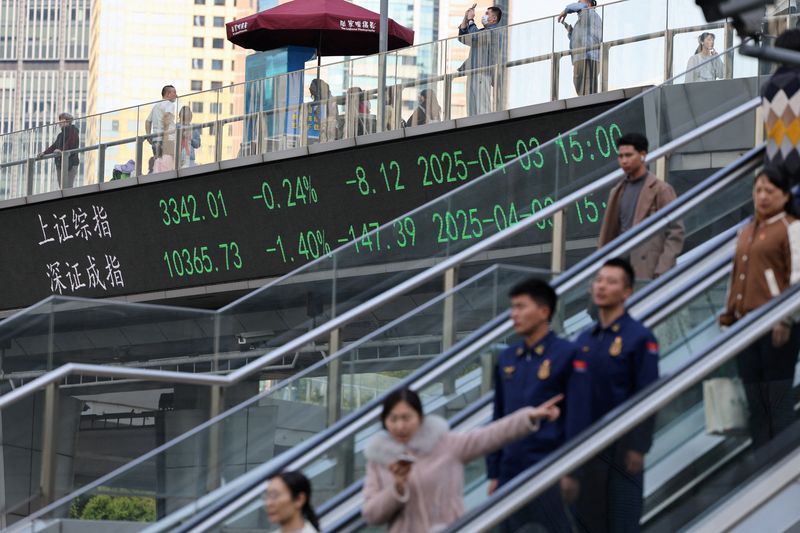

Stock Market Today: Stocks end mixed amid $9.5 trillion global wipeout

Stocks endured another volatile session as President Trump stands his ground on tariffs despite global market chaos.

Updated at 4:30 PM EDT by Rob Lenihan

Stocks ended mixed Monday, with the Dow losing more than 300 points, as global markets continued their historic reaction to President Donald Trump's tariff ambitions and the likely impact it will have on the world's biggest economy.

The Dow Jones Industrial Average fell 349 points, or 0.9%, to end the session at 37,965.60, while the S&P 500 shed 0.2%, but was down 4.7% at the lows of the session, to close at 5,062.25 and the tech-heavy Nasdaq inched up 0.10% to finish the day at 15,603.26.

"The good news is markets have probably moved past maximum uncertainty and are working their way through max pessimism," LPL Research analysts said in their weekly commentary. "Though that can't be measured precisely, the significant two-day downdraft adds to the evidence that bearish sentiment has reached an extreme."

If stocks haven't bottomed, the firm said that it thinks they are close.

"We got a flush, or washout, based on technical indicators," he said. "Buying when stocks are down 15-20% is frequently a winning trade, though the win certainly has come faster historically if recession is avoided. That can't be ruled out."

Updated at 12:31 PM EDT

Recession now?

Stocks are moving lower into the afternoon session, with the Dow off 690 points and the S&P 500 last seen 37 points, or 1.32% lower, from Friday's close.

Larry Fink, CEO of BlackRock, told an industry event in New York Monday that, according to company bosses he's speaking to, the U.S economy may already be in recession.

The Atlanta Fed's GDPNow tracker pegs the first quarter contraction at around 2.8%, following a 2.4% growth rate over the final three months of last year. The next update is expected on Wednesday.

$BLK CEO Larry Fink: "Most CEOs I talk to say we are probably in a recession right now...Airlines and air traffic are a canary in the coal mine. Right now the canary is sick"— The Transcript (@TheTranscript_) April 7, 2025

Updated at 11:22 AM EDT

Trump speaks

President Donald Trump has threatened another major escalation in his trade war with Beijing, vowing to impose an extra 50% tariff on China-made goods if officials don't remove the 34% retaliatory levy put in place last Friday.

"If China does not withdraw its 35% increase above their already long term trading abuse by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs (sic) on China of 50%, effective April 9th," the President said through a message on his Truth Social platform.

The escalation would, in theory, raise the U.S. tariff on China-made goods north of 100%.

Stocks extended declines in the wake of the comments, with the S&P 500 last marked 63 points lower and the Dow falling 760 points.

Trump on Truth Social: China issued Retaliatory Tariffs of 34%, on top of their already record-setting Tariffs, despite my warning that they will be immediately met with new and substantially higher Tariffs. Therefore, if China does not withdraw its 34% increase by tomorrow,…— FinancialJuice (@financialjuice) April 7, 2025

Updated at 10:26 AM EDT

Quickly erased

Stocks gave up their mid-morning rally within minutes, with the S&P 500 last marked 37 points lower on the session, and the Nasdaq back in negative territory. The Dow was last down 542 points.

BREAKING: The White House says the 90-day tariff pause headlines are "fake news."

Down we go.— The Kobeissi Letter (@KobeissiLetter) April 7, 2025

Updated at 10:21 AM EDT

Rally cap

Stocks are rebounding quickly following comments attributed to White House economic adviser Kevin Hassett, who said President Trump is considering a 90-day pause in tariffs for all countries, apart from China, to allow for renegotiation.

TheStreet has not been able to verify the credibility of the comments or the origin of the reporting source.

CNBC, meanwhile, has reported that White House officials are not aware of a contemplated pause in tariffs.

Nonetheless, the S&P 500 was last marked 165 points, or 3.65% higher on the session, with the Dow rising 885 points and the Nasdaq up 424 points, or 2.72%.

Updated at 10:12 AM EDT

Vol spike

The CBOE Group's VIX index, the market's key volatility gauge, trading north of $50 for the first time in more than five years, apart from brief spike at the height of the August yen crisis, as stocks continue to whipsaw amid the ongoing tariff uncertainty.

The VIX was last marked 20.85% higher on the session at $50.30, a level that suggests options trader are expecting daily swings of 3.15%, or 160 points, for the S&P 500 each day for the next 30 days.

The $VIX ended the week at 45.3, among the highest weekly closes in history.

What has happened in the past following the highest $VIX levels?

Stocks rallied 100% of the time over the next 1, 2, 3, 4, 5 years with returns far above historical averages.https://t.co/l5IYmkeySJ pic.twitter.com/dLB7ekFPJA— Charlie Bilello (@charliebilello) April 5, 2025

Updated at 9:35 AM EDT

Bear with me

The S&P 500 opened in bear market territory, falling 177 points, or 3.5% in the opening minutes of trading to extend its year-to-date slump to around 16.5%.

The Nasdaq, which closed in bear market range on Friday, was marked 565 points, or 3.63% lower, while the Dow slumped 1,215 points.

"Stocks are starting another week with elevated uncertainty about tariffs, their duration, and the potential for more retaliation," said Carol Schleif, chief market strategist at BMO Private Wealth. "The S&P 500 is hovering near bear market territory, as investors reset valuations to determine what makes sense under a new tariff regime."

"It is worth remembering that this market shock happened as the result of a surprising change in policy – not a fundamental breakdown in a key sector, such as housing in 2008 or tech in 2000," she added. "A moderation in the severity of that policy, particularly given the strong economic starting point much of the globe was on going into it, and could help create a market floor."

S&P 500 Opening Bell Heatmap (Apr. 07, 2025)$SPY -3.18%