Even After Losing Sales, This Defense Contractor Sells Over $20 Billion in Arms More Than Its Closest Competitor

In early May 2025, U.S. defense contractor Helix Defense showed off a new technological advancement that could transform American tactical defense strategy: STING, which the Washington Times defines as “a programmable and scalable airburst interceptor round that gives ground units a last-mile defense against drone swarms.” This anti-aircraft ammunition is designed to stop unmanned aerial […] The post Even After Losing Sales, This Defense Contractor Sells Over $20 Billion in Arms More Than Its Closest Competitor appeared first on 24/7 Wall St..

In early May 2025, U.S. defense contractor Helix Defense showed off a new technological advancement that could transform American tactical defense strategy: STING, which the Washington Times defines as “a programmable and scalable airburst interceptor round that gives ground units a last-mile defense against drone swarms.” This anti-aircraft ammunition is designed to stop unmanned aerial vehicles that can cause harm to troops. Unmanned aerial vehicles, including drones, have made it more diffcult to defend troops from attacks. By allowing American troops to deploy STING as needed, and from behind cover, it allows the military to proactively address the threat rather than waiting until they are under attack. (Here are the world’s deadliest and most controversial weapons — and the global push to ban them.)

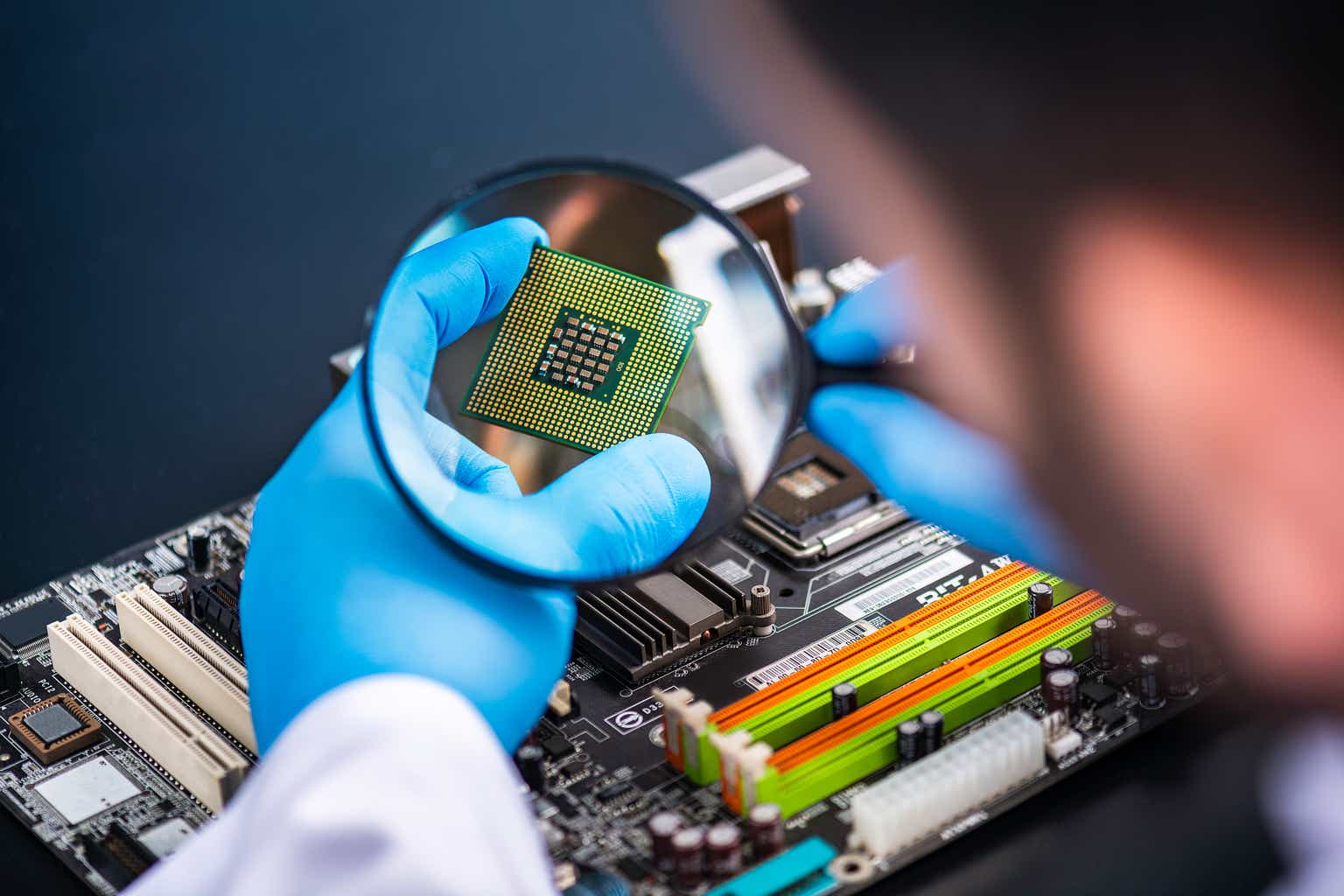

But Helix Defense isn’t the only defense contractor operating in the United States — which makes sense, considering the American military’s diverse needs. Some contractors develop weapons to be used in battle, while others play a role in cybersecurity and IT (in fact, Raytheon and Nightwing Group recently agreed to $8.4 million in fines after claims about issues with the cybersecurity system). Curious about the largest American weapons manufacturers and defense contractors? We were too, so 24/7 Wall St. sourced this information from the Stockholm International Peace Research Institute (SIPRI). Using SIPRI’s fact sheet, published in December 2024, on the “TOP 100 ARMS- PRODUCING AND MILITARY SERVICES COMPANIES, 2023,” 24/7 Wall St. ranked America’s largest defense contractors based on their arms sales in 2023. Companies are ranked in ascending order, with the company with the most revenue at the top of the list. Additional information on YoY change in inflation, total company revenue, and ranking was also taken from SIPRI.

This previously published article was updated in May 2025 to provide an overview of some of the innovation happening in the defense sector currently thanks to several defense contractors.

