Stock markets slide on bad GDP news as Trump puts blame on ‘Biden’s stock market’

Dow falls more than 750 at one point.

- Stocks fell once again Wednesday after worrisome GDP numbers. The drop reverses some of the gains the markets have seen this month since reciprocal tariffs were paused. Trump blamed his predecessor, saying "this is Biden's stock market."

The bears are back on Wall Street, but they're not roaring quite as loud as they did early Wednesday.

Stocks fell once more in mid-morning trading following discouraging data about the U.S. economy, stoking recession fears. President Donald Trump, meanwhile, tried to blame his predecessor for the decline, writing "This is Biden's Stock Market, not Trump's" on Truth Social.

The Dow was down 293 points (0.72%) as of 11:20 a.m. ET. The Nasdaq Index was off 240 points (1.37%), while the S&P 500 Index lost 54 points (1.39%). At one point, in early trading, the Dow was down more than 750 points.

The market sell-off comes after the Commerce Department announced the gross domestic product in the first quarter fell by 0.3%. That's a huge turnaround from the 2.4% growth in the fourth quarter of last year. The report also warned of a slowdown in consumer spending as well as government spending.

Stocks have spent much of April clawing back losses that came after Trump announced his reciprocal tariffs on the 2nd. Indices began to rebound once those tariffs were paused.

The GDP report, however, revived concerns that the back and forth on foreign policy could push the U.S. economy into a recession. That's despite the fact that the Q1 number could well be a statistical anomaly. The GDP sank in large part because consumers and businesses were importing goods ahead of the tariff rollout, which sent money out of the country.

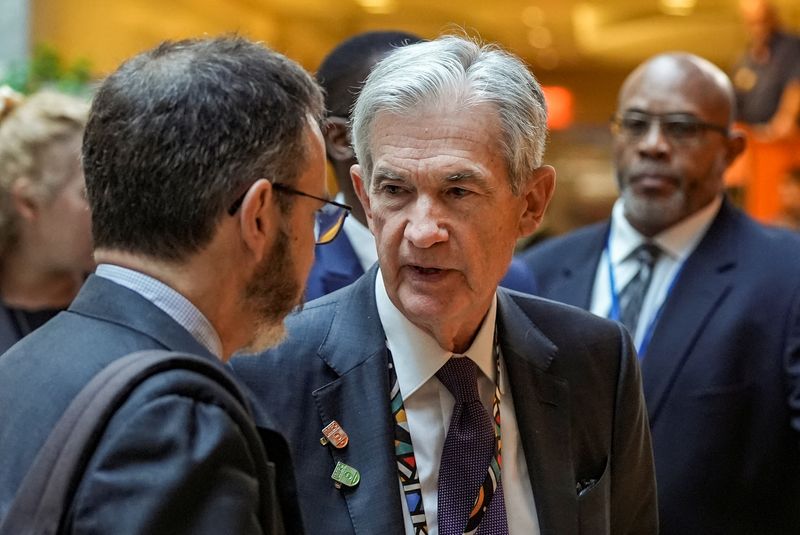

Trump, in his social media post, refused to accept responsibility, despite the losses taking place during his administration. He instead continued to insist the drop had nothing to do with tariffs.

"I didn’t take over until January 20th," he said. "Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers. Our Country will boom, but we have to get rid of the Biden 'Overhang.' This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!"

Since Trump has taken office, the S&P 500 has lost 9% of its value. The Dow and Nasdaq are both down approximately 8% compared to where they stood on Jan. 19.

This story was originally featured on Fortune.com

-logo-1200x675.png?v=20240521153233&w=240&h=240&zc=2)