3 Meme Stocks To Watch in May

Whether you own them or keep an eye on them, meme stocks are here and they are going to stay. Sometimes they generate stunning gains, and other times they dip to new lows; this is what makes meme stocks intriguing for investors. These are stocks of companies that have become popular amongst investors, but they […] The post 3 Meme Stocks To Watch in May appeared first on 24/7 Wall St..

Key Points

-

While meme stocks cannot make you rich, they can generate gains in the short-term.

-

These meme stocks have enjoyed a rally in the past and are worth watching out for amid the ongoing earnings season.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Whether you own them or keep an eye on them, meme stocks are here and they are going to stay. Sometimes they generate stunning gains, and other times they dip to new lows; this is what makes meme stocks intriguing for investors. These are stocks of companies that have become popular amongst investors, but they do carry an element of risk. They have higher-than-normal volatility and are a risky bet. However, if you’re willing to try your luck with meme stocks, here are three stocks to watch this month.

Palantir Technologies

Tech giant Palantir Technologies Inc. (NYSE: PLTR) remains one of the top meme stocks to watch out for this month. Jim Cramer has called it the “ultimate meme stock”, highlighting its strength even in market volatility. The company caters to the defence industry and is a top AI stock.

In the recently announced quarterly results, Palantir beat expectations and saw a 55% year-over-year jump in revenue to $628 million. The company generates the majority of its revenue from the Artificial Intelligence Platform, which is used by businesses. It also recently delivered the first Tactical Intelligence Targeting Access Node system to the army in the United States.

The company was once criticised for heavily focusing on government clients, but has seen a steady growth in commercial clients. Palantir saw the highest quarter of U.S. commercial contract value of $810 million, which is up 183% year-over-year. The commercial revenue jumped 71% year-over-year, while government revenue was up 45% year-over-year. In the quarter, it generated an impressive free cash flow of $370 million. The management raised the 2025 outlook, citing solid demand from U.S. businesses.

The stock is trading for $123 and is up 64% year-to-date. PLTR is one of the rare stocks that have survived and thrived in the market volatility this year. It has generated 123% returns in six months and 390% returns in 12 months. AI stocks will continue to remain in the limelight throughout 2025, and Palantir Technologies has already delivered high returns to investors.

AMC Entertainment

Cinema chain AMC Entertainment Holdings Inc. (NYSE: AMC) became the face of meme stocks a few years back. The company saw massive interest from investors in 2020, and the meme stock movement kept growing. It found support on social media and went as high as $261 in 2021. However, this rally was temporary, and the stock soon dropped.

For long-term investors, AMC Entertainment isn’t a good bet since it is suffering from a negative cash flow. There’s a drop in moviegoers with the growing streaming options. Home entertainment has taken center stage, and people are no longer willing to pay to watch movies. While the revenue has improved, profits have gone down.

The management has also resorted to cost-saving efforts, but the profit has only dropped. Between 2021 to 2024, the television and film production spending across the US was down by 28%, according to ProdPro. Additionally, President Trump has planned new tariffs of 100% on foreign movies which could make it difficult for AMC Entertainment to survive.

Currently trading for $2.64, the stock has dropped 34% in 2025 and 19.7% in 12 months. There is not much hope left for recovery, but the upcoming results could push the stock higher. AMC is set to report results on May 7, and this might work as a catalyst for the stock. When it comes to meme stocks, there can be any catalyst that takes it higher.

In the fourth quarter, the company beat expectations and reported revenue of $1.31 billion, up 18.3% year-over-year. Analysts are expecting a dip in revenue this quarter.

GameStop Corporation

GameStop Corp. (NYSE: GME) started the meme stock rally with the “Roaring Kitty” mania. The stock saw significant highs and generated tremendous returns for meme stock investors. It went from $4.71 in December 2020 to $81 in January 2021, all driven by the internet. The stock was trading at $48 in May 2024 and dropped to $26 today.

The stock generated 63% returns in 12 months and 15% in 6 months. The video game company has become a trending stock lately and is one to watch out for. In the fourth-quarter results, GameStop saw a revenue of $1.28 billion and a net income of $131.3 million, up from $63.1 million in the same quarter the previous year. Its operating income was $84.4 million, up from the operating income of $60.3 million in the prior period. Despite a drop in revenue, the company saw a jump in its operating income.