Why It Matters Now

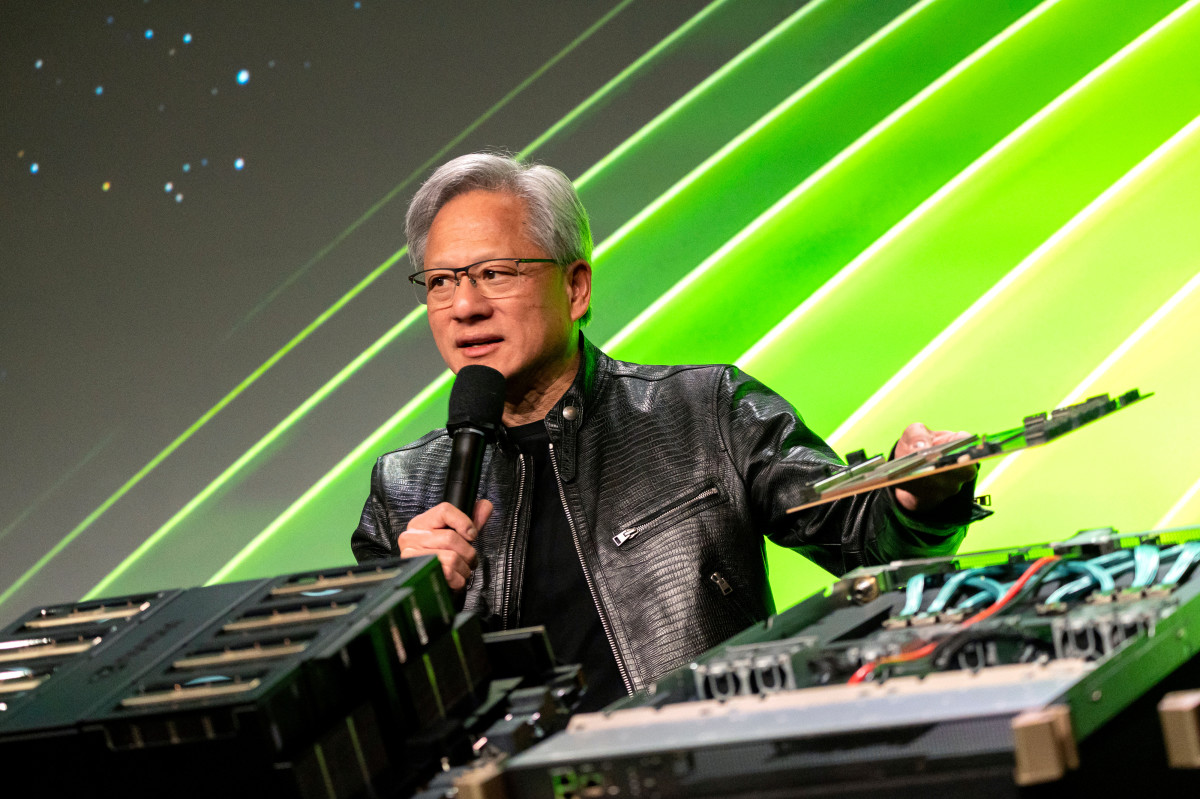

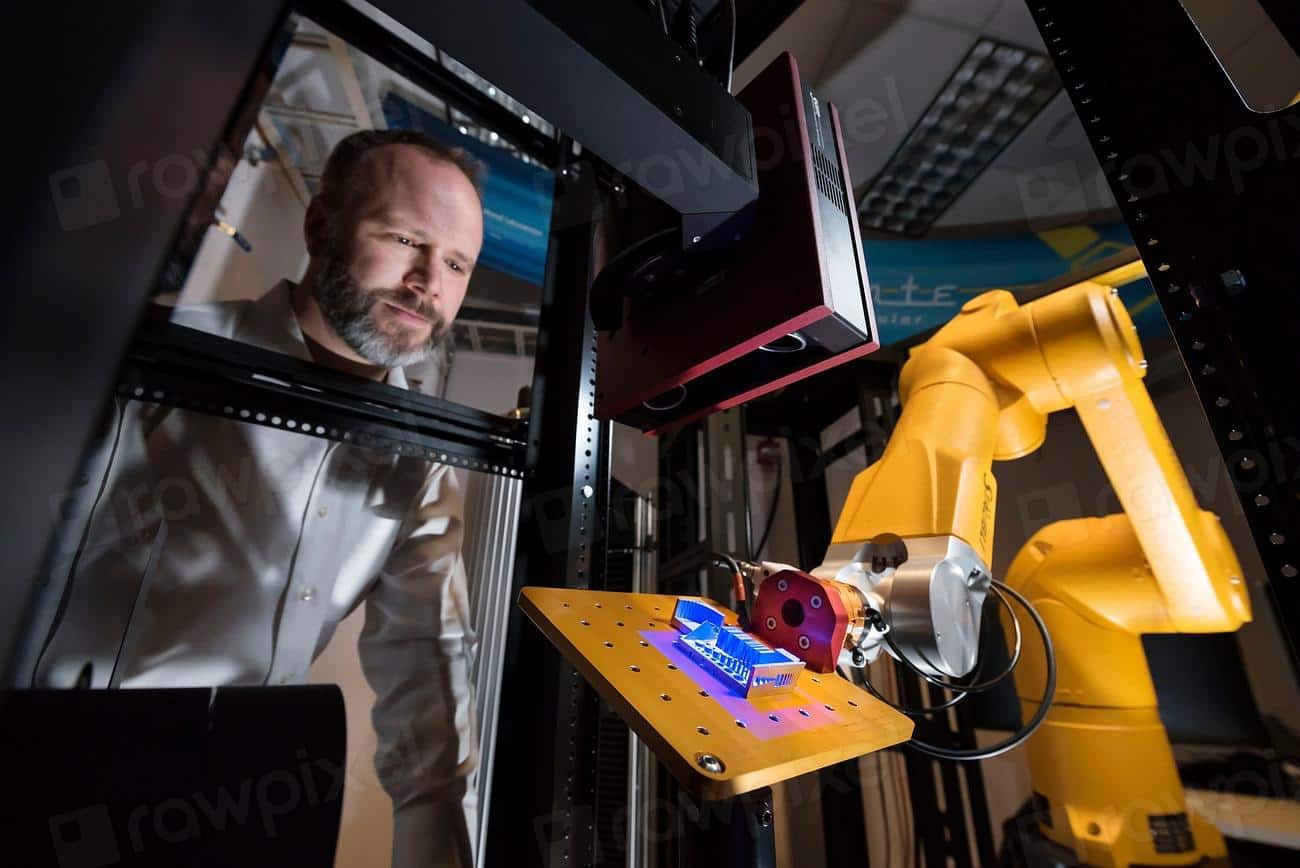

Approximately 10% of the U.S. government’s budget goes towards defense spending, which is an extraordinary large amount. In 2024, the U.S. spent $997 billion on defense spending — which is more than what was spent by China, Russia, Germany, India, Saudi Arabia, Ukraine, the United Kingdom, France, and Japan collectively. As you might expect, this has translated into militaristic power. The United States is considered one of the most well-funded and powerful militaries on a global scale. It also means that the U.S. requires a large private sector defense industry — and one that is rich with innovation. Within the last few months, American defense contractors like Stratolaunch have successfully tested a fully recoverable uncrewed hypersonic vehicle for the Department of Defense, and Palantir’s flagship Artificial Intelligence Platform now shows promise for streamlining government contracting. As military and technology needs continue to shift, it’ll be interesting to see what the world’s largest defense contractors do to remain up-to-speed and to ensure continued revenue growth.

Check out the United States’ largest defense contractors and weapons manufacturers:

37. The Aerospace Corp.

- Arms sales in 2023: $1.1 billion

- Total company revenue in 2023: $1.3 billion (82.2% arms sales)

