Life Hack: Avoid Property Taxes by Living in These Counties

It’s getting increasingly expensive to live — and Americans are beginning to feel the burn. Grocery, gas, and personal item costs have risen across the country while pay rates remain relatively stagnant. This has led to some serious and potentially devastating effects on our country. Capital One’s Mind Over Money study, run in conjunction with […] The post Life Hack: Avoid Property Taxes by Living in These Counties appeared first on 24/7 Wall St..

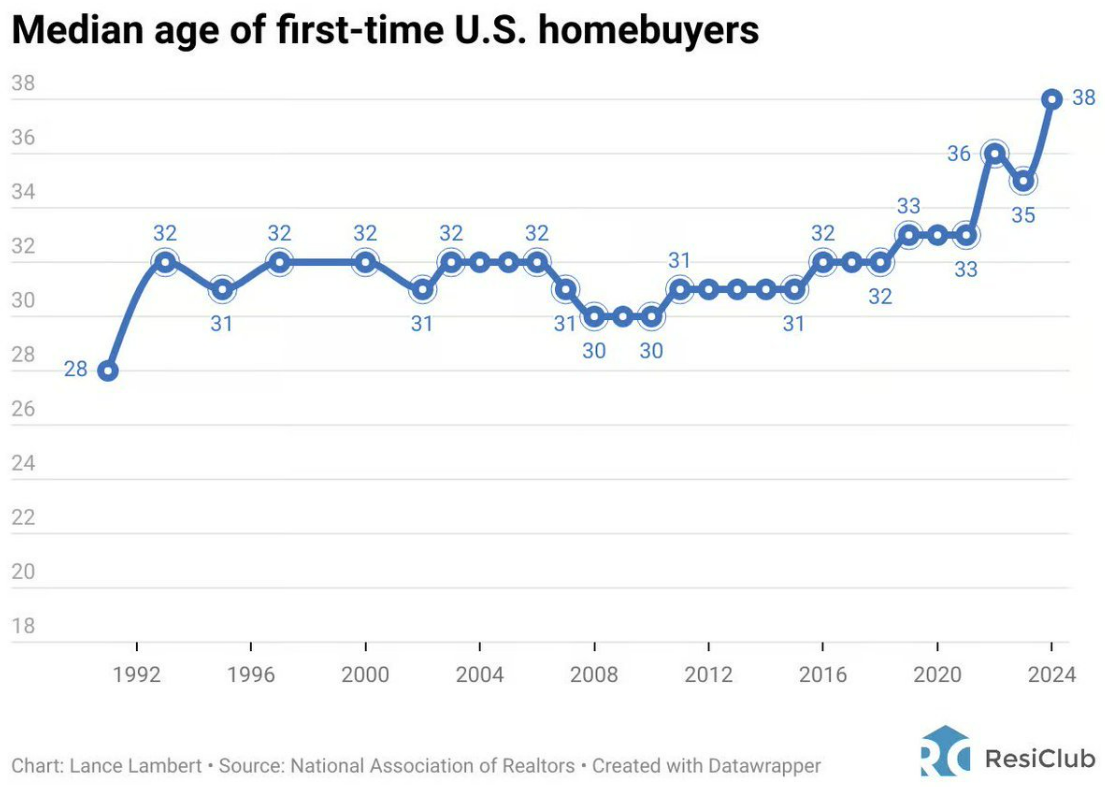

It’s getting increasingly expensive to live — and Americans are beginning to feel the burn. Grocery, gas, and personal item costs have risen across the country while pay rates remain relatively stagnant. This has led to some serious and potentially devastating effects on our country. Capital One’s Mind Over Money study, run in conjunction with The Decision Lab, found that a whopping 58% of American adults feel that finances completely control their lives — and 68% worry about not having enough money to retire. A recent LendingTree study provides an understanding of the falling fertility rate, with 77% of parents saying that raising a child was significantly more expensive than they thought. And with increasing concerns about the cost of healthcare and the cost of housing, with many millennials and Gen Zers now seeing home ownership as an impossible-to-reach goal, it feels like American society stands at a position of uncertainty. Some localities and counties are trying to make a difference for residents through lower property tax initiatives. Billings, Montana has been discussing property tax relief legislation — though critics remain concerned that this could financially knee-cap the city — and Texas lawmakers have also preliminarily agreed to $3 billion in property tax relief. But will this be enough? (Which U.S. state has the highest property tax in the nation?)

