Boomers Are Snapping Up 4 Super-Safe Passive Income Stocks Under $30

These four safe dividend-paying stocks trading under $30 are often overlooked but passive income home runs. The post Boomers Are Snapping Up 4 Super-Safe Passive Income Stocks Under $30 appeared first on 24/7 Wall St..

Baby Boomers love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or portfolio consists of income and stock appreciation.

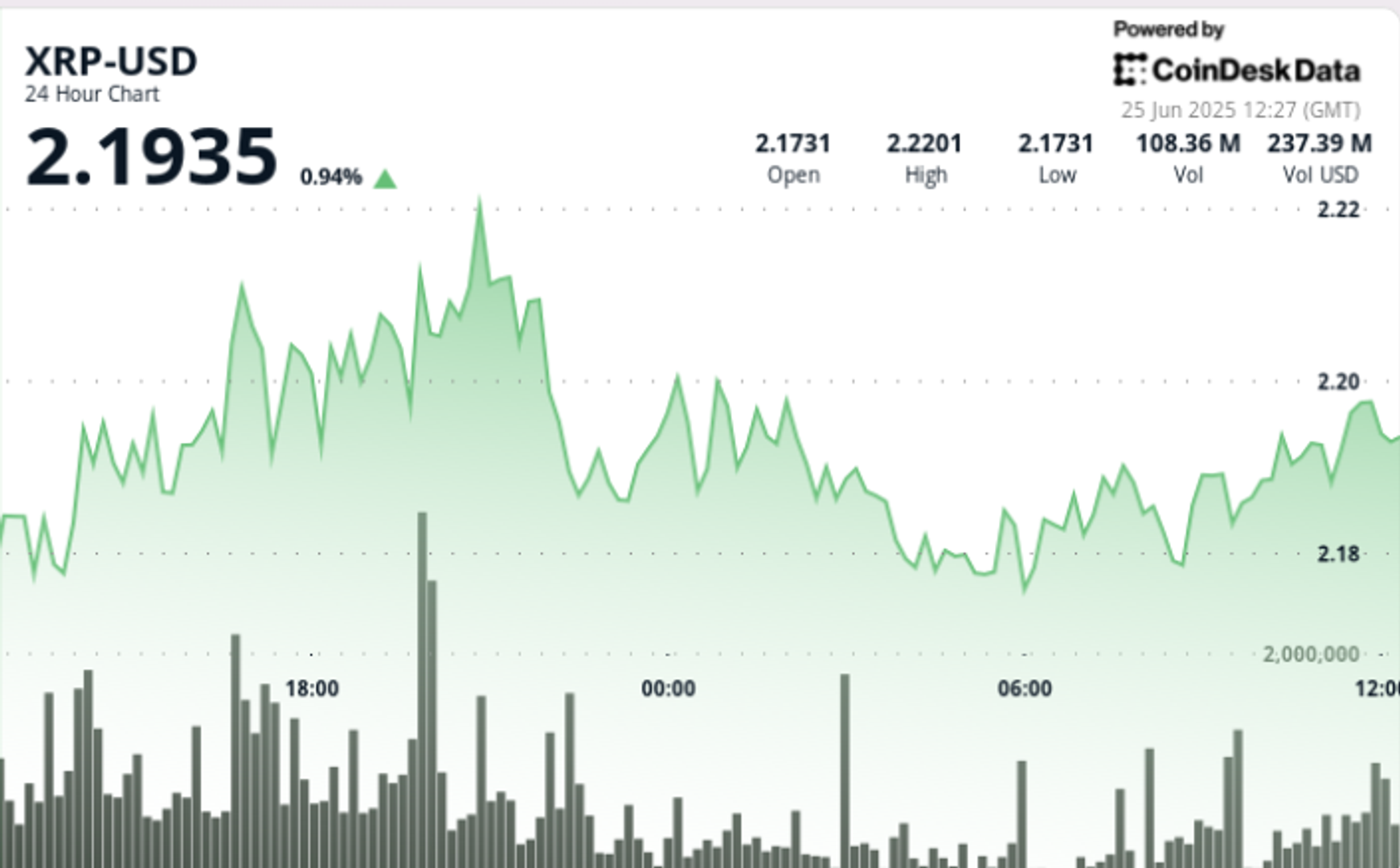

At 24/7 Wall St., we have closely followed dividend-paying stocks for over 15 years. With a growing audience of savvy Baby Boomers and retirees seeking safe passive income ideas that deliver more than the 10-year Treasury bond’s 4.40% bi-annual dividend, we have screened hundreds of stocks, looking for recurring, dependable dividend payouts and a degree of safety that allows for a good night’s sleep.

24/7 Wall St. Key Points:

-

Safe dividend-paying income stocks trading under $30 are passive income home runs.

-

Stocks trading under the $30 level offer Boomers a larger share count when they buy.

-

With the geopolitical environment increasing volatility, super-safe passive income stocks make sense.

-

Do safe passive income stocks make sense for you? Why not contact a financial advisor near you for a complete portfolio review? Click here to get started finding one today. (Sponsored)

Most Baby Boomer dividend investors seek solid passive income streams from quality dividend stocks. Passive income is a steady stream of unearned income that does not require active traditional work. Shared ideas for earning passive income include investments such as dividend stocks, bonds, and mutual funds, as well as real estate and additional income-producing side hustles.

We constantly screen our 24/7 Wall St. passive income stock research database for the best ideas for Boomers. We identified four stocks that are often overlooked by investors. All are rated Buy by top Wall Street firms, and all are trading under $30.

Why do we cover passive income dividend stocks?