- 1-yr. change in arms sales (inflation adj.): -1.9% (-$20.0 million )

- Notable weapons systems or services: Project Thor space-based weapons defense

- Ranking among all defense contractors globally: 95th largest

36. Mitre Corp.*

- Arms sales in 2023: $1.1 billion

- Total company revenue in 2023: $2.4 billion (46.6% arms sales)

- 1-yr. change in arms sales (inflation adj.): +3.8% (+$40.0 million )

- Notable weapons systems or services: Research and development for the USAF

- Ranking among all defense contractors globally: 93rd largest

- Note*: The arms revenue figure for this company is an estimate with a high degree of uncertainty.

35. Fluor Corp.

- Arms sales in 2023: $1.1 billion

- Total company revenue in 2023: $15.5 billion (7.2% arms sales)

- 1-yr. change in arms sales (inflation adj.): +3.7% (+$40.0 million )

- Notable weapons systems or services: Nuclear security and remediation, military facility and infrastructure maintenance and support

- Ranking among all defense contractors globally: 92nd largest

34. ViaSat*

- Arms sales in 2023: $1.2 billion

- Total company revenue in 2023: $4.3 billion (28.7% arms sales)

- 1-yr. change in arms sales (inflation adj.): +1.7% (+$20.0 million )

- Notable weapons systems or services: Military satellite communications

- Ranking among all defense contractors globally: 86th largest

