IonQ (Nasdaq: IONQ) Live: Earnings Are In

Live Updates Live Coverage Updates appear automatically as they are published. EPS -0.14 4:32 pm IonQ Inc, a leader in quantum computing and networking, reported its financial results for Q1 2025, showing a net loss of $32.3 million, which is an improvement from the $39.6 million loss in the same quarter last year. The company […] The post IonQ (Nasdaq: IONQ) Live: Earnings Are In appeared first on 24/7 Wall St..

Live Updates

Updates appear automatically as they are published.

EPS -0.14

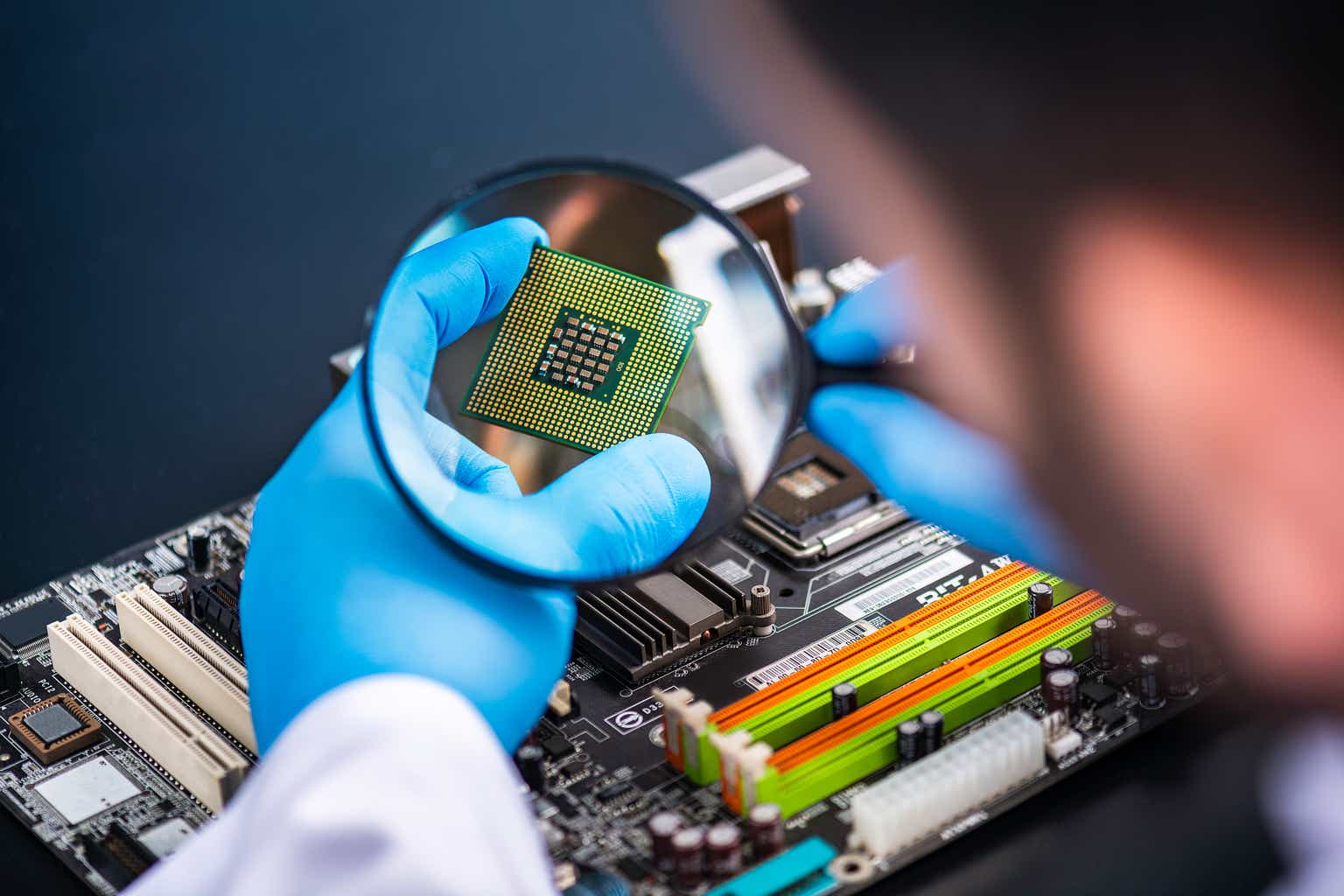

IonQ Inc, a leader in quantum computing and networking, reported its financial results for Q1 2025, showing a net loss of $32.3 million, which is an improvement from the $39.6 million loss in the same quarter last year. The company achieved revenue of $7.6 million, slightly down from $7.58 million in Q1 2024. IonQ’s cash and cash equivalents increased significantly to $697.1 million, bolstered by a $372.6 million ATM facility.

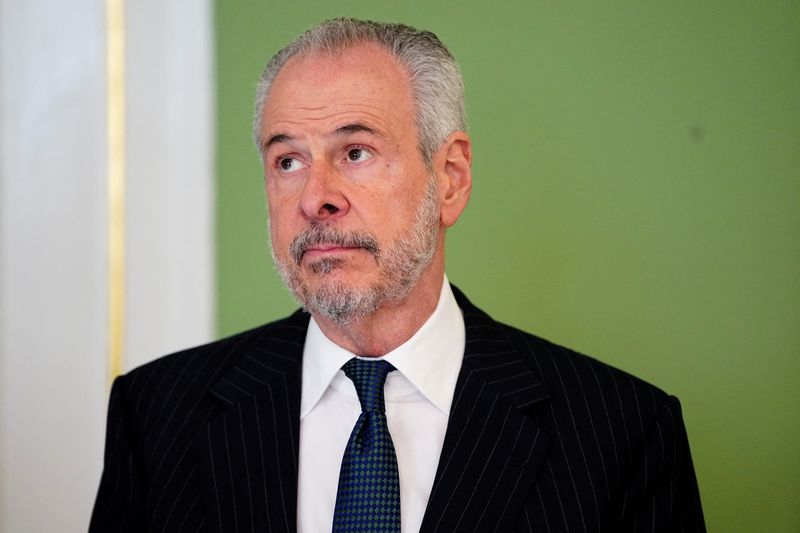

The company announced a $22 million deal with EPB to establish a quantum computing and networking hub, and a pending acquisition of Lightsynq Technologies to enhance its quantum internet and computing capabilities. IonQ also closed its acquisition of ID Quantique and agreed to acquire Capella, further strengthening its quantum networking position. CEO Niccolo de Masi expressed optimism about the company’s strategic advancements, including a 12% speed improvement in a quantum computing demonstration with Ansys. IonQ forecasts 2025 revenue between $75 million and $95 million, with Q2 expectations set between $16 million and $18 million.

