How Post-Liberation Day Spreads Could Present Opportunity in Devalued Sectors

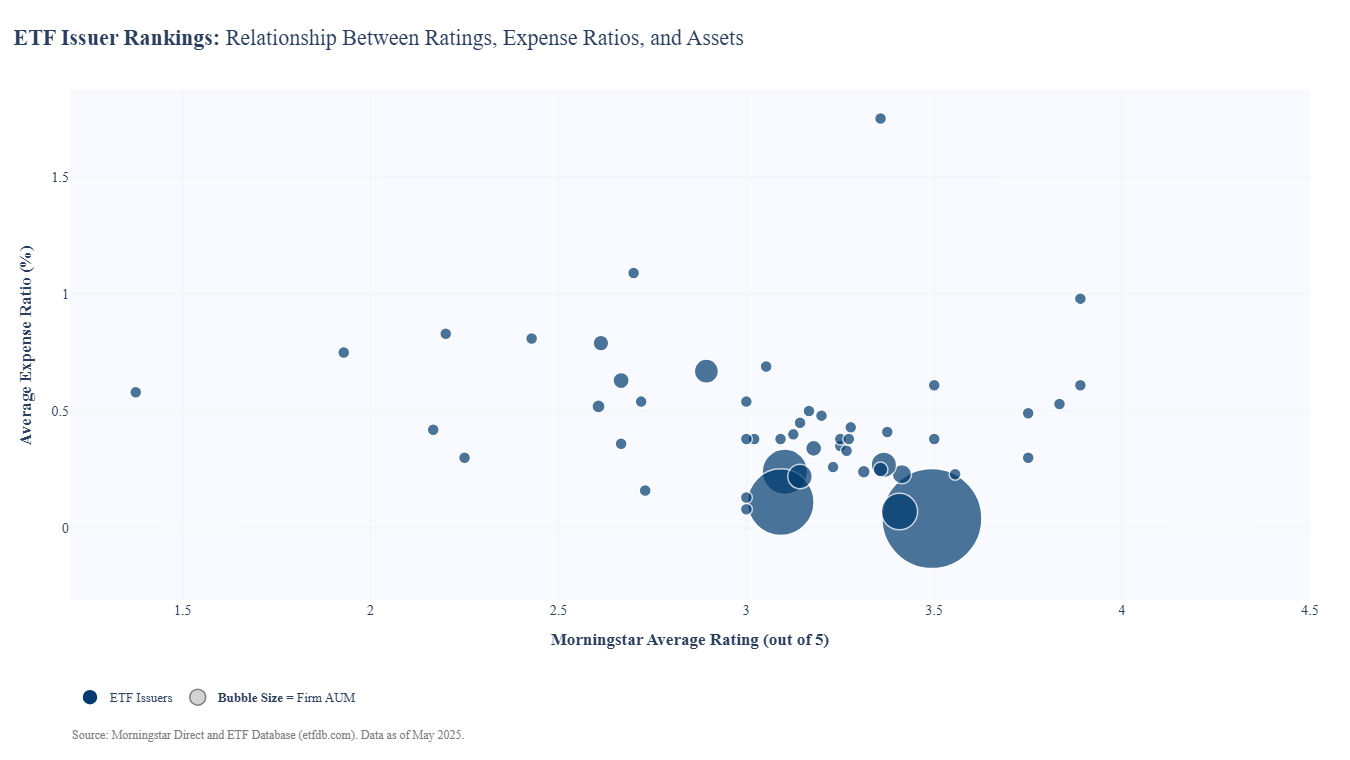

Credit spreads are widening – is it time to re-evaluate your fixed income portfolio? Learn about the CMBS market, its opportunities within undervalued sectors, and… The post How Post-Liberation Day Spreads Could Present Opportunity in Devalued Sectors appeared first on ETFguide.

Credit spreads are widening – is it time to re-evaluate your fixed income portfolio? Learn about the CMBS market, its opportunities within undervalued sectors, and how investors are capitalizing on current conditions post-liberation day.

In this episode of Spotlight, Brittany Mason @etfguide speaks with Chandler Nichols, VP, ETF Product Development at Advisors Asset Management about income opportunities with preferred securities and shorter duration bonds.

*ETF tickers mentioned in this episode include*

1. AAM Low Duration Preferred & Income Securities ETF (PFLD)

2. AAM SLC Low Duration Income ETF (LODI)

*Learn more about Advisors Asset Management’s ETF lineup*

https://www.aamlive.com/ETF

#dividendinvesting #dividendincome #dividendstocks #dividendgrowth #retirementincome #etf #sp500 #passiveincome #interestrates #yields #investor #inflationhedge #volatility #stocks #inflation #shorts

The post How Post-Liberation Day Spreads Could Present Opportunity in Devalued Sectors appeared first on ETFguide.