Google Parent Alphabet Just Gave Investors 2 Strong Reasons to Stay Bullish

What was the most heralded story from Google parent Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) first-quarter update Thursday evening? The company's better-than-expected revenue growth. Alphabet reported Q1 revenue of $90.2 billion, higher than the consensus Wall Street estimate of $89.1 billion.However, I don't think this story was the most important one for investors. Sure, Alphabet's share price jumped on Friday following the positive results. But the company has just given investors two strong reasons to remain bullish that are more significant than a quarterly revenue beat, in my opinion.Before the Q1 update, Alphabet stock was down roughly 16% year to date. Most of this decline can be attributed to worries about the negative impacts of the Trump administration's tariffs. It's probably fair to say that the White House's trade policy has been one of the four most disruptive factors for the stock market this century, alongside the dot-com bubble bursting, the 2007-2009 financial crisis, and the COVID-19 pandemic.Continue reading

What was the most heralded story from Google parent Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) first-quarter update Thursday evening? The company's better-than-expected revenue growth. Alphabet reported Q1 revenue of $90.2 billion, higher than the consensus Wall Street estimate of $89.1 billion.

However, I don't think this story was the most important one for investors. Sure, Alphabet's share price jumped on Friday following the positive results. But the company has just given investors two strong reasons to remain bullish that are more significant than a quarterly revenue beat, in my opinion.

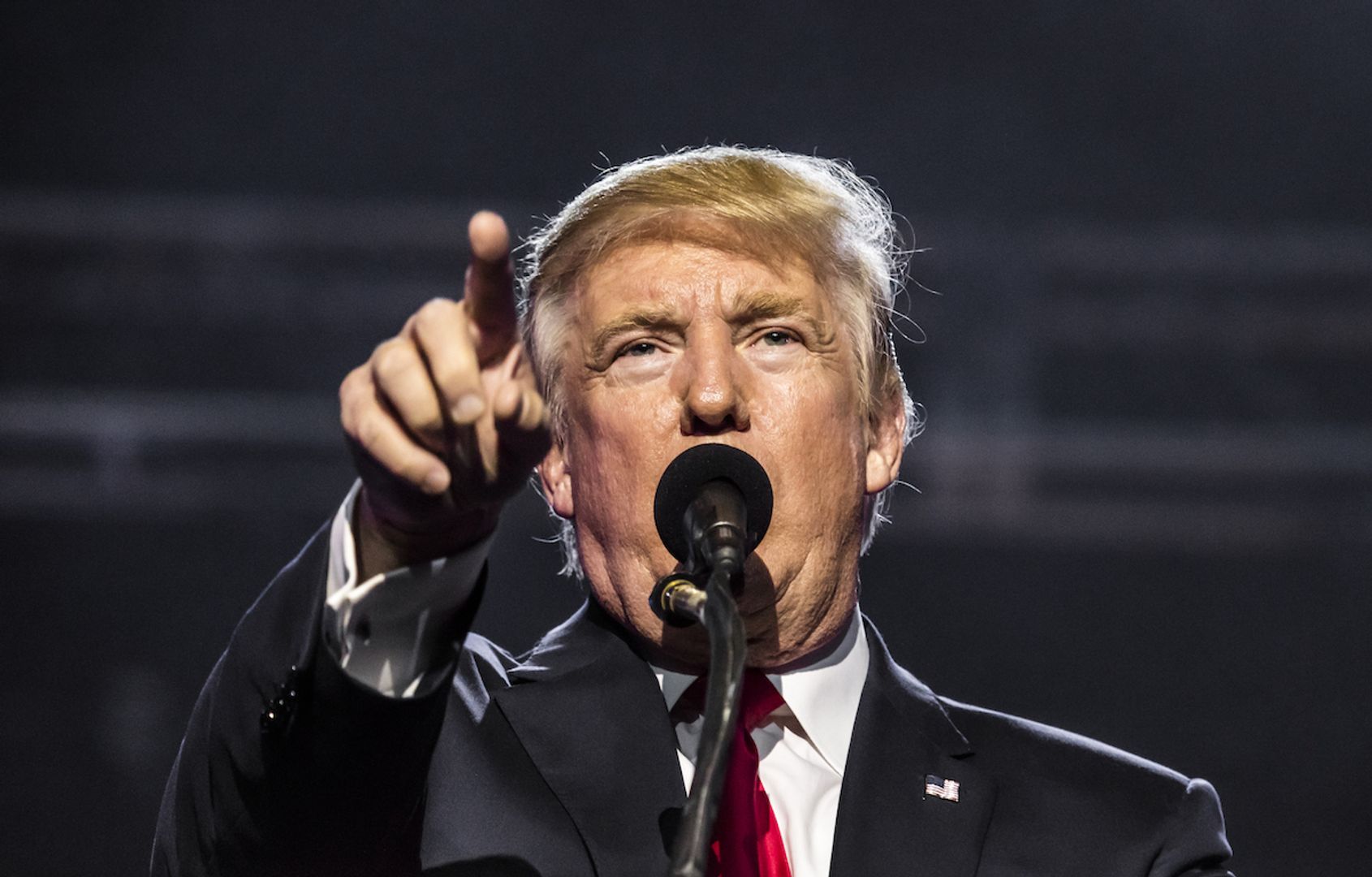

Before the Q1 update, Alphabet stock was down roughly 16% year to date. Most of this decline can be attributed to worries about the negative impacts of the Trump administration's tariffs. It's probably fair to say that the White House's trade policy has been one of the four most disruptive factors for the stock market this century, alongside the dot-com bubble bursting, the 2007-2009 financial crisis, and the COVID-19 pandemic.