Cathie Wood Is Dumpster Diving Again With These 3 Stock Buys

The Rise of a Frenzied Trading Style Cathie Wood, founder of ARK Invest, burst into investor consciousness in 2020 when her flagship ARK Innovation ETF (NYSEARCA:ARKK) soared 153%, fueled by bold bets on Tesla (NASDAQ:TSLA), Roku (NASDAQ:ROKU), and Zoom Communications (NASDAQ:ZM) during a tech-driven bull market. Her frenetic trading style — characterized by rapid, high-conviction […] The post Cathie Wood Is Dumpster Diving Again With These 3 Stock Buys appeared first on 24/7 Wall St..

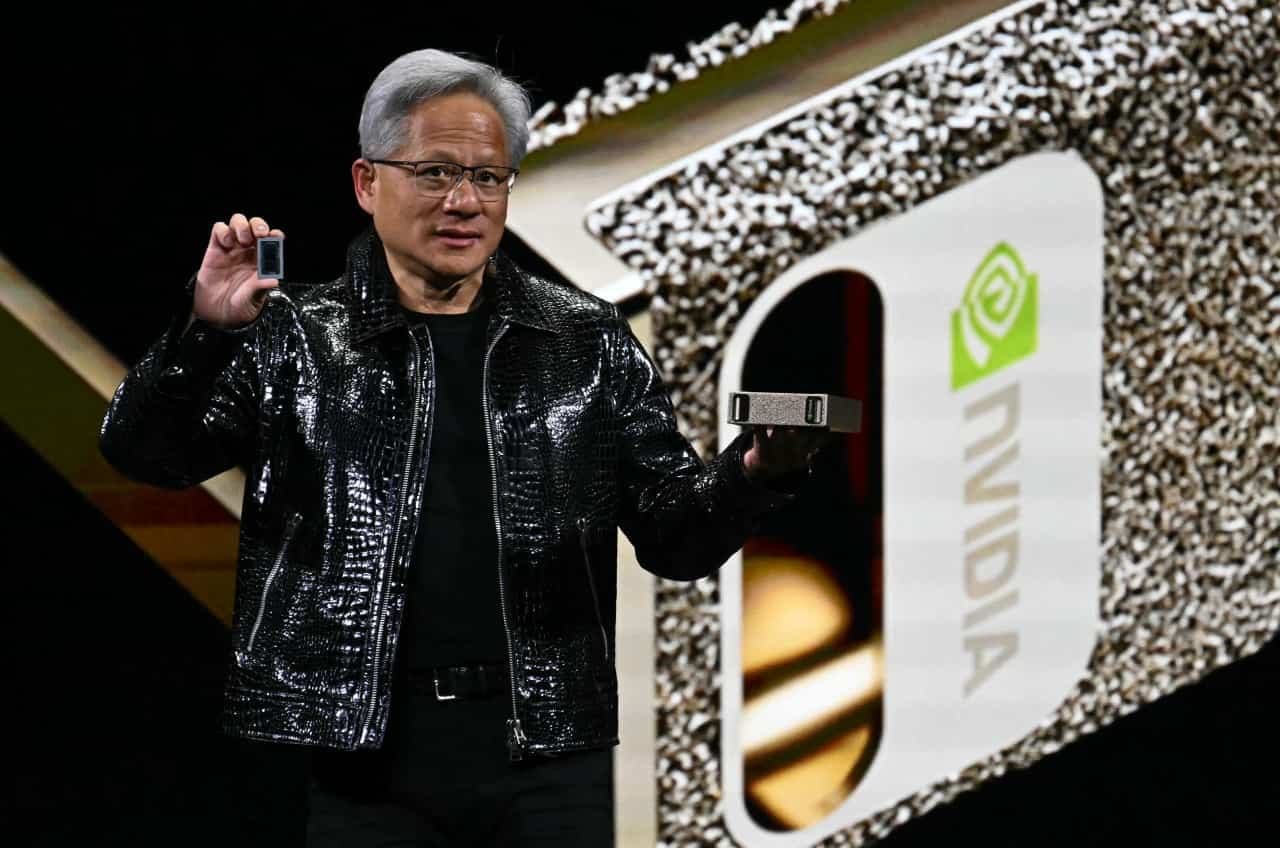

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Key Points in This Article:

The Rise of a Frenzied Trading Style

Cathie Wood, founder of ARK Invest, burst into investor consciousness in 2020 when her flagship ARK Innovation ETF (NYSEARCA:ARKK) soared 153%, fueled by bold bets on Tesla (NASDAQ:TSLA), Roku (NASDAQ:ROKU), and Zoom Communications (NASDAQ:ZM) during a tech-driven bull market.