At least in some areas of the country, property taxes remain low — and housing rates, groceries, and the overall cost of living also sit below average. To identify the counties in each state with the lowest property tax rates, 24/7 Wall St. sourced data on property taxes by state and county from the Tax Foundation, the world’s leading nonpartisan tax policy nonprofit organization. Although the data was last updated in 2025, it comprises median property taxes from 2023 with a note that this is a five-year estimate. Our comprehensive list includes the county in each state with the lowest median property tax payment. In times of a tie, we chose the county with the lowest median home value. Additional data on effective tax rate, local and state home values, county population, and median household income comes from a mix of the Tax Foundation, the U.S. Census Bureau, Zillow, property record searches, and the 2023 American Community Survey. These numbers are all current as of 2023 and were independently verified.

This previously published article was updated on May 6, 2025 to provide updated effective tax rates and population numbers, as well as to provide additional background on property taxes and their societal impacts.

What are Property Taxes?

Property taxes are annual or semi-annual fees that you pay based on the value of your property. Some states refer to real property, motor vehicles, and personal property as a whole under the guise of property taxes; others refer to real estate taxes as property taxes, with other taxes known as personal property taxes.

What Do Property Taxes Pay For?

Property taxes are incredibly important for where you live — and, in fact, represent your local government’s main form of revenue, or at least one of its main forms. So it makes sense that these taxes are used to improve and supplement your local area. Property taxes may be used for:

- Funding police and fire departments

- Constructing and/or repairing roads

- Establishing community pools or other community projects

- Funding education and/or educational initiatives

- Maintaining libraries

Factors Affecting Property Tax

How are property tax rates calculated? This really depends on two main factors: the tax rate in the town you live in and the assessed value of your home. You can usually use an online calculator or tool to give you an estimate of the property taxes you’ll owe.