- Note*: ViaSat acquired Inmarsat in 2023, and the 2022 arms revenue figure used to calculate one year change was the combined revenues of both companies.

33. Moog

- Arms sales in 2023: $1.2 billion

- Total company revenue in 2023: $3.3 billion (37.3% arms sales)

- 1-yr. change in arms sales (inflation adj.): -6.8% (-$90.0 million )

- Notable weapons systems or services: Military vehicle components

- Ranking among all defense contractors globally: 85th largest

32. Keysight Technologies

- Arms sales in 2023: $1.3 billion

- Total company revenue in 2023: $5.5 billion (22.9% arms sales)

- 1-yr. change in arms sales (inflation adj.): +2.5% (+$30.0 million )

- Notable weapons systems or services: Electronic military hardware and software

- Ranking among all defense contractors globally: 84th largest

31. Amphenol Corp.

- Arms sales in 2023: $1.4 billion

- Total company revenue in 2023: $12.6 billion (11.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +16.0% (+$190.0 million )

- Notable weapons systems or services: Electronic components for military aircraft, drones, tanks, and ground vehicles

- Ranking among all defense contractors globally: 81st largest

30. Curtiss-Wright Corp.

- Arms sales in 2023: $1.6 billion

- Total company revenue in 2023: $2.9 billion (55.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +9.0% (+$130.0 million )

