UNH, TGT, BDX: 3 Ridiculously Undervalued Stocks Set to Surge in May 2025

Certain stocks have declined significantly in the past few months as the economic cycle has been changing. The Federal Reserve seems well-positioned to do at least one rate cut this year. Inflation hasn’t been rising as much as expected. Instead, it has come in slightly cooler than expected. Companies managed to put their pent-up inventory […] The post UNH, TGT, BDX: 3 Ridiculously Undervalued Stocks Set to Surge in May 2025 appeared first on 24/7 Wall St..

Key Points

-

These stocks have declined significantly in the past year and are now below their intrinsic values.

-

It could be a good idea to buy the dip here, as the market is overly fearful about them.

-

These undervalued stocks could deliver significant upside as they eventually recover.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Certain stocks have declined significantly in the past few months as the economic cycle has been changing. The Federal Reserve seems well-positioned to do at least one rate cut this year. Inflation hasn’t been rising as much as expected. Instead, it has come in slightly cooler than expected.

Companies managed to put their pent-up inventory to use, and they are now building up inventory once more during this “temporary” tariff pause. The 30% tariffs on China and the 10% baseline tariffs will likely raise inflation, but it is unlikely to do so to the extent many had expected right after the Liberation Day tariffs were announced.

The following stocks have gone into undervalued territory and are worth looking into.

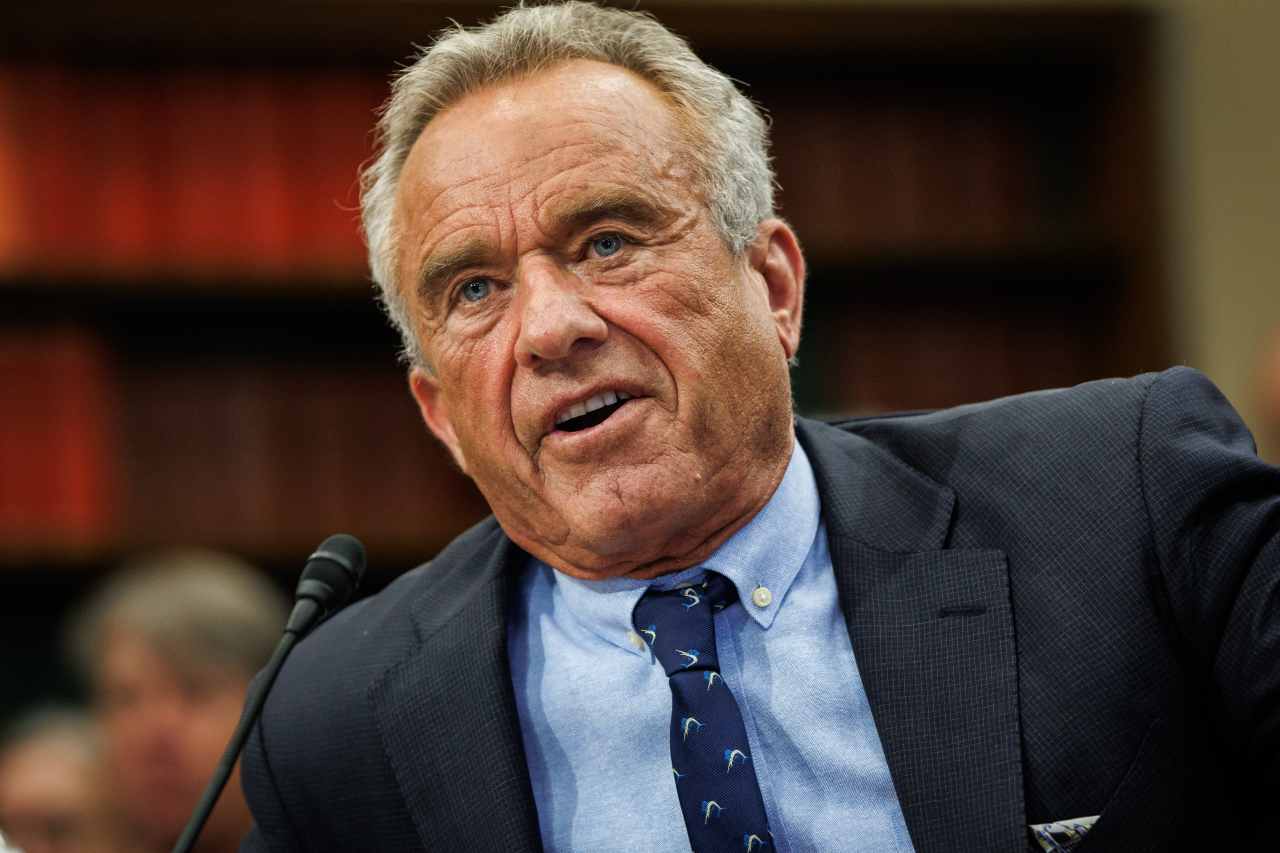

UnitedHealth (UNH)

UnitedHealth (NYSE:UNH) was among the biggest beneficiaries during peak uncertainty just a little over a month ago. Investors were piling into UNH stock as this healthcare insurance company was well-insulated from tariffs, and the policies of the current administration were expected to leave it unscathed.

