Trump Media Just Announced a Massive Stock Buyback

Always keep an eye on stock buybacks. Most of them increase shareholder value by reducing the total number of outstanding shares, which then increases the value of a stock. Essentially, it’s a company’s way of reinvesting in itself and rewarding shareholders. Trump Media Trump Media (NASDAQ: DJT) just announced a massive $400 million buyback program. […] The post Trump Media Just Announced a Massive Stock Buyback appeared first on 24/7 Wall St..

Key Points

-

Always keep an eye on stock buybacks. Most of them increase shareholder value by reducing the total number of outstanding shares.

-

Trump Media just announced a massive $400 million buyback program.

-

Are you ahead or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Always keep an eye on stock buybacks.

Most of them increase shareholder value by reducing the total number of outstanding shares, which then increases the value of a stock. Essentially, it’s a company’s way of reinvesting in itself and rewarding shareholders.

Trump Media

Trump Media (NASDAQ: DJT) just announced a massive $400 million buyback program.

“Since Trump Media now has approximately $3 billion on its balance sheet, we have the flexibility to take actions like this which support strong shareholder returns, as we continue exploring further strategic opportunities,” said CEO Devin Nunes, as quoted by CNBC.

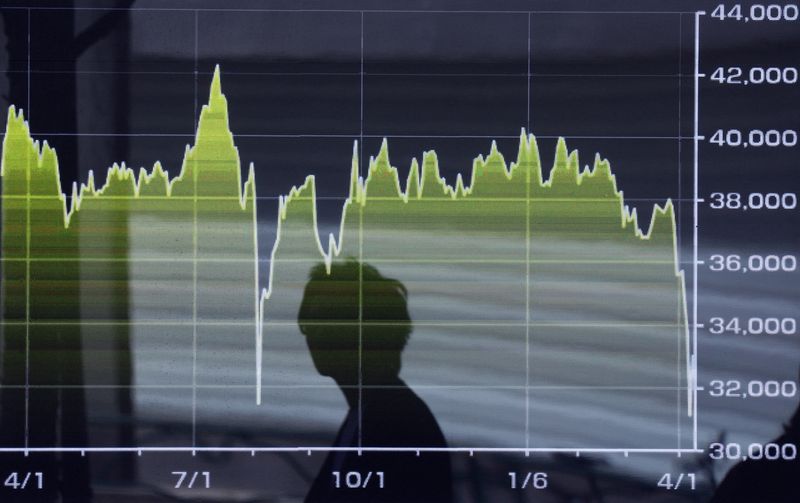

Oversold shares of DJT last traded at $18.42, which has served as support since April. From here, we’d like to see the DJT stock rally back to $27.50 initially.

Darden Restaurants

Darden Restaurants (NYSE: DRI) just announced a $1 billion buyback program, with no expiration date.

The company also increased its dividend to $1.50 per share, which is payable on August 1 to shareholders of record as of July 10.

Earnings weren’t too shabby either. In its most recent quarter, the company’s EPS of $2.98 beat estimates by a penny. Revenue of $3.3 billion, up 10.6% year over year, beat by $40 million.

“We had a strong quarter with same-restaurant sales and earnings growth that exceeded our expectations,” said President & CEO Rick Cardenas, as quoted in a company release. “Our adherence to our winning strategy, anchored in our four competitive advantages and being brilliant with the basics, led to a successful year. Our strategy remains the right one for the company, and we will continue to execute it to drive growth and long-term shareholder value.”

Exxon Mobil

Exxon Mobil (NYSE: XOM) has been aggressively buying back stock, too.

In fact, according to Barron’s, “Exxon bought back $4.8 billion worth of shares in the first quarter, which it said was consistent with its plan for $20 billion in annual repurchases.

In the quarter, the company spent more on dividends and buybacks than it made in free cash flow. The company’s balance sheet is relatively low on debt, so that isn’t a problem today.”

XOM also just paid a dividend of 99 cents on June 10 to shareholders of record as of May 15.

Pool Corporation

With warmer days ahead, pool stocks, like Pool Corp. (NASDAQ: POOL) are gaining traction.

Pool Corporation is the world’s largest wholesale distributor of swimming pool and related backyard products. It operates 447 sales centers in North America, Europe and Australia, and distributes more than 200,000 products to roughly 125,000 wholesale customers.

Plus, as the company generates more cash flow and margins continue to expand, Pool is also able to allocate more cash to stock buybacks and dividends. In fact, with a strong history of returning cash, it just increased its buyback program to $600 million.

It also declared a dividend of $1.25 per share, which was paid on May 29.

Robinhood

Robinhood (NASDAQ: HOOD) could see further upside.

For one, the company just increased its share buyback program to $1.5 billion. Two, director Christopher Payne just paid $2 million for 26,500 HOOD shares. He paid an average price of $74.19 each. Third, with Bitcoin expected to increase in value, HOOD should remain a strong beneficiary. And fourth, earnings have been strong.

Its first-quarter EPS of 37 cents beat estimates by four cents.

Revenue of $927 million, up 50% year over year, beat estimates by $9.84 million. Transaction-based revenues increased 77% year over year to $583 million, primarily driven by cryptocurrencies revenue of $252 million, up 100%, options revenue of $240 million, up 56%, and equities revenue of $56 million, up 44%.

“This quarter, we significantly accelerated product innovation across our key initiatives, highlighted by the announcement of Robinhood Strategies, Banking, and Cortex,” added Vlad Tenev, Chair and CEO of Robinhood. “Customers have responded — demonstrated by record-breaking net deposits, Robinhood Gold subscriptions, and options volume, as well as robust year-over-year growth in trading across all asset classes.”

Imperial Oil

With a yield of 2.58%, Imperial Oil (NYSEAMERICAN: IMO) is just as attractive.

It just paid out a 72-cent quarterly dividend on June 4. And it just renewed its buyback program of up to 5% of its outstanding stock (currently at 509.04 million) over the next 12 months. The new one-year program will begin on June 29, 2025, and will end, should the company purchase the maximum allowable number of shares, or on June 28, 2026, according to the company.

“Imperial delivered strong financial results in the first quarter, highlighting the resilience of our integrated business model,” added Brad Corson, chairman and chief executive officer, as quoted in a company earnings release. “The Upstream business continued to benefit from improved egress and narrower heavy oil differentials, while our Downstream profitability continued to reflect the structural advantages of the Canadian market.”

The post Trump Media Just Announced a Massive Stock Buyback appeared first on 24/7 Wall St..