Iconic fund manager sends shocking 3-word message on stocks

The investing legend offered a blunt outlook.

The stock market has been on a roller coaster since President Trump revealed higher-than-expected reciprocal tariffs on April 2. Global stocks fell sharply following the tariff announcement before rallying after President Trump paused reciprocal tariffs for 90 days, excluding China, on April 9.

The tariff seesaw has forced investors to reconsider economic and corporate profit outlooks following the S&P 500's robust 23% gains in 2024.

Recent economic data suggests a potential slowdown in the U.S. economy is underway. Tariffs could push us into stagflation or an outright recession, casting a long shadow over stocks, given that future expectations for revenue and profit growth primarily determine stock prices' valuation.

Related: Surprising recession news rocks stocks

If tariffs spark inflation and crimp supply chains, the U.S. economy could fall into a recession, dragging global economies down with it.

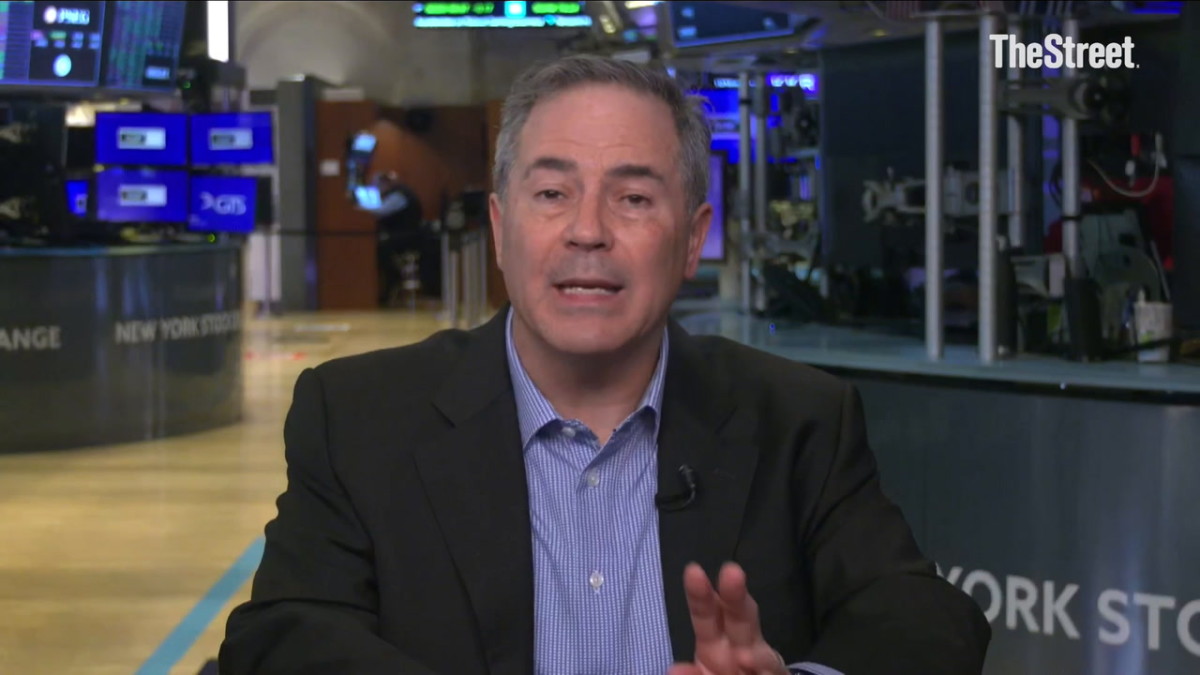

Global fund manager Mark Mobius is well aware of the potential domino effect associated with "when America sneezes, the world catches a cold."

Mobius is a legendary fund manager who is an expert in managing money outside the U.S., particularly in developing and emerging markets. He began managing Franklin Templeton's Emerging Markets Group in 1987, a role he held for 30 years before founding Mobius Capital Partners LLP.

Mobius has seen a lot over the past thirty-plus years, and this week, he offered a surprising message on how he's managing money in the wake of recent uncertainty.

Mark Mobius unveils surprising take on stocks

A tectonic shift is underway to reshape global trade, creating significant uncertainty roiling stock markets worldwide.

The iShares Europe ETF (IEV) fell 11%, the iShares Japan ETF (EWJ) fell 10%, and the iShares China Large-Cap ETF (FXI) fell 17% after Trump's "Liberation Day" tariffs announcement.

Most global markets have recovered some losses since reciprocal tariffs were paused for 90 days on April 9, but that doesn't necessarily mean investors are out of the woods yet.

"He (Donald Trump) has made revolutionary changes that affect not only the U.S. but the world... We're in a new world of thinking... We've got to get used to a new world order," said Mobius in a Bloomberg interview. "We think uncertainty will continue for the next three, four, six months, and we've got to get used to it."

Mobius has navigated the global markets' twists long enough to spot risks and opportunities. He's credited with predicting the post-Great Recession rally in 2009 and profiting from the Asian financial crisis in 1997 and Russia's stock market drop in 1998.

Despite his knack for taking advantage of beaten-down stock markets, he's not in any rush to press the buy button yet.

"We've seen the market come down. Some stocks are looking very attractive... India will be benefiting from what's happened with China. Some of these emerging countries will do quite well," said Mobius. "But we have to wait until this all even's out."

In the short term, India could benefit from acting as a middleman for China's exports to the United States, given that it currently faces tariffs of just 10%. Longer-term, businesses' desire to insulate against future China trade risks could shift production to India, especially if it is able to secure a favorable deal with America.

Treasury Secretary Bessent indicated this week that a trade deal with India could be near, calling it out as one that could get announced shortly.

In short, how tariff deals pan out will determine winners and losers.

"You're going to see more of this negotiation and bargaining taking place... This will all pan out, and we'll see a settling of what the agreements are going to be," said Mobius. "China will be the big question mark. If no agreement is reached with China, then I expect China not to do very well."

Perhaps stocks will move significantly higher when trade deals are completed. However, until then, Mobius isn't rushing to buy, especially since the yield on Treasury bills is above 4%

"Cash is king," concluded Mobius bluntly. "95% of my money in the funds are in cash."

Related: Veteran fund manager unveils eye-popping S&P 500 forecast

-logo-1200x675.png?v=20240521153233&w=240&h=240&zc=2)