Since 1926, dividends have contributed approximately 32% of the total return for the S&P 500, while capital appreciation has contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are essential for total return expectations. A study by Hartford Funds, in collaboration with Ned Davis Research, found that dividend stocks delivered an annualized return of 9.18% over the 50 years from 1973 to 2023. Over the same timeline, this was more than double the annualized return for non-payers (3.95%).

Ares Capital

The company specializes in providing financing solutions for the middle market. This company is a high-yielding business development company (BDC) that pays a substantial dividend. Ares Capital Corp. (NASDAQ: ARCC) specializes in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle-market companies.

It also makes growth capital and general refinancing. It prefers to invest in companies engaged in basic and growth manufacturing, business services, consumer products, healthcare products and services, and information technology sectors.

The fund will also consider investments in industries such as restaurants, retail, oil and gas, and technology sectors.

It focuses on investments in the Northeast, Mid-Atlantic, Southeast, and Southwest regions from its New York office, the Midwest region from the Chicago office, and the Western region from the Los Angeles office.

The fund typically invests between $20 million and $200 million, with a maximum investment of $400 million, in companies with an EBITDA between $10 million and $250 million. It makes debt investments between $10 million and $100 million

The fund invests through:

- Revolvers

- First-lien loans

- Warrants

- Unitranche structures

- Second-lien loans

- Mezzanine debt

- Private high yield

- Junior capital

- Subordinated debt

- Non-control preferred and common equity

The fund also selectively considers third-party-led senior and subordinated debt financings and opportunistically acquires stressed and discounted debt positions.

Ares Capital prefers to be an agent and lead the transactions in which it invests. The fund also seeks board representation in its portfolio companies.

Kinder Morgan

Kinder Morgan Inc. (NYSE: KMI) is one of North America’s largest energy infrastructure companies. This is one of the top energy stocks and remains a Wall Street favorite, paying a solid and dependable dividend.

The company operates through four segments:

- Natural Gas

- Products

- Terminals

- CO2

The Natural Gas Pipelines segment owns and operates

- Interstate and intrastate natural gas pipeline and underground storage systems

- Natural gas gathering systems and natural gas processing and treating facilities

- Natural gas liquids fractionation facilities and transportation systems

- Liquefied natural gas liquefaction and storage facilities

The Products Pipelines segment owns and operates refined petroleum products, crude oil, and condensate pipelines, associated product terminals, and petroleum OKE pipeline transmission facilities.

The Terminals segment owns and operates liquids and bulk terminals that store and handle various commodities, including:

- Gasoline

- Diesel fuel

- Chemicals

- Ethanol

- Metals

- Petroleum coke

- Owns tankers

Lastly, the CO2 segment produces, transports, and markets CO2 to recover and produce crude oil from mature oil fields. It owns interests in or operates oil fields, gasoline processing plants, and a natural oil pipeline system in West Texas. It holds and runs approximately 83,000 miles of pipelines and 144 terminals.

Pfizer

Pfizer Inc. (NYSE: PFE) was established in 1849 in New York by two German entrepreneurs. This top pharmaceutical stock was a massive winner in the COVID-19 vaccine sweepstakes, but it has been crushed over the past two years as many people have not received boosters. Pfizer discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It pays a dependable dividend, which has risen yearly for the past 16 years.

The company offers medicines and vaccines in various therapeutic areas, including:

- Cardiovascular, metabolic, and women’s health under the Premarin family and Eliquis brands

- Biologics, small molecules, immunotherapies, and biosimilars under the Ibrance, Xtandi, Sutent, Inlyta, Retacrit, Lorbrena, and Braftovi brands

- Sterile injectable and anti-infective medicines and oral COVID-19 treatment under the Sulperazon, Medrol, Zavicefta, Zithromax, Vfend, Panzyga, and Paxlovid brands

Pfizer also provides medicines and vaccines in various therapeutic areas, such as:

- Pneumococcal disease, meningococcal disease, and tick-borne encephalitis

- COVID-19 under the Comirnaty/BNT162b2, Nimenrix, FSME/IMMUN-TicoVac, Trumenba, and the Prevnar family brands

- Biosimilars for chronic immune and inflammatory diseases under the Xeljanz, Enbrel, Inflectra, Eucrisa/Staquis, and Cibinqo brands

- Amyloidosis, hemophilia, and endocrine diseases under the Vyndaqel/Vyndamax, BeneFIX, and Genotropin brands

Pfizer anticipates full-year 2025 revenues in the range of $61.0 to $64.0 billion. This includes the expectation that revenues from COVID-19 products in 2025 will be broadly consistent with those in 2024, after excluding approximately $1.2 billion of non-recurring revenue for Paxlovid in 2024.

Regions Financial

Serving the fast-growing sections of the United States, this is a conservative approach for growth and income investors seeking passive income. Regions Financial Corp. (NYSE: RF) is a full-service provider of consumer and commercial banking, wealth management, and mortgage products and services.

The company has customers across the South, Midwest, and Texas, and through its subsidiary, Regions Bank, operates approximately 1,250 banking offices and more than 2,000 ATMs.

Its segments include:

- Corporate Bank

- Consumer Bank

- Wealth Management

The Corporate Bank segment represents the bank’s commercial banking functions, including commercial and industrial lending, commercial real estate lending, and investor real estate lending.

The Consumer Bank segment represents its branch network, including consumer banking products and services related to:

- Residential first mortgages

- Home equity lines and loans

- Consumer credit cards

- Consumer loans, as well as the corresponding deposit relationships

The Wealth Management segment offers a range of credit-related products, including trust and investment management, asset management, retirement and savings solutions, and estate planning services.

Five Very Safe Dividend Stocks Can Provide a Lifetime of Monthly Passive Income

The post Boomers Are Snapping Up 4 Super-Safe Passive Income Stocks Under $30 appeared first on 24/7 Wall St..