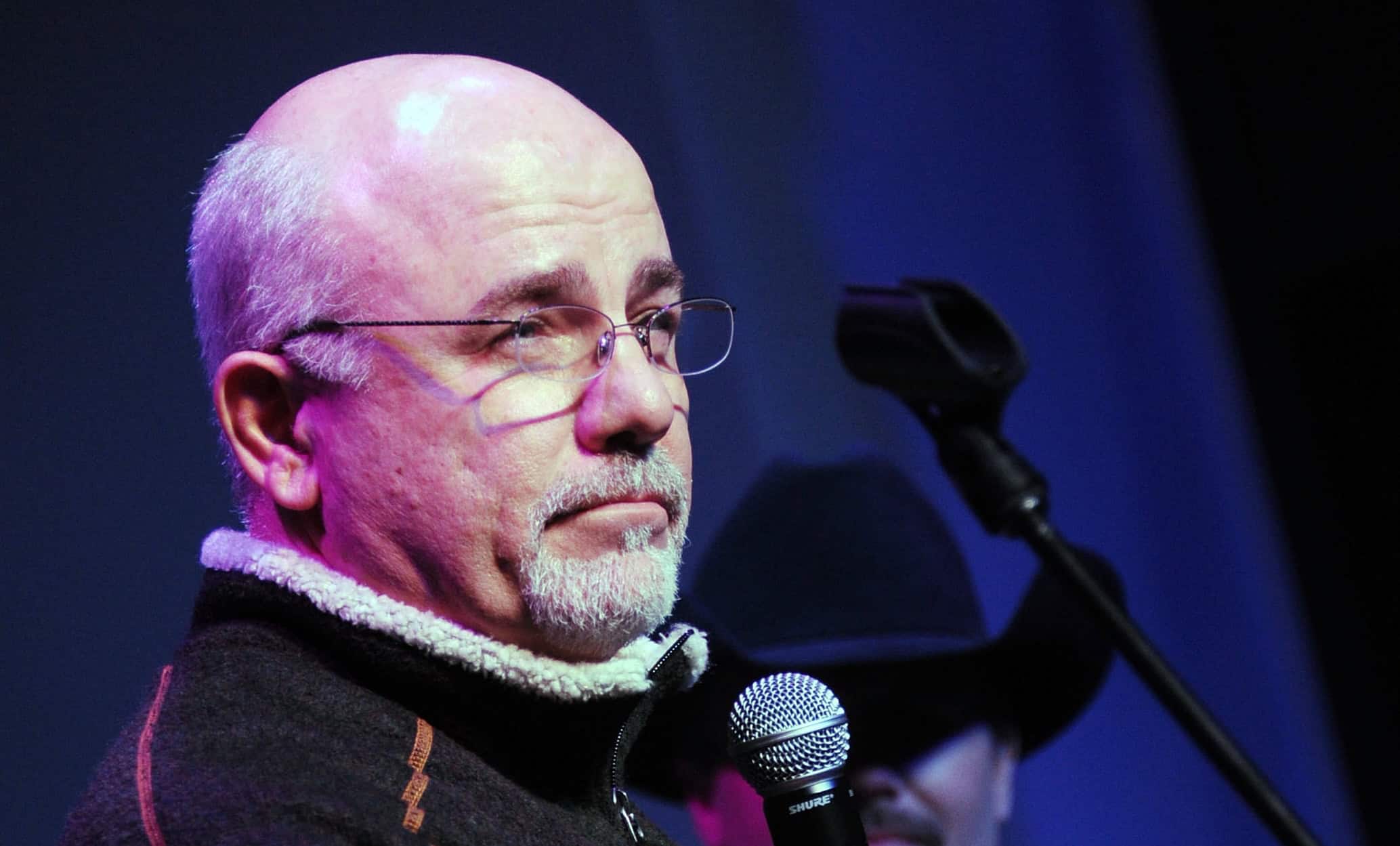

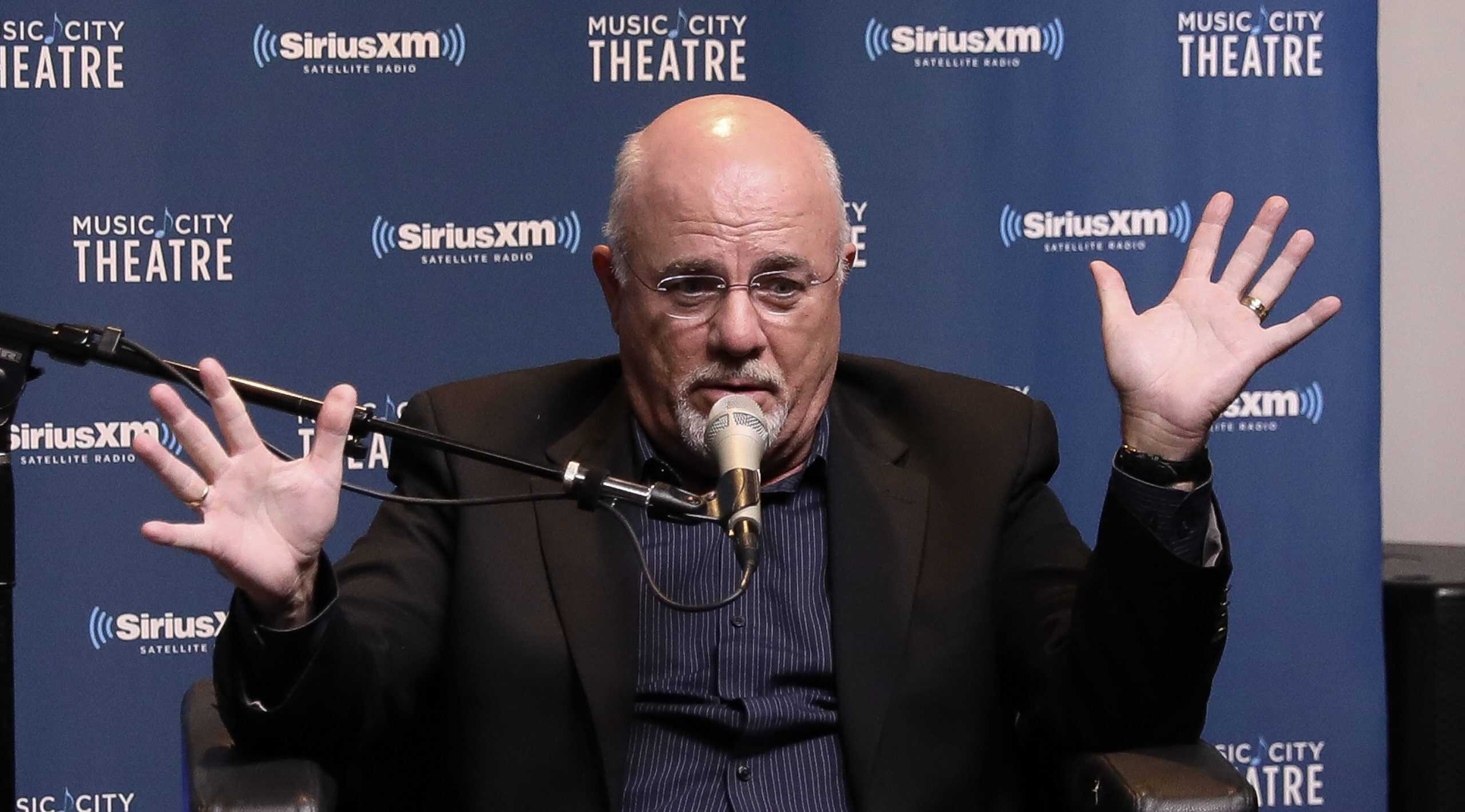

Reconsidering Dave Ramsey: A Closer Look at His Financial Philosophy

Dave Ramsey is a personal finance guru. He has dedicated his life to helping the masses learn how to pay off debt, save for important purchases, and build wealth. He is known for espousing the importance of getting out of debt, which most Americans suffer from. His famous “debt snowball” details how to firmly commit […] The post Reconsidering Dave Ramsey: A Closer Look at His Financial Philosophy appeared first on 24/7 Wall St..

