Why CRISPR Therapeutics Stock Was a Massive Winner on Wednesday

On Hump Day, investors piled into CRISPR Therapeutics (NASDAQ: CRSP) stock, sending its price more than 9% higher at the trading session's close. They were highly encouraged by the specialized healthcare company's latest quarterly earnings report, which was published after market hours Tuesday. That 9%-plus performance was in sharp contrast to the 0.3% decline of the S&P 500 index.For its fourth quarter of 2024, CRISPR booked revenue of just under $36 million. That was well under the more than $201 million the company earned in the same period of 2023. On the bottom line, CRISPR flipped to a generally accepted accounting principles (GAAP) loss of $37 million ($0.44 per share) against a profit of $98 million in the year-ago quarter. Even though both metrics worsened notably, they still came out well ahead of the consensus analyst estimates. On average, prognosticators tracking CRISPR stock were expecting the gene-editing company to post only $7.6 million for revenue and a far steeper net loss of $1.23 per share. Continue reading

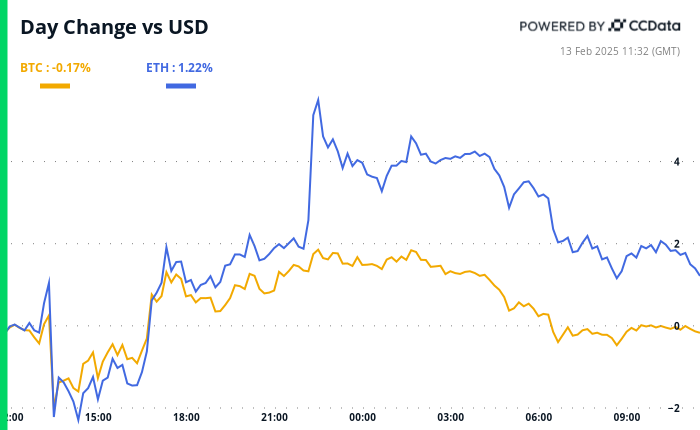

On Hump Day, investors piled into CRISPR Therapeutics (NASDAQ: CRSP) stock, sending its price more than 9% higher at the trading session's close. They were highly encouraged by the specialized healthcare company's latest quarterly earnings report, which was published after market hours Tuesday. That 9%-plus performance was in sharp contrast to the 0.3% decline of the S&P 500 index.

For its fourth quarter of 2024, CRISPR booked revenue of just under $36 million. That was well under the more than $201 million the company earned in the same period of 2023. On the bottom line, CRISPR flipped to a generally accepted accounting principles (GAAP) loss of $37 million ($0.44 per share) against a profit of $98 million in the year-ago quarter.

Even though both metrics worsened notably, they still came out well ahead of the consensus analyst estimates. On average, prognosticators tracking CRISPR stock were expecting the gene-editing company to post only $7.6 million for revenue and a far steeper net loss of $1.23 per share.