- Notable weapons systems or services: Turret aiming and stabilization tools

- Ranking among all defense contractors globally: 79th largest

29. Eaton

- Arms sales in 2023: $1.7 billion

- Total company revenue in 2023: $23.2 billion (7.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +8.2% (+$130.0 million )

- Notable weapons systems or services: Vehicle components for M1-A1 Abrams tanks, Stryker combat vehicles, and Humvees

- Ranking among all defense contractors globally: 77th largest

28. Parsons Corp.

- Arms sales in 2023: $1.8 billion

- Total company revenue in 2023: $5.4 billion (33.8% arms sales)

- 1-yr. change in arms sales (inflation adj.): +15.0% (+$240.0 million )

- Notable weapons systems or services: C2Core command and control aircraft tool suite

- Ranking among all defense contractors globally: 75th largest

27. BWX Technologies

- Arms sales in 2023: $1.9 billion

- Total company revenue in 2023: $2.5 billion (75.6% arms sales)

- 1-yr. change in arms sales (inflation adj.): +6.8% (+$120.0 million )

- Notable weapons systems or services: Naval nuclear propulsion components

- Ranking among all defense contractors globally: 70th largest

26. Sierra Nevada Corp.*

- Arms sales in 2023: $1.9 billion

- Total company revenue in 2023: $2.0 billion (97.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +19.1% (+$310.0 million )

- Notable weapons systems or services: M-28 Special Operations Multi-Role Aircraft

- Ranking among all defense contractors globally: 68th largest

- Note*: The arms revenue figure for this company is an estimate with a high degree of uncertainty.

25. Oshkosh Corp.

- Arms sales in 2023: $2.1 billion

- Total company revenue in 2023: $9.7 billion (21.7% arms sales)

- 1-yr. change in arms sales (inflation adj.): -5.8% (-$130.0 million )

- Notable weapons systems or services: Joint Light Tactical Vehicles

- Ranking among all defense contractors globally: 63rd largest

24. Teledyne Technologies

- Arms sales in 2023: $2.1 billion

- Total company revenue in 2023: $5.6 billion (37.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +0.5% (+$10.0 million )

- Notable weapons systems or services: Autonomous underwater Slocum G3 Glider

- Ranking among all defense contractors globally: 62nd largest

23. General Atomics*

- Arms sales in 2023: $2.1 billion

- Total company revenue in 2023: N/A

- 1-yr. change in arms sales (inflation adj.): -4.9% (-$110.0 million )

- Notable weapons systems or services: MQ-9A Reaper drone

- Ranking among all defense contractors globally: 61st largest

- Note*: The arms revenue figure for this company is an estimate with a high degree of uncertainty.

22. Jacobs Engineering Group

- Arms sales in 2023: $2.4 billion

- Total company revenue in 2023: $16.4 billion (14.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +7.8% (+$170.0 million )

- Notable weapons systems or services: Intelligence training and analysis, mission support services

- Ranking among all defense contractors globally: 55th largest

21. TransDigm Group

- Arms sales in 2023: $2.6 billion

- Total company revenue in 2023: $6.6 billion (39.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +5.8% (+$140.0 million )

- Notable weapons systems or services: Military parachutes

- Ranking among all defense contractors globally: 53rd largest

20. Parker-Hannifin Corp.

- Arms sales in 2023: $2.6 billion

- Total company revenue in 2023: $19.9 billion (13.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +10.2% (+$240.0 million )

- Notable weapons systems or services: Aerospace components

- Ranking among all defense contractors globally: 52nd largest

19. Textron

- Arms sales in 2023: $2.9 billion

- Total company revenue in 2023: $13.7 billion (21.5% arms sales)

- 1-yr. change in arms sales (inflation adj.): -3.0% (-$90.0 million )

- Notable weapons systems or services: Bell V-280 Valor assault aircraft

- Ranking among all defense contractors globally: 49th largest

18. Bechtel Corp.

- Arms sales in 2023: $3.0 billion

- Total company revenue in 2023: $20.6 billion (14.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +4.2% (+$120.0 million )

- Notable weapons systems or services: Ground based nuclear launch infrastructure

