Should I invest all my retirement savings in US treasuries for guaranteed returns over the next 15 years?

If you are someone who doesn’t love the ups and downs of the stock market, there is a definite question about how else you can diversify. Whether it’s because of market volatility or just a general distaste for owning stock, it’s okay to want to diversify in financial areas with less overall risk to your […] The post Should I invest all my retirement savings in US treasuries for guaranteed returns over the next 15 years? appeared first on 24/7 Wall St..

If you are someone who doesn’t love the ups and downs of the stock market, there is a definite question about how else you can diversify. Whether it’s because of market volatility or just a general distaste for owning stock, it’s okay to want to diversify in financial areas with less overall risk to your cash.

In this scenario, the Redditor is trying to decide whether investing in US treasuries is the best way to earn money before retirement.

Some people are clearly looking at alternative investment ideas that involve less risk than the stock market.

The big red flag around this strategy is around inflation and how much inflation is happening year after year.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

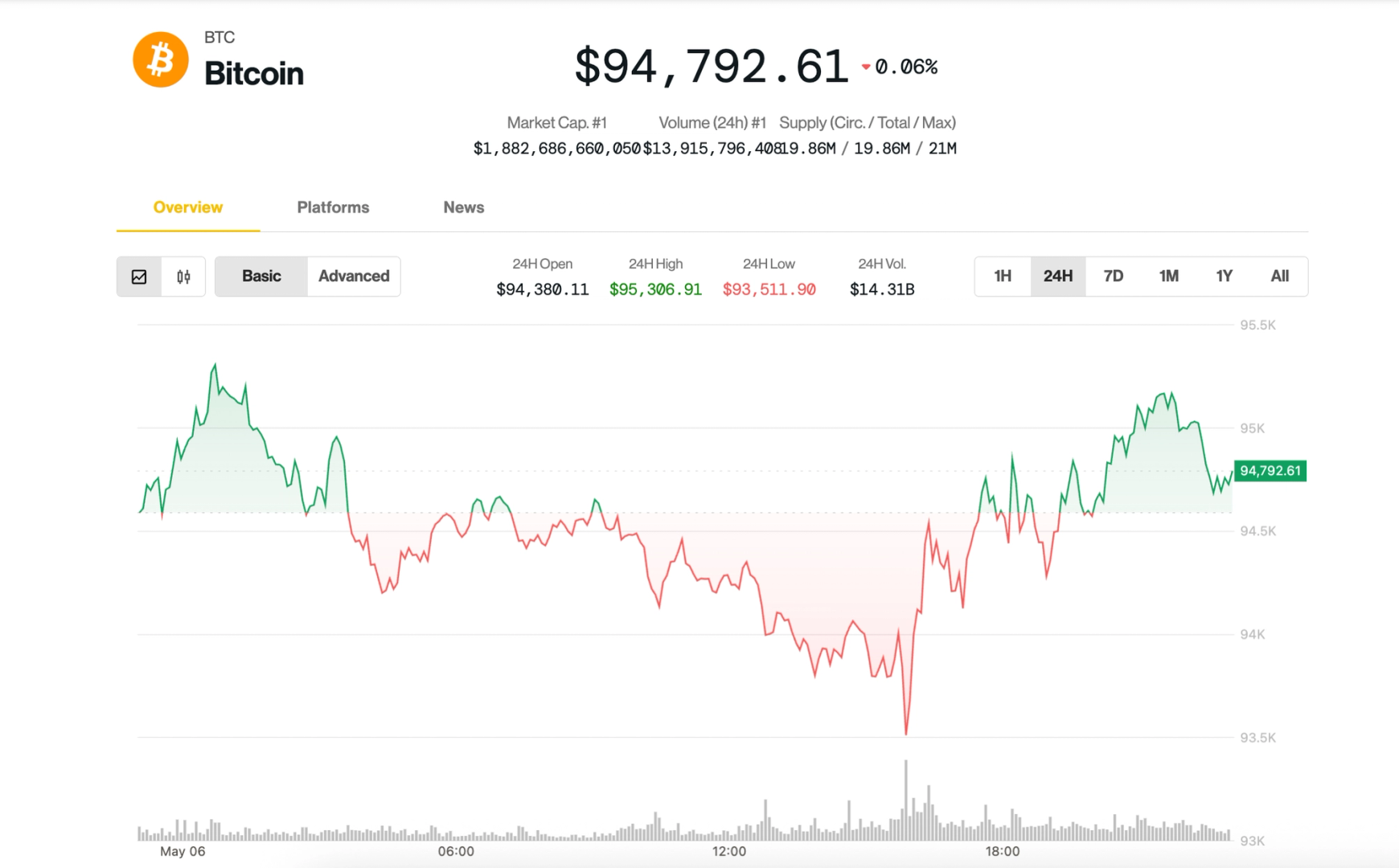

For this reason, one Redditor posting in r/Fire asks about the risks of investing in U.S. treasuries. Knowing they can buy a US treasury that matures in 2041 at 4.75% is incredibly appealing to them, and they wonder why more people aren’t taking advantage of this 15-year promised return.

As someone who regularly debates the necessity of investing in the stock market versus bonds, HYSA, SPXX, etc., I can wholeheartedly understand where this Redditor is coming from.

