I have a $3 million portfolio but it’s all in tech. How do I diversify without a huge tax hit?

There’s a reason people say the tech sector effectively “controls” the stock market. Sure, tech titans aren’t the only players in the market. But there are a few key companies whose movement tends to dictate how the market is performing on a whole. Is that a good thing? Not really. But for better or […] The post I have a $3 million portfolio but it’s all in tech. How do I diversify without a huge tax hit? appeared first on 24/7 Wall St..

Key Points

-

It’s a dangerous thing to have your portfolio invested in one sector of the market.

-

Taking advantage of a down market could help you diversify without incurring a huge tax bill.

-

You may want to consult a professional for help rebalancing your portfolio.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

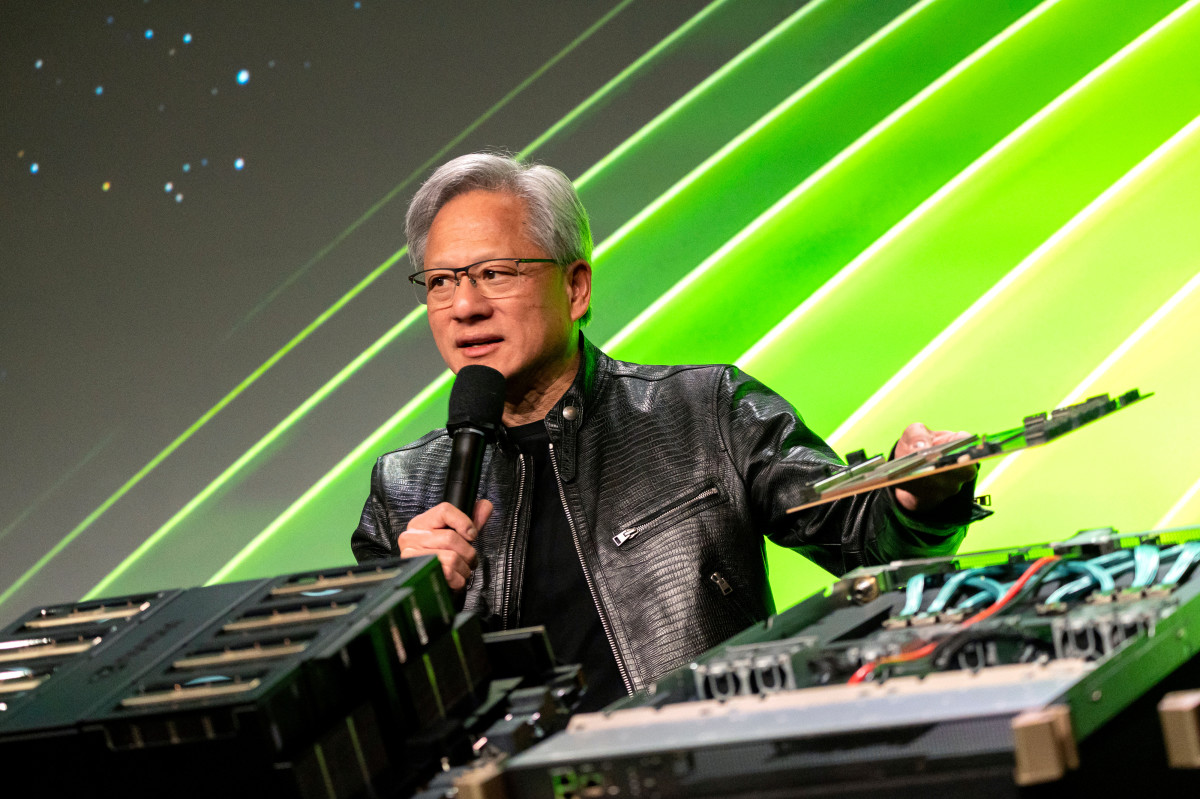

There’s a reason people say the tech sector effectively “controls” the stock market. Sure, tech titans aren’t the only players in the market. But there are a few key companies whose movement tends to dictate how the market is performing on a whole.

Is that a good thing? Not really. But for better or worse, the Magnificent 7 stocks — a group of seven dominant tech companies — commonly have the most influence on the market. And that makes the tech sector on a whole very vulnerable to volatility.

In this Reddit post, we have someone with a $3 million portfolio. The problem? That entire portfolio consists of a handful of tech stocks.

The poster knows they need to diversify. But if they sell a lot of their tech shares now, they could be looking at a potentially huge tax bill, despite recent downward movement in the market. So they need to be careful in how they go about things.

It’s important to diversify

It’s easy to see how the poster got into this situation. Tech stocks have enjoyed outsized growth these past few years, so they now comprise a large chunk of many people’s portfolios.

But it’s definitely not a good thing to have your portfolio invested in one sector of the market only. If that sector crashes, you could be looking at serious losses. Given that the poster has a $3 million portfolio, they need to make some changes ASAP.

The market has been particularly volatile since tariff policies were announced in April. And we don’t know what the next few months have in store. So I would recommend that the poster immediately try to diversify out of tech.

How to rebalance strategically

Despite recent market turbulence, the poster is likely still sitting on huge gains. And selling off a large chunk of their tech stocks is apt to introduce a tax headache in the form of capital gains.

Still, the poster can go about things strategically. If they sell at a time when their tech stocks have lost value year to date, they’re still probably looking at gains — but perhaps less substantial ones than earlier in the year. And that way, they can go out and buy replacement assets at a lower cost.

Either way, though, this situation is tricky. So I would urge the poster, and anyone else who needs to diversify quickly in today’s market, to consult a professional.

That person could be a tax pro or a financial advisor. But either way, a professional can help come up with a strategy to branch out while minimizing the tax-related implications.

A financial advisor might be a particularly good person for the poster here to consult with, because the poster may need help putting together a balanced portfolio. An advisor can recommend different investments based on the poster’s age, risk tolerance, and personal goals.

Meanwhile, if you haven’t checked your portfolio in a while, you may want to give it a look. It may be that you’re more heavily invested in tech than you thought you were, in which case it could pay to make some changes yourself.

The post I have a $3 million portfolio but it’s all in tech. How do I diversify without a huge tax hit? appeared first on 24/7 Wall St..