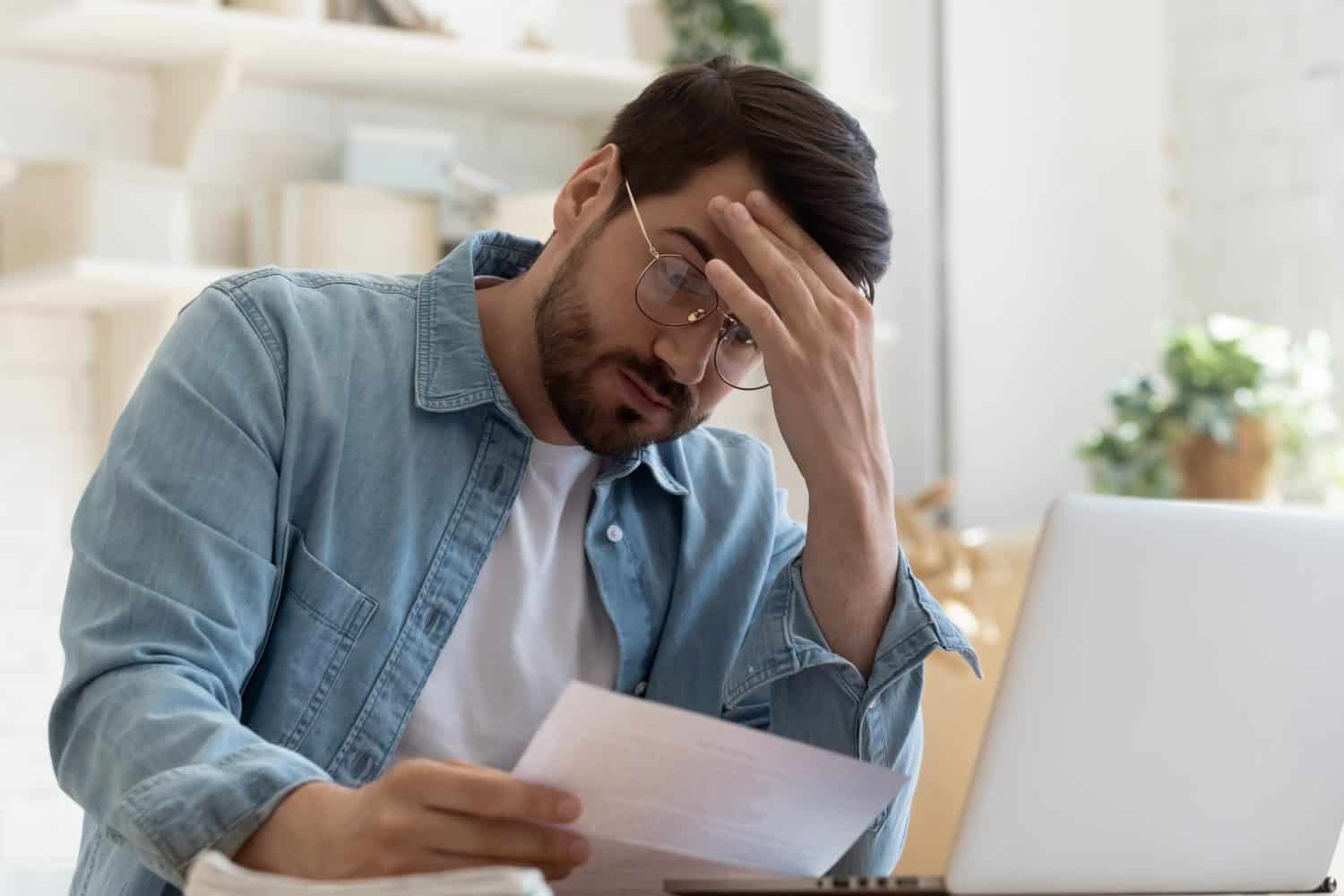

Is retiring at 56 with $5 million too risky because of the market?

There are many benefits to retiring on the early side — escaping a stressful job, reclaiming your time, and getting to enjoy things like travel while your health is strong. But there can be risks to retiring early, like running out of money or having to cover very expensive health insurance costs until you’re […] The post Is retiring at 56 with $5 million too risky because of the market? appeared first on 24/7 Wall St..

Key Points

-

Retiring on the early side carries risk, but you can mitigate it with enough savings.

-

A down market shouldn’t mess with your retirement plans if you have the right asset allocation.

-

If you’re not sure, speak to a financial advisor for guidance.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

There are many benefits to retiring on the early side — escaping a stressful job, reclaiming your time, and getting to enjoy things like travel while your health is strong.

But there can be risks to retiring early, like running out of money or having to cover very expensive health insurance costs until you’re eligible for Medicare. And when you’re retiring early in the midst of a down market, things can be even more stressful.

In this Reddit post, we have a 56-year-old worker who announced their retirement last month. They, along with their 58-year-old wife, had been planning that for months.

The poster has $5 million in investments and no debt except for a $100,000 mortgage balance, which they can easily pay off. And with their kids grown and done with college, they’re looking at reasonable expenses.

However, the state of the market has them worried, and understandably so. But whether they need to change their plans depends on their investments.

A stock market downturn doesn’t have to interfere with an early retirement

Early retirees risk depleting their savings prematurely. But with $5 million, the poster here has a pretty decent cushion.

Even if they have to pay for health coverage for a good number of years, it seems like they should have enough money to handle that expense.

The problem is the market. April has been an extremely volatile month for stocks. Tariff announcements sent the market reeling. And while there have been ups and downs, many investors are seeing year-to-date losses in their portfolios.

Of course, the worst time to tap a portfolio for cash is when its value has declined. But the poster may not be in such a bad position if they invested wisely.

It’s a good idea to shift away from stocks to some degree when retirement is right around the corner. The poster presumably did not make the decision to retire early on a whim. And if they planned accordingly, it may be that a good chunk of their portfolio is in bonds right now, which means it isn’t subject to the same losses the stock portion may have experienced.

With the right asset mix, the poster may be more than fine to move forward with their retirement plans. It depends on their portfolio composition, and also, their comfort level.

If retiring early will be a huge source of stress, it may not be worth it. They’ll need to consider that aspect, too.

A financial advisor can offer guidance

It’s understandable for the poster here to have some concerns, so what they should consider doing is consulting with a financial advisor. A financial advisor can review their portfolio to let them know if they’re looking at serious losses by retiring now. And if it turns out the poster’s portfolio is not set up properly for an early retirement, a financial advisor can help them correct that mistake.

Market conditions aside, it’s generally a good idea to talk to a financial professional about early retirement, since there are extra expenses like healthcare to consider. So either way, this sort of discussion could benefit the poster, or anyone else who’s in a similar situation.

The post Is retiring at 56 with $5 million too risky because of the market? appeared first on 24/7 Wall St..