Jim Cramer Favors Utility Stocks to Combat Tariffs

Jim Cramer feels America’s largest utility stocks can hold their value regardless of tariffs. Many are already doing well due to the rising energy needs of AI infrastructure. The post Jim Cramer Favors Utility Stocks to Combat Tariffs appeared first on 24/7 Wall St..

Jim Cramer is preparing for the tariffs that will be put on goods from Canada, China, and Mexico. His short list includes some of America’s largest utilities, which have very little reliance on business and financial relationships outside the United States.

24/7 Wall St. Key Points:

-

Jim Cramer feels America’s largest utility stocks can hold their value regardless of tariffs.

-

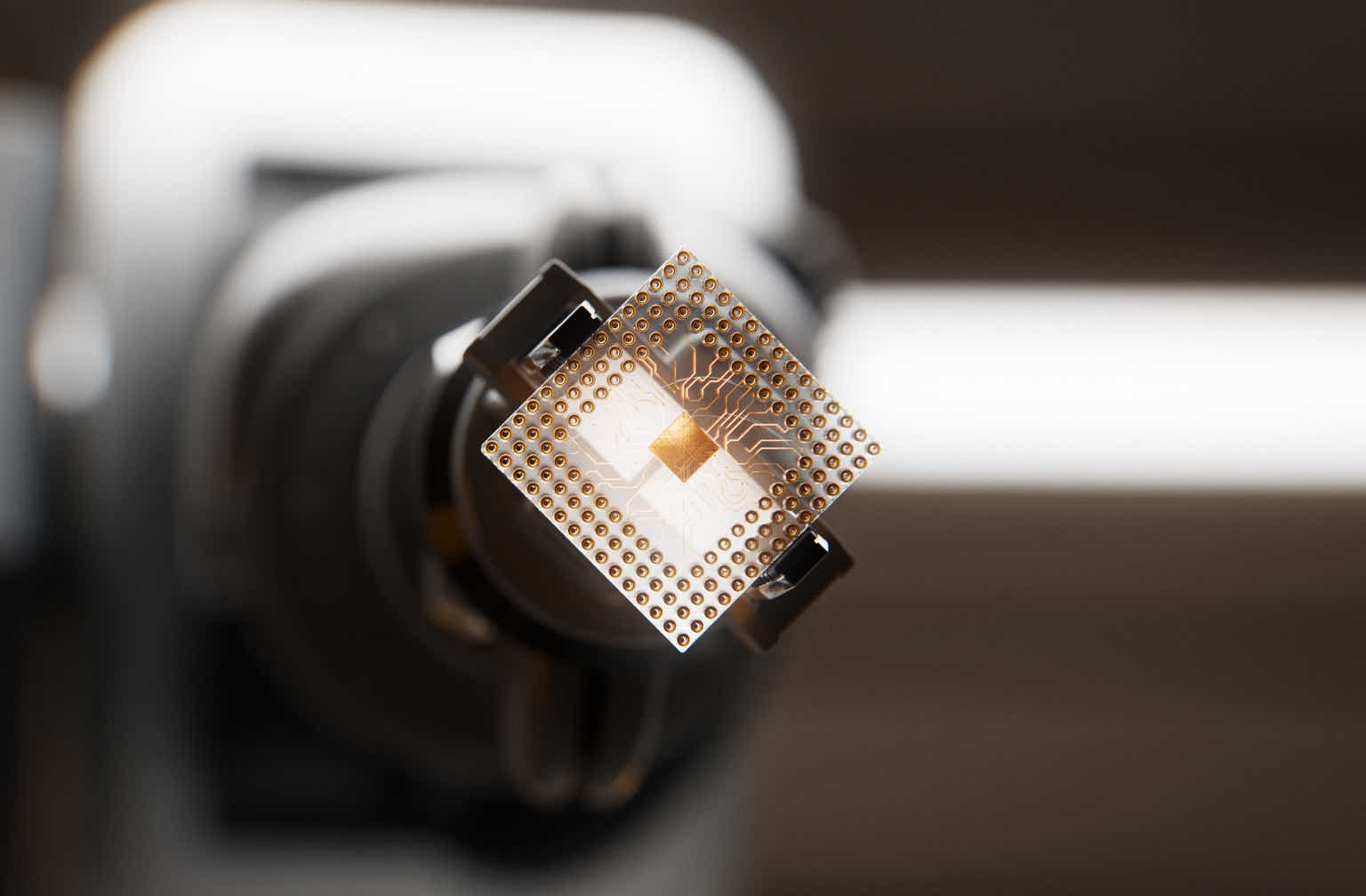

Many are already doing well due to the rising energy needs of AI infrastructure.

-

Take this quiz to see if you’re on track to retire. (sponsored)

He recently listed American Electric Power Co. Inc. (NASDAQ: AEP), Entergy Corp. (NYSE: ETR), and Sempra (NYSE: SRE) among the utility stocks he likes as he spoke on CNBC. “These are the stocks that can hold their value no matter what country’s next on the tariff docket,” he commented. Many utility stocks are already doing well in anticipation of the energy needs of artificial intelligence (AI) server infrastructure.

American Electric Power is based in Columbia, Ohio, and has customers across Ohio, parts of Texas, and West Virginia. Last year, it had revenue of $19.7 billion and net income of $3 billion. Like many utility stocks, it has a high dividend yield of 3.5%

Based in New Orleans, Entergy has customers across Arkansas, Louisiana, Mississippi, and Texas. Its revenue last year was $11.9 billion, and net income of $1.1 billion. The stock carries a 2.8% yield.

Sempra is based in San Diego. It has 40 million customers in Southern California. Last year, it had revenue of $13.2 billion and net income of $3.5 billion. Its yield is 3.6%.

The need for AI server farms will almost certainly push up electricity demand. According to Utility Dive, “Some U.S. utilities may need to increase their annual generation by more than a quarter over the next three years in order meet rising electricity demand led by data centers and artificial intelligence, according to new analysis from Bain & Company.”

These stocks have very little tariff exposure, and their revenue could quickly increase in the short term.

Retire in Comfort: 3 Utility Stocks That Keep Your Paychecks Flowing

The post Jim Cramer Favors Utility Stocks to Combat Tariffs appeared first on 24/7 Wall St..