Should Retirees Be Avoiding the Stock Market? Here’s the Truth

An older relative of mine retired recently and asked for advice on managing his portfolio. I told him his best bet was to sit down with a financial advisor (which I am not) for personalized guidance. But he’s a little stubborn (and stingy), so I figured that advice wouldn’t fly. At first glance, it seemed […] The post Should Retirees Be Avoiding the Stock Market? Here’s the Truth appeared first on 24/7 Wall St..

An older relative of mine retired recently and asked for advice on managing his portfolio. I told him his best bet was to sit down with a financial advisor (which I am not) for personalized guidance. But he’s a little stubborn (and stingy), so I figured that advice wouldn’t fly.

Key Points

-

It’s a good idea to scale back on stocks during retirement.

-

Avoiding stocks completely is a bad idea.

-

It’s best to strike a balance so your portfolio can enjoy some continued growth.

-

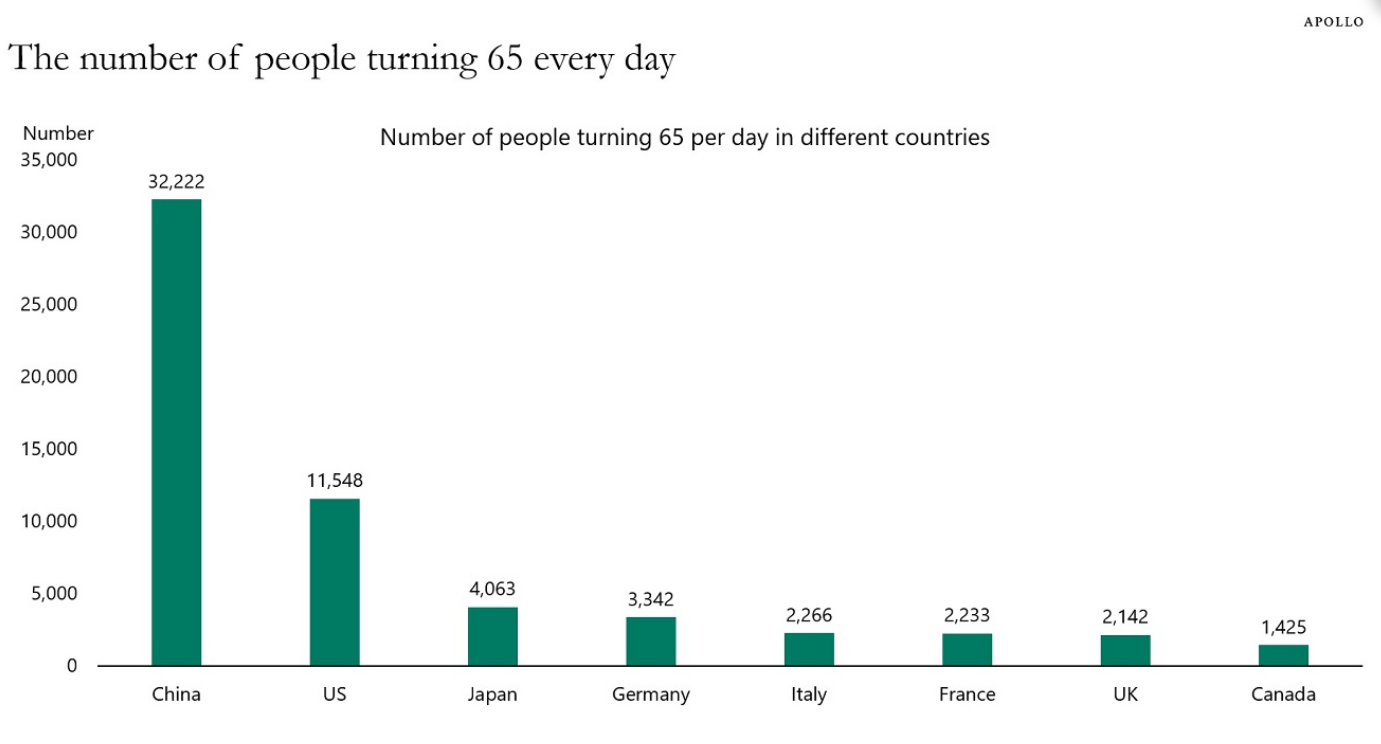

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

At first glance, it seemed like his investments were nicely balanced. But then he asked me if he should get rid of all of his stocks now that he’s no longer working. And my answer was an emphatic no.

It’s a big myth that retirees should avoid the stock market at all costs. And buying into it could cost you a lot of income for your senior years.