- Ranking among all defense contractors globally: 48th largest

17. V2X

- Arms sales in 2023: $3.4 billion

- Total company revenue in 2023: $4.0 billion (86.1% arms sales)

- 1-yr. change in arms sales (inflation adj.): +30.2% (+$790.0 million )

- Notable weapons systems or services: Logistics support

- Ranking among all defense contractors globally: 44th largest

16. Science Applications International Corp.

- Arms sales in 2023: $3.9 billion

- Total company revenue in 2023: $7.4 billion (52.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): -1.5% (-$60.0 million )

- Notable weapons systems or services: Counter unmanned aerial systems

- Ranking among all defense contractors globally: 40th largest

15. Sandia National Laboratories

- Arms sales in 2023: $4.2 billion

- Total company revenue in 2023: $4.8 billion (87.9% arms sales)

- 1-yr. change in arms sales (inflation adj.): +2.9% (+$120.0 million )

- Notable weapons systems or services: Nuclear weapons development

- Ranking among all defense contractors globally: 37th largest

14. KBR

- Arms sales in 2023: $4.2 billion

- Total company revenue in 2023: $7.0 billion (60.8% arms sales)

- 1-yr. change in arms sales (inflation adj.): -4.7% (-$210.0 million )

- Notable weapons systems or services: Laser weapon systems

- Ranking among all defense contractors globally: 36th largest

13. General Electric

- Arms sales in 2023: $4.7 billion

- Total company revenue in 2023: $68.0 billion (6.9% arms sales)

- 1-yr. change in arms sales (inflation adj.): +2.6% (+$120.0 million )

- Notable weapons systems or services: Black Hawk and Apache helicopter engines

- Ranking among all defense contractors globally: 31st largest

12. Honeywell International

- Arms sales in 2023: $5.0 billion

- Total company revenue in 2023: $36.7 billion (13.6% arms sales)

- 1-yr. change in arms sales (inflation adj.): +3.5% (+$170.0 million )

- Notable weapons systems or services: Operations platforms for military aircraft

- Ranking among all defense contractors globally: 29th largest

11. CACI International

- Arms sales in 2023: $5.7 billion

- Total company revenue in 2023: $7.7 billion (74.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +13.5% (+$680.0 million )

- Notable weapons systems or services: SkyTracker drone technology

- Ranking among all defense contractors globally: 25th largest

10. Amentum

- Arms sales in 2023: $6.5 billion

- Total company revenue in 2023: $8.6 billion (75.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): -5.6% (-$380.0 million )

- Notable weapons systems or services: Electronic submarine components, rotary wing flight training, aviation command and control support

