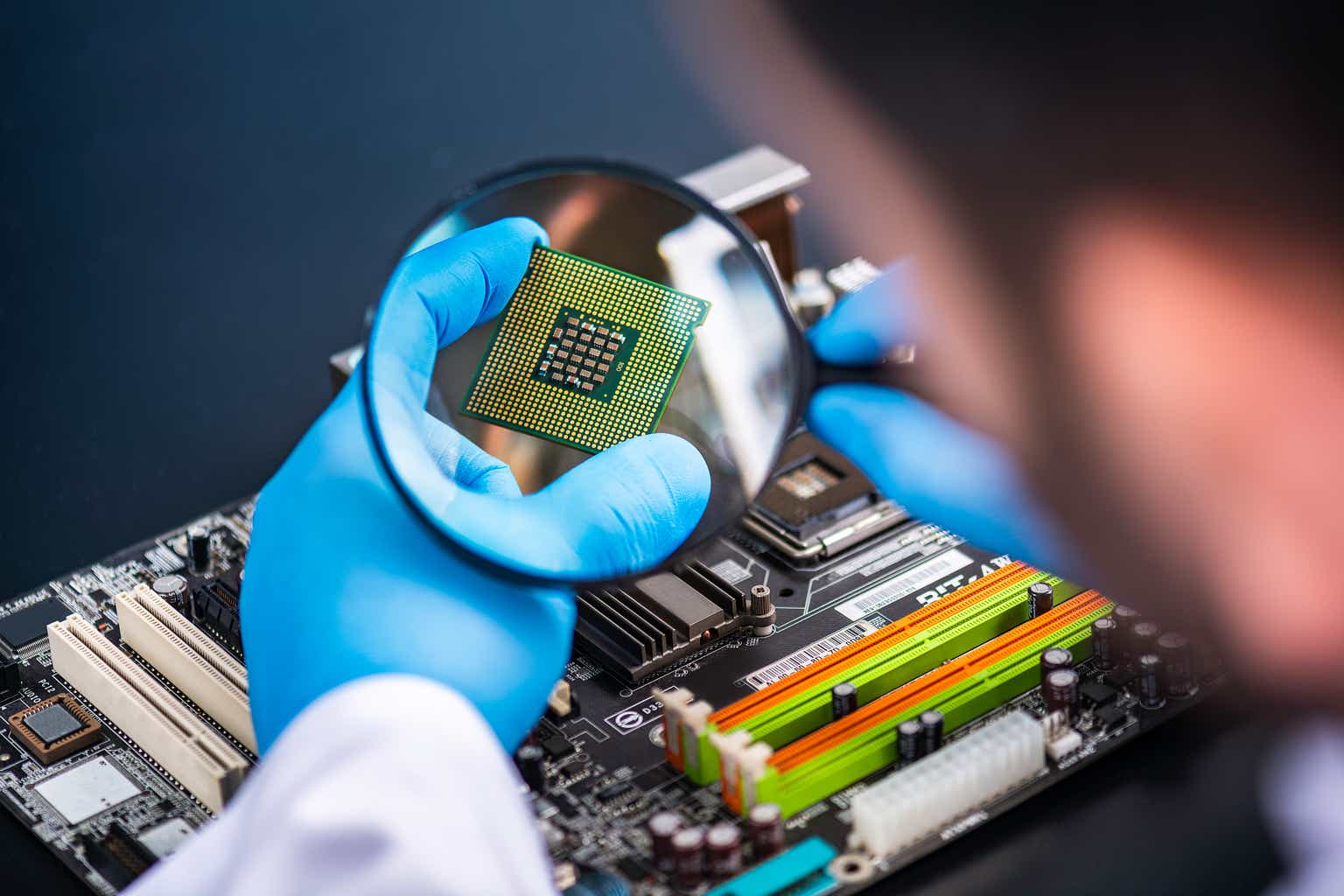

ARM Holdings (Nasdaq: ARM) Earnings Live: Record Revenue And AI Prowess

Live Updates Live Coverage Updates appear automatically as they are published. Record Revenue and Profitability 4:28 pm Q4 revenue topped $1.24 billion, the first time ever Arm exceeded $1B in a single quarter. Full-year revenue hit $4.01 billion, up 24% YoY, marking a significant growth acceleration. Non-GAAP operating margin surged to 52.8% in Q4, a […] The post ARM Holdings (Nasdaq: ARM) Earnings Live: Record Revenue And AI Prowess appeared first on 24/7 Wall St..