Dave Ramsey is a personal finance guru. He has dedicated his life to helping the masses learn how to pay off debt, save for important purchases, and build wealth. He is known for espousing the importance of getting out of debt, which most Americans suffer from. His famous “debt snowball” details how to firmly commit to paying off your smallest debt first, before rolling any freed-up income into the next debt down the list. Checkout one man’s journey from Dave Ramsey ambivalence to recognizing the value in his teachings.

Initial Impressions

I’ve never been a Dave Ramsey super-fan.

Not because I have anything against the man, you understand. It’s just that Dave Ramsey gives advice for people who don’t yet know how to manage their money well, and that’s never really been a problem for me. I haven’t had a reason to listen to him, personally.

A Growing Respect

Writing these columns for 24/7 however, has allowed me to get better acquainted with Ramsey and the kind of financial advice he gives. And I have to say, the more I listen to this guy, the more I like him.

Simply put, there’s a reason Dave Ramsey is so popular.

A Real-Life Call-In Case: the couple with separate finances

Take the curious case of the husband and wife, married 10 years, who still maintain separate bank accounts and haven’t combined their financial resources. In this particular instance, it was the wife who called in, explaining that while she’s always been the more “responsible” partner in this family, and hesitant to combine finances with her husband, a recent job loss and consequent loss of income (on her part) had her re-examining her hesitance to combine finances with her husband.

Cynical Response

Now, a cynical observer might respond to this situation thusly: “Huh. So, you didn’t want to share a bank account with your husband before, but now, 10 years in, you’ve got no income and now you want to share income?”

Ramsey’s Response

This isn’t the route Ramsey took, however. He didn’t assign blame, didn’t talk down to his caller, didn’t in any way imply that her sudden change of heart was motivated by the fact that a situation, that worked well for her before, suddenly didn’t seem so attractive when she had no money coming in. Instead, Ramsey took a kinder and bigger picture view of this couple’s relationship and homed in on what they hoped to accomplish beyond this particular incident of one spouse (or the other) temporarily being out of work.

Ramsey’s View on Shared Finances: Why Joint Accounts Matter

Statistically, he said, couples tend to have stronger and happier marriages when they combine finances. What’s more, statistically, the “vast majority” of 10,000 millionaire families, that Ramsey’s company surveyed for a recent study, were found to have “had shared finances.” And “statistically” therefore, “if you want to be a millionaire,” then the best way to do this appears to be by first combining finances with your spouse.

Why might that be?