Why Low Property Taxes Matter in 2025

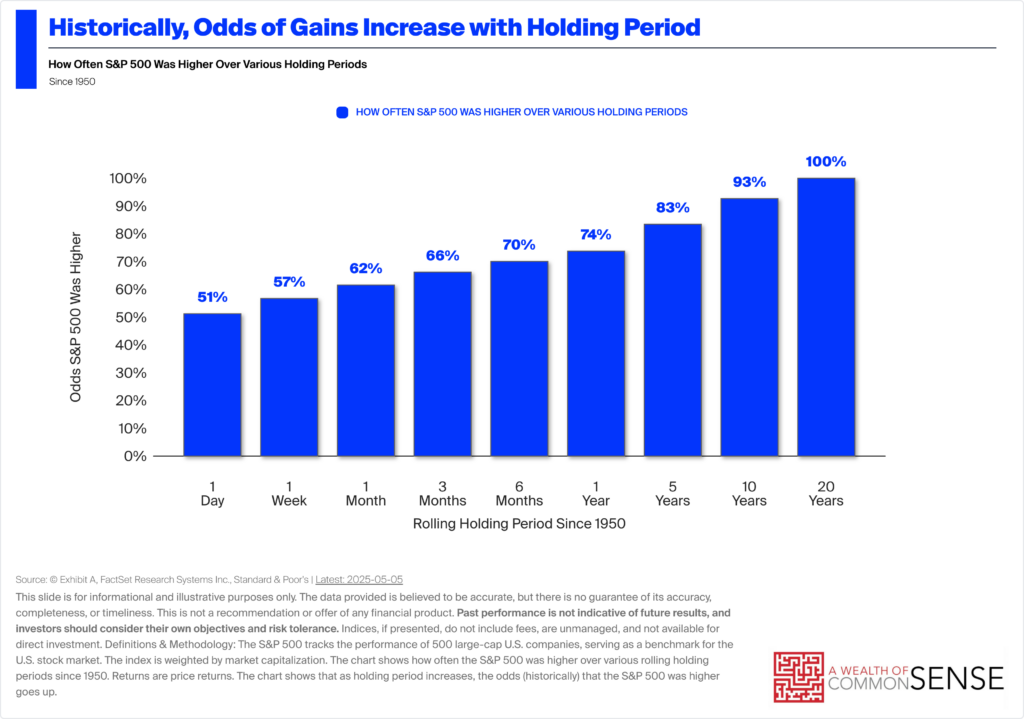

Right now, only 13% of Americans feel good about their finances — which doesn’t bode well for widespread economic growth or for the people who have always dreamed about buying a house, but may not feel comfortable putting signficant amounts of money down. For these individuals, buying a home in a low-tax area could be helpful. Unlike income taxes, which are levied at the state and federal levels, property taxes are largely determined by local governments, and partially as a result, they vary considerably across the country — and some Americans are paying far less every year than others. Of course, by choosing somewhere to live with lower property taxes, you may also end up in a lower-income area or an area that is less populated or has less business. But considering 66% of Americans also say their property tax values are now significantly higher than they once thought, maybe heading somwhere with a lower cost-of-living isworth it.

Here is the county in each state with the lowest property taxes:

Alabama: Choctaw County

- Median property taxes paid in county, 2023: $199

- Effective property tax rate, FY 2023: 0.1780%

- Median home value: $111,800 ($179,358 statewide)

- Median household income: $44,483 ($62,212 statewide)

- County population: 12,252

Alaska: Kusilvak Census Area

- Median property taxes paid in census area, 2023: $199

- Effective property tax rate, FY 2023: 0.2737%

- Median home value: $72,700 ($371,500 statewide)

- Median household income: $48,233 ($89,336 statewide)

- Census area population: 8,001

Arizona: Greenlee County

- Median property taxes paid in county, 2023: $351

- Effective property tax rate, FY 2023: 0.3588%

- Median home value: $136,300 ($436,600 statewide)

- Median household income: $75,239 ($77,300 statewide)

- County population: 9,369

Arkansas: Monroe County

- Median property taxes paid in county, 2023: $405

- Effective property tax rate, FY 2023: 0.4927%

- Median home value: $82,200 ($210,599 statewide)

- Median household income: $43,955 ($63,250 statewide)

- County population: 6,512

California: Modoc County

- Median property taxes paid in county, 2023: $1,445

- Effective property tax rate, FY 2023: 0.6816%

- Median home value: $212,000 ($813,980 statewide)

- Median household income: $56,648 ($89,870 statewide)

- County population: 8,500

Colorado: Prowers County

- Median property taxes paid in county, 2023: $494

- Effective property tax rate, FY 2023: 0.3274%

- Median home value: $150,900 ($514,000 statewide)

- Median household income: $57,601 ($92,911 statewide)

- County population: 11,751

Connecticut: Northeastern Connecticut Planning Region

- Median property taxes paid in area, 2023: $4,340

- Effective property tax rate, FY 2023: 1.5428%

- Median home value: $281,300 ($381,629 statewide)

- Median household income: $87,564 ($92,240 statewide)

- Local population: 96,692

Delaware: Sussex County

- Median property taxes paid in county, 2023: $1,171

- Effective property tax rate, FY 2023: 0.3314%

- Median home value: $353,300 ($337,200 statewide)

- Median household income: $78,162 ($86,340 statewide)

- County population: 263,509

Florida: Holmes County

- Median property taxes paid in county, 2023: $527

- Effective property tax rate, FY 2023: 0.5917%

- Median home value: $101,400 ($410,000 statewide)

- Median household income: $48,236 ($71,711 statewide)