Live Updates

Updates appear automatically as they are published.

Record Revenue and Profitability

-

Q4 revenue topped $1.24 billion, the first time ever Arm exceeded $1B in a single quarter.

-

Full-year revenue hit $4.01 billion, up 24% YoY, marking a significant growth acceleration.

-

Non-GAAP operating margin surged to 52.8% in Q4, a sharp increase from 42.1% a year ago.

-

Non-GAAP EPS of $0.55 for Q4 beat guidance and rose 53% YoY.

Arm is delivering strong financials while scaling investments — a sign of sustainable and efficient growth.

Last-second thoughts

ARM heads into earnings facing a more skeptical market after a volatile post-IPO run. Licensing strength and uptake of the Armv9 architecture are key to maintaining growth and margin expansion. Watch for updates on AI-related demand in smartphones and data center, and any read-throughs on China exposure amid ongoing trade uncertainty.

Bull vs. Bear Case for ARM

Bull Case:

ARM’s bulls are anchored by its position at the center of the AI chip ecosystem. With record revenue in 3 of the last 4 quarters, a $147 mean target price, and high-profile deals like Project Stargate with OpenAI and SoftBank, bulls argue ARM is still in early innings. Royalty revenue has grown thanks to Armv9 adoption, and the Compute Subsystem (CSS) is expanding the TAM by offering turnkey silicon solutions. Long-term EPS growth is forecast at 31%.

Bear Case:

Bears cite ARM’s lofty 30x+ sales multiple and the risk that AI revenue growth is not yet flowing through royalty lines fast enough. Licensing revenue fell sequentially in 2024, and some analysts worry about overdependence on smartphone royalties and softness in China. With target prices ranging from $73 to $203, the Street sees a wide dispersion of outcomes

AI Licensing Demand in Focus

Arm Holdings (NASDAQ: ARM) is riding a wave of structural tailwinds into its Q1 2025 earnings report, fueled by rising demand for its AI-ready chip architectures. The company is forecast to post $875M in revenue and $0.32 EPS, but the real market-moving catalyst will be licensing activity and royalty growth.

Last quarter, Arm posted strong double-digit growth in royalty revenues, driven largely by adoption of Armv9 architecture—optimized for AI acceleration across mobile, cloud, and edge. The company’s emerging Compute Subsystem (CSS) offering is also drawing investor attention. By providing turnkey chip designs, CSS shortens customers’ time-to-market and adds a new layer of monetization to Arm’s already sticky business model.

