The Consequences of Chaos

This market has been trying to digest a series of unexpected policy disappointments. Most corporate executives thought we would be getting tax cuts, deregulation, and a business-friendly environment. Instead, we have gotten April 2nd Liberation Day tariff announcements. With tariffs, we have seen two big issues: First, it’s GOALS. What is the purpose of… Read More The post The Consequences of Chaos appeared first on The Big Picture.

This market has been trying to digest a series of unexpected policy disappointments. Most corporate executives thought we would be getting tax cuts, deregulation, and a business-friendly environment. Instead, we have gotten April 2nd Liberation Day tariff announcements.

With tariffs, we have seen two big issues:

First, it’s GOALS. What is the purpose of these tariffs? Why are we implementing them? Towards what ends? Are we changing our global relationships, alliances, and trading partners? What are we hoping to accomplish?

Second, the METHODS. How are we implementing these tariffs? What’s the methodology for deploying them? How transparent are we communicating our intentions to our trading partners and citizens?

The goals and the implementation methods have been, at best, opaque and confusing. Definitely clumsy, somewhat amateurish. April 2nd revealed that the president and his economic team do not truly understand how global economies and trade work. Their calculations of tariffs were lifted straight from ChatGPT, and the explanations underlying each specific country’s tariffs make little sense. It seems misguided, reckless, and poorly thought out.

We. Tariffed. Penguins.

“Liberation Day” is now threatening to liberate Americans from robust real wage growth, low unemployment, and a good chunk of their retirement savings.

Markets are a future cash-flow discounting mechanism. Consensus prior to April 2 had estimated future corporate revenues and profits. Post April 2nd, that consensus was revelead to be wildly over-estimated. The current pricing of equities is getting adjusted downwards to reflect future decreases in consumer spending and corporate investments, all driven lower by across-the-board tariffs. These are a tax on consumers and businesses that will make everything they purchase from overseas much more expensive. That adjustment has so far reduced the Nasdaq by 17% YTD, the Russell 2000 by 18%, with the S&P500 and Dow not far behind.

~~~

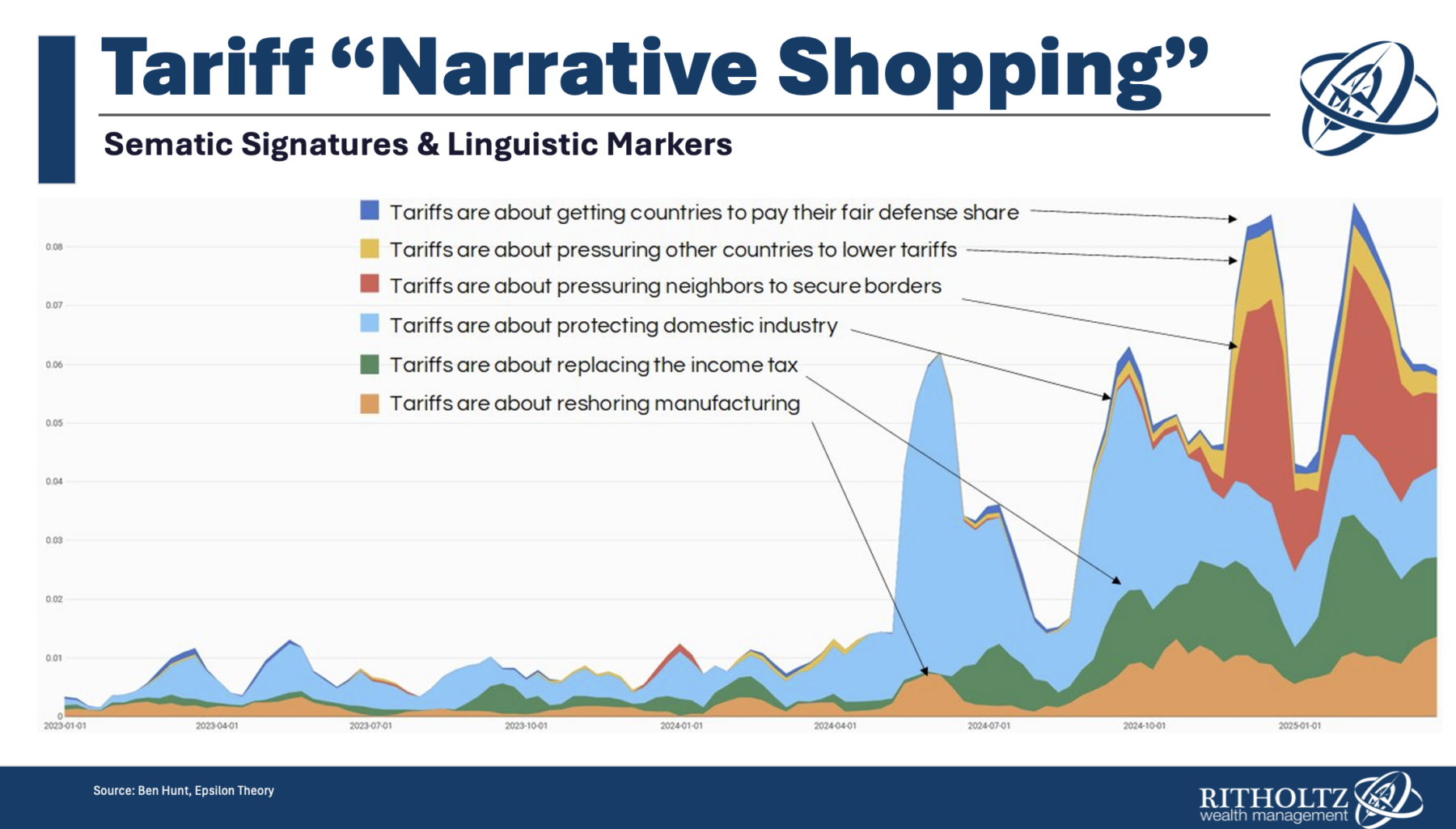

The implementation of tariffs is beyond the scope of this simple post, but what about the goals? Ben Hunt of Epsilon Theory does a fascinating analytical apporach, working off of Substack and blogs and news outlets and social media data. They data analytics on the language, looking for linguistic markers and semantic signatures about different subjects. This creates a baseline to identify how frequently they’re used.

That data is then used to show how this changes over time:

We see then-presidential candidate Trump discuss tariffs, primarily focused on “protecting domestic industry” (light blue). That’s the sort of thing you say when you’re a candidate running for office and hoping to win votes in Michigan and Wisconsin and Ohio.

The other things candidate Trump was about pressuring our neighbors to secure borders.

What’s so fascinating about this narrative shopping analysis is that after the election the reasons for the tariffs began to shift. Pressuring our neighbors to secure borders, getting other countries to pay their share for defense.

“Narrative shopping” refers to the idea that this is a policy we want implemented, even if we are not exactly sure why. We want these tariffs, so let’s search for a rationalization. Here are a bunch of different reasons, let’s trial balloon them, we’ll float ’em out there and see what sticks…

There are no winners in a Trade war and the April 2nd Supersized Tariff regime have gone beyond most people’s worst fears.

~~~

What are the “Best-case” and “Worst-case” scenarios of the 2025 Tariff Wars? I’ll discuss those later this week…

Previously:

Tune Out the Noise (February 20, 2025)

7 Increasing Probabilities of Error (February 24, 2025)

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

Source:

Narrative Shopping

by Rusty Guinn

Epsilon Theory, April 3, 2025

The post The Consequences of Chaos appeared first on The Big Picture.