All of that made UNH look like a great bet, but that didn’t last long.

UNH stock fell in mid-April after disappointing investors with Q1 earnings and a downgrade of its full-year guidance. It expects 2025 adjusted EPS between $26 and $26.5 vs. expectations of $29.73 at the midpoint. Q1 EPS missed estimates by 1.28%, and revenue missed estimates by 1.82%.

Those who’ve bought the dip afterwards were met with further declines of 16.6% before the stock plunged even more this week. The company’s CEO Andrew Witty suddenly stepped down, and UnitedHealth also suspended its annual forecast. This is after President Donald Trump signed an executive order aiming to reduce drug costs.

Trump’s executive order specifically targets the role of PBMs like UnitedHealth’s Optum Rx. Regardless, I don’t think this is something that should be priced in to this extent.

Optum Rx constitutes 33.3% of UnitedHealthcare’s revenue, and this is a lower margin segment compared to other Optum businesses. And that’s if the segment gits hit in the first place. Previous attempts to go after PBMs have led to courts blocking them, and the executive order is tough to fully enforce.

The selloff to me seems overdone at this point. Minus the Q1 miss, which wasn’t that severe, the bearishness is mostly based on speculation. UNH at 13 times earnings prices in the worst-case scenario, and UNH should recover significantly in the 24 months. Historically, Wall Street has paid 22 times earnings for this stock.

The consensus price target of $536.05 implies 71.6% upside.

Target (TGT)

Target (NYSE:TGT) was a Wall Street darling during 2020-2021 but has underperformed since. Consumer spending began to shift away from services due to inflation surging, and the company found itself with excess inventory in discretionary categories. As such, it had to go through markdowns to clear stock. In turn, the margin was pressured, and investors sold off the stock.

TGT stock is down nearly 30% year-to-date, and this is partly due to the company announcing a rollback of some of its Diversity, Equity, and Inclusion (DEI) programs. Foot traffic fell 7.9% year-over-year in the week beginning March 31, as the “boycott” is still ongoing. Target’s Q4 revenue declined 3.1% to $30.9 billion, and net income fell 20.19%.

But if you look at the long run, TGT could deliver solid gains from the 63%-plus selloff from its peak so far. If we look at trailing net income and EBITDA, it has been on a downtrend for the past two quarters, but it is still well above 2023 levels.

Target is expected to turn a corner this year. Sales growth is expected to be positive for the foreseeable future, and EPS growth is expected to return after a 0.31% decline in FY2026. This should coincide with TGT stock starting a turnaround.

TGT comes with a dividend yield of 4.63%, and trades at less than 11 times earnings vs. 15.64 times earnings historically.

The consensus price target at $128.57 implies 33.7% upside. Price targets go as high as $180.

Becton Dickinson and Co (BDX)

Becton Dickinson and Co (NYSE:BDX) sells medical devices and instruments. The stock declined significantly two weeks ago, and despite a recovery, it is still down 17%. The company reported Q2 FY 2025 EPS of $3.35, which beat expectations of $3.28. But it posted revenue of $5.27 billion, which missed expectations of $5.35 billion.

The company specifically mentioned that cuts to U.S. research grants led to increased pressure on research spending in the second quarter. It also saw a negative impact from tariffs on its fiscal 2025 earnings. This was stated to be around 25 cents per share.

Becton Dickinson also lowered its full-year guidance. Projected revenue was slightly narrowed between $21.8 billion and $21.9 billion from $21.7 billion and $21.9 billion. The real downgrade was that organic revenue growth expectations were lowered to 3% to 3.5% from 4% to 4.5%. The guidance for adjusted diluted EPS was also lowered between $14.06 to $14.34 from the prior range of $14.3 to $14.6.

I expect the stock to bottom out soon, as tariffs are no longer as significant as the company accounts for in its guidance. Plus, none of the disappointments are bad enough to justify the stock falling 24.1% year-to-date. BDX stock has historically traded within the range of $225 to $280 since 2018, and it is likely to return to that range eventually, especially if management re-adjusts guidance after tariffs pause and trade deals.

Currently, the stock comes with little downside risk. The consensus price target at $231.44 implies 34.67% upside potential, and even the lowest price target at $185 implies upside. In the meantime, you can sit on its 2.42% dividend yield.

The post UNH, TGT, BDX: 3 Ridiculously Undervalued Stocks Set to Surge in May 2025 appeared first on 24/7 Wall St..