CoreWeave vs. IonQ: Which High-Risk, High-Reward Stock Is a Better Buy

As the old adage goes, higher risk, higher reward. But riskier investments can also be accompanied by outsized downsize risk. While momentum investing will end in tears for many, for a lucky few who pick the right names at the right time, there are significant spoils to be had. Of course, you’ve got to actually […] The post CoreWeave vs. IonQ: Which High-Risk, High-Reward Stock Is a Better Buy appeared first on 24/7 Wall St..

As the old adage goes, higher risk, higher reward. But riskier investments can also be accompanied by outsized downsize risk. While momentum investing will end in tears for many, for a lucky few who pick the right names at the right time, there are significant spoils to be had. Of course, you’ve got to actually ring the register to lock in those gains after a sizable move. Vicious rallies in stocks tend to be accompanied by equally violent (and perhaps more painful) corrections.

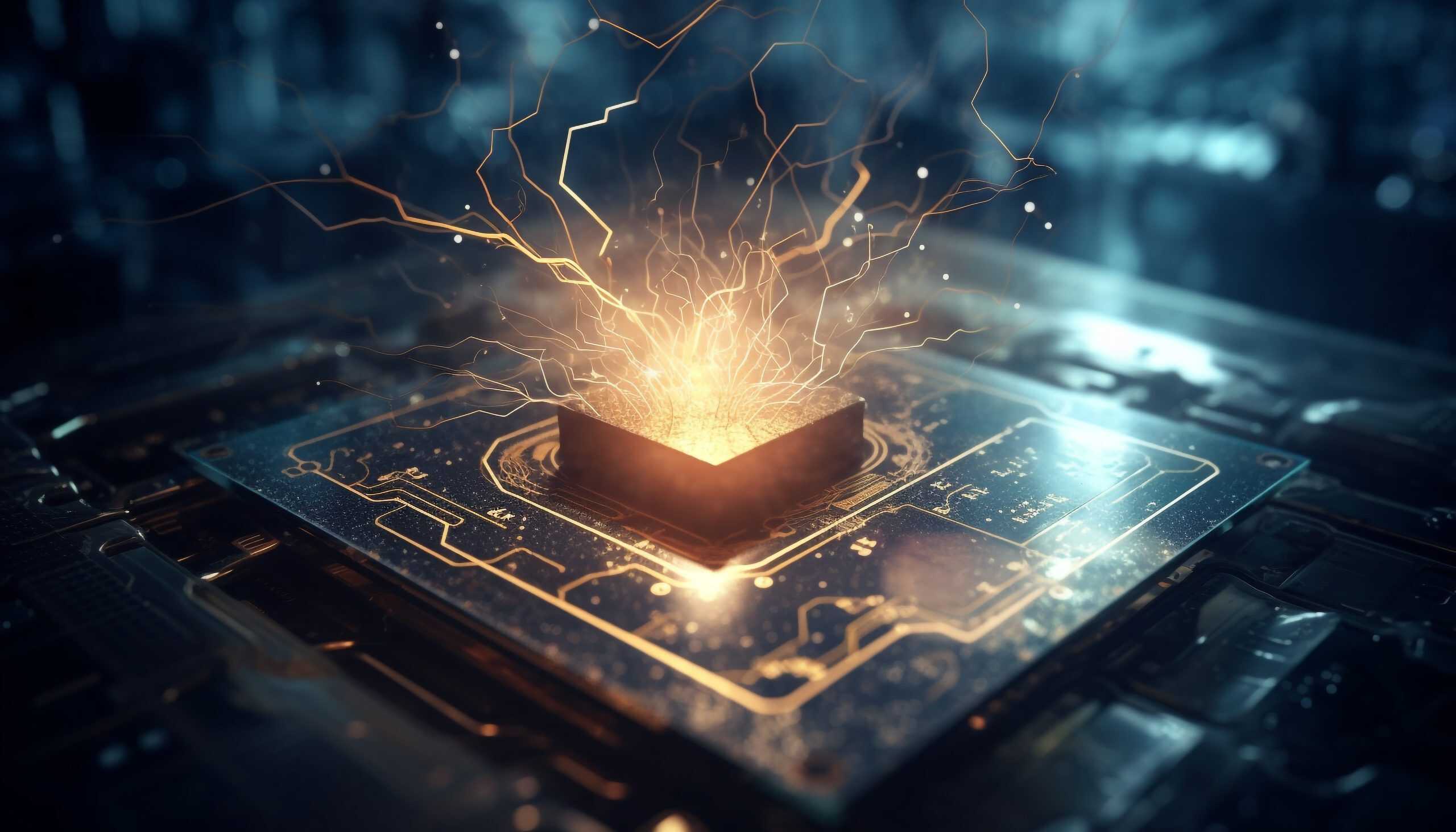

That’s the boom-and-bust nature to be expected with some of the market’s highest-flying tech sensations. At the same time, getting out of a high flyer too early can also cause one to kick themselves and buy shares at even higher prices later on. Indeed, NVIDIA (NASDAQ:NVDA) was one such name that consistently found new ways to soar higher, despite clocking in multi-bagger gains year after year.