- County population: 19,944

Georgia: Wheeler County

- Median property taxes paid in county, 2023: $562

- Effective property tax rate, FY 2023: 0.7534%

- Median home value: $74,600 ($350,000 statewide)

- Median household income: $45,262 ($74,664 statewide)

- County population: 7,081

Hawaii: Hawaii County

- Median property taxes paid in county, 2023: $1,392

- Effective property tax rate, FY 2023: 0.2862%

- Median home value: $486,400 ($715,900 statewide)

- Median household income: $77,215 ($97,360 statewide)

- County population: 207,615

Idaho: Clark County

- Median property taxes paid in county, 2023: $592

- Effective property tax value, FY 2023: 0.2916%

- Median home value: $203,000 ($470,600 statewide)

- Median household income: $52,083 ($74,900 statewide)

- County population: 801

Illinois: Pulaski County

- Median property taxes paid in county, 2023: $668

- Effective property tax value, FY 2023: 0.8247%

- Median home value: $81,000 ($286,800 statewide)

- Median household income: $43,227 ($87,820 statewide)

- County population: 4,911

Indiana: Pulaski County

- Median property taxes paid in county, 2023: $646

- Effective property tax value, FY 2023: 0.4799%

- Median home value: $134,600 ($244,855 statewide)

- Median household income: $59,956 ($70,051 statewide)

- County population: 12,385

Iowa: Pocahontas County

- Median property taxes paid in county, 2023: $1,066

- Effective property tax value, FY 2023: 1.1426%

- Median home value: $93,300 ($234,000 statewide)

- Median household income: $63,423 ($80,860 statewide)

- County population: 6,976

Kansas: Chautauqua County

- Median property taxes paid in county, 2023: $1,012

- Effective property tax value, FY 2023: 1.5987%

- Median home value: $63,300 ($231,500 statewide)

- Median household income: $54,592 ($72,639 statewide)

- County population: 3,347

Kentucky: Wolfe County

- Median property taxes paid in county, 2023: $391

- Effective property tax value, FY 2023: 0.5889%

- Median home value: $66,400 ($190,037 statewide)

- Median household income: $29,052 ($62,417 statewide)

- County population: 6,282

Louisiana: West Carroll Parish

- Median property taxes paid in parish, 2023: $199

- Effective property tax value, FY 2023: 0.2039%

- Median home value: $97,600 ($252,600 statewide)

- Median household income: $48,514 ($58,320 statewide)

- Parish population: 9,323

Maine: Piscataquis County

- Median property taxes paid in county, 2023: $1,487

- Effective property tax value, FY 2023: 0.9700%

- Median home value: $153,300 ($360,000 statewide)

- Median household income: $55,234 ($75,7400 statewide)

- County population: 17,486

Maryland: Somerset County

- Median property taxes paid in county, 2023: $1,603

- Effective property tax value, FY 2023: 0.9757%

- Median home value: $164,300 ($400,000 statewide)

- Median household income: $52,462 ($101,652 statewide)

- County population: 24,910

Massachusetts: Nantucket County

- Median property taxes paid in county, 2023: $2,985

- Effective property tax value, FY 2023: 0.2512%

- Median home value: $1,387,000 ($540,000 statewide)

- Median household income: $119,750 ($101,341 statewide)

- County population: 14,440

Michigan: Luce County

- Median property taxes paid in county, 2023: $1,121

- Effective property tax value, FY 2023: 1.0154%

- Median home value: $110,400 ($249,100 statewide)

- Median household income: $54,338 ($69,183 statewide)

- County population: 6,435

Minnesota: Traverse County

- Median property taxes paid in county, 2023: $1,070

- Effective property tax value, FY 2023: 0.9718%

- Median home value: $110,100 ($342,995 statewide)

- Median household income: $65,931 ($87,556 statewide)

- County population: 3,136

Mississippi: Issaquena County

- Median property taxes paid in county, 2023: $314

- Effective property tax value, FY 2023: 0.3462%

- Median home value: $90,700 ($181,232 statewide)

