Here’s Why Your 2026 Social Security COLA Might Disappoint You

If you get most or all of your retirement income from Social Security, money might be perpetually tight. In fact, workers are advised to save for retirement because it’s a known thing that Social Security will only replace so much of your pre-retirement earnings. However, a lot of people struggle to save for retirement for […] The post Here’s Why Your 2026 Social Security COLA Might Disappoint You appeared first on 24/7 Wall St..

-

Some keypoint here

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started.

If you get most or all of your retirement income from Social Security, money might be perpetually tight. In fact, workers are advised to save for retirement because it’s a known thing that Social Security will only replace so much of your pre-retirement earnings.

However, a lot of people struggle to save for retirement for various reasons. Stagnant wages, high costs, and unexpected bills can prevent workers of modest means from building up meaningful IRA or 401(k) balances, leaving them very reliant on Social Security once retirement rolls around.

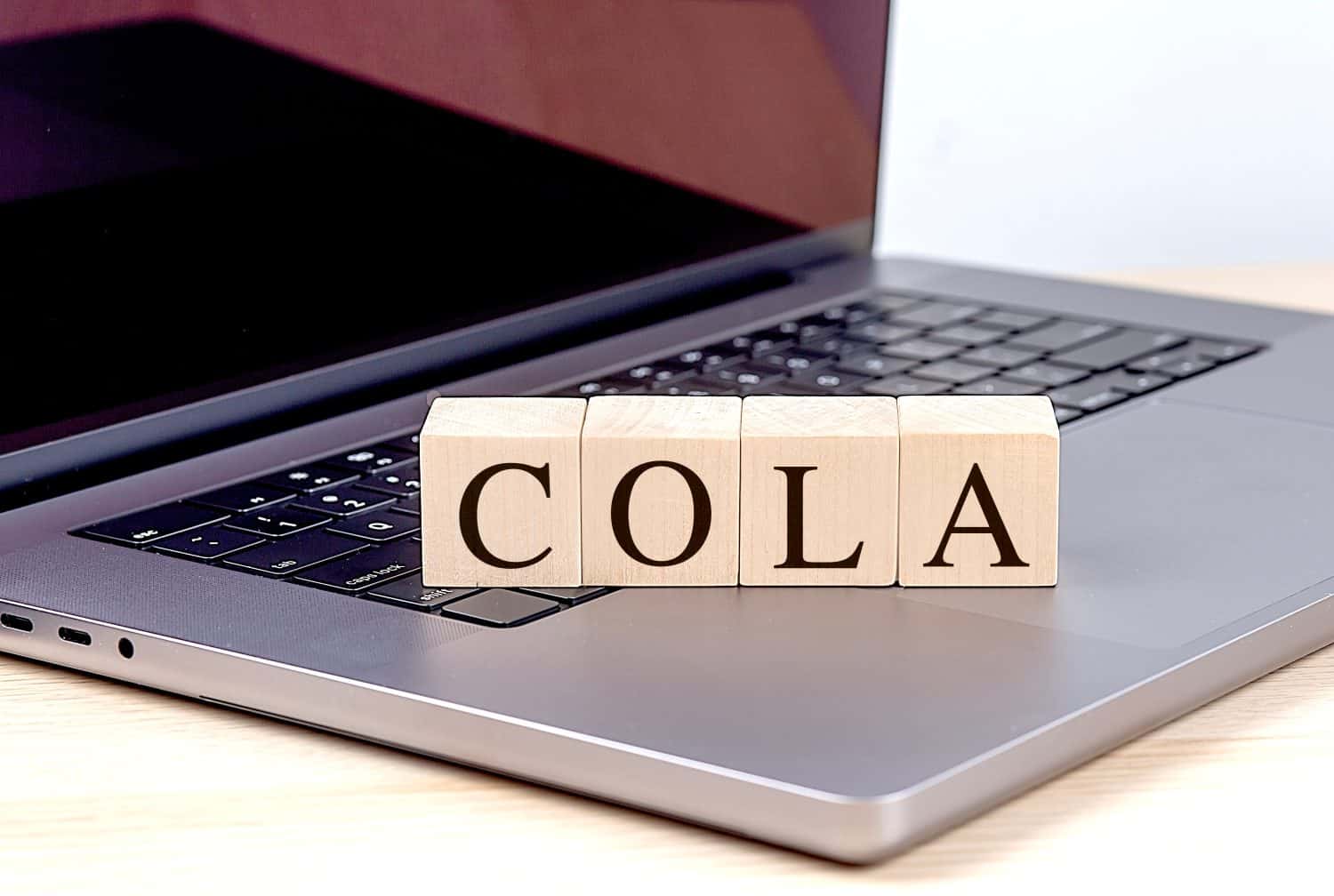

It’s for this reason that annual cost-of-living adjustments (COLAs) are so important to Social Security recipients. Without those COLAs, benefits would stay the same over time, putting seniors at an immediate disadvantage in the face of rising living costs.

In 2025, Social Security benefits got a 2.5% COLA. And a lot of seniors were unhappy with that. But unfortunately, next year’s COLA situation isn’t shaping up to be any better.

Some potentially upsetting news

It’s too soon to predict what 2026’s Social Security COLA will be. That’s because COLAs are based on third quarter inflation data.

But based on initial inflation readings, there are estimates floating around. And the current working estimate is 2.3%.

That would make 2026’s COLA the smallest to arrive in six years. And it would also no doubt put a lot of retirees in a very tight financial spot.

Prepare now for a smaller raise

A smaller Social Security COLA isn’t a totally bad thing, since it’s a sign of cooling inflation. But that may not be much consolation to retirees who need a larger boost to stay afloat.

If you’re someone who mostly lives on Social Security, consider this your heads-up that 2026’s COLA may not be all that spectacular. But with careful planning, you can potentially work around it.

One thing you could do is go back to work on a part-time basis. And don’t worry — you’re allowed to collect Social Security if you’re still working. In fact, if you’ve already reached full retirement age, you can earn any amount of income without it taking away from your benefits.

Another option is to try to reduce your living costs. You can look at downsizing, sharing a living space if you’re single, or moving to a part of the country that’s more affordable on a whole.

If you’re not yet retired but are getting close, consider this a warning to take a close look at your savings, and to consider postponing retirement a bit longer if you don’t have much money banked.

If you retire without a decent nest egg, you could end up dangerously reliant on Social Security like so many seniors today. And you don’t want to end up in a situation where a not-so-great COLA makes your life even more stressful.

Of course, Social Security’s 2026 COLA could end up coming in well above 2.3% if inflation starts rising again. But that’s not really a good thing, either. So all told, anyone who stands to get hurt by a 2.3% COLA should examine their financial situation closely and consider key changes.

The post Here’s Why Your 2026 Social Security COLA Might Disappoint You appeared first on 24/7 Wall St..