Middle Class, Poor, Rich? This Is How You Figure It Out

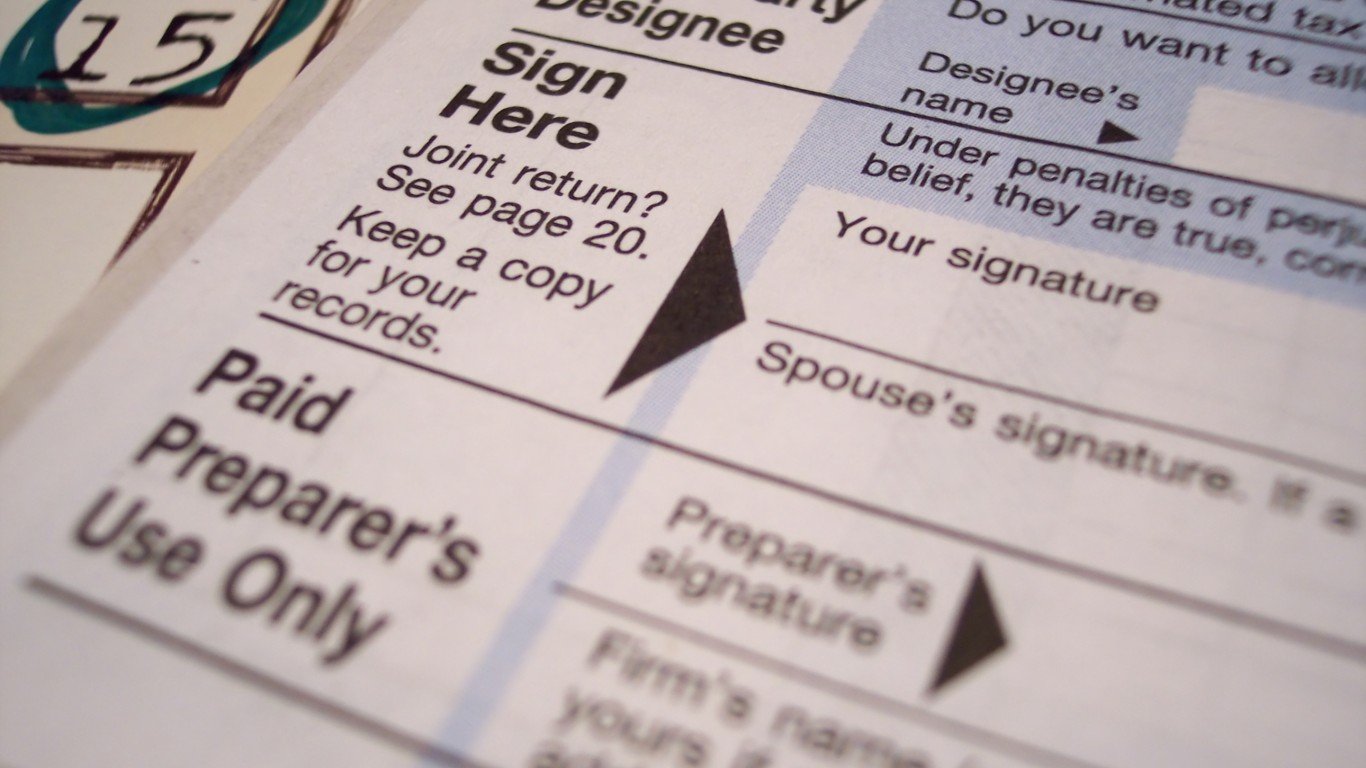

It’s tax time in America, and as taxpayers total up how much they owe, or how much they’ll get back from the IRS this year, one question bugs us all: Are we paying too much? More importantly, are you paying too much? Maybe you’re not “poor,” exactly, such that you shouldn’t pay any taxes. But […] The post Middle Class, Poor, Rich? This Is How You Figure It Out appeared first on 24/7 Wall St..

It’s tax time in America, and as taxpayers total up how much they owe, or how much they’ll get back from the IRS this year, one question bugs us all: Are we paying too much?

More importantly, are you paying too much? Maybe you’re not “poor,” exactly, such that you shouldn’t pay any taxes. But surely “the rich” should be paying more. After all, you’re just a “middle class” taxpayer, and it sure feels like you’re paying a lot.

And do you know what? You’re probably right, at least about the middle class part.