But it’s not too hard to imagine that the ongoing AI revolution will propel other relatively unknown tech darlings up the market cap leaderboard. In this piece, 24/7 Wall St. looks at two riskier but high-growth potential stocks in CoreWeave (NASDAQ:CRWV) and IonQ (NYSE:IONQ) that may appeal to the younger investors with higher risk tolerances. If you are looking to add a touch of spice to your portfolio, just be aware of the downside risks that can come with such high-growth momentum plays, especially those that are lacking on the earnings front with limited clarity as to what comes next.

Key Points in This Article:

- Since its post-Liberation Day lows, cloud-computing startup CRWV has gained over 341%.

- Quantum computing company IonQ has seen its stock gain more than 119% since its year-to-date low in March.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

CoreWeave

CoreWeave was a standout name in the 2025 IPO class, now up over 330% since its debut day all the way back in March. At the time, it was a pretty unnerving time to put new money to work in markets, let alone a new issue, given President Trump’s tariffs and the post-Liberation Day sell-off that caused a rush back into safe-haven assets. If you braved the dip by picking up a few shares of CRWV, you were greatly rewarded in short order. Since the post-Liberation Day lows, cloud-computing startup CRWV has gained over 341%.

After such a euphoric gain, the AI cloud company now sports a valuation north of $82 billion. Indeed, that’s quite hefty for the once-humble startup that debuted on public markets just months ago. As demand for AI compute (not just GPUs, but CPUs, storage, and all other technologies needed) continues to go off the charts with all sorts of new AI agents and GPU-intensive reasoning models set to go online, it seems CoreWeave has all the right tailwinds at its back to continue its ascent.

While I do not doubt the magnitude of the AI tailwinds, I do find CRWV stock difficult to value. Then again, most hyper-growth stocks that rocket out of the gate do tend to seem expensive based on most traditional valuation metrics.

According to 18 Wall Street analysts, the stock receives a consensus “Moderate Buy” rating. However, prospective investors should be mindful of the company’s currently negative price-to-earnings (P/E) ratio of -70.8. DA Davidson analyst Gil Luria is also a bit concerned about the price of admission — CRWV goes for close to 30 times price-to-sales (P/S). With the lone sell rating on the stock and a price target that entails significant downside from current levels, perhaps investors would keen on the name may wish to wait for a pullback before punching their ticket.

IonQ

Speaking of pullbacks, IonQ is an exciting stock that’s fresh off a swift V-shaped bounce from its first half plunge of nearly 58%. Indeed, it seemed like IonQ stock was about to fade into the background. But as it turned out, it was prime time to buy the stock, as it more than doubled in a matter of months. Today, shares of the quantum computing company are 20% off all-time highs after dipping shortly before running into a ceiling of resistance at around $48 per share.

With renewed optimism about the hope of quantum computing and a solid quarterly earnings report (losses narrowed more than expected) delivered in May, IONQ stock definitely looks intriguing, especially for investors who are ready to look beyond AI for the next wave of tech-driven disruptive growth.

Investors must gauge the growth and catalysts to be had so that they can have a better understanding of a firm’s ability to grow into a pie-in-the-sky multiple. In such cases, expensive stocks can appear cheaper as their share prices march higher. As a frontrunner in quantum, I’d not bet against the name, even if you think we’re decades away from a “useful” quantum computer. After gaining over 520% in a year, though, my main concern lies in the valuation.

IonQ receives a “Strong Buy” rating from Wall Street, but only five analysts currently cover the stock. Like CoreWeave, the company also sports a negative P/E ratio that currently registers at -27.25.

Personally, I’d wait for another one of those sharp dips before seriously considering a position. In any case, I do find IONQ to be the more exciting stock than CRWV as far as disruptive innovation is concerned.

The post CoreWeave vs. IonQ: Which High-Risk, High-Reward Stock Is a Better Buy appeared first on 24/7 Wall St..