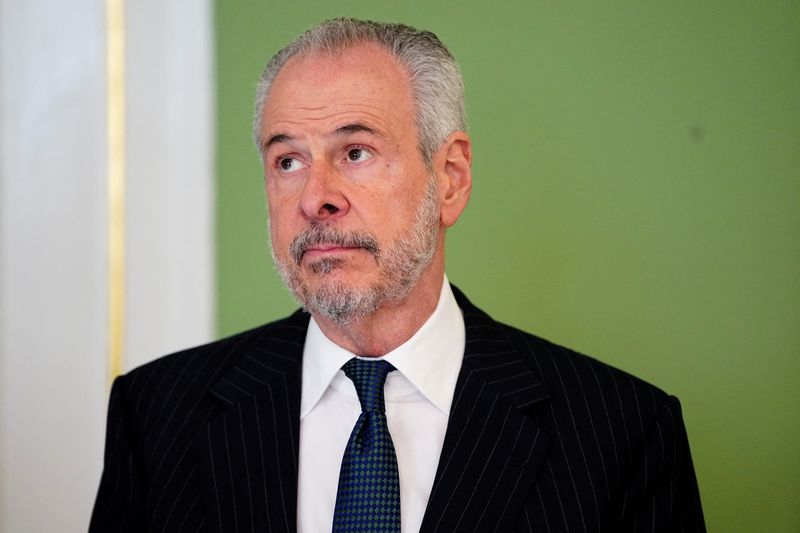

CEO Rene Haas has positioned Arm as the “plumbing of the AI revolution,” and hyperscalers seem to agree. The company’s designs now sit at the heart of leading AI chips used by Amazon, Microsoft, and even AI-centric startups developing custom silicon.

With the stock trading at premium multiples, any miss on margin expansion or licensing velocity could create turbulence. But if Arm surprises to the upside—especially in software-defined infrastructure—it could cement its role as the stealth winner in the AI chip arms race.

ARM consensus snapshot

Arm’s Q4 FY2024 print is expected to close out the year with modest top-line acceleration and margin stabilization, following a volatile fiscal stretch.

-

Q4 FY2024 Revenue Estimate: $875.4 million

-

Q4 FY2024 EPS Estimate: $0.30

-

Full-Year Revenue Estimate (FY2025): $3.9–4.1 billion

-

FY Gross Margin Guide: ~95%, consistent with licensing business

-

YoY Royalty Growth Target: Low double digits, dependent on v9 ramp and China

Arm trades at a steep multiple, so the Street will be focused on royalty ASPs, China mix stability, and any early signs of AI inference royalty uplift from new verticals. The risk isn’t a bad quarter — it’s whether the numbers are good enough to support a $128B market cap with a 159x P/E.

3 Keys to watch when the market closes

1. Arm China Sidestep – Signs of Success?

Investors will be listening for signs that ARM is successfully bypassing its messy Arm China JV. If they’re seeing traction from direct licensing to Chinese firms, that would reduce a major overhang.

2. Royalty Uplift – Early Wins from Armv9?

Armv9’s higher royalty structure is a margin lever. Expect questions about what % of mobile chips now use Armv9—and how that’s trending QoQ.

