What I Would Do With an Extra $25,000 – $35,000 Before My Semi-Retirement

It’s nice to imagine what we’d do if we had an extra $25,000 or so. For today’s young people, many of whom will see a sizeable financial windfall coming their way, as the great generational wealth transfer moves on, it’s worth exploring what one would do if they have a generous sum headed their way. […] The post What I Would Do With an Extra $25,000 – $35,000 Before My Semi-Retirement appeared first on 24/7 Wall St..

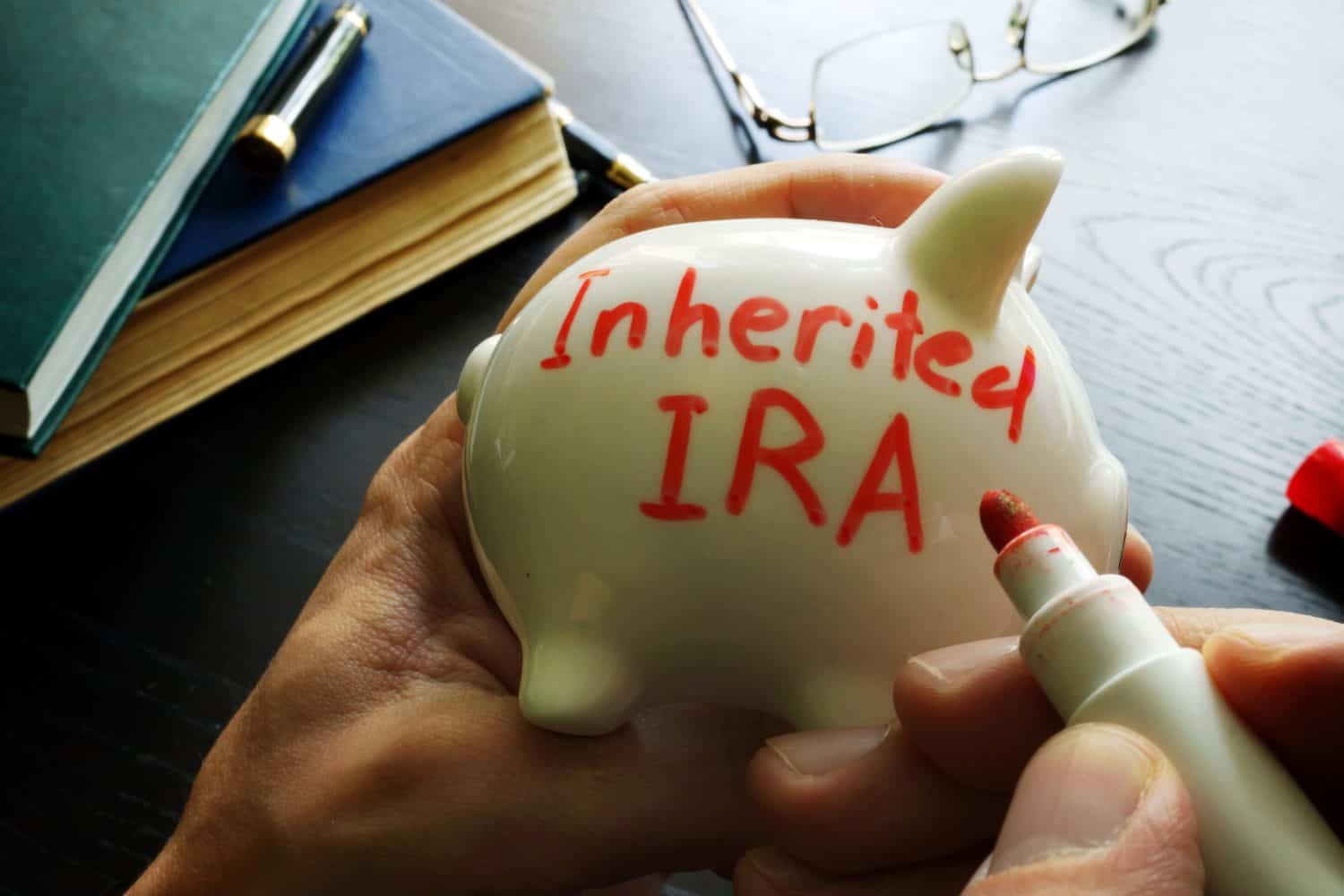

It’s nice to imagine what we’d do if we had an extra $25,000 or so. For today’s young people, many of whom will see a sizeable financial windfall coming their way, as the great generational wealth transfer moves on, it’s worth exploring what one would do if they have a generous sum headed their way. Of course, not everyone who has an inheritance or generous financial gift coming their way will seek to use the funds to move ahead financially.

Though there’s no shame in splurging a portion of any windfall on travel and experiences if one’s already in good financial shape, with a steady job and the ability to stay on top of 401(k) contributions, soon-to-be heirs should be thinking about how such extra cash could help them achieve financial security or independence.

In this piece, we’ll go over what I believe are some of the smartest moves for prospective retirees who were fortunate enough to stumble upon a small five-figure sum.

Key Points

-

It’s all right to spend a portion of a windfall headed one’s way. But for those seeking financial freedom, paying off debt and buying the dip in the market should come first.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Draw up a budget. Figure out what you want to spend and what you’ll save.

Drawing up a budget and allocating cash to specific buckets would be a wise first move, so that one can spend a portion of the cash without all the guilt. Indeed, it’s never any fun saving the entirety of a financial windfall, especially if you’re already off to a hot start. Of course, if you’re knee deep in high-interest debt or you’re having difficulty paying the bills, throwing most, if not all, of the $25,000 or so towards the student loan bill makes the most sense.

In any case, I’d take my sweet time in deciding on the perfect percentage to spend versus save. For someone who’s been longing to travel to Europe, committing to spending 10% of a windfall isn’t at all a terrible idea if it means you’ll save and invest the rest prudently.

Invest in a tax-advantaged fund while using the proceeds to buy value stocks on the way down.

For the portion that’s to be invested, the first move is to contribute to tax-advantaged accounts (ensure there’s still room before proceeding) and find out what types of stocks to buy. While going for a simple S&P 500 or total stock market ETF is a good way to go for most beginning passive investors, I’d also not shy away from individual bargains to be had after the turbulent start to summer. Just because the S&P 500 is around halfway to fully recovering doesn’t mean every stock is on the mend. Some names remain under considerable pressure over their tariff exposure.

A stock like Apple (NASDAQ:AAPL) was clobbered last week, shedding around 5% of its value following a decent quarterly result that was plagued by tariff uncertainty. Indeed, the Cupertino-based iPhone maker sees tariffs costing the firm $900 million for June. That’s not as horrific for the firm that has more than $3 trillion, but it’s a major thorn in the side, for sure.

The longer the tariffs linger, the larger the bill Apple could get as Tim Cook and the company scramble to restructure manufacturing to avoid the brunt of tariffs. For now, it looks like Apple is targeting India as its manufacturing location for U.S. iPhones. And while it’s a wise move to diversify beyond China, such a move is going to take time.

In any case, I view the pullback below $200 per share as way overdone at this point. Sure, Warren Buffett may have sold a few quarters back, but Apple remains a stock to hang onto for the long haul, in my view. In the meantime, count me as unsurprised if there’s some pull forward in demand for iPhones in the U.S. in the June quarter, as consumers look to pick up an iPhone before prices have a chance to really surge.

The post What I Would Do With an Extra $25,000 – $35,000 Before My Semi-Retirement appeared first on 24/7 Wall St..