Looking at Less Risk

In this Redditor’s situation, they are looking at a scenario where they can buy a US treasury at 4.75% interest that matures in 2041 at face value. Their question surrounds why people hesitate to invest in something like this that promises a guaranteed return for the next 15 years.

There is a bit of a caveat here, as the Redditor is planning for a FIRE (financial independence, retire early) lifestyle that allows them to live at or under a 3% safe withdrawal rate. While this is excellent news for them that they can live on a smaller amount of money, it’s not exactly the same scenario for everyone.

Even so, this Redditor is scratching their head as to why people wouldn’t consider this a safer investment than the stock market. Better yet, they wonder if there is any potential (realistic) scenario in which the US would default, and if that scares people away.

The Biggest Risk

On the surface, this Redditor isn’t in the wrong, as this guaranteed rate of return seems pretty promising for those who are okay earning a little less for guaranteed stability. However, the caveat here is what many commenters on this post are calling the “800-pound gorilla.”

The issue with Redditor’s proposal to invest solely in US treasuries is that, due to inflation, you won’t get enough growth out of it. At least, this is how some Redditors like to think. Of course, there is another caveat here, as it has been roughly 30 years since the US averaged above a 4.75% annual inflation rate over 16 years.

The rub here is that if the Redditor is pulling out 3% every year, they are only left with 1.75% growth, which, compared to the 2.9% inflation in 2025, means you are not earning enough to keep up with inflation. This notion kills the idea that you are in a position to make significant money from this treasury investment strategy.

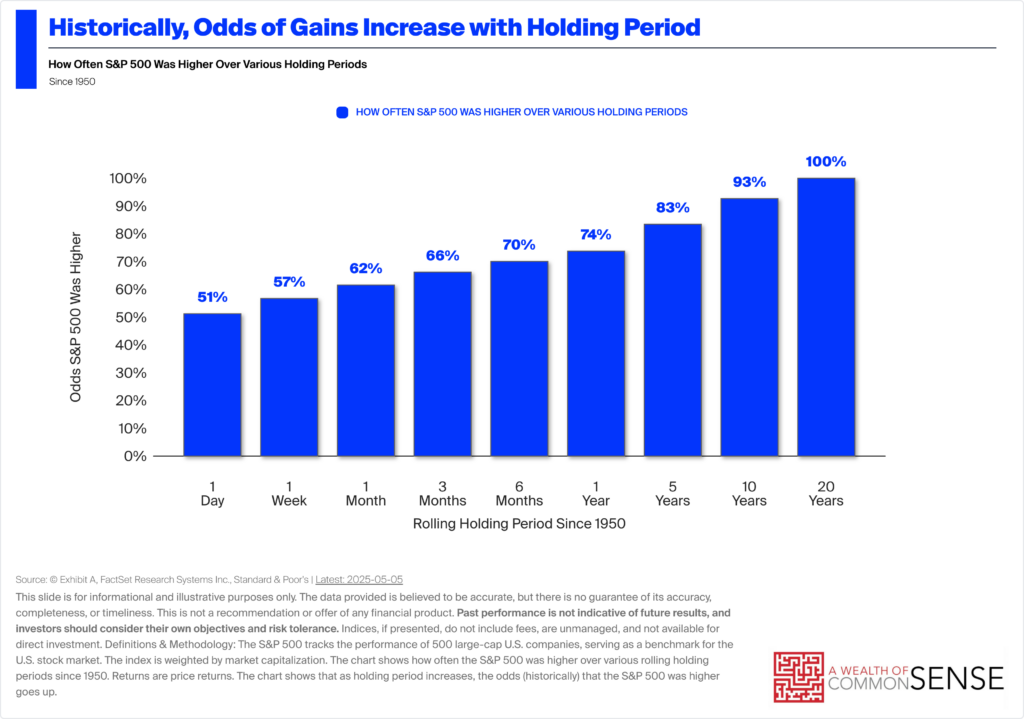

This is opposed to a stock strategy where you could make 6-10% annually, giving you a greater cushion of earnings versus rising inflation. In other words, if you have 3% inflation and a 3% safe withdrawal rate, a 6% annual return is when you break even. If you earn 7-10% returns in stocks, you’d have to invest and be willing to go along for the ride on the market, but you’ll be earning more.

Could the US Ever Default?

Investment strategy aside for the moment, and there is no reason to sugarcoat this, but if the US ever defaults, as the original poster wonders, it would lead to greater concerns. The economic crisis in this country would be massive and throw the (financial) world into chaos. Another currency, like the British pound or the Euro, could take over and lead the world to stability, but if the US defaults, there are far greater problems than treasury investments.

The good news is that there is very little likelihood of this happening, even in a volatile stock market world. Simply stated, it’s not easy to imagine a scenario in which the US could default on its treasury bonds in a way that would introduce chaos worldwide.

Aside from any potential doomsday scenario, the real question is whether the treasury bond strategy can hedge against the original poster’s withdrawal rate and inflation to earn money safely. Spoiler alert: not likely. Ultimately, this is why investment opportunities like ETFs or Vanguard funds remain the most popular investment strategy over the long term. Still, you must be willing to stomach short-term volatility for long-term growth.

The post Should I invest all my retirement savings in US treasuries for guaranteed returns over the next 15 years? appeared first on 24/7 Wall St..