Final thoughts before earnings

IonQ continues to trade as a long-duration tech bet, and expectations are centered around R&D milestones more than financials. The market will likely focus on updates to its quantum roadmap (particularly AQ64 and future systems), federal contract momentum, and commentary on customer scaling. A soft print may be overlooked if forward outlook strengthens.

Bull and Bear Case for IonQ

Bull Case:

IonQ bulls view it as the front-runner in commercial quantum computing, with real revenue ($66.9M in 2024) and growing government partnerships. Morgan Stanley analysts noted IonQ and IBM are the only two generating meaningful revenue in the space. Backed by DARPA, involved in the $2.5B Quantum Leadership Act, and with a product pipeline leading to AQ64, the TAM could explode. Its target price sits at $40, vs. a current price of ~$29, implying 31% upside.

Bear Case:

The bear case is rooted in commercialization risk and cash burn. IonQ lost $32M in EBITDA last quarter, and its full profitability path is unclear. Citron and others argue that at current valuations, it prices in multiple years of future growth with little margin for error. Quantum remains a long game—and the timeline is still “a big debate,” as one Morgan Stanley analyst noted.

Scaling and Roadmap Execution

The spotlight is squarely on execution against its ambitious roadmap. While the company is guiding for revenue of $6.5 to $7.5 million—still modest in absolute terms—the real story lies in quantum system performance and the forward-looking AQ64 chip, which aims to push the envelope of algorithmic qubit performance by 2026.

