10 Questions to Ask a Financial Planner About Social Security

When you think about all of the different ways Social Security can benefit your life, like additional income during retirement, disabilities, and spousal and survivor benefits, it’s important to know everything you can about this program before you leap forward. For this reason, you should ask your financial advisor some questions as they can best […] The post 10 Questions to Ask a Financial Planner About Social Security appeared first on 24/7 Wall St..

When you think about all of the different ways Social Security can benefit your life, like additional income during retirement, disabilities, and spousal and survivor benefits, it’s important to know everything you can about this program before you leap forward.

Talking with a financial advisor may be the best decision around Social Security.

Knowing the details of this program will help you better understand its role in your financial future.

Financial advisors are well-versed in Social Security benefits to help you figure out your next steps.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Key Points

For this reason, you should ask your financial advisor some questions as they can best help you get set up for the future. Whether these are softball or hardball questions about the program, there is no such thing as knowing too much about Social Security.

10. What About Getting A Divorce?

So long as you are married for at least 10 years, divorced spouses can receive Social Security benefits from the higher-earning spouse. You can even start making a claim at 62, but only if the marriage is over and the amount would exceed any benefit you might earn yourself.

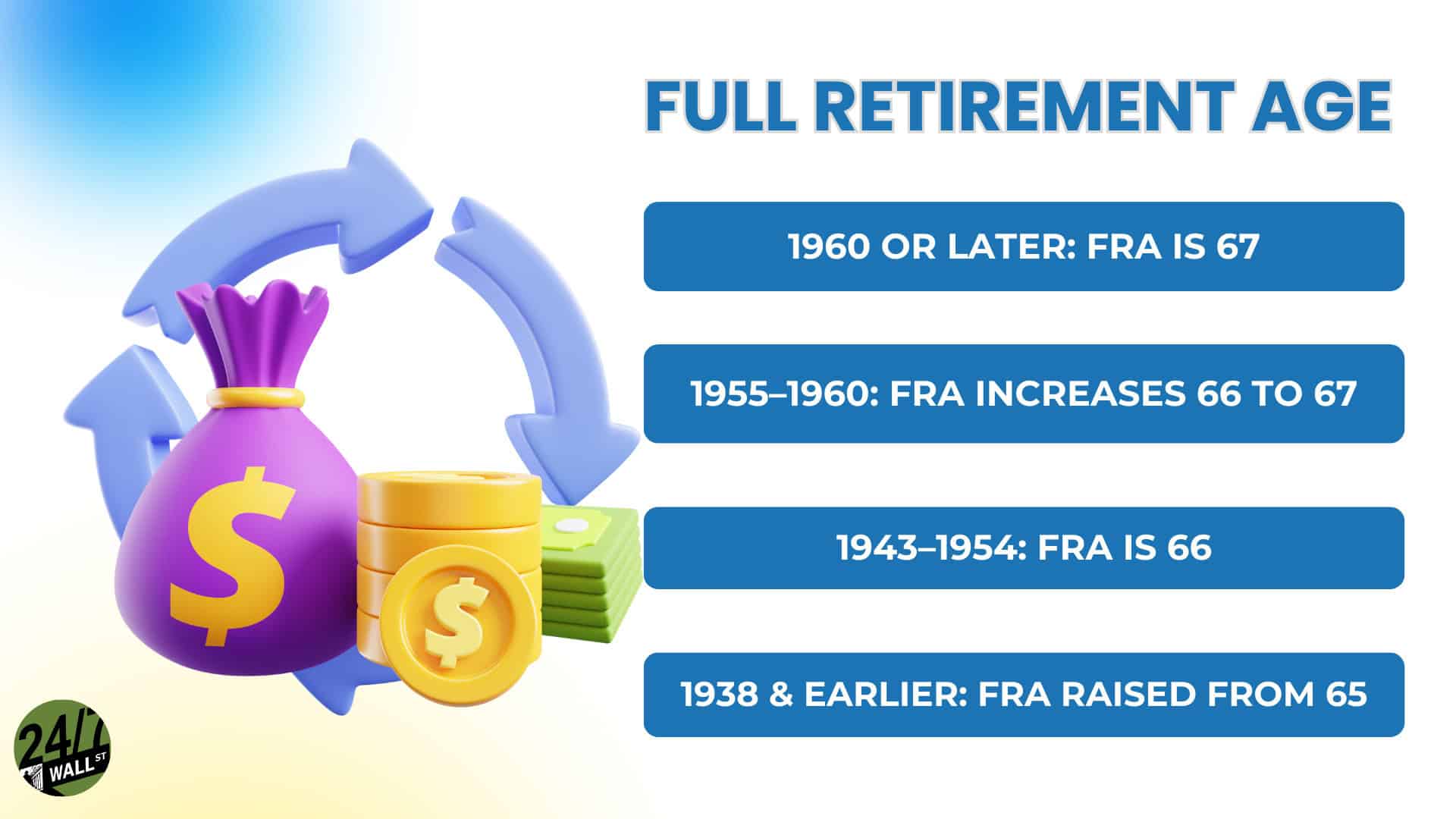

Survivor Benefits

If your spouse dies, you could receive up to 100% of their benefits, depending on your age, and not theirs when they passed away. Survivor benefits start at 60, but a financial advisor will tell you that if you can wait till FRA at 67, you’ll receive 100% of the payout.