- Median household income: $29,271 ($54,915 statewide)

- County population: 1,256

Missouri: Reynolds County

- Median property taxes paid in county, 2023: $553

- Effective property tax value, FY 2023: 0.4612%

- Median home value: $119,900 ($251,900 statewide)

- Median household income: $44,357 ($68,500 statewide)

- County population: 5,950

Montana: Wibaux County

- Median property taxes paid in county, 2023: $654

- Effective property tax value, FY 2023: 0.7086%

- Median home value: $92,300 ($524,000 statewide)

- Median household income: $64,792 ($79,220 statewide)

- County population: 910

Nebraska: Grant County

- Median property taxes paid in county, 2023: $853

- Effective property tax value, FY 2023: 0.7489%

- Median home value: $113,900 ($255,577 statewide)

- Median household income: $69,063 ($74,985 statewide)

- County population: 565

Nevada: Eureka County

- Median property taxes paid in county, 2023: $541

- Effective property tax value, FY 2023: 0.2900%

- Median home value: $277,800 ($435,900 statewide)

- Median household income: $73,095 ($76,364 statewide)

- County population: 1,917

New Hampshire: Coos County

- Median property taxes paid in county, 2023: $3,511

- Effective property tax value, FY 2023: 2.0702%

- Median home value: $169,600 ($470,000 statewide)

- Median household income: $58,439 ($96,838 statewide)

- County population: 31,372

New Jersey: Cumberland County

- Median property taxes paid in county, 2023: $5,048

- Effective property tax value, FY 2023: 2.4553%

- Median home value: $205,600 ($513,000 statewide)

- Median household income: $64,499 ($99,781 statewide)

- County population: 152,326

New Mexico: Harding County

- Median property taxes paid in county, 2023: $328

- Effective property tax value, FY 2023: 0.3792%

- Median home value: $86,500 ($345,100 statewide)

- Median household income: $41,250 ($60,980 statewide)

- County population: 624

New York: Hamilton County

- Median property taxes paid in county, 2023: $2,369

- Effective property tax value, FY 2023: 0.9789%

- Median home value: $242,000 ($559,900 statewide)

- Median household income: $68,950 ($81,600 statewide)

- County population: 5,082

North Carolina: Hyde County

- Median property taxes paid in county, 2023: $753

- Effective property tax value, FY 2023: 0.6296%

- Median home value: $119,600 ($367,600 statewide)

- Median household income: $43,724 ($70,800 statewide)

- County population: 4,607

North Dakota: Sioux County

- Median property taxes paid in county, 2023: $410

- Effective property tax value, FY 2023: 0.4691%

- Median home value: $87,400 ($278,800 statewide)

- Median household income: $41,676 ($76,525 statewide)

- County population: 3,643

Ohio: Meigs County

- Median property taxes paid in county, 2023: $1,117

- Effective property tax value, FY 2023: 0.9850%

- Median home value: $113,400 ($238,700 statewide)

- Median household income: $46,701 ($69,680 statewide)

- County population: 21,767

Oklahoma: Cimarron County

- Median property taxes paid in county, 2023: $386

- Effective property tax value, FY 2023: 0.4085%

- Median home value: $94,500 ($225,348 statewide)

- Median household income: $57,204 ($67,330 statewide)

- County population: 2,191

Oregon: Lake County

- Median property taxes paid in county, 2023: $1,407

- Effective property tax value, FY 2023: 0.6413%

- Median home value: $219,400 ($527,600 statewide)

- Median household income: $61,222 ($88,740 statewide)

- County population: 8,293

Pennsylvania: Forest County

- Median property taxes paid in county, 2023: $1,162

- Effective property tax value, FY 2023: 1.0384%

- Median home value: $111,900 ($295,000 statewide)

- Median household income: $50,061 ($79,820 statewide)

- County population: 6,449

Rhode Island: Providence County

- Median property taxes paid in county, 2023: $4,661

- Effective property tax value, FY 2023: 1.3745%

- Median home value: $339,100 ($427,000 statewide)

