2 Nifty50 Dividend Giants to Buy Today

Indian stock market indices saw a downturn in the early trading hours on Monday, with Nifty50 and Sensex falling sharply. Nifty50 dropped below the 25,000 mark, due to growing tensions in the Middle East and the implications of U.S. military actions. Analysts believe that market performance will continue to be influenced by global developments and […] The post 2 Nifty50 Dividend Giants to Buy Today appeared first on 24/7 Wall St..

Key Points

-

These 2 Nifty50 stocks are strong dividend companies with an upside potential.

-

Both these companies have survived market volatility and have the potential to increase dividends.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

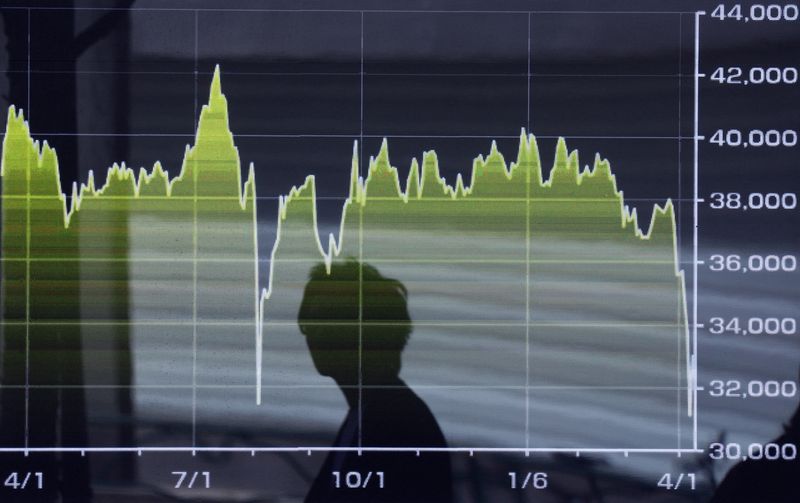

Indian stock market indices saw a downturn in the early trading hours on Monday, with Nifty50 and Sensex falling sharply. Nifty50 dropped below the 25,000 mark, due to growing tensions in the Middle East and the implications of U.S. military actions. Analysts believe that market performance will continue to be influenced by global developments and that market volatility could be seen due to geopolitical tensions.

Amid the ongoing volatility, investors need to look for stocks that have seen it all and yet thrived. These are companies that believe in rewarding shareholders and stand strong despite the market’s ups and downs. If you’re a passive income investor, here are 2 Nifty50 dividend giants to buy today.

Hindustan Zinc

Dividend yield: 6.6%

Hindustan Zinc is engaged in the business of exploring, extracting, and processing minerals. It has several mines and plants in addition to four capital solar plants in Rajasthan. Trading for Rs. 443, the stock has remained flat in 2025 and is down 32.74% in 12 months. Overall, it is up over 100% in five years. It enjoys a strong dividend yield of 6.6%.

India’s zinc demand is expected to double over the next five to ten years and the company is taking the necessary steps to double the production capacity. Hindustan Zinc has a strong future ahead and the board has approved a growth capex of Rs.12,000 crore which is aimed at increasing the refining metal capacity by 250 KTPA (kilotonnes per annum). This project is expected to be completed in three years.

In the recent quarter, the company reported a net consolidated profit of Rs. 3,003 crore, up 47.3% year over year and the income stood at Rs 9,314 crore, up 20.37% year-over-year. The company announced an interim dividend of Rs. 7 per share. The rising silver prices have also benefited Hindustan Zinc.

Analysts at JM Financial have a buy rating for the stock with a price target of Rs. 550. Motilal Oswal has a price target of Rs.480. Hindustan Zinc is a stable, fundamentally strong company with an attractive dividend yield. It has the ability to sustain dividends and increase them in the long term.

Tata Steel

Dividend yield: 2.37%

Exchanging hands for Rs.152, Tata Steel stock is down 14% in 12 months but the stock has regained the lost value over the past six months and is up 11% in 2025. Overall, the stock has soared over 300% in five years. Tata Steel is a steel manufacturing company in India.

In the recent quarterly results, Tata Steel saw an impressive 117% year-over-year jump in net profit to Rs. 1,201 crore. The company saw an improvement in the volume, but its revenue dropped due to the low steel prices in the fourth quarter. It announced a dividend of Rs.3.6 per share.

The management is set to invest $2.5 billion in its Singapore unit during FY26 to support its European business and for debt repayment. Its consolidated revenue came in at Rs. 56,218 crore, down 4% year over year and its Indian operations saw a 19% drop in net profit due to the lower steel prices.

However, the long-term picture looks positive for Tata Steel. The demand for steel is always going to be there but once the price picks up, we could see Tata Steel report impressive numbers again. Despite the dip in profits in its India operations, the quarterly sales were the best-ever in the country at 21 million tonnes.

Any dip in the stock is a chance to buy and analysts recommend holding the stock for the next two years.

The post 2 Nifty50 Dividend Giants to Buy Today appeared first on 24/7 Wall St..