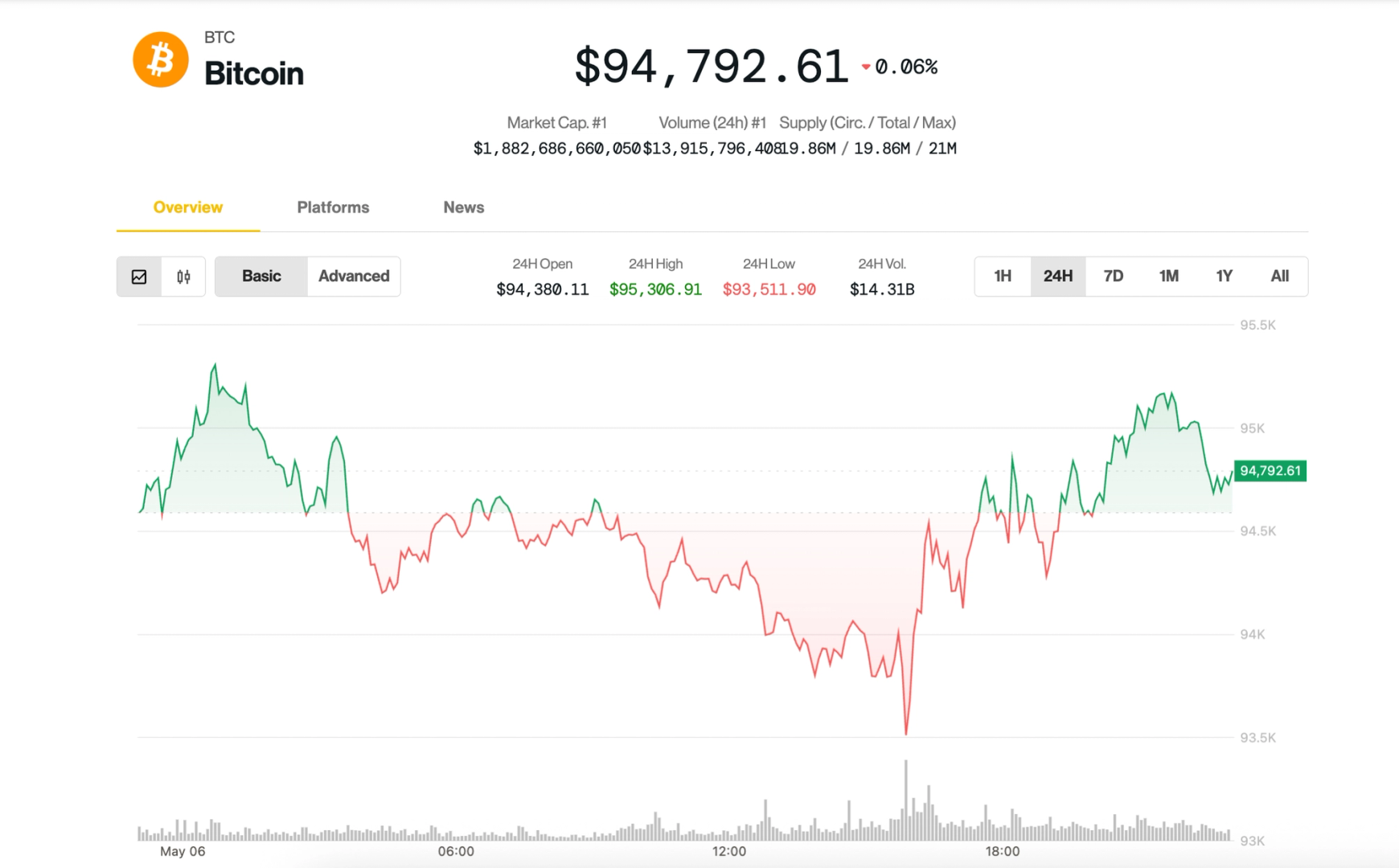

The company has recently sold its Canadian business to Electronics Boutique Canada Inc., and it will relaunch the 185 stores as EB Games Canada. The management is also moving towards speculative investments, which make the stock riskier. It announced a strategy to invest in bitcoin last month, and the news led to a bump in the stock price, but it was short-lived. While the management has strengthened the company financially, it has not been able to turn around business operations.

Investing in GME stock isn’t without risks. While the stock has remained steady in the past six months, it could be impacted by volatility.

The post 3 Meme Stocks To Watch in May appeared first on 24/7 Wall St..