Insiders Invested Millions in these Five Rebounding Stocks

We would never suggest that investors base their investing decisions solely on insider buying. Instead, what you want to do is do your due diligence, technically and fundamentally, before jumping in. The last thing you want to do is buy if the stock has exploded higher already. So, it’s just best to do your research […] The post Insiders Invested Millions in these Five Rebounding Stocks appeared first on 24/7 Wall St..

Key Points

-

We would never suggest that investors base their investing decisions solely on insider buying. Instead, what you want to do is do your due diligence.

-

Marriott Vacations Worldwide director Christian Asmar bought 412,449 shares for just over $27.88 million.

-

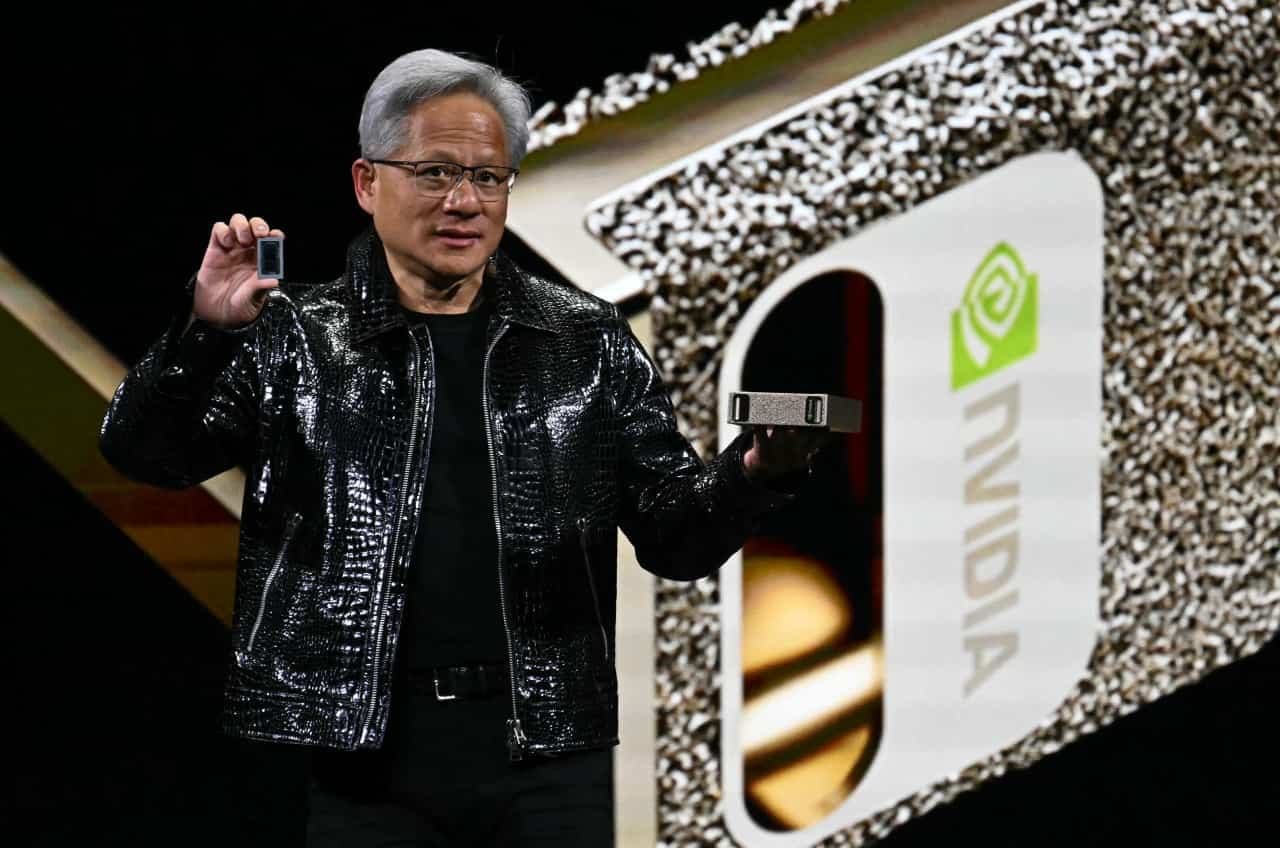

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

We would never suggest that investors base their investing decisions solely on insider buying.