9. Will Social Security Be Around In the Future?

This question is on the minds of millions of baby boomers and even millennials. The answer is nobody knows anything for certain. However, a financial advisor will tell you that the Social Security Administration has indicated that by 2035, the trust fund will only be able to cover between 75-80% of current benefit amounts.

Plan for Uncertainty

This uncertainty with Social Security’s future is exactly why a financial advisor is in your life. They will help you look at other potential revenue streams, like an annuity, that would help provide you with guaranteed income so you can be sure all your bills will be paid on time.

8. Can I Withdraw Benefits and Still Work?

This is a timeless question that still gets asked, especially as more baby boomers continue to work out of necessity or a desire to stay active. A financial advisor would tell you that your benefits could be reduced if you are still working and trying to withdraw if you earn over $22,320 in 2025. Thankfully, any reduction is temporary, as your benefits would be recalculated at 67 to ensure you get everything.

Working After Full Retirement Age

If you try to work past Full Retirement Age at 67, you can work and earn as much as possible without impacting your benefits. The period between 62 and 67 is the most crucial time to speak with a financial advisor. However, know that if you are working and earning Social Security, there could be an increase in the tax bracket between the two income streams.

7. How Are Cost-of-Living Adjustments Determined?

Thankfully, the Social Security program traditionally receives a cost-of-living increase every year, and there have only been three years since COLA was included that it hasn’t occurred. In 2025, a 2.5% COLA increase was determined by comparing the Consumer Price Index for Urban Wage Earners and Clerical Workers in the third quarter of 2024, with the percentage increase now attributed to SS.

Counting On COLA

Even so, the likelihood of a cost-of-living increase every year is high. It’s rarely going to be enough. A financial advisor will help you understand how any COLA would help you, but they should also be helping determine how to structure other investments to handle rising inflation.

6. Can You Delay Past 70?

Yes, you can, though I’m not sure any good financial advisor would tell you to do so. However, you can ask your financial advisor to run a scenario where you receive a lump sum if you file after 70 versus higher future payments. They will tell you if there is a significant trade-off.

Pros and Cons of Delaying

Even if you have the financial means to delay, a financial advisor probably wouldn’t recommend doing so. However, your unique scenario might find you needing to pay off a debt where a lump sum from the program could help, at the expense of reducing your long-term Social Security income.

5. How do I maximize my benefits?

The answer to this question is easy: Wait until you are 70 before withdrawing from the Social Security program. A financial advisor would tell you this isn’t a one-size-fits-all answer, though, as you have to look at your whole financial picture before making this decision.

The Big Picture

The difference between withdrawing Social Security at 62 and 70 is considerable financially, but it also depends on other scenarios, like whether you will have a different income during this time. A financial advisor will also help you consider the tax implications of waiting this additional time.

4. What are the Tax Implications?

A financial advisor will tell you that up to 85% of your Social Security benefits will be taxable, depending on your household combined income. Unsurprisingly, many financial advisors learn that millions believe SS is tax-free, which is not the case so that they will walk you through the thresholds.

Reducing Tax Impact

One of the best reasons to have a financial advisor is so they can help you reduce the tax impact of not just Social Security but all of your investments. You might reduce your taxable income by exploring tax-efficient strategies, such as converting traditional IRA funds to a Roth IRA to reduce taxable income in the future.

3. How Is Eligibility Determined?

The Social Security Administration lays out precise eligibility requirements for the program, and for the most part, every American qualifies. However, you have to earn a certain amount of credits, which you can earn if you work full-time for at least 10 years.

Determining Payments

When you talk with a financial advisor, they will tell you that the benefits are determined using an “average indexed monthly earnings,” which looks at 35 years of your top earning years. Even if you have worked for 40 years, only your top 35 years of earnings are calculated.

2. How Does Social Security Work With A Spouse?

One of the best aspects of the Social Security program in its current form is spousal benefits. As of 2025, a spouse can receive as much as 50% of their partner’s SS benefits beginning at 67 or Full Retirement Age. The hope is that this helps create a situation where the spouse who earned less or was a stay-at-home parent also has some benefits.

Coordinate Your Benefits

If you have a good financial advisor, they should help you determine when to claim benefits for the higher-earning spouse and when to start claiming for the lower-earning spouse.

1. When Should I Start Taking Benefits?

Ultimately, the most important question anyone can ask about Social Security is when you should start taking benefits. As you can begin claiming benefits anytime after you turn 62 and before you turn 70, there are things your financial advisor can help you look at, like health and current financial holdings, to answer this question best.

Pros and Cons

When you look at the different ages available, a financial advisor will tell you that at 62, you could be leaving 30% of your benefits on the table compared to the 100% you would receive at 67. They would also tell you that if you can wait till you’re 70, you’d see an 8% boost between 67 and 70, which means even more money available for retirement.

The post 10 Questions to Ask a Financial Planner About Social Security appeared first on 24/7 Wall St..