- Median household income: $78,204 ($81,860 statewide)

- County population: 660,615

South Carolina: Marion County

- Median property taxes paid in county, 2023: $397

- Effective property tax value, FY 2023: 0.4574%

- Median home value: $86,800 ($335,000 statewide)

- Median household income: $34,501 ($67,804 statewide)

- County population: 28,508

South Dakota: Oglala Lakota County

- Median property taxes paid in county, 2023: $199

- Effective property tax value, FY 2023: 0.4364%

- Median home value: $45,600 ($226,570 statewide)

- Median household income: $34,769 ($74,421 statewide)

- County population: 13,434

Tennessee: Fentress County

- Median property taxes paid in county, 2023: $519

- Effective property tax value, FY 2023: 0.3419%

- Median home value: $151,800 ($339,900 statewide)

- Median household income: $50,865 ($67,097 statewide)

- County population: 19,696

Texas: Crockett County

- Median property taxes paid in county, 2023: $466

- Effective property tax value, FY 2023: 0.3329%

- Median home value: $140,000 ($335,100 statewide)

- Median household income: $76,292 ($79,060 statewide)

- County population: 2,858

Utah: Rich County

- Median property taxes paid in county, 2023: $846

- Effective property tax value, FY 2023: 0.2905%

- Median home value: $291,200 ($540,000 statewide)

- Median household income: $76,875 ($98,336 statewide)

- County population: 2,670

Vermont: Essex County

- Median property taxes paid in county, 2023: $2,828

- Effective property tax value, FY 2023: 1.6884%

- Median home value: $167,500 ($315,000 statewide)

- Median household income: $58,985 ($81,200 statewide)

- County population: 6,010

Virginia: Buchanan County

- Median property taxes paid in county, 2023: $404

- Effective property tax value, FY 2023: 0.4420%

- Median home value: $91,400 ($382,725 statewide)

- Median household income: $42,216 ($90,974 statewide)

- County population: 19,087

Washington: Garfield County

- Median property taxes paid in county, 2023: $1,306

- Effective property tax rate, FY 2023: 0.6097%

- Median home value: $214,200 ($613,000 statewide)

- Median household income: $62,411 ($94,952 statewide)

- County population: 2,363

West Virginia: McDowell County

- Median property taxes paid in county, 2023: $278

- Effective property tax rate, FY 2023: 0.5650%

- Median home value: $49,200 ($146,578 statewide)

- Median household income: $29,980 ($60,410 statewide)

- County population: 17,439

Wisconsin: Iron County

- Median property taxes paid in county, 2023: $1,777

- Effective tax rate, FY 2023: 1.1450%

- Median home value: $155,200 ($285,000 statewide)

- Median household income: $59,058 ($75,670 statewide)

- County population: 6,288

Wyoming: Niobrara County

- Median property taxes paid in county, 2023: $731

- Effective tax rate, FY 2023: 0.3764%

- Median home value: $194,200 ($355,923 statewide)

- Median household income: $48,987 ($77,200 statewide)

- County population: 2,354

Washington, D.C.

- Median property taxes paid in county, 2023: $4,100

- Effective property tax rate, FY 2023: 0.5769%

- Median home value: $724,600

- Median household income: $106,287

- County population: 678,972

Puerto Rico: Several Counties

As you know, Puerto Rico is a U.S. territory — so we wanted to look at what property taxes might look like in certain counties or municipalities. The following all have a median property tax estimate of $199:

- Adjuntas Municipio

- Aguas Beunas Municipio

- Aibonita Municipio

- Ciales Municipio

- Corozal Municipio

- Guayanilla Municipio

- Jayuya Municipio

- Juncos Municipio

- Lares Municipio

- Maricao Municipio

- Patillas Municipio

- Sabana Grande Municipio

- Vieques Municipio

- Yauco Municipio

Median home values and household incomes vary between counties.

The post Life Hack: Avoid Property Taxes by Living in These Counties appeared first on 24/7 Wall St..