USDT on Lightning: the Good, the Bad, and the Unknown

Bitcoin Magazine USDT on Lightning: the Good, the Bad, and the Unknown A look at the upsides and downsides of a tighter integration of USDT into the Lightning Network. This post USDT on Lightning: the Good, the Bad, and the Unknown first appeared on Bitcoin Magazine and is written by Roy Sheinfeld.

Bitcoin Magazine

USDT on Lightning: the Good, the Bad, and the Unknown

Everyone has heard the Chinese proverb British misquote: “May you live in interesting times,” and how it’s supposed to be a curse. It sounds deep, like a quote for edgelords over 80.

But have you ever considered the alternative? According to the Anglo-Saxon Chronicle, there were nearly two centuries where nothing much happened. Vivian Mercier famously called Waiting for Godot “a play in which nothing happens, twice.” But nothing happening 191 times? I’ll take interesting times any day.

And that’s exactly what we have now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been talking a lot recently about how Lightning is the common language of the bitcoin economy and how bitcoin is a medium of exchange (and it really is; read our report).

These two arguments now seem to be converging. Thanks to Lightning working as a common language, it makes bitcoin interoperable with a wide range of adjacent technologies, like USDT. And USDT is going to turbocharge bitcoin into new use cases, new markets, and new challenges on a scale that the Lightning ecosystem has yet to experience.

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

USDT on Lightning is terra incognita. Interesting times indeed. So let’s think about what it means for USDT to join Lightning and for Lightning to move USDT — the opportunities, the risks, and the wide open questions.

Taproot Assets 101

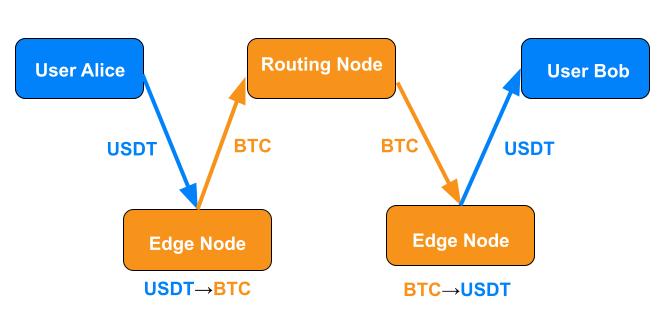

Lightning was originally intended to increase the throughput of the bitcoin blockchain, so bitcoin was to be its only cargo. Taproot Assets is a new protocol that allows fungible assets (e.g. stablecoins) to be transmitted over Lightning as hashed metadata piggybacking on the same infrastructure used to process bitcoin payments.

The way it works is pretty simple for anyone who understands Lightning. The recipient generates an invoice that pings edge nodes (i.e. the nodes connecting users to the broader network) for exchange rates between bitcoin and the asset in question — USDT in the current case. Once the user accepts an edge node’s exchange rate, they generate an invoice for the payment and send it to the payer. The payer sends the asset to the edge node on their own side, the edge node converts everything into a normal-looking bitcoin payment, the payment proceeds through routing nodes along the network as usual, the edge node on the recipient’s end converts the payment back into the original asset (USDT) and forwards it to the recipient.

Taproot Assets leverages the versatility of Lightning and bitcoin to let users transfer new kinds of assets over the network, using bitcoin as the universal medium of exchange. One corollary of all the nodes speaking Lightning is that any routing nodes between the edge nodes see only BTC in transit. Lightning tells them how to move BTC, and that’s all they’re doing as far as they know. Awesome.

But there’s more to it than just technical specs. USDT is, after all, a massive medium of exchange. Tens of billions of USDT value change hands every day spread across millions of payments. Its daily trading volumes are in the same ballpark as the Brazilian real and the Indian rupee. This is a big deal. So what does Lightning mean for USDT, and what does the addition of USDT mean for Lightning?

