After Sluggish Year, Is Now The Time to Buy Tüpraş Hisse (BITS: TUPRS) For Its Dividend?

Tüpraş (BIST: TUPRS) is the leading oil refiner in Turkey and despite a pretty robust 2024 operationally, the stock is down over 33% so far in 2025. For income investors focused on Tüpraş ‘s ultra-high dividend yield of 12.14%, a steep discount could be a fabulous time to pick up discounted shares. Despite Brent crude […] The post After Sluggish Year, Is Now The Time to Buy Tüpraş Hisse (BITS: TUPRS) For Its Dividend? appeared first on 24/7 Wall St..

Tüpraş (BIST: TUPRS) is the leading oil refiner in Turkey and despite a pretty robust 2024 operationally, the stock is down over 33% so far in 2025. For income investors focused on Tüpraş ‘s ultra-high dividend yield of 12.14%, a steep discount could be a fabulous time to pick up discounted shares.

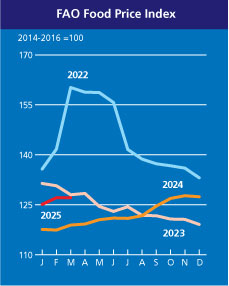

Despite Brent crude oil prices taking a 8% dip in 2025, crack spread margins are significantly due to a surplus of refined products in the European market and a slow down in demand. In addition, continued geopolitical issues from U.S. sanctions on Russian and Red Sea shipping disruptions, has narrowed crude price differentials.

This explains the discount in the stock price but will this slowdowns continue to hurt Tüpraş ‘s share price? Lets dive in.

Key Points

-

Tupraş’s 12.14% dividend yield shines despite 33.53% stock drop, attracting income investors.

-

Strong 2024 production and sustainability efforts bolster Tüpraş amid market challenges.

-

Dividends are flat-out one of the best ways to build wealth over the long haul, and these two dividend legends can’t stop cutting investors checks. Click here to reveal the names.

Operationally Strong

Refining production in 2024 was the strongest since 2019 with capacity utilization rates exceeding 93%, which was well above the 85-90% guidance. Total refined production of 26.7 million tons and 30.4 million tons sold, was the highest in almost a decade. This was helped by:

-

Major maintenance completed in H1 2024, boosting H2 production.

-

Turkey’s oil consumption rose 4%, with 21% gasoline and 6% jet fuel demand growth.

-

Zero-carbon electricity production grew 21% to 1.27 TWh, driven by Entek’s hydropower (56%) and wind (28%) plants.

In short, despite external pressures, management exceeded internal targets and maintained operational prowess.

Dividend Is King

-

Ended 2024 with $1.555 billion (TRY 55 billion) net cash.

-

Net debt-to-EBITDA at negative 1.1x, which means the company is plenty liquid.

-

Long-term debt rose from 15% to 52% of liabilities, lessoning short term debt risk and repaid $700 million in Eurobonds.

Other Projects

Is Tupras Stock a Buy

Analysts are bullish on the Turkish Refiner. Of the 12 stock analysts covering Tüpraş , the consensus is an “Outperform” rating according to S&P Capital IQ and the 1 year price target for the stock is $4.82 which is 33% above the share price right now. Essentially, analysts expect the share price to gain back all the loses from 2025, giving investors an opportunity to receive a hearty dividend at a sharp discount.

The stock is understandably trading at 3.97 times earnings and its 266% payout ratio this past year is concerning, especially if margins remain compresses for a few years or longer. And with geopolitical issues abound, that is a possibility, however with a strong cash reserve and management focused on operational efficiency, Tüpraş’s dividend might be worth the risk.

The post After Sluggish Year, Is Now The Time to Buy Tüpraş Hisse (BITS: TUPRS) For Its Dividend? appeared first on 24/7 Wall St..