- Ranking among all defense contractors globally: 21st largest

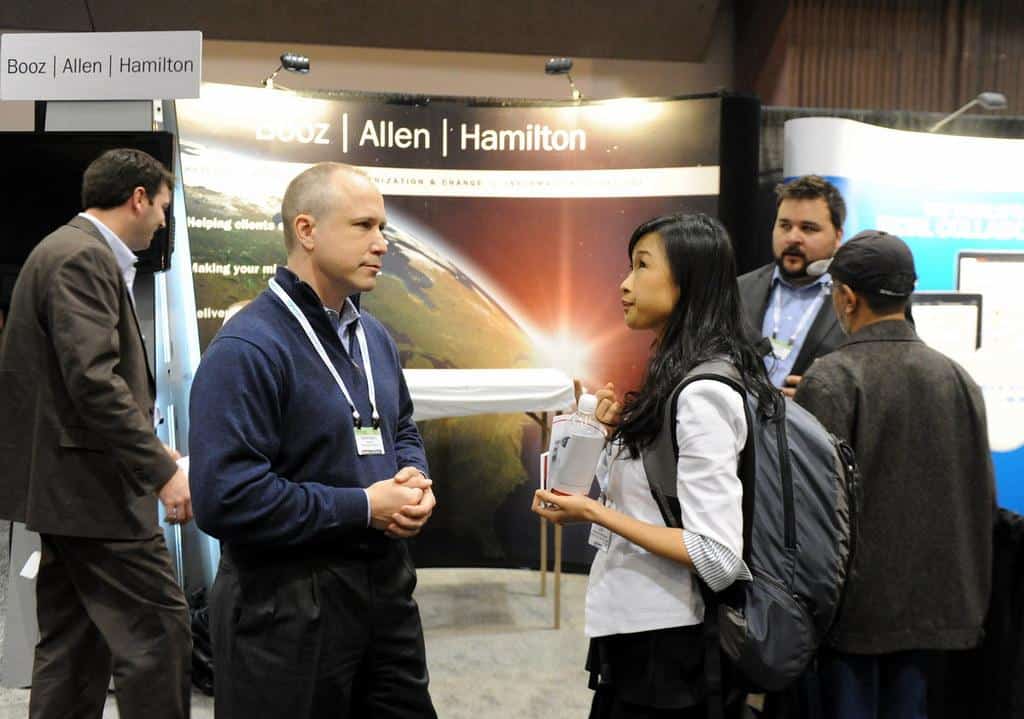

9. Booz Allen Hamilton

- Arms sales in 2023: $6.9 billion

- Total company revenue in 2023: $10.7 billion (64.7% arms sales)

- 1-yr. change in arms sales (inflation adj.): +12.4% (+$760.0 million )

- Notable weapons systems or services: Defense consulting

- Ranking among all defense contractors globally: 20th largest

8. Leidos

- Arms sales in 2023: $8.7 billion

- Total company revenue in 2023: $15.4 billion (56.5% arms sales)

- 1-yr. change in arms sales (inflation adj.): +1.7% (+$150.0 million )

- Notable weapons systems or services: GBU-69/B precision guided munitions

- Ranking among all defense contractors globally: 19th largest

7. HII

- Arms sales in 2023: $9.3 billion

- Total company revenue in 2023: $11.5 billion (81.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +1.9% (+$170.0 million )

- Notable weapons systems or services: Gerald R. Ford-Class aircraft carriers

- Ranking among all defense contractors globally: 17th largest

6. L3Harris Technologies*

- Arms sales in 2023: $14.8 billion

- Total company revenue in 2023: $19.4 billion (76.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +12.2% (+$1.6 billion )

- Notable weapons systems or services: Sky Warden ISR Strike Aircraft

- Ranking among all defense contractors globally: 11th largest

- Note*: L3Harris Technologies acquired Aerojet Rocketdyne in 2023, and revenue figures are adjusted to account for the merger.

5. General Dynamics Corp.

- Arms sales in 2023: $30.2 billion

- Total company revenue in 2023: $42.3 billion (71.4% arms sales)

- 1-yr. change in arms sales (inflation adj.): +3.2% (+$930.0 million )

- Notable weapons systems or services: M1A1 Abrams Main Battle Tank

- Ranking among all defense contractors globally: 5th largest

4. Boeing

- Arms sales in 2023: $31.1 billion

- Total company revenue in 2023: $77.8 billion (40.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): +2.0% (+$600.0 million )

- Notable weapons systems or services: V-22 Osprey aircraft

- Ranking among all defense contractors globally: 4th largest

3. Northrop Grumman Corp.

- Arms sales in 2023: $35.6 billion

- Total company revenue in 2023: $39.3 billion (90.5% arms sales)

- 1-yr. change in arms sales (inflation adj.): +5.8% (+$2.0 billion )

- Notable weapons systems or services: B-21 Raider long-range strike fighter

- Ranking among all defense contractors globally: 3rd largest

2. RTX (formerly Raytheon Technologies)

- Arms sales in 2023: $40.66 billion

- Total company revenue in 2023: $68.9 billion (59.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): -1.3% (-$530.0 million )

- Notable weapons systems or services: Javelin Missile

- Ranking among all defense contractors globally: 2nd largest

1. Lockheed Martin Corp.

- Arms sales in 2023: $60.8 billion

- Total company revenue in 2023: $67.6 billion (90.0% arms sales)

- 1-yr. change in arms sales (inflation adj.): -1.6% (-$1.0 billion )

- Notable weapons systems or services: F-35 Lightning II multirole combat aircraft

- Ranking among all defense contractors globally: the largest

The post Even After Losing Sales, This Defense Contractor Sells Over $20 Billion in Arms More Than Its Closest Competitor appeared first on 24/7 Wall St..