Paycom Looks to Turn the Corner

Here's our initial take on Paycom Software's (NYSE: PAYC) fourth-quarter financial report.Paycom Software's fourth-quarter financial report showed incremental progress in the human capital management software specialist's efforts to mount a turnaround. Revenue growth of 14% for the quarter helped Paycom close 2024 with 11% annual sales gains. Similarly, an impressive finish to 2024 on the profit front was responsible for Paycom seeing adjusted profit rise 3% for the full year. Gains in client counts and stored data were small but maintained some upward momentum.Founder/CEO Chad Richison was pleased that the company's strategic plan resulted in better results than expected to end 2024. The leader remains convinced that maximizing the level of automation in its software will be the key to its long-term success, and Richison recommitted Paycom to further investments in innovation and automation going forward.Continue reading

Here's our initial take on Paycom Software's (NYSE: PAYC) fourth-quarter financial report.

Paycom Software's fourth-quarter financial report showed incremental progress in the human capital management software specialist's efforts to mount a turnaround. Revenue growth of 14% for the quarter helped Paycom close 2024 with 11% annual sales gains. Similarly, an impressive finish to 2024 on the profit front was responsible for Paycom seeing adjusted profit rise 3% for the full year. Gains in client counts and stored data were small but maintained some upward momentum.

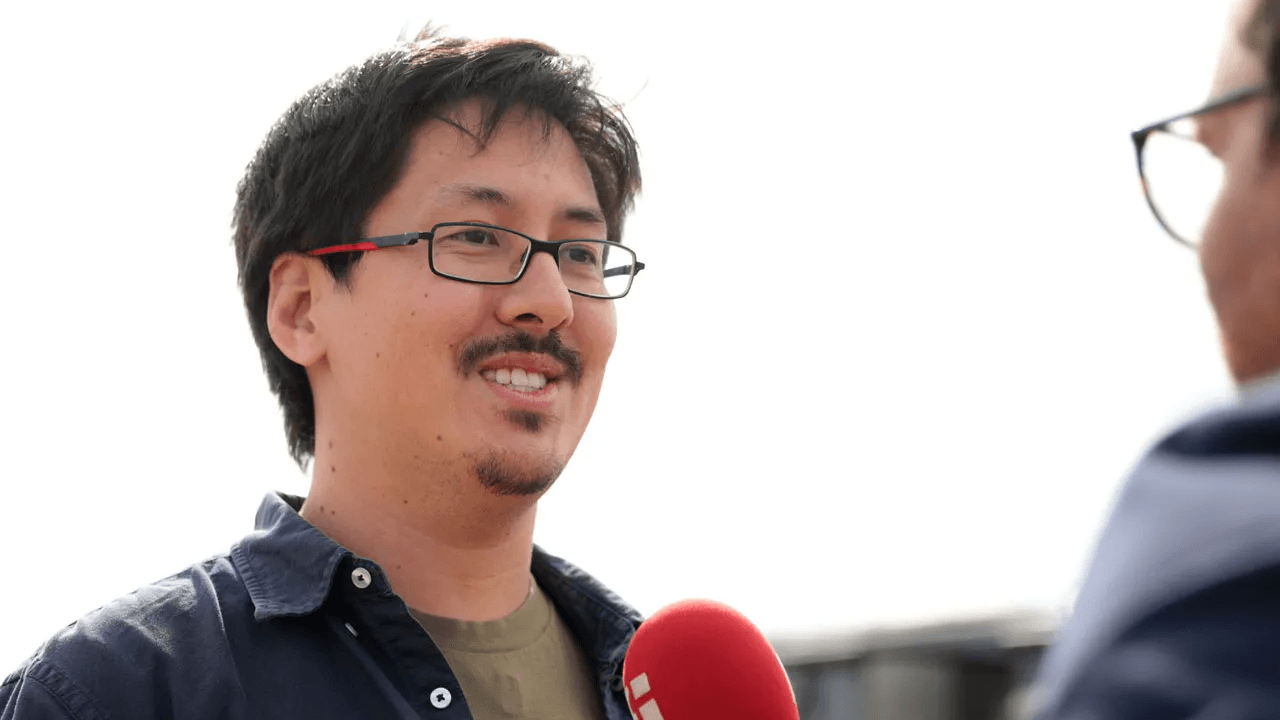

Founder/CEO Chad Richison was pleased that the company's strategic plan resulted in better results than expected to end 2024. The leader remains convinced that maximizing the level of automation in its software will be the key to its long-term success, and Richison recommitted Paycom to further investments in innovation and automation going forward.