Top U.S. Imports from Mexico Spared, For Now, From Tariffs

With world markets reeling from the impact of President Trump’s sweeping trade tariffs, one unlikely country is quietly celebrating: Mexico. Given the acrimonious relationship between Trump and Mexico over issues of undocumented immigration and trade policy, few observers would have expected Mexico to be sitting pretty in April 2025. But while 25% tariffs remain in […] The post Top U.S. Imports from Mexico Spared, For Now, From Tariffs appeared first on 24/7 Wall St..

With world markets reeling from the impact of President Trump’s sweeping trade tariffs, one unlikely country is quietly celebrating: Mexico. Given the acrimonious relationship between Trump and Mexico over issues of undocumented immigration and trade policy, few observers would have expected Mexico to be sitting pretty in April 2025. But while 25% tariffs remain in place on cars, steel, and aluminum imported from Mexico, the free trade agreement between the two countries has shielded billions of dollars of other products from punishing tariffs, for now. What other products could be on the chopping block if that situation changes? That’s what we’ll look into in this article.

Despite tensions with Mexico over trade and border issues, the United States has so far confined tariffs to a few areas of heavy industry. This gives Mexico a unique opportunity to replace other countries as the main suppliers of the U.S. in a host of areas of the economy.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Key Points

U.S.-Mexican Trade Volume

According to the Office of the United States Trade Representative, in 2024 the total volume of U.S.-Mexican trade was just shy of $840 billion. American exports to Mexico added up to $334 billion and imports stood at $505.9 billion. This left the U.S. in a trade deficit of $171.8 billion vis-a-vis our southern friends.

Current Status of Tariffs

Mexican President Claudia Sheinbaum has taken a cautious approach with the unpredictable policy shifts coming out of Washington, believing that her country’s free trade agreement with the United States, which was renegotiated by President Trump in his previous term, would safeguard the country. While the U.S. imposed tariffs of 10% or more on over 90 countries, including some with which we enjoy free trade agreements, Mexico was spared except for the existing 25% tariffs on automobiles, steel and aluminum.

About Those Mexican Cars . . .

The total value of the 2.9 million vehicles imported into the U.S. from Mexico in 2024 was $78.5 billion. Maybe you’re thinking you don’t want to buy a Mexican car so you don’t care if they are taxed. But would you be interested in any of these brands? Because they all manufacture vehicles for the U.S. market in Mexico. Analysts warn prices for the lowest-end new cars of most popular models could now rise to $30,000 or more.

- BMW

- Ford

- General Motors

- Honda

- Kia

- Mazda

- Nissan

- Stellantis (Chrysler, Dodge, Jeep, etc.)

