2 Stock Split Stocks To Buy Hand-Over-Fist in May

The value of a stock split is exactly zero. A company divides its existing shares into multiple shares, reducing the price per share while maintaining the overall market capitalization, but nothing about a company’s fundamentals like earnings and revenue is changed. Despite this, stock splits are popular with investors and management alike. Investors view them […] The post 2 Stock Split Stocks To Buy Hand-Over-Fist in May appeared first on 24/7 Wall St..

The value of a stock split is exactly zero. A company divides its existing shares into multiple shares, reducing the price per share while maintaining the overall market capitalization, but nothing about a company’s fundamentals like earnings and revenue is changed.

24/7 Wall St. Insights:

-

Stock splits are ultimately useless in determining the long-term, fundamental value of a business.

-

Even so, investors and the markets like them as they imply a bullish hint at continued growth.

-

The two stock-split stocks below remain good long-term, buy-and-hold stocks despite their splits because their businesses remain strong.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Despite this, stock splits are popular with investors and management alike. Investors view them as a bullish signal, often associating splits with strong past performance and growth confidence, leading to short-term price gains. Management uses splits to make shares more affordable, attracting smaller investors and boosting liquidity. It is also seen as a chance to increase institutional investments and index inclusion, particularly for price-weighted indices like the Dow Jones Industrial Average.

Two recent stock-split stocks present compelling opportunities for investors who should consider buying hand-over-fist in May.

Nvidia (NVDA)

