Jensen Huang Just Put a $1 Trillion Price Tag on the AI Gold Rush

NVIDIA (NASDAQ:NVDA) just pole-vaulted into first place in the market race after last week’s impressive surge of nearly 7%. Undoubtedly, it now seems like just a matter of time before the $3.8 trillion AI chip behemoth makes history by passing the $4 trillion market cap mark. Though there’s plenty of AI hype already priced into the […] The post Jensen Huang Just Put a $1 Trillion Price Tag on the AI Gold Rush appeared first on 24/7 Wall St..

NVIDIA (NASDAQ:NVDA) just pole-vaulted into first place in the market race after last week’s impressive surge of nearly 7%. Undoubtedly, it now seems like just a matter of time before the $3.8 trillion AI chip behemoth makes history by passing the $4 trillion market cap mark.

Though there’s plenty of AI hype already priced into the stock, at today’s still-modest price of admission (35.9 times forward price-to-earnings), many may still be underestimating the potential for NVIDIA to continue to gain as the next stage of the AI gold rush plays out.

Key Points in This Article:

- AI data center spending could blow past the $1 trillion mark by 2028.

- By then, I think NVIDIA could be commanding a market cap closer to $5 trillion.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

The AI boom could carry a price tag of more than $1 trillion. Agents and robotics look to be up next.

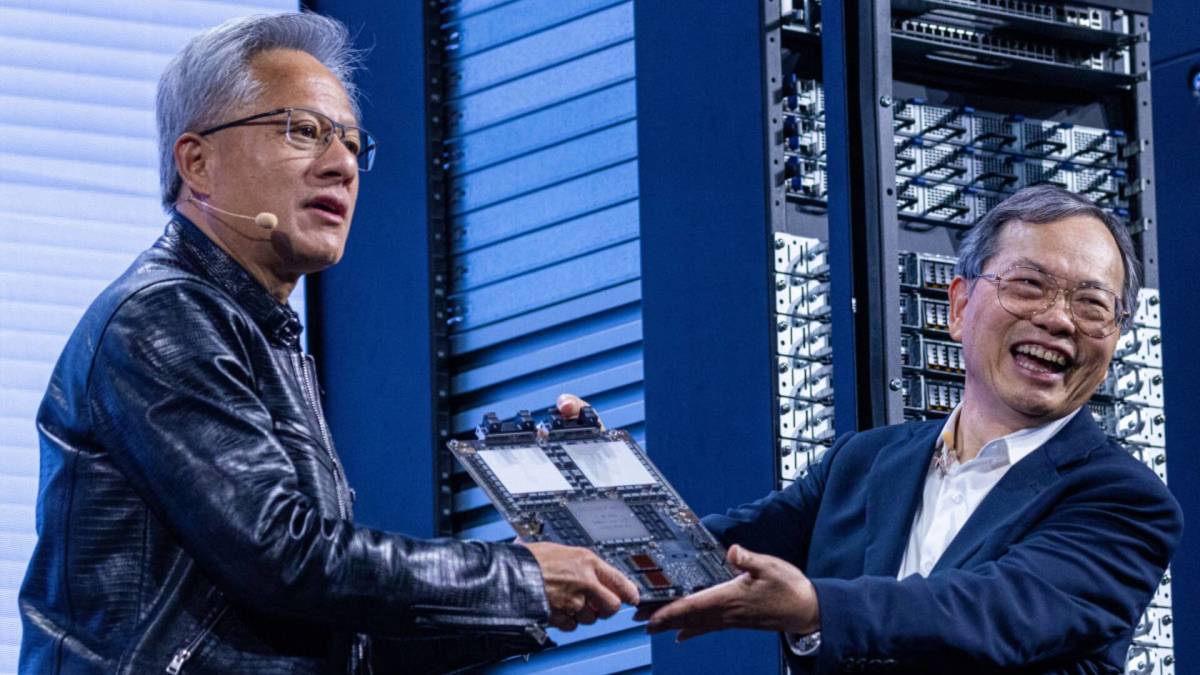

Indeed, NVIDIA’s legendary leather jacket-dawning top boss, Jensen Huang, thinks AI data center spending could blow past the $1 trillion mark by 2028. By then, I think NVIDIA could be commanding a market cap closer to $5 trillion than $4 trillion, which is just another 5% gain away from today’s closing price of around $155 per share.

Undoubtedly, the AI inference boom may still be in its early days, at least relatively speaking. Beyond the latest boom, though, Huang sees robotics as the next big opportunity that could see firms scoop up NVIDIA’s latest and greatest hardware. Indeed, NVIDIA’s CEO always seems to be thinking a few years ahead of most others. And as NVIDIA stock enjoys its latest melt-up and breakout, I still don’t think it’s too late to pick up a few shares.

With a massive growth ceiling, not just in AI but also in robotics and the metaverse (or Omniverse), it’s tough to put a cap on the company’s growth, especially with Huang calling the shots. In recent quarters, we’ve heard quite a bit about the rise of agentic AI (AI agents) and its promise to transform the working world for good.

Such a boom could certainly cause NVIDIA’s next-generation chips to fly off the shelves in short order. Undoubtedly, perhaps Rubin and beyond could make the Blackwell boom seem mild in comparison. In any case, if agents are indeed the future, firms looking to unlock their full potential are going to need significantly more AI computing power. And NVIDIA, the all-star batter with an unmatched batting average, is once again going to need to step up to the plate to make that big swing.

How about the AGI factor?

Of course, there’s also the wildcard of artificial general intelligence (AGI) and superintelligence, which several smart tech visionaries, including OpenAI’s top boss Sam Altman, seem to be stopping at nothing to achieve. Indeed, it’s hard to tell if AGI and its like really is around the corner, as Altman believes, or if it’s still a long way off.

In any case, if such a superintelligence is indeed closer to reality, the implications for AI chip makers, I believe, could be profound. If you’re a believer in AGI, as Altman is, perhaps NVIDIA, the largest company on Earth, is still a value play, even at these fresh new heights. Not every tech mind is nearly as optimistic as Altman is regarding the AGI timeline, though. But, of course, it is something to keep tabs on as an AI investor.

Jensen Huang sold some stock in June. Is it time to take profits?

Despite shedding light on the massive market opportunity ahead, Jensen Huang recently took some profits off the table, trimming just north of $14 million worth of shares prior to the latest breakout to $155 per share. Indeed, it’s always a bit concerning when a CEO does a bit of selling.

That said, the selling activity is relatively small compared to the man’s net worth (around $130 billion and counting). As such, I wouldn’t hit the panic button in response to the modest share sale.

At the end of the day, Nvidia has enough gas in the tank to keep its growth engine going strong for years to come. Whether we’re talking about the $1 trillion opportunity in AI or the potential $1 trillion boom in robotics that could follow, Nvidia stands out as a long-term hold for growth-minded investors comfortable with the volatility.

The post Jensen Huang Just Put a $1 Trillion Price Tag on the AI Gold Rush appeared first on 24/7 Wall St..