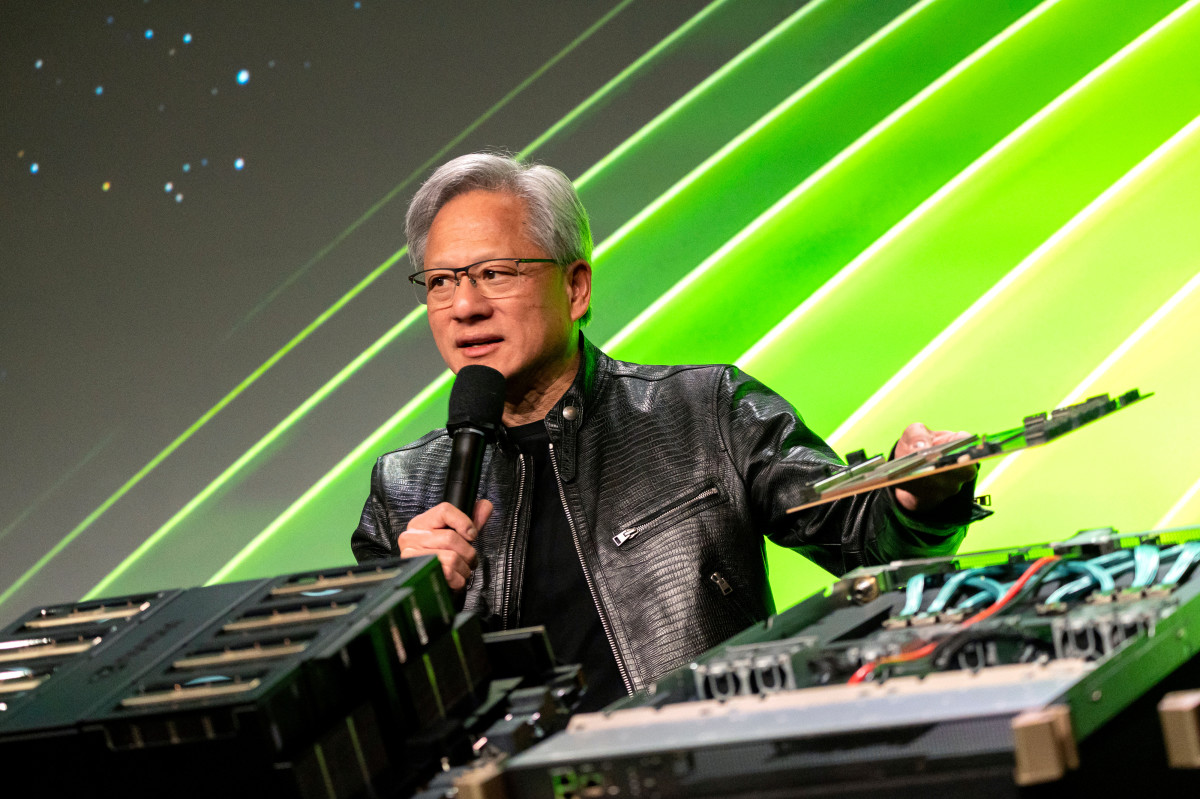

3. Cloud CPU Share – Is Nvidia Driving the Bus?

Any mentions of Nvidia, Microsoft, or Amazon using custom Arm-based silicon could be a bombshell. ARM’s deeper presence in cloud workloads might be the “hidden” growth engine of this cycle.

Where ARM Holdings share price is before earnings tonight

Arm Holdings enters today trading flat before earnings after the market closes but we will keep an eye on how it fluctuates during the day.

With a market cap of $128.5B and a sky-high P/E ratio of 159.7, Arm multiple suggests plenty of growth ahead . The company’s core value proposition — licensing architecture to nearly every smartphone, IoT, and AI chip maker — remains intact. But the real narrative lies in its pivot to higher-value workloads, especially in data center and AI inference.

Investors are focused on how well Arm monetizes v9 architecture rollouts, the resilience of licensing demand in China, and progress in automotive compute. While handset royalties remain under pressure, expanding content per chip and Neoverse traction have supported growth.

Today’s earnings will be judged on whether Arm can keep converting its ubiquitous footprint into premium pricing power — and whether that’s enough to justify one of the most expensive multiples in the semiconductor world.

Arm Holdings (NASDAQ: ARM) reports its Q4 FY2024 results today, after market close. The chip IP giant is expected to post revenue of $875.4 million and earnings of $0.30 per share, according to consensus estimates.

Fresh off its blockbuster IPO last fall, Arm enters the print with a powerful narrative around AI-adjacent licensing and embedded systems. FY2024 was a year of stabilization in global smartphone volumes, but Arm’s key growth lever has shifted — from handset royalty volume to expanding exposure in data center and automotive silicon.

In Q3, the company posted 14% year-over-year growth, driven by higher licensing of its v9 architecture and increased per-chip content in client devices. CEO Rene Haas has repeatedly pointed to opportunities in AI inference, where Arm-based accelerators are increasingly powering edge and mobile inference workloads.

Investors will look for clarity on licensing strength, China-related headwinds, and updates on high-performance computing roadmaps — particularly around Neoverse and AI-capable cores. With Nvidia and Qualcomm both building around Arm IP, today’s numbers will offer insight into how well Arm is monetizing industry-wide transitions.

The post ARM Holdings (Nasdaq: ARM) Earnings Live: Record Revenue And AI Prowess appeared first on 24/7 Wall St..