Management has emphasized rapid scaling, noting the company is already delivering 35-algorithmic-qubit “Forte” systems to commercial and government customers. IonQ’s position as the only publicly traded quantum pure play continues to attract attention from institutional and strategic partners, especially after being selected for the DARPA Quantum Benchmarking Program and further integrating with platforms like Amazon Braket and Microsoft Azure Quantum.

The company ended 2024 with $66.9M in total bookings, crushing prior guidance and suggesting a growing backlog of enterprise and federal demand. That momentum will need to continue, particularly as peers like Rigetti and D-Wave look to regain relevance.

Today’s earnings call will be less about beating consensus and more about reaffirming IonQ’s execution credibility—and whether it remains the front-runner in the race toward commercially viable quantum computing.

IonQ pre-earnings snapshot

IonQ remains pre-commercial in terms of revenue scale, but analysts are watching closely for signs of growing bookings and quantum adoption.

-

Q1 2025 Revenue Estimate: $7.6 million

-

Q1 2025 EPS Estimate: –$0.18

-

Q1 2025 EBITDA Estimate: –$36 million

-

FY 2025 Revenue Forecast: $36–38 million

-

Total FY Bookings Target: $90–100 million

What matters most here is momentum — not margin. The Street will focus on: new customer logos, any increased clarity on delivery of new QPUs, and whether IonQ can hit its stated goal of revenue-generating system installs by 2026. The company remains non-GAAP unprofitable and will continue to fund operations through its ~$336 million cash reserve.

3 things to watch after the closing bell

1. DARPA Quantum Benchmarking – First Signs of Institutional Validation

Any mention of initial feedback or milestones from this government-sponsored quantum initiative could add credibility and near-term relevance to IonQ’s tech.

2. AQ64 Roadmap Check – Still 2026? Or Sooner?

Markets are baking in AQ64 for early 2026. If IonQ suggests they’re ahead of schedule—or drops new performance milestones—this could shift valuation sentiment substantially.

3. International & Supply Chain Exposure – Cost Watch

Geopolitical volatility is increasing scrutiny of high-tech supply chains. Management commentary on input cost pressure or export control risks (especially re: China) could catch investor attention.

IonQ Stock Price slides modestly before earnings release

IonQ stock is trading down 1.0% so far on the day.

But the stock is still up 237% over the past year, making it one of the most explosive early-stage tech names of 2024. The company’s valuation — $7.06 billion — reflects investor optimism not in current revenue (just over $7M expected this quarter), but in its quantum computing roadmap.

Investors continue to bet that trapped-ion QPUs will outperform rival architectures in the race toward fault-tolerant, error-corrected quantum computing.

Today’s earnings will be all about future projections and little to do with quarterly financials — commentary around commercialization, defense contracts, and QPU deployment timelines could reaccelerate the narrative.

IonQ Inc. (NYSE: IONQ) will report its Q1 2025 results today, Tuesday after market close, followed by a conference call. Wall Street expects revenue of $7.6 million and an EPS loss of $0.18, according to Capital IQ.

As one of the few public quantum computing companies, IonQ occupies a unique position — one driven more by roadmap credibility than near-term financials. 2024 was a transition year, as IonQ made progress on scaling hardware (Aria-class systems), investing in system control, and growing its bookings pipeline, which ended FY24 at $70.2 million, up 30% year over year.

CEO Peter Chapman has been transparent about the company’s long-term horizon, emphasizing that while revenue remains modest, IonQ is aggressively investing in quantum error correction and hardware robustness as it marches toward the 64–128 trapped ion range. The company burned over $60 million in free cash in Q4 alone, but maintains $336 million in cash on hand — enough to fund operations for years without profitability.

Investors will be watching closely for new customer wins, system deployment milestones, and any updates on anticipated QPU commercialization in 2026–2027. This earnings call will also serve as a check-in on hardware roadmap execution, especially after competitor Neutral Atom-based systems showed progress in Q1.

The post IonQ (Nasdaq: IONQ) Live: Earnings Are In appeared first on 24/7 Wall St..