Stock Market Today: Stocks reverse gains after hawkish Fed rate decision

Stocks are looking to their first gains of the week but need to navigate a tricky Fed rate decision later in the session.

U.S. stocks pared gains in late Wednesday trading while the dollar snapped its recent run of declines and Treasury yields steadied, as investors reacted to a key Federal Reserve policy meeting and planned trade talks between Washington and Beijing.

Updated at 2:13 PM EDT

Hawkish Fed

The Federal Reserve held it benchmark rate steady for the third consecutive time this year following its two-day meeting in Washington and noted that upside risks to both inflation and unemployment have increased in the world's biggest economy.

The Fed left its key Fed Funds rate unchanged at between 4.25% and 4.5%, where it has remained since the central bank last cut rates in December, but by raising the risks of stagflation, suggested that near-term rate cuts are increasingly unlikely.

"Uncertainty about the economic outlook has increased further," the Fed said in its prepared statement. "The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen."

Stocks were little-changed following the Fed statement, with the S&P 500 last marked 7 points higher and the Dow rising 240 points. The tech-focused Nasdaq was last seen 50 points lower on the session.

Benchmark 10-year Treasury note yields eased 2 basis points to 4.267% while 2-year notes were pegged at 3.783%.

PRESS RELEASE: Federal Reserve issues FOMC statement (May 2025)https://t.co/O99tTXfSsC pic.twitter.com/5NYScHiIHw— LiveSquawk (@LiveSquawk) May 7, 2025

Updated at 11:23 AM EDT

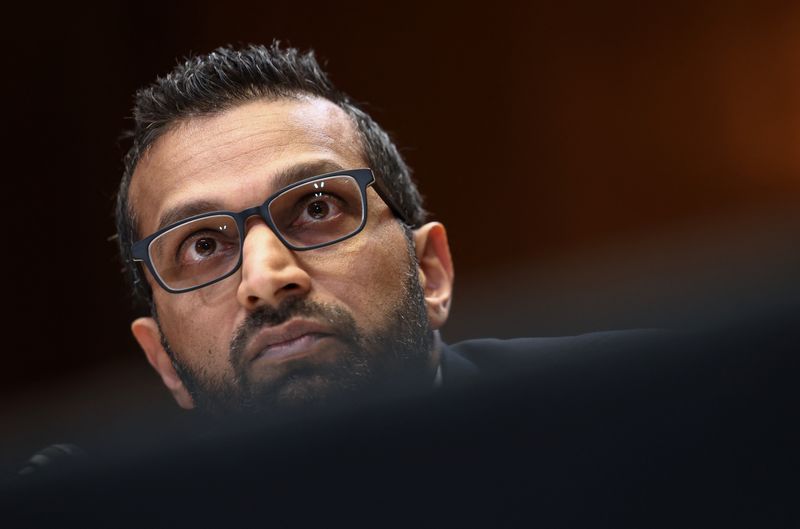

Searching questions

Google shares are moving firmly lower in late morning trading following comments from Apple's head of services, Eddy Cue, who said the tech giant might consider adding AI-powered additions to its search browser.

Apple, which currently has a revenue-sharing agreement with Google, said it was considering Perplexity or Anthropic for the Safari browser after it saw the first-ever decline in overall search last month. The Apple/Google revenue share is worth around $20 billion a year.

Google shares were last marked 4.9% lower at $157.05 each while Apple slid 2.06% to $194.42 each.

$AAPL, browser searches in browser fell for first time in April $GOOG, could be overshadowed by ChatGPT $MSFT pic.twitter.com/OcRNDb99KO— Special Situations