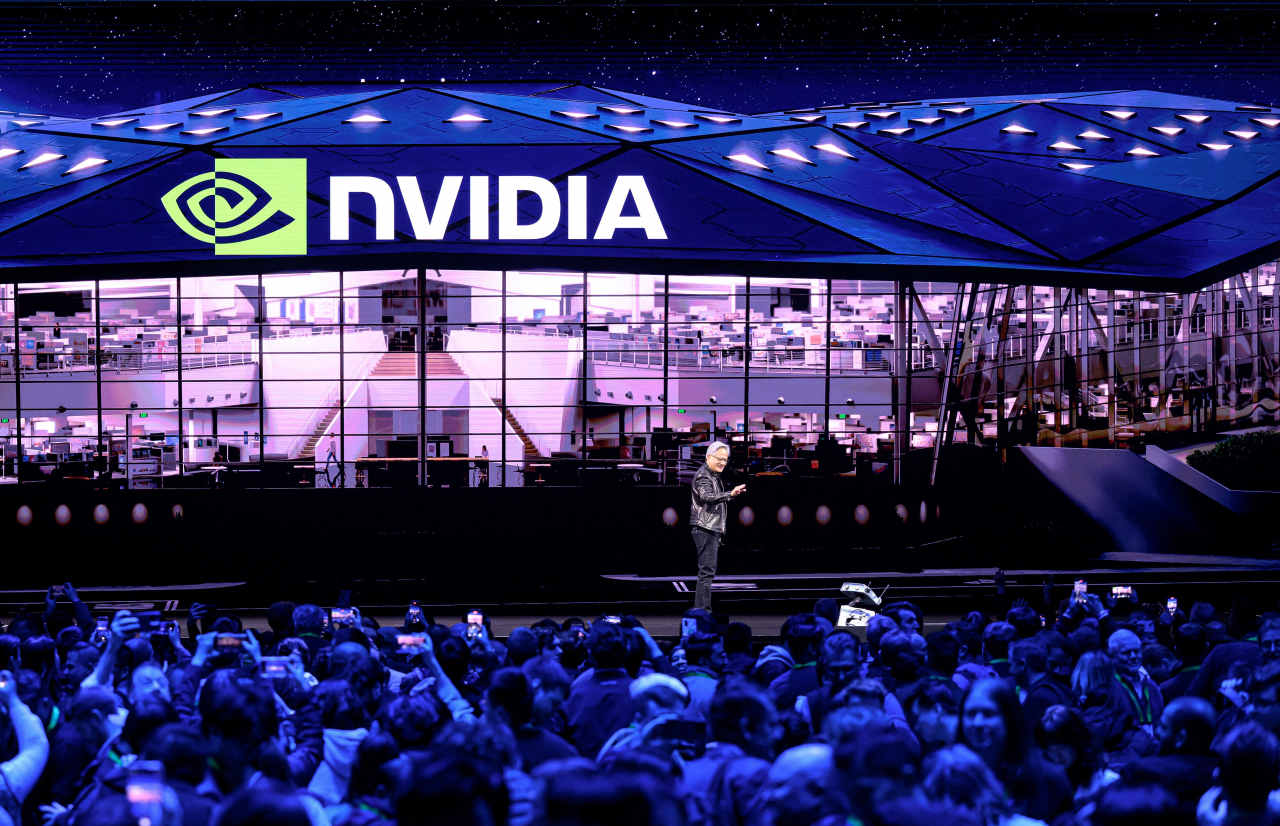

Health-care company Grail GRAL, chip giant Nvidia (NVDA) and bitcoin specialist MicroStrategy (MSTR) were the Nasdaq 100 leaders.

The Standard & Poor's 500 Index was up just two points 6,094. The index nearly broke its 52-week high of 6,147 on Tuesday when the market enjoyed a stupendous rally on the news of the U.S. attack on Iran's nuclear facilities .

The Dow Jones Industrial Average slipped 89 points to 43,000.

Some profit-taking was probably in order after Tuesday, when the Dow finished with a 507-point gain.

Oil prices were higher, and bond yields moved higher. The 10-year Treasury yield was at 4.325%, up from Tuesday's 4.296%.