- Toyota

- Volkswagen

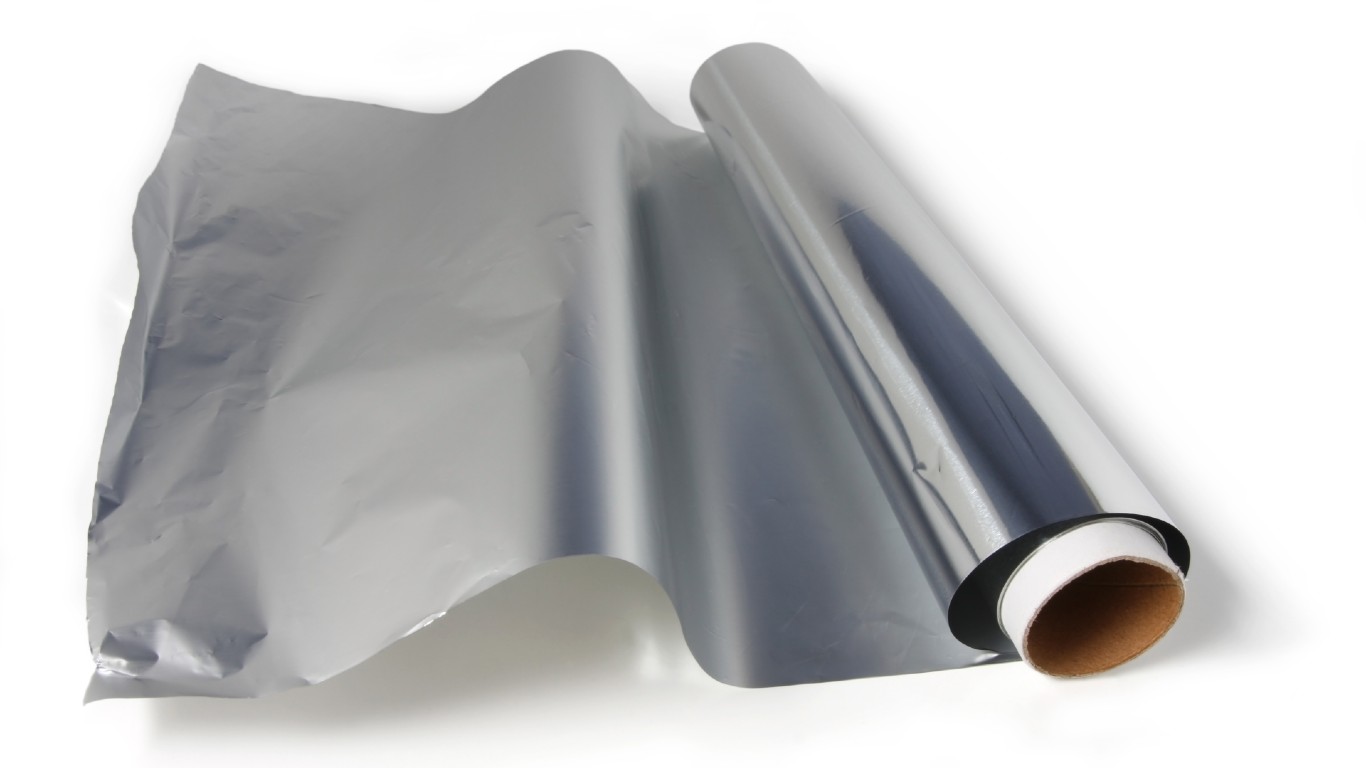

Impact of Aluminum and Steel Tariffs

In 2024, Mexico exported $3.31 billion in iron and steel to the U.S. and $1.84 billion of aluminum. New tariffs on imported aluminum and steel can be expected to increase the costs of aircraft, industrial machinery, farm equipment, construction materials, household appliances, canned goods, and electronics. And of course, every time you buy a plane ticket you’re helping to buy aircraft; when you buy a can of corn you’re also paying for the tractor that helped grow it, the can it was packed in, and the machinery that manufactured both. All made of tariffed industrial metals.

Top Imports from Mexico To Keep an Eye On

There is little doubt we haven’t heard the last of this issue. So if the administration does decide to slam Mexico with tariffs, here are some areas to watch. These were some of the top Mexican imports to the United States by monetary value as of 2024.

Industrial Equipment

Machinery, nuclear reactors, and boilers imported from Mexico amounted to $105.83 billion during 2024. This category also includes things like air conditioners, refrigerators, centrifuges, and engine parts. Price increases in some of these areas will impact consumers directly; others indirectly across thousands of unrelated products that go through a manufacturing or storage process involving this type of equipment.

Electrical and Electronic Equipment

In 2024, the U.S. imported $87.56 billion in electrical and electronic equipment from Mexico. This includes insulated wires and cables, smartphones, computer monitors, projectors, and electrical transformers. This is an area essential to telecommunications and energy generation.

Optical and Medical Equipment

Photo, optical, technical, and medical apparatus Americans purchased from Mexico was $22.92 billion in 2024. More specifically, imports in this area include medical, surgical, and dental instruments, syringes and sutures, orthopedic devices, supply meters for gas, liquid, or electricity, regulating instruments, revolution counters, and pedometers.

Mineral Fuels and Oils

The total value of mineral fuels, oils, and distillation products the U.S. imported from Mexico in 2024 was $16.85 billion. Mexico is a major producer of distilled petroleum products of all kinds.

Agricultural Products

Vegetables, roots, and tubers alone accounted for $10.24 billion in American imports from Mexico in 2024. Think tomatoes, cucumbers, cabbage, cauliflower, and kale, for starters.

Plastics

Mexican plastic products sold to the United States in 2024 amounted to $8.23 billion. Some plastic products from Mexico you’ll find in the store are plastic kitchenware and other household products, plastic building materials, and packaging materials.

Will Increased U.S. Production Offset Tariffs?

The intention of the tariffs is to bring manufacturing jobs back to the United States, but because labor costs are up to 75% higher than in Mexico, the price of these goods is likely to remain elevated even with an increase in domestic industrial metals production. American workers will need to be trained and retained in these jobs. In some cases, manufacturers will solve the problem through automation rather than hiring more people. This requires a substantial up-front investment in high technology, though, and those costs will also be passed on to consumers. So no matter where the tariffs land, one thing’s clear: it’s time for every family to expect tighter budgets, whether you’re looking to buy a yacht or just get an oil change.

The post Top U.S. Imports from Mexico Spared, For Now, From Tariffs appeared first on 24/7 Wall St..