Key Points

-

54% of Americans believe they are in the middle class, and 52% of them actually are.

-

Middle class status varies with location, with higher levels of income needed to make the cut in more expensive, cities, states, and countries.

-

Relative to the rest of the world, even the poorest Americans rank in the top 10% of earners, globally.

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started. (Sponsored)

H.L. Mencken once famously observed that “wealth is any income that is at least one hundred dollars more a year than the income of one’s wife’s sister’s husband.” Which is to say that most of us consider ourselves something other than wealthy, something other than “rich,” so long as our income is more or less equal to what most people we know are earning.

Anyone who earns less than that is “poor.” Anyone who earns more than that must be “rich.”

While this seems like a subjective standard, you may be surprised to learn that it’s actually pretty accurate. In a survey conducted by Gallup Polls last year, 54% of Americans defined themselves as middle class. An independent study by Pew Research that same year, meanwhile, applied objective standards to determine the true answer. And do you know what?

The correct answer is that 52% of Americans are in fact middle class, as Pew defines it. Which is almost the exact number that we (collectively) guessed.

How do you define middle class?

Pew’s study defines middle class as any income ranging from two-thirds of the median U.S. household income (roughly $85,000), up to two times that amount. Crunching 2022 historical data, Pew therefore concluded that a middle-class income is therefore anywhere from $56,600 to $169,800.

Logically, therefore, anyone living in a household earning less than $56,600 is “poor.” And if the combined incomes of all the people living in your home exceed $169,800… congratulations! You’re “rich”!

(Even if, after paying the tax bill, you don’t exactly feel like it).

Caveats and provisos

There is, however, one quibble that’s worth observing, and this one comes from the realtor community: “Location, location, location.” Which is to say, that whether your household feels rich, middle class, or poor, depends an awful lot on where your house is located.

Globally for example, the World Bank defines extreme poverty as living on less than $2.15 per day ($785 per person). For a three person household such as is used in the Pew survey, that works out to $2,355 in annual household income.

Let me say that again. In the United States, you can be considered poor at a household income of $56,600. Which is an income 24 times greater than what the rest of the world considers poor.

Fact is, “poor” families in the United States, earning $56,600 a year, rank in the top 5% of households globally. Poor families in the U.S. who earn half that amount still rank in the top 10% globally. Or in other words:

Globally speaking, we’re all really rich.

More caveats and more provisos

To a lesser extent, the same can be said of people within the United States, where a “poor” income in one city or state can easily qualify as “middle class” in another. Pew even has a tool to confirm this, so you can check and compare how your wealth would rank in different cities and states.

For example, say you earn $56,600 in New York City. Just reading those words, you probably already have a hunch that makes you “poor” in NYC, right? (Hint: Right). And I just finished telling you it puts you right on the dividing line between poor and middle class, nationally. And yet, in Owensboro, Kentucky; Detroit, Michigan; or Erie, Pennsylvania, at that same income level, you’re solidly middle class.

For that matter, just a few hours upstate from NYC, in the capital of Albany, $56,600 is enough income to move you up to the middle class, too!

Practical advice

Now aside from scratching an itch, and satisfying some curiosity as to how you stand in our everlasting race to keep up with “the Joneses,” what practical ideas can we derive from the above data?

First and foremost, it’s probably a reminder to count your blessings. Whether rich, middle class, or “poor,” as Pew defines it, just by virtue of living in the United States at all, we all enjoy a vastly higher standard of living than probably at least 90% of humans living on Earth.

Simply put, you’re starting off in no worse than 800 millionth place, in a race of 8 billion. So have some compassion for the 7.2 billion people who don’t have it nearly so well as you do. And don’t worry so much about whether someone else got to start off in 799,999,999th place.

But second, if you really do want to move up from “poor” to “middle class,” or from “middle class” to “rich,” the simplest way to do that might be to change your zip code. Move from an expensive metropolis to somewhere a bit less swanky, or even move abroad. Especially if you have a work-from-home job, that could be the easiest way to increase your relative income, and stretch what dollars you do earn, a little farther.

Third and finally, one of the best times to consider relocating to give yourself an income boost might be in retirement. While estimates vary, some sources suggest as many as five million American retirees, or one in six, currently reside abroad. There’s probably a reason for that.

The post Middle Class, Poor, Rich? This Is How You Figure It Out appeared first on 24/7 Wall St..