The Good

… for Bitcoin

So far, much of the strategy to bitcoinizing commerce has focused on orange pilling as many people as possible and growing the circular economy one user at a time. This strategy has perhaps reached the limits of its scale. The circle has grown massively in the last decade and a half, but it’s still limited, and we need to think in terms of millions at a time.

Now that USDT and BTC are natively interoperable on Lightning, the circle has gained tangents. With USDT on Lightning, each party to a payment — the payer and the recipient — can choose whether to use BTC or USDT on their own end, and neither depends on the other’s decision. A customer can pay in BTC, and the merchant can receive USDT. Or the customer can pay in USDT, and the merchant can receive BTC. Or they can both use the same asset. It doesn’t matter. Once both assets are native to Lightning, they become automatically, frictionlessly interchangeable. Everyone is free to opt for bitcoin’s advantages as a medium of exchange grown from the bottom up by the users or for USDT’s advantages as an asset whose price is as stable as US monetary policy and Tether’s liquid reserves.

Lightning and, by extension, bitcoin stand to gain millions of users and billions of dollars worth of spending power. It’s a qualitative extension of bitcoin’s utility. The new use cases will do more good for bitcoin than a boatload of orange pills. It’s also potentially a quantitative explosion for Lightning. Many of those new users might not even know that they’re using Lightning thanks to its efficacy as the common language of the bitcoin economy. But we ol’ school Lightning vets know. This is what we’ve been building towards.

And since we just mentioned how Lightning would make USDT easier for American users to access, USDT will also make it easier for them to use Lightning. American tax regulation treats BTC like an equity, making each payment a potentially complex concatenation of tax events. But if US users can access Lightning with an asset that never incurs capital gains, then they’ll have access to many of Lightning’s advantages without one of its particular regulatory drawbacks.

…for Tether

Tether typically issues USDT on proven blockchains that have achieved significant market traction, and they have no interest in launching their own. USDT is currently available on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron. Note that these are all proof-of-stake (PoS) blockchains (except Liquid, which uses a federation), so they’re necessarily more centralized than bitcoin.

These blockchains also face different tradeoffs. Ethereum is relatively decentralized for a PoS blockchain, but its transaction fees are notoriously high. Tron is cheaper. Perhaps that’s why, according to one estimate, nearly 7x more monthly active retail USDT users opt for Tron over Ethereum and send 8x more retail volume over Tron. But Tron is notoriously centralized, making it a choke point for USDT. If Tron were to fail, Tether would lose something like half of its total capacity across all blockchains. Ouch. By allowing USDT to be transacted over Lightning, which is inherently decentralized, Tether mitigates their dependency on cheap, centralized blockchains.

Further, Lightning could make USDT much more convenient to use in the US market. US exchanges sometimes limit USDT transactions to certain blockchains. For example, Coinbase says “Coinbase only supports USDT on the Ethereum blockchain (ERC-20). Do not send USDT on any other blockchain to Coinbase.” Lightning gives big exchanges like Binance, Coinbase, and Kraken (which already support Lightning today) a decentralized alternative for USDT payments to offer their users.

The Bad

The new American administration has mooted onshoring the entire stablecoin industry and suggested that regulating it is their “first priority.” In other words, they’ll be paying very close attention to every development. As long as stablecoins like USDT are pegged to the dollar, those who control the dollar and profit from it will want to control the stablecoins too.

Regulators think they can even improve on freedom by regulating it. They can’t help it. It’s in their nature. But it follows that, as USDT gains utility on Lightning and Lightning gains utility as a means to move USDT, we’re all going to be attracting greater scrutiny from regulators. It’s hard to say how much they’ll actually be able to do or what they’re going to try, but it won’t be any fun. Regulation is always friction.

One area that’s likely to attract regulatory scrutiny is the edge nodes. Conventional centralized exchanges tend to be subject to KYC/AML rules in many jurisdictions. If the edge nodes will be automatically exchanging USDT and BTC and forwarding payments, they might also look a lot like conventional exchanges to regulators, who tend not to like decentralization.  Read More

Read More