Instead, what you want to do is do your due diligence, technically and fundamentally, before jumping in. The last thing you want to do is buy if the stock has exploded higher already. So, it’s just best to do your research first.

That being said, here’s what insiders have been buying.

Modular Medical

Modular Medical (NASDAQ: MODD) just saw director William Wulfsohn buy 2,530 shares for just over $200,957. The Manchester Management Company bought 677,082 shares at $1.92 per share.

The company recently entered into definitive subscription agreements worth proceeds of about $12 million. It plans to use those proceeds to prepare for the commercial availability and its submission to the US FDA for a tubeless version of its MODD1 product. MODD1 is a 90-day patch pump, which features new microfluidics technology to allow for the low-cost pumping of insulin.

GeneDx Holdings

Keith Meister, a 10% shareholder of genetic testing company, GeneDx Holdings (NASDAQ: WGS), just bought 100,000 shares for $5.6 million.

Fueling upside, Jefferies’ analysts just upgraded the stock to a buy rating with a price target of $80. As noted by Seeking Alpha, “Analysts at Jefferies now see a clear path to recovery driven by strong growth in neonatal intensive care unit testing, new clinical indications, and improving cost efficiency.”

The company also posted its third consecutive quarter of profitability with Q1 2025 revenues exceeding $87 million. Management also raised its 2025 revenue guidance to $360 million to $375 million. Plus. its focus on NICU [neonatal intensive care unit] expansion, strengthened by the ultraRapid genome sequencing launch and the Fabric Genomics acquisition, positions it well for future growth.

ConocoPhillips

ConocoPhillips’ (NYSE: COP) Executive Vice President, Kirk Johnson, bought $499,472 worth of ConocoPhillips. He bought 5,300 shares at a cost of $94.24 each.

The oil giant is just starting to pivot higher, with oil set to gush with an intensifying war with Iran. We also have to consider that Iran has threatened to shut down the Strait of Hormuz, which supplies 20% of global oil. A disruption to that route could easily send oil prices well above $80 a barrel again, which would be good for COP shareholders.

Fueling more interest, the company just paid a dividend of 78 cents per share on June 2. Plus, analysts at Raymond James recently raised their price target on COP to $109 with an outperform rating on the stock.

Marriott Vacations Worldwide

Marriott Vacations Worldwide (NYSE: VAC) director Christian Asmar bought 412,449 shares for just over $27.88 million. He paid an average price of $67.61 on June 17. On June 18, he picked up 337,551 shares at an average price of $68.11 for $22.99 million.

The company also just declared a quarterly dividend of 79 cents. That was paid on June 6 to shareholders of record as of May 23.

Recent earnings weren’t too shabby. While revenue of $1.2 billion, as compared to the $1.195 billion posted a year earlier, missed estimates by $10 million, its EPS of $1.66 beat by 23 cents.

“We had a strong first quarter, growing first-time buyer sales and Adjusted EBITDA, illustrating the power of our leisure-focused business model,” said John Geller, president and chief executive officer, as quoted in the company’s earnings release. “We are reiterating our full-year Adjusted EBITDA guidance in light of our strong profitability performance and progress on our transformation initiatives.”

In addition, analysts at Morgan Stanley just raised their price target on VAC by $8 to $65 with an equal weight rating. As noted by TheFly.com, “‘The firm raised estimates modestly across the board’ for its Gaming & Lodging coverage to reflect better Q1 results and roughly in-line guidance expectations and mark-to-market adjustments for higher multiples.”

Smithfield Foods

Food processing company, Smithfield Foods (NASDAQ: SFD), Chief Business Officer Keller Watts just bought 4,291 shares for $101,353.

Recent earnings were also solid. In its first quarter, the company’s EPS of 58 cents beat estimates by 11 cents. Revenue of $3.78 billion, up 9.9% year over year, beat estimates by $160 million.

“Our first quarter fiscal 2025 operating profit of $321 million and adjusted operating profit of $326 million both increased more than 85% versus the first quarter of 2024, driven by a sharp rebound in our Hog Production segment and strong execution on our strategies,” said Smithfield President and CEO Shane Smith.

“Our strong first quarter results mark a solid start to 2025. We have reaffirmed our outlook for the full year, and we remain focused on executing our strategies to deliver higher operating profit in 2025. Our strong financial position provides us with the financial flexibility to invest in growth and return value to our shareholders.”

The post Insiders Invested Millions in these Five Rebounding Stocks appeared first on 24/7 Wall St..