The Investor Analogy

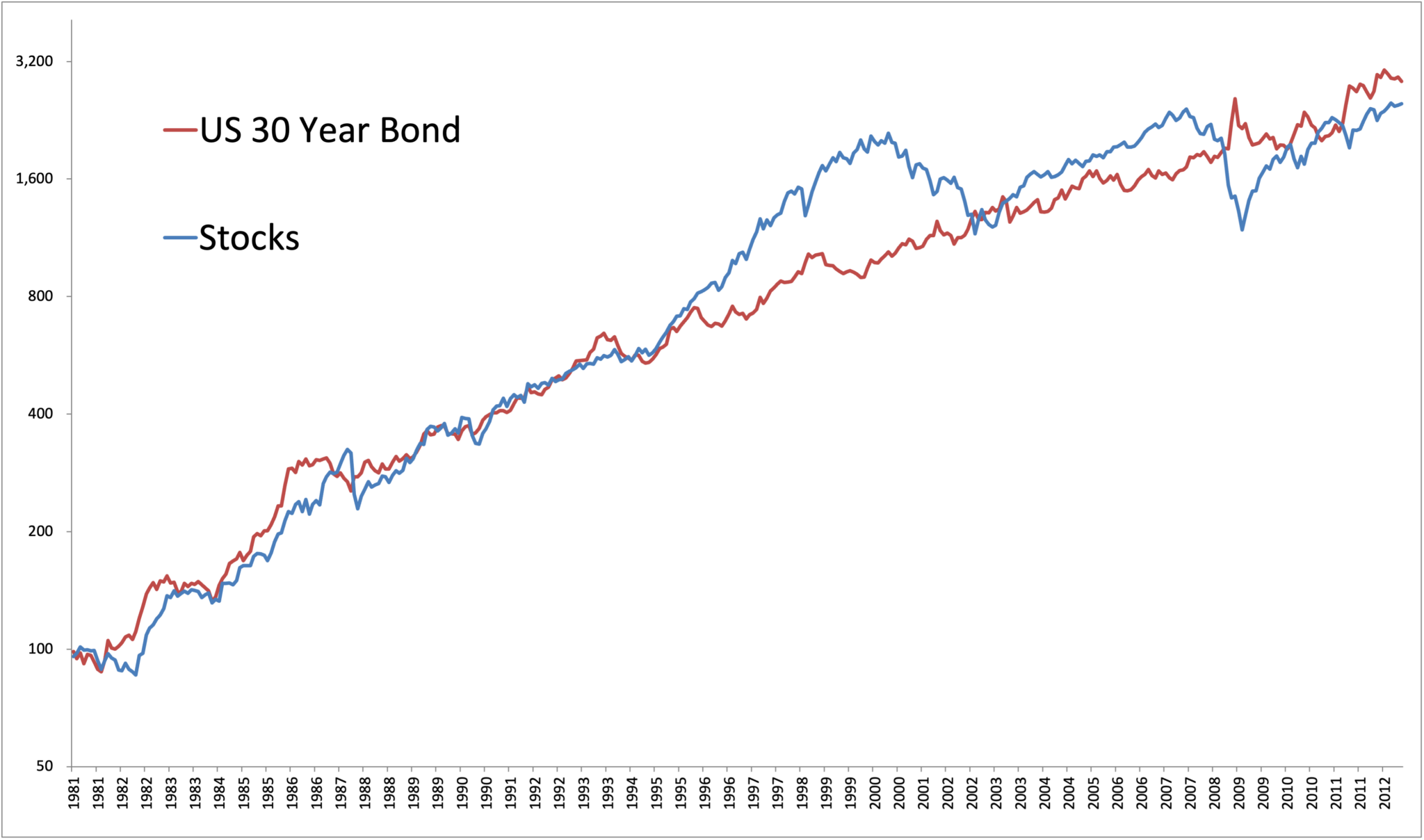

Think about it like an investor. If you invest in a company with a single product, say a biotech startup that has a single cancer drug in phase 1 trials, well, that might work out really well for you if over time the drug goes through phase 2 and phase 3 successfully, comes to market, and becomes a blockbuster $1 billion-a-year drug. Or it could fail fantastically, if that single product fails its phase 2 trial, kind of like a spouse losing a job.

Investors like myself try to limit the risk of such a flame-out by investing in companies with more than one product, or investing in more than just one stock. It’s called “diversification,” and while it may limit the upside (like one spouse not having to worry about the other spouse’s spending, because they keep their finances separate), it also adds stability. If one revenue stream fails, there’s another revenue stream still coming in to keep the company (or the portfolio, or the family) afloat long enough for the other half of the company (or the portfolio, or the family) to recover from the setback.

Applying the Lesson: Shared Goals Require Shared Systems

Ramsey’s advice is for the spouses to sit down and agree on what they are trying to accomplish, financially. Then, any time one spouse wants to make a purchase, they have a common framework to examine the decision and agree on whether it helps or hurts the shared long-term goal. The family shares “one checkbook, one budget, one set of goals.” They also share one or two incomes feeding into their shared budget and contributing to their shared goals.

The Takeaway

Ramsey’s advice weaves emotional intelligence with practical financial applications. He encourages collaboration, trust, and accountability. Come what may, unity of purpose and sharing of income contributes to reaching shared goals. Sounds like good advice to me.

The post Reconsidering Dave Ramsey: A Closer Look at His Financial Philosophy appeared first on 24/7 Wall St..