3 Reasons Why This Ultra-Safe High-Yield Dividend Stock Is Worth Buying Now

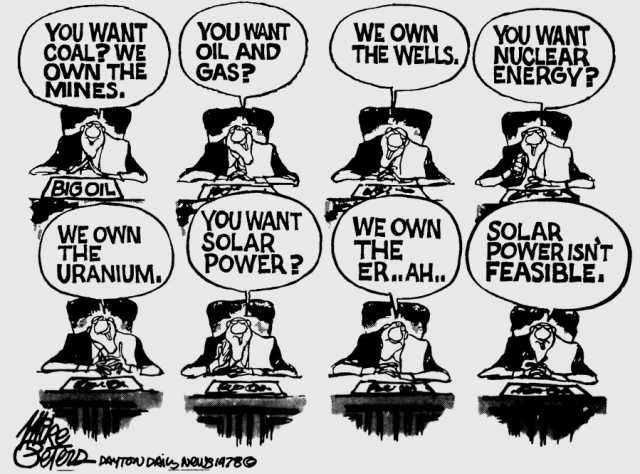

Shares of Clorox (NYSE: CLX) are down 7.4% since it reported earnings on Feb. 3. The consumer goods company continues to make big changes it hopes can chart a path toward margin expansion. Clorox has come a long way in the last few years, but many of its investments have yet to translate to bottom-line results.Here are three reasons patient investors should consider buying and holding the high-yield dividend stock over the long term.Image source: Getty Images.Continue reading

Shares of Clorox (NYSE: CLX) are down 7.4% since it reported earnings on Feb. 3. The consumer goods company continues to make big changes it hopes can chart a path toward margin expansion. Clorox has come a long way in the last few years, but many of its investments have yet to translate to bottom-line results.

Here are three reasons patient investors should consider buying and holding the high-yield dividend stock over the long term.

Image source: Getty Images.