Tesla (TSLA) shares were down 5% at $321 as sales in Europe continued to slump. Tesla's new-car registrations fell more than 40% in May, The Wall Street Journal reported, citing data from a European industry body.

Nine of 11 S&P 500 sectors are lower. The leading sectors are:

- Technology, led by Super Micro Computer (SMCI) and Nvidia.

- Communications Services, led by Google parent Alphabet (GOOGL) , up 2.8% at $171.40; Fox Corp. (FOXA) , up 0.7% to $56.28; and Netflix (NFLX) , up 0.3% to 1,283.

Energy sector, led by Valero Energy (VLO) , up 0.8% to $136.92, is the best of the declining sectors and basically flat.

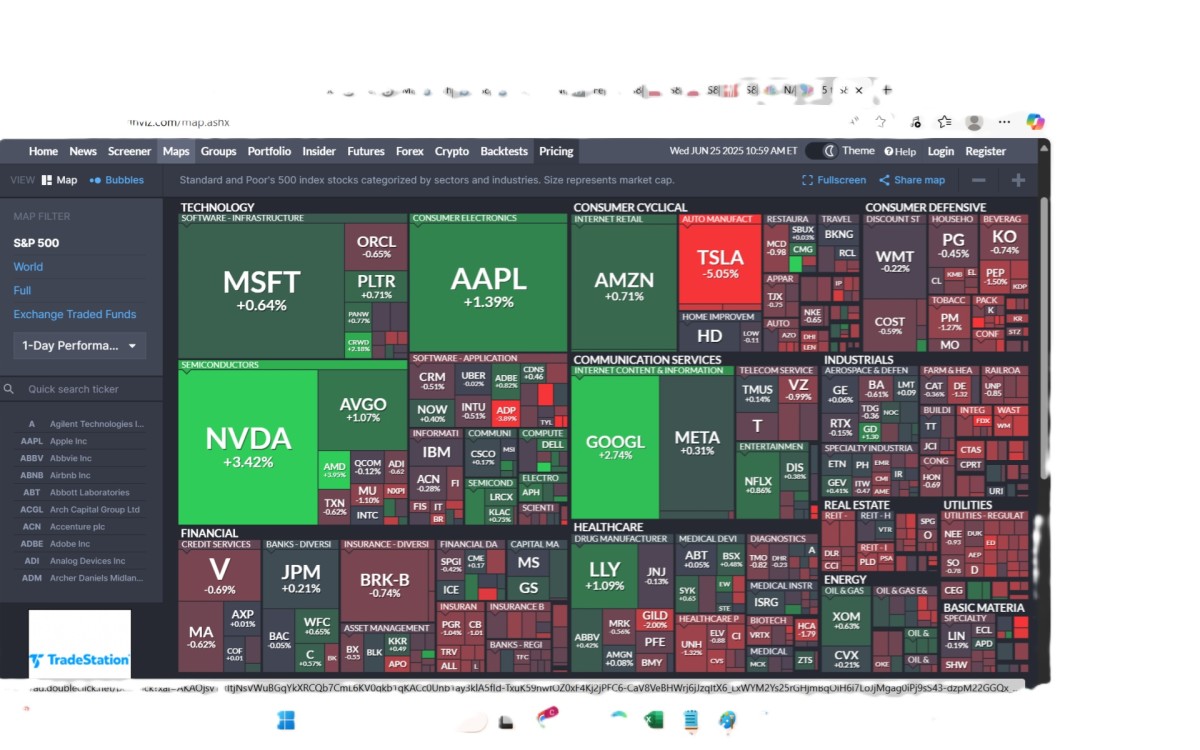

Tech is the big winner

Tech's dominance in Wednesday's market is very big, as this heat map of the S&P 500 from Finviz shows. The sizes of the boxes in the map are ranked by market cap.

Various shades of green indicate stocks that are higher. (Bright green is tops or 3% or more higher; bright orange is a 3% loss or more.)

Stock Market Today

Stocks were looking at continuing this week's rally even as oil prices and interest rates were moving higher.

Futures trading suggests the Standard & Poor's 500 Index will open higher by about 8 points, and the Nasdaq-100 Index was looking at a 75-point gain. Both indexes flirted with all-time highs on Tuesday when stocks enjoyed a stupendous rally.

Futures trading in the Dow Jones Industrial Average suggest the blue chips will open down slightly.