Her frenetic trading style — characterized by rapid, high-conviction moves in disruptive technologies like AI, genomics, and blockchain — catapulted ARK’s assets under management from $5 billion in 2018 to $60 billion by 2021.

However, her aggressive approach led to volatility, with ARKK plummeting 67% in 2022 and delivering a five-year cumulative return of just 2.1%, greatly lagging the S&P 500’s 100% gain.

Despite this, Wood’s knack for spotting long-term trends keeps her a Wall Street icon. Yesterday, she scooped up shares of Airbnb (NASDAQ:ABNB), Illumina (NASDAQ:ILMN), and Shopify (NASDAQ:SHOP), signaling bargain hunting in beaten-down tech stocks. When Wood buys, investors take notice, as her picks often foreshadow growth opportunities. You might want to pay attention, too.

Airbnb (ABNB): Riding the Travel Rebound

Airbnb, a disruptor in the travel industry, saw ARK’s ARKK ETF purchase 19,622 shares valued at $2.6 million, reflecting Wood’s confidence in its recovery. Despite a 19% drop from its February peak, Airbnb reported first-quarter revenue of $2.27 billion, up 6% year-over-year, slightly beating expectations. Its global network of 7.7 million listings and 121 million nights booked in Q1 underscore its scale.

Analysts see growth accelerating as travel demand rebounds after the easing of Middle East tensions, with most analysts maintaining their hold recommendation while Citigroup reiterated its buy rating though it cut its price target from $170 to $155 per share, implying 17% upside .

Airbnb’s investments in AI-driven personalization and new services like “Icons” unique stays enhance user engagement. However, regulatory risks in cities like New York and competition from hotels pose challenges.

Wood’s recent $23.7 million Airbnb buying spree suggests she views these as short-term hurdles, betting on the platform’s ability to capitalize on a multi-trillion-dollar travel market over the next decade.

Illumina (ILMN): Genomics Revolution Leader

Illumina, a genomics pioneer, caught Wood’s eye with ARKK acquiring 28,266 shares worth $2.57 million as part of her sustained investment in biotech. Illumina’s high-speed gene-sequencing technology dominates genomic research, with applications in cancer diagnostics and reproductive health.

The biotech’s first-quarter revenue of $1.04 billion was flat year-over-year, but cost-cutting measures boosted margins, and management raised its NovaSeq X platform’s adoption guidance.

Analysts project minimal annual revenue growth through 2026, though its gains continue to be driven by demand for precision medicine, a market expected to reach $175 billion by 2030. Wood, who added 93,000 shares last November, believes Illumina’s microarray platforms will expand into agriculture and environmental science, diversifying its revenue stream.

Risks include competition from Thermo Fisher (NYSE:TMO) and regulatory delays, but Illumina’s 80% market share and $14.5 billion valuation — trading at an adjusted P/E of 27, some 72% below its five-year average of 92 — make it a bargain.

Wood’s focus on genomics suggests Illumina is poised to lead a multi-trillion-dollar healthcare transformation.

Shopify (SHOP): E-Commerce’s Resilient Giant

Shopify, a leading e-commerce platform, saw ARK buy 33,829 shares across its ARKK, Ark Next Generation Internet ETF (NYSEARCA:ARKW), and Ark Fintech Innovation ETF (NYSEARCA:ARKF), valued at $3.9 million, underscoring Wood’s bullish stance.

Shopify’s first-quarter revenue surged 27% to $2.4 billion, marking eight consecutive quarters of over 25% growth, despite margin pressures. Its platform has facilitated $1 trillion in sales since 2006, a significant portion of which occurred in the last few years.

Analysts forecast more than 20% revenue growth through 2027, driven by international expansion and AI-enhanced tools like Shopify Magic.

The stock, at $114, trades 30% below its 2021 peak, offering value with a forward P/E of 79 that is 72% below its five-year average. Risks include softening consumer confidence and competition from Amazon (NASDAQ:AMZN), but Shopify’s resilience under CEO Tobi Lutke and its $149 billion market cap signal long-term potential.

Wood’s aggressive buying reflects her belief in Shopify’s role in another multi-trillion-dollar opportunity, this one the digital commerce ecosystem.

The post Cathie Wood Is Dumpster Diving Again With These 3 Stock Buys appeared first on 24/7 Wall St..