The Truth About the 4% Rule – Why It’s Not a Guarantee for Never Running Out of Money

If you live in the FIRE (financial independence, retire early) world, the 4% rule is one of the crown jewels of this movement. Known as the “Safe Withdrawal Rate,” it hopefully allows you to live comfortably on this withdrawal amount during retirement. Well, one Redditor is inquiring about the reality of this rule and whether […] The post The Truth About the 4% Rule – Why It’s Not a Guarantee for Never Running Out of Money appeared first on 24/7 Wall St..

If you live in the FIRE (financial independence, retire early) world, the 4% rule is one of the crown jewels of this movement. Known as the “Safe Withdrawal Rate,” it hopefully allows you to live comfortably on this withdrawal amount during retirement.

The 4% rule has long been the north star for the FIRE community.

There is a reality today where the 4% rule needs to be increased to account for rising inflation.

The financial advisor who created the 4% rule has updated it to reflect 4.5%.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

Well, one Redditor is inquiring about the reality of this rule and whether or not it really allows your money to last for 30 years. Posting in r/Fire, the Redditor’s curiosity stems from just how often the 4% SWR pops up in Fire threads and whether it’s as good as people think it is.

What Is The 4% Rule

The 4% rule originated in 1994, when one financial advisor believed that between 3% and 4% of the total balance of your retirement money is safe to spend annually. The hope is that if you live with a 4% withdrawal rate, it’s still conservative spending while allowing you to live comfortably.

Of course, to this Redditor’s point, the 4% rate might be a commonly held belief, but it’s also subject to economic conditions and inflation. Some individuals might need more than 4% to live comfortably, such as additional cash to help pay for medical expenses, home repair costs, or some other one-time cost that pops up suddenly.

The bottom line is that what you need to spend differs from what I need to spend, but 4% has long remained a financial north star for the FIRE community. After 25 years of research, Bill Bengen, the financial whiz who introduced the 4% safe withdrawal rate proposal, has since modified it to a 4.5% rule to allow for annual inflation-adjusted withdrawals.

Bill Bengen’s Update

According to Bill Bengen, the example of how much money you need for the next 30 years is as follows. He believes you pull out 4.5% in the first year, or $4,500 from a $100,000 IRA. In the second year, you would adjust for inflation, which, let’s say, is 10%, so you would pull out $4,950 in your second year of retirement, and so on with every year adjusting up or down for inflation.

What Bill says hopefully remains true today: If your “time horizon” increases beyond 30 years, your safe withdrawal rate will need to decrease. If you plan to retire for 35 years, you’d want to be at 4.3%, at 40 years, 4.2%, and so on.

Ultimately, the 4.5% rate is ideal now if you want to make your money last for 30 years because it gives you an even bigger cushion during this period of higher inflation.

Will It Last 30 years

Getting right to the heart of the Redditor’s question, there’s no guaranteed answer that the 4% rule will last you for 30 years, as it all depends on your spending. In theory, the 4% rule will remain standard practice as it’s still the best way to safely spend whatever you have saved during retirement.

Judging by the comments in this Reddit thread, there is strong universal agreement with minor adjustments, the 4% rule still holds. However, there is a separate belief that you still need room for discretionary spending, so the 4.5% rule Bill has updated to is likely more true than most Redditors currently recognize.

Even adjusting for inflation, the 4% rule does not guarantee that retirement money will last indefinitely. One giant medical expense or home repair can completely throw off your 4% planning.

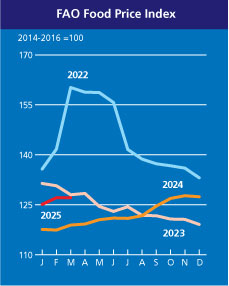

The same can be said for a sudden increase in inflation, like we had in 2022, which would have required a significant increase from 4% to account for the rising cost-of-living. Now contrast this to 2.9% in 2025, which is more manageable with a 4.5% safe withdrawal rate.

Given the ebbs and flows of what you need financially, there is a good chance that the 4% rule might not work for everyone, as it’s all about personalized planning.

The post The Truth About the 4% Rule – Why It’s Not a Guarantee for Never Running Out of Money appeared first on 24/7 Wall St..