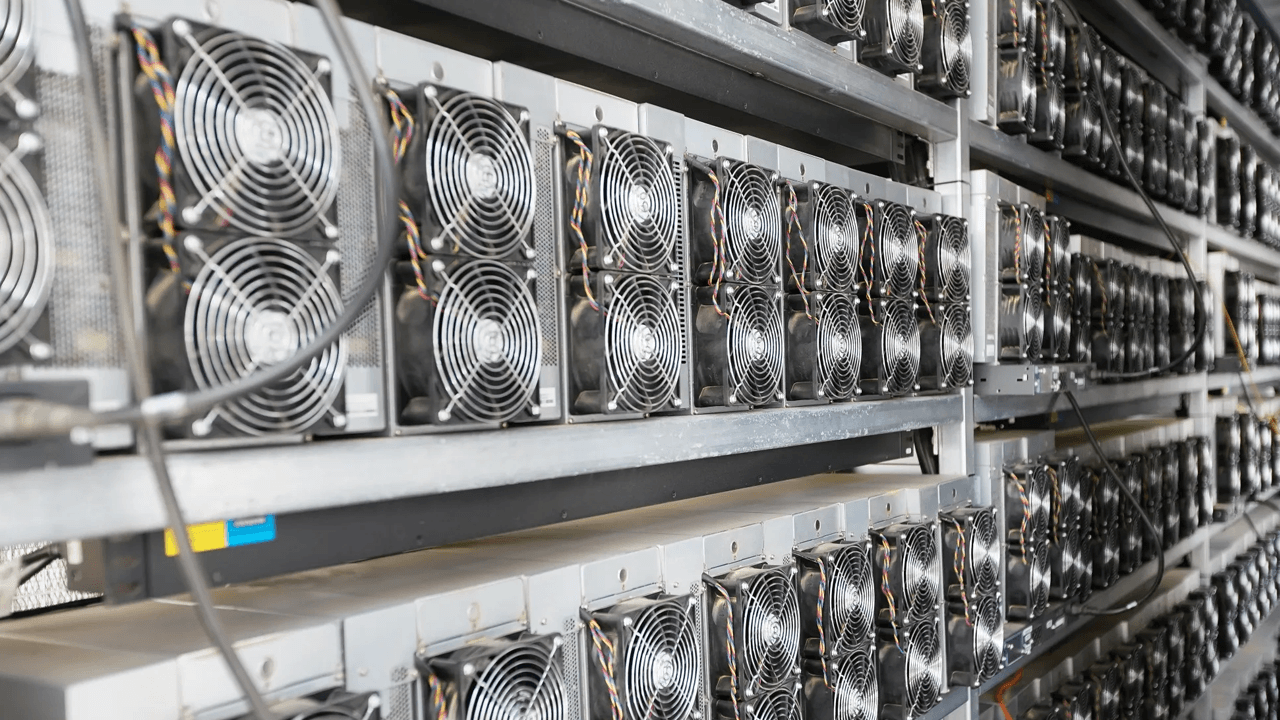

Nvidia (NASDAQ:NVDA), the far-and-away frontrunner in artificial intelligence graphics processing units (GPUs), executed a 10-for-1 stock split on June 7, 2024, reducing its share price from $1,200 to $120 to enhance affordability. Today, NVDA stock trades around $113 per share, 6% below the post-split price but the all-time high of $153 reached in early January. Briefly the most valuable company on the market with a $3.6 trillion market cap, Nvidia is now the third biggest stock with a $2.7 trillion market value.

The split followed NVDA stock’s 239% surge in 2023, driven by AI chip demand and reflecting management’s confidence in continued growth. Fourth-quarter revenue hit $39.3 billion, up 78% year-over-year and 12% sequentially, with data center sales (where it houses its AI chips) at $35.6 billion, a 93% increase from last year.

While its forward P/E of 26 appears high, it aligns with projected full-year 2025 earnings of $4.50 per share, implying a 44% upside to a $165 per share one-year price target by analysts. Nvidia’s 0.03% dividend yield is modest, but its 92% annual EPS growth over the past five years underscores its growth potential.

The AI market is expected to become an $826 billion opportunity by 2030, according to Statista, and Nvidia is positioned to dominate as its H100 GPUs powers 90% of generative AI models. Its next-generation Blackwell superchip has already secured billions of dollars in sales for the chipmaker.

While risks abound for Nvidia, including competition from Advanced Micro Devices (NASDAQ:AMD) tariff hikes, and, more recently, export restrictions, for which it recently announced a massive $5.5 billion writedown, but NVIDIA’s 70% market share in AI GPUs makes it a must-buy, long-term holding post-split.

Walmart (WMT)

The world’s largest retailer, Walmart (NYSE:WMT) conducted a 3-for-1 stock split on February 26, 2024, lowering its share price from $180 to $60 to make shares more accessible, especially for its employee stock purchase program. WMT stock today, though, trades at $97 per share, a 61% gain, with a $778 billion market cap. The split came after a 20% stock gain in 2023, signaling confidence in Walmart’s everyday low-price policies and the growth of its e-commerce business amid inflationary pressure.

Fourth-quarter revenue reached $180.6 billion, up 5.3% year-over-year on a currency adjusted basi, with e-commerce sales growing 16% globally (20% higher in the U.S.). E-commerce now accounts for 18% of Walmart’ global sales and the fourth-quarter was the 11th consecutive quarter they exceeded 10% growth.

Its 1.0% dividend yield has increased for 51 consecutive years, making Walmart a Dividend King, and it increased the payout 13% in 2024, the largest increase in company history. The retail giant’s forward P/E of 37 seems high considering the $103 per share one-year price target Wall Street assigned, implying just 6% upside, but its grocery dominance, particularly in what could be a tariff-starved environment, warrants the premium.

Some 90% of U.S. consumers live within 10 miles of a store, driving hundreds of billions in sales every year. Free cash flow of $12.7 billion in 2024, although down $2.5 from the year before, supports $6.7 billion in dividend payments and $4.5 billion in share buybacks.

Challenges to the retailer’s continued success include tariffs on imported goods. Reuters said 60% of Walmart’s products are imported from China and the retailer reportedly warned President Trump his tariffs could lead to empty store shelves.

However, Walmart’s pricing power and e-commerce momentum make it a stock to buy-and-hold for decades post-split.

The post 2 Stock Split Stocks To Buy Hand-Over-Fist in May appeared first on 24/7 Wall St..