Prediction: 1 AI Stock That Will Eclipse Amazon in 5 Years

E-commerce giant Amazon (Nasdaq: AMZN) is one of the largest companies and is the world’s biggest cloud computing service provider. It has a market cap of $1.92 trillion and is a heavily diversified business that has grown by leaps and bounds in the past decade. The company is investing heavily in artificial intelligence and has […] The post Prediction: 1 AI Stock That Will Eclipse Amazon in 5 Years appeared first on 24/7 Wall St..

E-commerce giant Amazon (Nasdaq: AMZN) is one of the largest companies and is the world’s biggest cloud computing service provider. It has a market cap of $1.92 trillion and is a heavily diversified business that has grown by leaps and bounds in the past decade. The company is investing heavily in artificial intelligence and has invested $4 billion in Anthropic, an AI safety and research company.

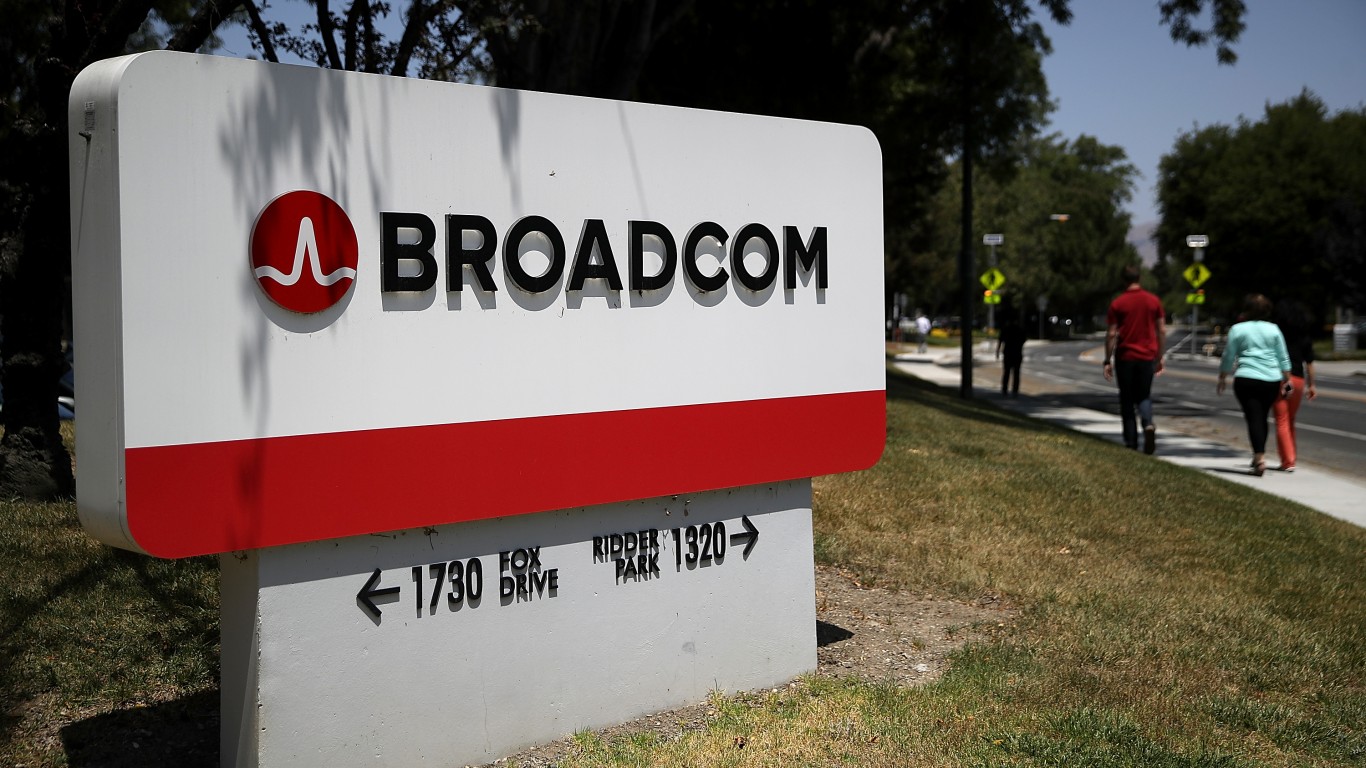

It intends to spend about $100 billion on capital expenditure this year and keep expanding its offerings. While Amazon has become a leader, there’s one AI stock that can eclipse Amazon in the next five years. Tech giant Broadcom (Nasdaq: AVGO) is a strong competitor for Amazon and could eclipse the stock very soon.

Key Points

-

Broadcom stock is up 600% in five years.

-

The tech company has a stable balance sheet, impressive client base and a unique product.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Chip maker Broadcom has impressed investors with solid returns over the past few years. Exchanging hands for $188, AVGO stock is up 45% in 12 months, but down 18.8% year-to-date. Overall, the stock is down from the 52-week high of $251 and has seen volatility in the past month. I believe this is one stock that can give Amazon solid competition in the next five years.

The growing demand for Broadcom’s chips and the rapid expansion of the AI industry will drive business growth. Its chips are used in a wide range of applications and the chip maker’s numbers speak for itself. AVGO has generated over 600% returns in five years and this is no small feat.

AI will continue to be the growth driver

Broadcom’s claim to fame is the custom chips it designs, these chips are used to perform certain tasks and there is growing demand for them. As AI software usage increases, the demand for its chips will increase. This has helped Broadcom report impressive revenue numbers. In the recent quarter, it saw a revenue of $4.1 billion, up 77% year over year. I believe the same momentum will continue throughout 2025.

The company estimates that the market for AI chips will grow to $90 billion in the next three years which will provide ample scope for expansion. The management is expecting a 44% jump in the AI revenue this quarter as it continues to add new partners to its roaster. It also has a solid balance sheet and a cash balance of $9.31 billion. Its strong fundamentals allow the company to pay steady dividends and reward shareholders. The stock has a dividend yield of 1.25% and the company has increased dividends for 13 consecutive years.

Impressive client portfolio

Broadcom has three well-known customers- Nvidia (Nasdaq: NVDA), Alphabet (Nasdaq: GOOGL), and Meta Platforms (NASDAQ:META). Other than these three, the company also caters to Juniper, Arista Networks, Supermicro, and Dell Technologies. These partnerships have become a major growth driver for the business.

Because Broadcom will continue to bring new customers on board, we can assume that it will see massive revenue growth in the next few years. It could become a dominant industry player and maintain its position till 2030.

Massive AI-related upside

Analysts have downgraded the stock citing recession fears but the long-term picture looks attractive. There could be a temporary dip in the fundamentals due to tariffs but Broadcom has the portfolio and the client base to beat the market.

The AI-related opportunity is massive and analysts are optimistic about the future of the company. Its portfolio is the key to success. It is developing 3-nanometer XPUs which are unique and one of a kind in the industry. It is also planning to develop the first 2-nanometer AI XPU to meet the changing needs of its hyperscale clients.

If Broadcom continues to beat expectations, investors could end up paying a premium for the stock. The stock will overtake Amazon over the next five years and is a buy while trading in the dip.

The post Prediction: 1 AI Stock That Will Eclipse Amazon in 5 Years appeared first on 24/7 Wall St..