With only $400k stashed away for retirement, can we afford to lose my wife’s 401(k) contributions?

A $400,000 nest egg may be somewhat slim if one is looking to wind down for retirement within the decade. However, for this couple in their 30s who took to the r/HENRYfinance subreddit (short for High Earner, Not Rich Yet), they seem to be in relatively decent shape for a relatively early retirement in their […] The post With only $400k stashed away for retirement, can we afford to lose my wife’s 401(k) contributions? appeared first on 24/7 Wall St..

A $400,000 nest egg may be somewhat slim if one is looking to wind down for retirement within the decade. However, for this couple in their 30s who took to the r/HENRYfinance subreddit (short for High Earner, Not Rich Yet), they seem to be in relatively decent shape for a relatively early retirement in their 50s. And while there’s a sense of urgency from this Reddit user, who’s wondering if they can afford to forego their wife’s 401(k) contributions, I do think that there’s little reason to stop contributing, especially if one is serious about pursuing FIRE in around two decades’ time.

At the end of the day, putting an end to (or pausing) 401(k) contributions could move one from the retirement fast lane to that middle lane or even the really slow lane on the very right. Additionally, the annual tax bill would likely come in a bit heftier, given the tax advantages to be had by contributing regularly to a 401(k).

Key Points

-

Halting 401(k) contributions could derail an early retirement in its tracks.

-

Add inflation into the equation, and choosing to contribute less to the 401(k), I believe, makes less sense if the couple seeks to retire early.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Hitting the pause button on 401(k) contributions is sometimes needed

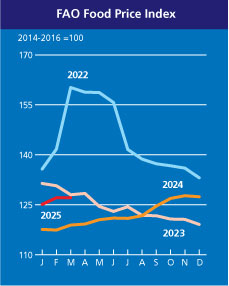

Undoubtedly, lingering inflation still seems to be a problem for many, even if President Trump claims that it’s non-existent and there’s room for the Federal Reserve to slash interest rates. Also, if tariffs stick around for the long haul (and there’s a good chance that they could), the cost of living could continue to rise for the next few years.

If one is having difficulty meeting the monthly budget and there’s not a whole lot more that can be cut, then I’d consider hitting the pause button on one member of the family’s 401(k) contributions. And there’s really no shame in temporarily putting off 401(k) contributions, so long as one commits to continue contributing once they’re back to normal and there’s more than enough cash to meet one’s costs of living.

Additionally, I’d strongly encourage the Reddit user to chat with a financial planning pro so that the numbers on retirement can be crunched. For a clearer picture of whether or not the couple can afford to forego 401(k) contributions, the monthly expenses, income situation, retirement goals, and investment asset allocation need to be carefully considered.

Does not contributing run the risk of losing out on an employer match?

Many experts agree that a 401(k) match from an employer is pretty much like “free money.” Personally, I think it’s just another benefit, but one that employees should aim to maximize if they’re able. If foregoing 401(k) contributions means also missing out on the employer match, one may feel even more of a sting (combined with a higher tax bill at the end of the year) from opting not to contribute. If the budget is tight, perhaps cutting out unnecessary expenses would be the more prudent financial move, especially for a couple who’s keen on retiring a few years earlier than the traditional age.

Though $400,000 is respectable for a couple in their 30s, I’d argue that the size of the nest egg should have less influence on the decision to continue contributing to a 401(k). If there’s an employee match in place, I’m not a big fan of halting contributions.

However, if there’s no match, and one could use a bit of extra monthly liquidity to cover the soaring costs of living, I’m not against having one member of the family pause contributions for the time being, especially if the emergency fund isn’t as fat as it could be ahead of a potential tariff-induced affordability crisis.

The bottom line

Personally, I’d consult a financial advisor to get a more detailed answer. However, if I had to form an opinion, I’d argue that reducing contributions to the 401(k) isn’t a good move, whether or not early retirement is the goal. With dependents to consider, both members of the family should be contributing all they can and preparing for what could be a turbulent next few years as inflation looks to persist.

The post With only $400k stashed away for retirement, can we afford to lose my wife’s 401(k) contributions? appeared first on 24/7 Wall St..