Sitting on $25K in cash—should Jim Cramer’s or Cathie Wood’s advice be followed?

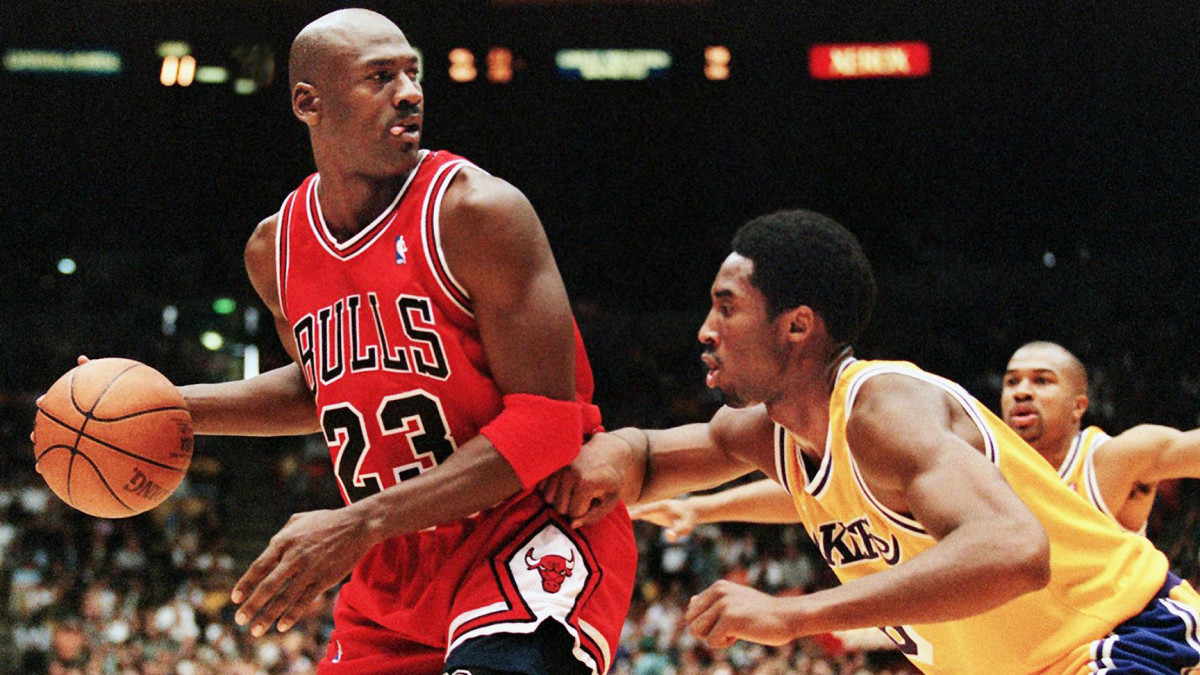

For decades, rivalries have captivated us—Magic vs. Bird, Ali vs. Frazier, Yankees vs. Red Sox. In the financial world, CNBC’s Jim Cramer and ARK Invest’s Cathie Wood stand as modern adversaries, their clashing investment styles drawing passionate followings. With $25,000 in cash, an investor might wonder whether to join Team Cramer or Team Cathie. Before […] The post Sitting on $25K in cash—should Jim Cramer’s or Cathie Wood’s advice be followed? appeared first on 24/7 Wall St..

Key Points

-

CNBC’s Jim Cramer has been hosting his stock investing show for 20 years, and has had his share of controversies over the years.

-

Cathie Wood of ARK Invest has developed her own following as a result of her ETF’s strong but controversial 39% average annual return performance from 2014 to 2021, but has leveled off since.

-

Cramer has criticized Wood often in the past leading to perceptions of a competitive feud between the two stock gurus, with neither stock guru possessing a decisive track record edge.

-

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

The Harvard Roots of Mad Money

Jim Cramer, a Philadelphia native, built his reputation on CNBC’s “Mad Money,” averaging 178,000 daily viewers, enough to sway markets temporarily. With a government degree and law degree from Harvard, he honed his skills at Goldman Sachs (1984–1987) before launching a hedge fund. He cashed out before the 1987 crash and managed the fund until 2001. His TV career kicked off in 2002 with “Kudlow & Cramer,” but “Mad Money” in 2005 catapulted him to fame amid the dot-com boom and DIY trading surge. His celebrity peaked with a cameo in Iron Man (2008). Despite a dip to 127,000 viewers recently, his influence persists.

The Doyenne of Disruptive Innovation Investing

Cathie Wood, founder and CEO of ARK Invest, thrives on high-risk, high-reward bets. A Los Angeles native, she graduated summa cum laude from USC with a finance and economics degree. Her career includes managing a $5 billion fund at AllianceBernstein and co-founding Tupelo Capital Management in 1998. Launching ARK Invest in 2014, she pioneered actively managed ETFs focused on disruptive tech—electric vehicles, AI, robotics, and more. Her ARK Innovation ETF breaks from passive norms, targeting transformative industries. By late 2024, ARK’s portfolio hit $12.7 billion

Showdown In the Octagon

Whose Advice To Follow?

Cramer’s jabs at Wood’s acumen seem petty, while her restraint highlights maturity. Her Joby call beat his, hinting at stronger tech insight. Research sectors driving ARK’s returns, but beware Cramer’s track record. A financial planner could tailor this further, ensuring your cash works hardest. I would side with ARK ETFs with a $25,000 sum.

The post Sitting on $25K in cash—should Jim Cramer’s or Cathie Wood’s advice be followed? appeared first on 24/7 Wall St..