Why you can’t afford to dump your stocks completely

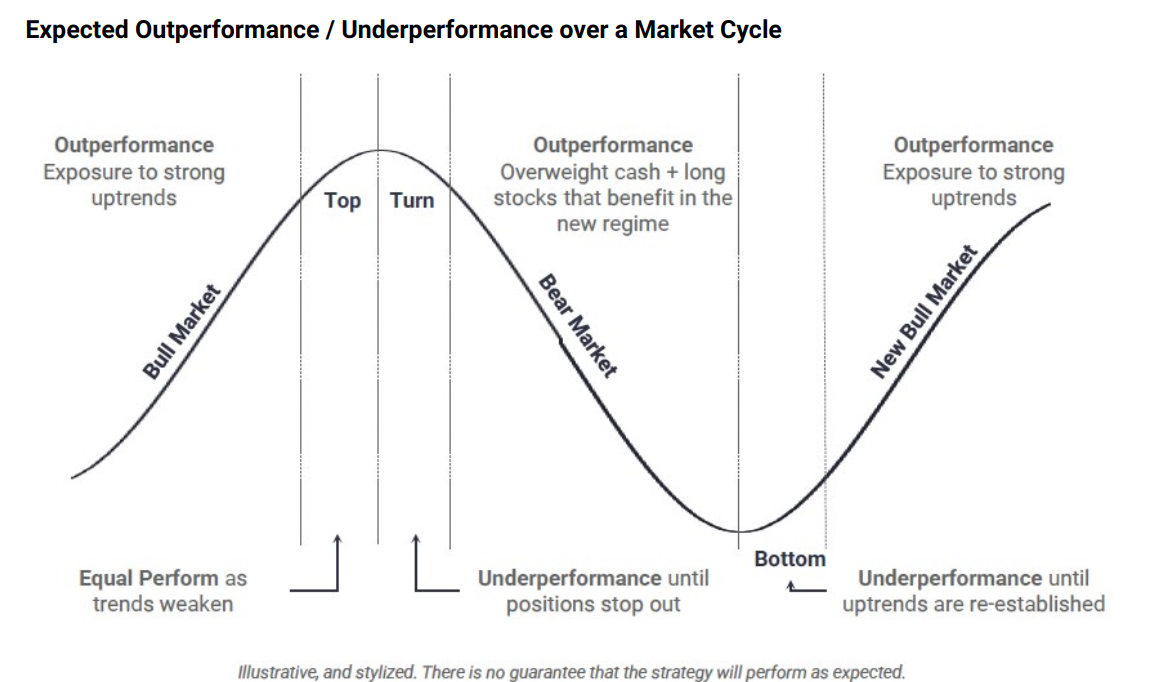

When you’re in the process of building wealth for retirement, it’s important to load up on stocks to generate growth in your portfolio. Once you’re actually retired, it’s important to limit your risk, since at that stage of life, you’re tapping your portfolio for income.

But there’s a big difference between limiting your risk and getting rid of your stock holdings completely. And I wouldn’t tell any retiree to avoid the stock market, period.

You need stocks in your portfolio to continue generating gains. If you dump them, you’ll be more limited in the amount of money you can safely withdraw each year.

The famous 4% rule, for example, hinges on a pretty equal mix of stocks and bonds. If you were to eliminate the stock portion and only invest in bonds during retirement, your portfolio most likely would not be able to support or sustain a 4% withdrawal rate. The result? Less income for you.

It’s all about balance

I’m not going to suggest that it’s a great idea to have 80% of your portfolio in stocks during retirement. Do I think 50% is a reasonable percentage? Absolutely — especially if you also make a point to keep one to two years’ worth of living expenses in cash on hand in case of a prolonged market slump.

Of course, if you’re very averse to risk, you could go a little lighter on stocks in retirement and perhaps limit them to 40% or even 30% of your portfolio. But know that if you unload too much risk, you’ll be limited in the amount of money you get to withdraw as annual income.

If you’re worried about holding stocks in retirement, my best advice is the same one I tried to give my relative — consult a financial advisor. Sure, I can offer up some general guidance on an appropriate asset mix in retirement. But an advisor can offer up personalized guidance based on your specific financial situation.

A financial advisor might also be able to show you why investing in stocks in moderation is not a dangerous thing, but a helpful thing. After all, your retirement savings should be providing you with more than just income. They should be giving you peace of mind, too. And it may take some outside help to get to a place where you can feel good about holding onto stocks later in life.

The post Should Retirees Be Avoiding the Stock Market? Here’s the Truth appeared first on 24/7 Wall St..